Successfully navigating the requirements of a licensing test is a critical step for anyone looking to enter the property industry. The process involves mastering a range of topics, from legal frameworks to practical applications, all of which are essential for achieving certification. By understanding core concepts and honing your test-taking strategies, you can improve your chances of success and feel more confident as you approach the assessment.

Focused study and consistent practice are the best approaches to tackle the various sections of the exam. Knowing what to expect, familiarizing yourself with common problem types, and recognizing key topics will allow you to answer each question more efficiently. With careful preparation, you can strengthen your knowledge and set yourself up for success.

As you prepare, keep in mind that many questions revolve around fundamental principles that form the foundation of professional practice. From property transactions to financial arrangements, mastering these essentials ensures you’re ready to take on real-world challenges once certified. This guide provides you with the tools to approach the challenge methodically and effectively, so you can achieve your goals with confidence.

California Real Estate Principles Exam Guide

Preparing for the property licensing assessment requires a clear understanding of the core topics covered in the test. By breaking down the material into manageable sections, you can approach your studies in a structured way. This guide will provide you with an overview of essential areas, helping you focus your efforts on what matters most for success. Thorough preparation involves both memorizing key concepts and understanding how they apply in practical situations.

Essential Topics to Master

Understanding the legal framework, financial principles, and various property management concepts is crucial. You will encounter topics related to ownership rights, contracts, transactions, and financing methods. In addition to this, it’s important to grasp ethical considerations and the responsibilities of a licensed professional. Focusing on these areas ensures that you are prepared to handle the types of challenges that professionals in the field encounter daily.

Effective Study Strategies

One of the best ways to retain information is through consistent practice. Start by reviewing key concepts and taking practice tests to familiarize yourself with the format of the questions. Analyzing sample problems and understanding how to solve them will help you manage time efficiently on the day of the assessment. Additionally, revisiting areas that seem challenging will solidify your understanding and boost your confidence.

Overview of California Real Estate Exam

The property licensing assessment is designed to evaluate your knowledge and understanding of key concepts essential for success in the field. It covers a wide range of topics, from legal frameworks and financial arrangements to the practical applications of property transactions. The goal is to ensure that aspiring professionals possess the skills needed to navigate the challenges of the industry responsibly and effectively.

This evaluation consists of multiple sections, each focusing on specific areas of practice. It is essential to be well-prepared for the variety of topics that may arise, as the test will assess your ability to apply concepts in real-world scenarios. Effective preparation involves mastering the core material and familiarizing yourself with the question format, which will ultimately allow you to approach the test with confidence and clarity.

Key Concepts for Exam Success

To achieve success in the property licensing assessment, it is crucial to focus on the fundamental concepts that are tested most frequently. A solid grasp of these core areas will help you approach the test with confidence. Mastering the essential topics ensures that you can answer questions accurately and efficiently, even when faced with challenging scenarios.

Here are some of the key areas to prioritize during your preparation:

- Legal Frameworks – Understanding the laws that govern property transactions is essential for making informed decisions in practice.

- Property Ownership – Familiarity with various types of ownership rights and how they affect transactions is fundamental to your knowledge base.

- Contracts and Agreements – Knowing the details of contracts, from terms to execution, ensures you understand their role in the industry.

- Financial Principles – Concepts such as financing methods, mortgages, and loans are critical for understanding the financial side of property transactions.

- Ethical Considerations – An understanding of ethical standards helps you navigate professional challenges with integrity.

Focusing on these key topics will give you the foundation necessary to handle all aspects of the assessment. Through practice and repetition, you’ll be able to apply this knowledge to answer questions accurately under exam conditions.

Understanding Real Estate Law in California

To succeed in the property industry, it is crucial to understand the legal framework that governs transactions and relationships. Laws related to property ownership, transfers, and contractual obligations provide the foundation for conducting business in this field. Being well-versed in these regulations ensures that professionals can navigate challenges and protect both clients and themselves in various dealings.

One of the key aspects to focus on is how property law defines rights and responsibilities. Understanding how ownership is transferred, what constitutes a binding contract, and the legal processes involved in disputes is essential. Additionally, professionals must be familiar with the various legal protections in place for both buyers and sellers, as well as the penalties for violations of these laws.

As you prepare, it’s important to concentrate on the most frequently tested areas, such as property titles, contracts, and land use regulations. A clear grasp of these legal concepts will help you confidently address any questions related to this area of practice during the assessment.

Common Question Types in Final Exam

During the assessment, you will encounter a variety of question formats that test your understanding of core concepts. These questions are designed to assess your ability to apply knowledge in practical scenarios, so it’s important to be familiar with the common types of inquiries you may face. Understanding the structure of each type will help you approach them with confidence and increase your chances of success.

The most common types include:

- Multiple Choice – These questions present a scenario with several possible answers. You must select the correct option based on your understanding of the topic.

- True or False – Simple statements that require you to determine if the information is accurate or not.

- Scenario-Based – These questions present real-world situations and ask you to apply your knowledge to identify the correct course of action or decision.

- Calculation-Based – You may be asked to solve problems involving financial concepts, such as loan calculations or commission structures.

- Definition and Terminology – These questions focus on your ability to define key terms and concepts accurately.

Being familiar with these formats will help you prepare effectively, as each type tests different aspects of your knowledge. Regular practice with sample questions is a great way to strengthen your skills and improve your performance on test day.

Mastering Property Ownership and Rights

Understanding property ownership and the rights associated with it is essential for anyone pursuing a career in the industry. This area of knowledge forms the foundation for making informed decisions about transactions, property management, and legal matters. Whether dealing with residential or commercial properties, a solid grasp of ownership structures and rights is crucial for success in the field.

Types of Ownership

There are several forms of property ownership, each with distinct rights and responsibilities. It is important to understand these different structures to navigate legal and financial aspects effectively. Some common types include:

- Fee Simple – The most complete form of ownership, giving the holder full control over the property.

- Joint Tenancy – Ownership shared between two or more individuals, with rights of survivorship.

- Tenancy in Common – Shared ownership where each party holds a distinct, transferable interest.

- Life Estate – Ownership lasting for the duration of a person’s life, after which the property passes to another party.

Rights of Property Owners

Property ownership comes with a set of legal rights, which define what the owner can and cannot do with the property. These rights include:

- Right to Possess – The right to occupy and use the property as desired, within legal boundaries.

- Right to Transfer – The ability to sell, lease, or bequeath the property to others.

- Right to Exclude – The power to prevent others from using or entering the property without permission.

- Right to Encumber – The ability to place liens or mortgages on the property to secure loans.

Mastering these concepts is vital for passing the assessment and applying the knowledge effectively in professional practice. Knowing the various forms of ownership and the associated rights will help you confidently address situations involving property transactions and disputes.

Important Terms Every Student Should Know

In any professional field, a deep understanding of key terminology is essential for clear communication and accurate decision-making. For those preparing for the property licensing assessment, mastering specific terms is crucial to navigating the complexities of the industry. These terms not only appear frequently on the test but are also fundamental to daily practice in the field.

Here are some of the most important terms you should become familiar with:

- Deed – A legal document that transfers ownership of property from one party to another.

- Mortgage – A loan agreement secured by the property being purchased, often used to finance real estate transactions.

- Encumbrance – A claim or lien on a property, such as a mortgage, that can affect the owner’s ability to sell or transfer the property.

- Appraisal – An assessment of a property’s value, typically conducted by a licensed appraiser, to determine its market worth.

- Title – The legal right to own, use, and transfer property; also refers to the document that proves ownership.

- Closing – The final step in a property transaction, where all documents are signed and ownership is officially transferred.

- Zoning – Local government regulations that dictate how property can be used, including restrictions on commercial or residential developments.

- Escrow – A neutral third party that holds funds or documents until all conditions of a transaction are met.

- Leasehold – A property interest where a tenant has the right to use and occupy a property for a specified period, but does not own it.

Familiarizing yourself with these terms will provide a solid foundation for understanding more complex concepts and will improve your ability to navigate both the test and real-world scenarios in the property field.

Preparing for Real Estate Contracts

Understanding the intricacies of property agreements is essential for anyone preparing for a licensing assessment. Contracts are central to property transactions, and mastering the details of these documents will not only help you perform well in the test but also ensure you’re equipped to handle real-world situations. Whether dealing with purchase agreements, leases, or other legal documents, a solid grasp of contract fundamentals is crucial for success.

Key Elements of a Contract

Every legally binding agreement in property transactions shares certain essential components. These elements ensure that the contract is enforceable and protects the interests of all parties involved. The primary elements include:

- Offer and Acceptance – A clear proposal made by one party and accepted by the other is fundamental to any contract.

- Consideration – Something of value must be exchanged between the parties, such as money or services.

- Legal Purpose – The contract must have a lawful objective and not violate any laws.

- Mutual Consent – All parties must agree to the terms freely, without duress or fraud.

- Competence – Each party involved must have the legal capacity to enter into the agreement.

Types of Real Estate Contracts

There are several types of contracts used in property transactions, each with distinct characteristics and applications. Here are a few of the most common:

- Purchase Agreement – A formal agreement outlining the terms of a property sale, including price, contingencies, and deadlines.

- Lease Agreement – A contract between a property owner and a tenant detailing the terms of rental, payment, and responsibilities.

- Listing Agreement – An agreement between a property seller and an agent that sets forth the terms for marketing and selling the property.

- Option Agreement – An agreement allowing the buyer the right to purchase the property at a later date, usually at a set price.

Mastering the components of these contracts and understanding how they function in various property transactions is crucial for excelling in the assessment and in your professional practice. Through careful study and practice, you’ll be well-prepared to handle contract-related scenarios confidently.

Exploring Real Estate Finance Fundamentals

Understanding the financial aspects of property transactions is essential for anyone looking to succeed in the industry. Financing is a critical part of most property deals, whether purchasing, selling, or refinancing. The ability to navigate financing options, understand interest rates, and analyze loan terms is vital for both test preparation and real-world application. This section will introduce you to the basic concepts and tools used in property financing.

Below are some of the key elements that you should be familiar with:

| Concept | Description |

|---|---|

| Loan Types | Different types of loans such as conventional, FHA, and VA loans, each with varying requirements and benefits. |

| Amortization | The process by which loan payments are applied toward both principal and interest over time, reducing the balance owed. |

| Interest Rate | The percentage charged on the loan balance, typically set by the lender and influenced by market conditions. |

| Principal | The amount of money borrowed, which must be repaid with interest over the term of the loan. |

| Down Payment | The initial payment made by the buyer, typically a percentage of the property’s purchase price, which reduces the loan amount. |

| Loan-to-Value (LTV) | A ratio used by lenders to assess the risk of the loan, calculated by dividing the loan amount by the appraised value of the property. |

Grasping these concepts will not only help you perform well in the assessment but will also give you the foundation needed to make sound financial decisions in the industry. With the right understanding, you’ll be able to confidently navigate property financing and assist clients with various loan options and strategies.

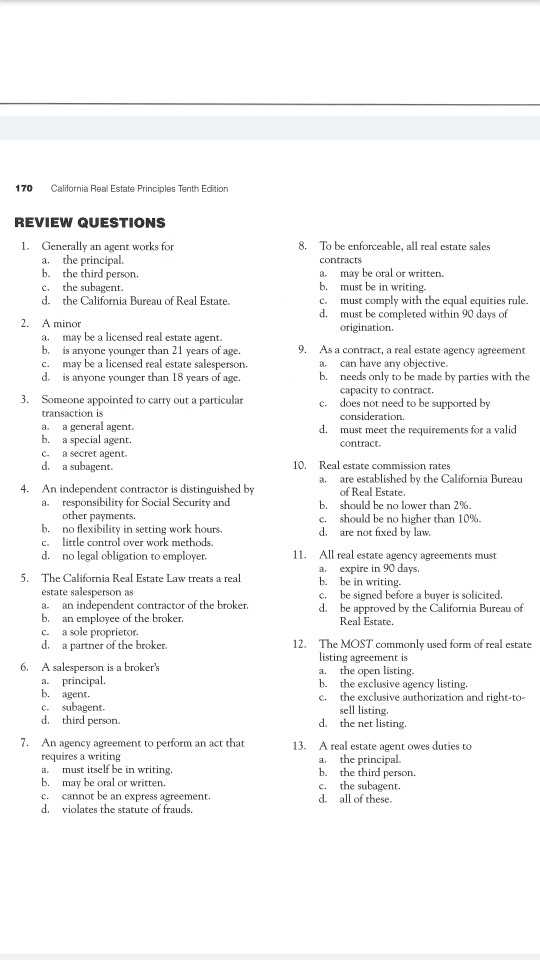

Understanding Agency Relationships in Real Estate

Agency relationships form the foundation of most property transactions. These relationships define the roles, responsibilities, and duties between agents and their clients. Understanding the different types of agency relationships is crucial for both legal compliance and effective practice in the industry. A strong grasp of how these connections work will help ensure that all parties are properly represented and protected throughout the transaction process.

There are several key concepts to familiarize yourself with when it comes to agency relationships:

- Fiduciary Duty – The legal obligation an agent has to act in the best interest of their client, including loyalty, confidentiality, and full disclosure.

- Agency Agreement – A formal contract that outlines the agent’s responsibilities and the terms of the relationship with their client.

- Dual Agency – A situation where a single agent represents both the buyer and the seller in a transaction, requiring full disclosure and informed consent from both parties.

- Exclusive Agency – A contract where the agent has the exclusive right to represent a client, but the client can still sell the property without the agent’s help and avoid paying a commission.

- General Agency – A broader agency where the agent has the authority to act on behalf of the client in multiple areas of the client’s business or life, not limited to just one transaction.

- Special Agency – A limited form of agency where the agent has specific authority to perform a particular task, such as representing the client in a property sale.

By comprehending these agency relationships, you can better navigate the roles and responsibilities involved, ensuring ethical conduct and smooth dealings in property transactions. A well-informed agent understands the intricacies of agency law, which fosters trust and confidence in their clients.

Real Estate Principles and Ethics Review

Understanding the core values and ethical guidelines is essential for anyone pursuing a career in the property industry. The foundation of good practice lies not just in knowledge of the processes, but also in the ability to apply ethical standards in every transaction. This section will review the fundamental concepts of property transactions, emphasizing the importance of integrity, fairness, and transparency in all dealings.

To succeed in this field, it is crucial to be familiar with the key principles and ethical expectations that govern interactions between agents, clients, and other stakeholders. Below are several core concepts to focus on:

- Honesty and Transparency – Always providing truthful information and disclosing relevant facts to all parties involved in a deal.

- Confidentiality – Protecting client information and ensuring that personal and financial details are kept private unless consent is given to share them.

- Fair Representation – Ensuring that all clients, regardless of their position, are represented fairly and without bias, with their best interests in mind.

- Avoiding Conflicts of Interest – Ensuring that personal interests do not interfere with professional responsibilities or the client’s needs.

- Compliance with Laws – Adhering to all legal requirements and regulations governing property transactions in the relevant jurisdiction.

- Duty of Care – Providing services to clients with competence and diligence, protecting their interests at every step of the transaction.

These ethical principles are not just guidelines but are often legally required for those working in the property field. Understanding and applying them in practice will help build trust with clients and enhance the reputation of professionals within the industry. By incorporating ethical standards into everyday activities, property practitioners can ensure that their actions contribute positively to both the market and their own careers.

Essential Calculations for the Exam

Accurate calculations are critical for success in property-related assessments. Understanding how to compute different values quickly and correctly is an essential skill for anyone entering the field. These calculations often cover a variety of scenarios, from determining commissions to calculating interest rates and property values. Mastering these will not only prepare you for the assessment but also for real-world transactions.

The following table outlines some of the key calculations you will need to know for the assessment:

| Calculation Type | Formula | Example |

|---|---|---|

| Commission Calculation | Sale Price x Commission Rate | $200,000 x 5% = $10,000 |

| Loan-to-Value Ratio (LTV) | Loan Amount ÷ Property Value | $150,000 ÷ $200,000 = 75% |

| Interest Calculation | Principal x Interest Rate x Time | $100,000 x 6% x 1 = $6,000 |

| Property Tax Calculation | Property Value x Tax Rate | $300,000 x 1.25% = $3,750 |

| Gross Rent Multiplier (GRM) | Property Price ÷ Gross Annual Rent | $500,000 ÷ $50,000 = 10 |

Being familiar with these calculations will give you a significant advantage during your assessment and in future professional scenarios. It’s crucial to practice them until you can apply them easily and accurately. By mastering these essential computations, you will be better prepared for any task that requires financial analysis and decision-making in property transactions.

How to Approach Multiple Choice Questions

When faced with multiple choice items, it is important to develop a strategic approach to help improve your accuracy and efficiency. These types of questions test your understanding of concepts and your ability to apply them under time constraints. Having a clear strategy will enable you to eliminate incorrect answers and confidently choose the correct one.

Here are some effective strategies to tackle multiple choice items:

- Read the Question Carefully: Make sure you fully understand what is being asked before considering the options. Look for keywords or phrases that provide context.

- Eliminate Clearly Incorrect Answers: Often, you can immediately rule out one or two choices. Focus on what you know to be wrong, which increases the probability of selecting the correct answer from the remaining options.

- Look for Context Clues: The wording of one option may directly oppose or support another. Pay attention to subtle hints in the phrasing of the question or the available answers.

- Don’t Overthink It: Trust your first instinct unless you’re sure another option is clearly better. Overthinking can often lead to mistakes.

- Make Educated Guesses: If you’re unsure, try to make an educated guess by reasoning through the options logically. Consider the overall context of what you have studied.

- Stay Calm and Focused: Don’t rush through multiple choice items. Take a deep breath and read each question thoroughly before making a decision.

By employing these strategies, you can confidently approach multiple choice items and improve your chances of success. Proper preparation combined with a focused approach will help you tackle any challenging question set with ease.

Time Management Tips for Exam Day

Managing your time effectively on test day is essential for achieving the best possible outcome. With limited time and a variety of tasks to complete, it is crucial to stay organized and focused. Proper time management helps reduce stress, avoid rushing, and ensures you have ample time to address every section of the assessment thoroughly.

Here are some practical tips to make the most of your time during the test:

- Plan Ahead: Before you start, review the entire test and estimate how long you should spend on each section. This will help you allocate time effectively, preventing you from spending too much time on any one question.

- Stick to Your Schedule: Once you’ve allocated time to each section, be disciplined about sticking to the schedule. If you find yourself spending too much time on a difficult question, move on and return to it later.

- Prioritize Easier Questions: Begin with the questions that are easier for you. This builds confidence and ensures you accumulate points before tackling the more challenging ones.

- Stay Calm: Don’t panic if you feel like time is running out. Take a deep breath, refocus, and move methodically through the remaining items. Stress can negatively impact your performance.

- Keep Track of Time: Keep an eye on the clock, but don’t obsess over it. Check periodically to ensure you’re on track, but avoid checking too frequently, as it can distract you.

- Review Your Work: If time permits, always leave a few minutes at the end to review your answers. Double-check for any mistakes or missed questions.

By following these time management strategies, you can approach the test with confidence, ensuring that you stay calm and focused while completing the assessment effectively.

Study Resources and Practice Tests

Preparing for an assessment requires using the right materials and practice tools to reinforce your knowledge and test-taking skills. Utilizing comprehensive study resources and taking practice tests can help familiarize you with the types of tasks you will face, improving both your understanding and confidence. By incorporating various study aids into your routine, you can ensure you are well-prepared for the challenges ahead.

Key Study Resources

To prepare effectively, it’s essential to use high-quality resources that cover all relevant topics. Here are some options to consider:

- Textbooks and Study Guides: Look for materials specifically designed to cover all essential concepts. These resources often break down complex information into manageable sections, making it easier to understand.

- Online Courses: Many online platforms offer courses that teach key concepts through videos, quizzes, and interactive lessons. These can be a great supplement to traditional study methods.

- Flashcards: Digital or physical flashcards are a quick and effective way to test your knowledge on key terms and concepts. They help with memorization and recall.

- Audio Resources: Listening to podcasts or recorded lectures is a convenient way to absorb information while on the go, making it easier to review important topics during free moments.

Practice Tests for Effective Review

Practice tests are an invaluable tool for assessing your readiness and identifying areas that need further review. Here’s how you can benefit from them:

- Simulate Test Conditions: Taking practice tests under timed conditions mimics the real assessment, helping you get used to the pressure of time constraints and ensuring you’re comfortable with the format.

- Identify Weak Areas: By reviewing your practice test results, you can pinpoint where you’re struggling and devote more time to those specific areas.

- Track Progress: Regularly taking practice tests allows you to measure your improvement and adjust your study plan accordingly, boosting your confidence.

- Question Variety: Practice tests offer a diverse range of questions, ensuring you’re exposed to a broad spectrum of topics and problem types.

By combining quality study resources with plenty of practice tests, you will have a solid foundation for achieving success in your assessment. The more you practice and review, the more prepared you will be to tackle the test with ease and confidence.

Real Estate Regulations You Must Know

Understanding the rules and guidelines that govern the property industry is crucial for anyone looking to succeed in the field. These regulations are in place to ensure fairness, transparency, and legal compliance in all aspects of property transactions. Familiarity with these laws will help you navigate the complexities of the market and avoid potential pitfalls. Below, we’ll discuss key regulations that every aspiring professional should be aware of.

Essential Property Laws

There are several important laws and regulations that govern property transactions. These laws dictate how property can be bought, sold, or leased, as well as the rights and obligations of buyers, sellers, and agents. Key regulations include:

- Disclosure Requirements: Sellers are legally required to disclose certain information about a property’s condition to buyers, including any known defects or issues that may affect the property’s value or safety.

- Contract Law: Property transactions often involve detailed contracts, and understanding contract law is essential for ensuring that all agreements are legally binding and enforceable.

- Anti-Discrimination Laws: Fair housing regulations prohibit discrimination based on race, color, religion, sex, familial status, or national origin in any aspect of property sales or rental.

- Land Use Regulations: Local zoning laws and land use regulations control how land can be developed, subdivided, and used. It’s important to know how zoning laws can affect property value and what can and cannot be done with a piece of land.

- Tax Laws: Understanding the tax implications of property ownership, including property taxes and capital gains taxes, is essential for both buyers and sellers.

Key Licensing and Ethics Rules

In addition to property-specific regulations, it’s important to understand the ethical guidelines and licensing rules that govern property professionals. These include:

- Agent Licensing Requirements: Property professionals must obtain the proper licenses to legally practice. This typically involves passing a certification test, meeting experience requirements, and maintaining ongoing education to stay current with industry changes.

- Code of Ethics: Agents must adhere to a strict code of ethics that ensures honesty, integrity, and professionalism when working with clients and other industry professionals.

- Escrow Laws: The escrow process ensures that both buyers and sellers fulfill their contractual obligations before the transfer of ownership. Understanding escrow laws and procedures is essential to managing property transactions smoothly.

By understanding and adhering to these key regulations, you will be better equipped to navigate the legal landscape of property transactions and ensure that you remain in compliance with the law throughout your career.

Common Mistakes to Avoid in the Exam

While preparing for any assessment, it’s essential to recognize the common pitfalls that can hinder your performance. Understanding these mistakes in advance helps you avoid them and approach the test with confidence. Being aware of frequent errors allows you to focus on key concepts, manage time effectively, and avoid unnecessary confusion during the assessment process.

Typical Mistakes to Watch Out For

Several common errors often arise during assessments. Identifying these beforehand can greatly improve your chances of success. Below is a list of mistakes to avoid:

| Mistake | Impact | How to Avoid |

|---|---|---|

| Rushing Through the Questions | Leads to careless mistakes and missed details. | Take your time to read each question thoroughly before answering. Double-check for hidden clues or nuances. |

| Skipping Questions | Missed opportunities to earn points and incomplete responses. | Answer all questions, even if you’re unsure. Eliminate obvious incorrect choices to narrow down options. |

| Overthinking the Answers | Confuses your initial instinct and leads to incorrect answers. | Trust your first choice unless you’re sure that a change is necessary. |

| Not Managing Time | Running out of time, resulting in unfinished sections. | Set time limits for each section and keep track of time throughout the assessment. |

| Ignoring Instructions | Missing specific requirements or guidelines. | Read all instructions carefully to ensure you’re following the correct format and responding appropriately. |

How to Improve Your Performance

In addition to avoiding common mistakes, there are several strategies that can enhance your performance during the assessment:

- Stay Organized: Keep your materials and notes well-organized so you can easily reference them during your review.

- Practice Regularly: Take practice tests to get familiar with the question types and format, helping to improve speed and accuracy.

- Stay Calm: Maintain composure throughout the assessment. Stress can negatively impact your ability to think clearly and focus on the tasks at hand.

By being mindful of these common mistakes and applying strategies to avoid them, you’ll be well-prepared to perform at your best.