Preparing for an assessment in the field of financial technology requires a deep understanding of various principles and methodologies. This area covers a range of topics, each crucial for demonstrating proficiency in the subject. By focusing on core themes, one can ensure a well-rounded preparation for the challenges ahead.

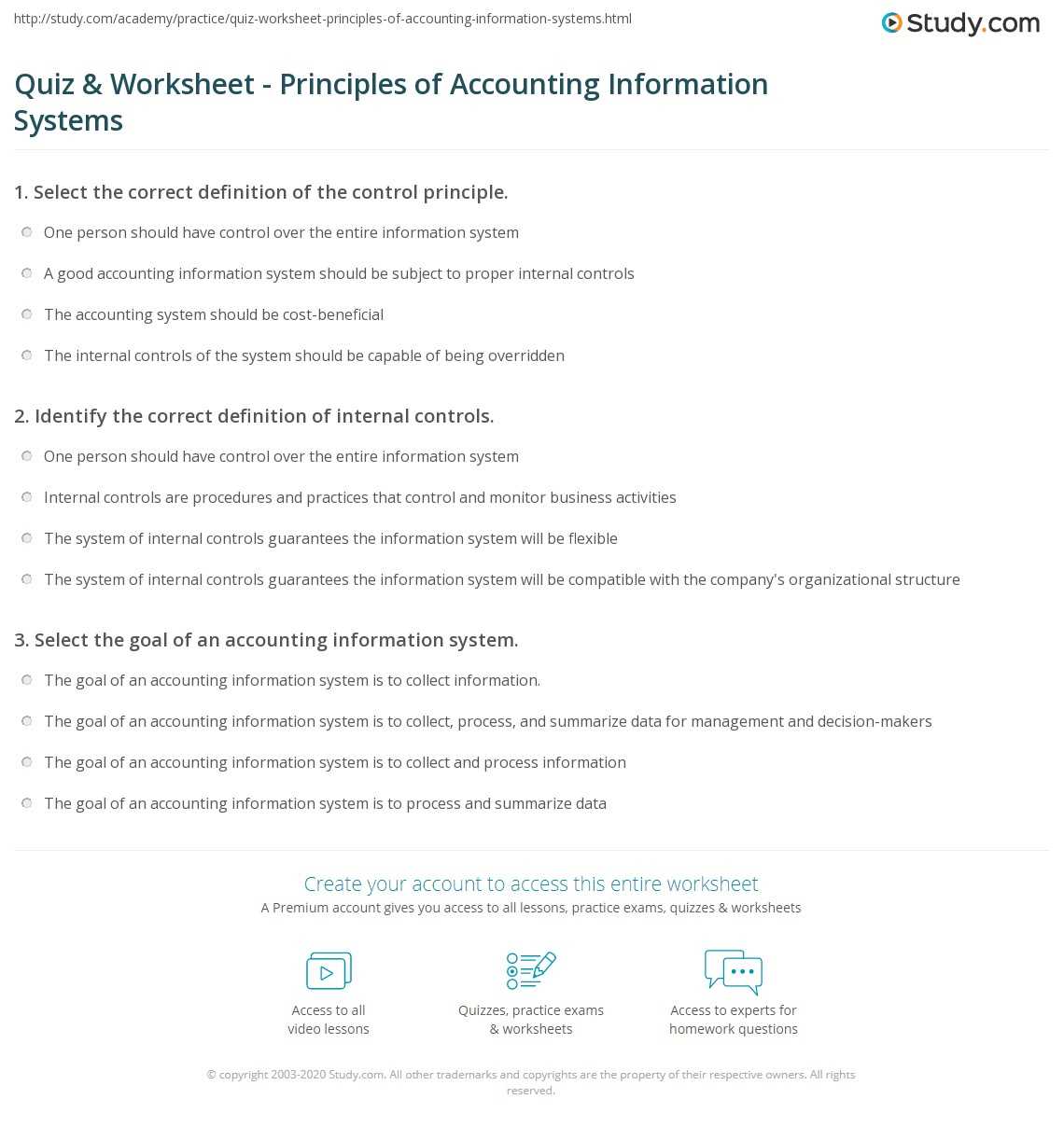

Effective preparation involves familiarizing yourself with the terminology, practices, and theories that shape the way businesses manage their financial operations through technology. Grasping the underlying concepts will not only help with solving specific problems but also provide insights into broader system functions.

To excel, it’s important to practice solving real-world challenges that reflect common scenarios encountered in modern corporate environments. This will sharpen your ability to think critically and apply knowledge under time constraints. The key lies in mastering the principles and understanding their practical applications to achieve success.

Accounting Information Systems Exam Questions and Answers

In the realm of financial technology, assessments often test one’s ability to understand key concepts and apply them to practical situations. Mastery of these topics involves grasping both theoretical foundations and real-world applications. This section provides a closer look at typical challenges that might arise and offers insight into how to tackle them effectively.

Core Areas of Focus

To excel, one must familiarize themselves with a variety of essential topics. These often include the design and operation of systems, risk management, and the integration of tools used for financial decision-making. Below are some of the main themes commonly tested:

- System architecture and flow of data

- Risk management and internal control mechanisms

- Data processing and storage methods

- Security measures and encryption techniques

- Audit trails and compliance standards

Approaching Problem-Solving

To succeed in practical challenges, it’s essential to practice critical thinking and develop problem-solving strategies. When faced with a scenario, follow these steps:

- Identify the problem and determine the key variables involved.

- Apply relevant theories or methods to address the issue.

- Evaluate the implications of different solutions.

- Choose the most effective approach based on your analysis.

By honing these skills, you will be better prepared to tackle a wide range of problems confidently and efficiently.

Key Topics in Accounting Information Systems

In the study of financial management through technology, understanding the essential areas of focus is crucial. These topics provide the foundation for effectively managing data, ensuring security, and optimizing operational efficiency. Below are the core subjects that form the backbone of this field, which are often explored in assessments and real-world applications.

Important Areas to Master

To succeed, it’s important to have a solid grasp of various domains, such as the design of processes, control mechanisms, and the role of technology in handling financial data. A deep understanding of these concepts is essential for practical application in business operations.

| Topic | Key Concepts |

|---|---|

| System Design | Flow of data, process optimization, scalability |

| Internal Controls | Audit trails, fraud prevention, regulatory compliance |

| Risk Management | Identifying risks, implementing safeguards, reducing vulnerabilities |

| Security Protocols | Encryption, access control, data integrity |

| Data Processing | Automation, data storage, retrieval techniques |

Practical Applications

Understanding these key areas will not only help in academic settings but will also provide the necessary skills for real-world problem-solving. These concepts are directly applicable to managing business operations, improving efficiency, and ensuring security across various platforms.

Understanding System Design in Accounting

The design of financial management frameworks plays a pivotal role in ensuring efficiency and accuracy in business operations. This process involves creating structures that facilitate smooth data flow, minimize errors, and support decision-making. By focusing on key design principles, one can optimize the handling and processing of financial data in various settings.

Core Components of System Design

A well-designed framework includes several essential elements that work together to support seamless operations. These components focus on ensuring data accuracy, security, and accessibility for all stakeholders. Understanding these elements is crucial for evaluating how effective a design is in meeting organizational needs.

- Data Input: Capturing accurate and timely information.

- Processing: Transforming raw data into useful outputs.

- Storage: Organizing and maintaining data for easy retrieval.

- Output: Providing meaningful results to users for decision-making.

Importance of Design in Organizational Success

Effective design directly impacts the smooth functioning of operations. By focusing on optimization, businesses can reduce risks associated with data loss, delays, or security breaches. Moreover, a well-executed design enhances overall performance and ensures that stakeholders have the tools they need to make informed decisions.

Common Exam Questions on Data Management

In the realm of financial data handling, understanding how to manage and organize large amounts of data is crucial. This topic is frequently tested as it covers a range of processes, from capturing and storing data to ensuring its accessibility and security. Mastering these concepts allows individuals to navigate challenges effectively and optimize business operations.

Key Concepts to Understand

When preparing for challenges related to data management, it’s important to focus on several key concepts that ensure data is properly structured and protected. Below are some of the common themes that frequently come up in assessments:

- Data collection methods and accuracy

- Organizing data for efficient access

- Techniques for ensuring data integrity

- Data security practices to prevent breaches

- Backup and disaster recovery planning

Practical Scenarios to Consider

Practical applications of data management principles often involve real-world scenarios that require critical thinking. In these situations, the goal is to apply theoretical knowledge to solve problems such as data inconsistencies, breaches, or inefficiencies. Preparation should include practice with case studies and hands-on problem-solving to build confidence in handling various situations.

Important Concepts of Internal Controls

Effective management of financial processes relies heavily on safeguarding assets and ensuring reliable reporting. Proper control mechanisms are essential for preventing errors, fraud, and other risks that could undermine business operations. These mechanisms provide a framework for monitoring activities, ensuring compliance, and maintaining transparency across all operations.

Key Elements of Internal Control

Strong control measures are built around several core components. These elements work together to ensure that processes are secure, efficient, and compliant with relevant standards. Understanding these aspects is crucial for maintaining robust and effective operational frameworks.

- Control Environment: Establishing a culture of accountability and integrity.

- Risk Assessment: Identifying and evaluating potential threats to operations.

- Control Activities: Implementing procedures to mitigate identified risks.

- Information and Communication: Ensuring accurate and timely exchange of information.

- Monitoring: Continuously evaluating the effectiveness of control mechanisms.

Implementing Effective Control Measures

For internal controls to function optimally, they must be integrated into daily operations. This includes setting clear policies, training personnel, and regularly reviewing control mechanisms to adapt to new challenges. The success of these controls depends on the ability to identify weaknesses and address them proactively to avoid any disruptions to business functions.

How to Analyze Financial Information Systems

Analyzing financial tools and frameworks involves evaluating their effectiveness in processing, storing, and reporting data. This process ensures that all operations run smoothly, that data integrity is maintained, and that decisions are based on accurate and reliable information. A thorough analysis is key to optimizing performance and identifying areas for improvement.

Steps to Conduct a Thorough Analysis

To effectively assess financial management tools, one must focus on several critical steps. These steps include evaluating the efficiency of data handling, the accuracy of reports, and the security measures in place to protect sensitive information. The analysis also involves understanding how well these tools align with business goals and compliance requirements.

- Assess data flow: Understand how data moves through various processes and identify potential bottlenecks.

- Evaluate security measures: Review the protocols for protecting financial data from unauthorized access or loss.

- Examine reporting capabilities: Analyze how well the system generates accurate and timely reports for decision-making.

- Check scalability: Determine if the system can handle growing data volumes and more complex operations.

- Ensure compliance: Verify that the system complies with legal and regulatory standards.

Identifying Areas for Improvement

While evaluating these aspects, it is crucial to identify areas where the framework can be optimized. This could involve recommending new technologies, streamlining workflows, or improving security measures to minimize risks. By continuously reviewing and improving financial management tools, businesses can stay ahead of emerging challenges and enhance their operational efficiency.

Preparing for Exam Questions on Security

Understanding how to safeguard data and protect critical assets is a vital component of any business environment. Preparing for challenges related to security requires a deep understanding of risk management, encryption, and the protocols that ensure confidentiality, integrity, and availability of sensitive information. This section explores essential topics to focus on when getting ready for assessments in this area.

Key Security Concepts to Review

Familiarizing yourself with the fundamental principles of security is crucial. These concepts form the basis of how businesses protect their data from potential breaches and attacks. By mastering these areas, you can better analyze situations and apply the appropriate protective measures.

- Data Encryption: Methods used to encode data, ensuring that only authorized users can access it.

- Access Control: Ensuring that only authorized personnel can access sensitive data and resources.

- Threat Detection: Identifying potential risks and vulnerabilities before they can be exploited.

- Backup Strategies: Creating secure copies of data to prevent loss during unexpected events.

- Incident Response: Planning for quick action in the event of a security breach or attack.

Approaching Security Challenges

When addressing security-related scenarios, it’s important to apply a systematic approach. Begin by identifying the potential threats or vulnerabilities, then analyze the most appropriate measures to mitigate risks. Understanding real-world case studies can also be beneficial, as it provides insight into how security breaches are handled and what preventative measures are most effective.

Examining ERP Systems in Accounting

Enterprise Resource Planning (ERP) platforms are powerful tools that help businesses integrate and manage key operations, ensuring seamless data flow across different departments. These platforms enable organizations to streamline processes, reduce inefficiencies, and improve decision-making by providing real-time data insights. When evaluating such platforms, it’s essential to understand how they support financial operations and contribute to overall organizational success.

Key Features of ERP Platforms

ERP solutions are designed to provide comprehensive solutions for managing various business functions. In the context of financial management, these platforms offer several features that simplify tasks such as budgeting, financial reporting, and auditing. Understanding how these features work together can help evaluate the effectiveness of a given platform in supporting day-to-day operations.

- Integration: Seamlessly combines data from multiple departments into a unified platform.

- Automation: Reduces manual intervention, minimizing errors and enhancing efficiency.

- Real-Time Data: Provides up-to-date insights that improve decision-making processes.

- Customization: Adapts to the unique needs of different organizations, allowing for tailored solutions.

Evaluating the Effectiveness of ERP Tools

When assessing the effectiveness of ERP platforms, it’s important to look at factors such as user experience, system scalability, and data security. A well-implemented ERP solution can significantly enhance business operations, but choosing the right platform requires thorough analysis and understanding of an organization’s specific requirements. Additionally, continuous monitoring and periodic updates are key to maintaining the system’s relevance and efficiency over time.

Accounting Software and System Integration

Modern business operations rely heavily on software that can efficiently handle financial data while integrating seamlessly with other operational platforms. Proper integration allows for smooth data flow across various functions, enabling better management, improved accuracy, and faster decision-making. This section explores how well-designed software solutions can connect different business functions, making it easier to manage resources and ensure effective oversight.

Benefits of Software Integration

Integrating financial software with other tools within the organization offers several advantages, particularly in terms of efficiency, accuracy, and scalability. These integrations help to automate routine tasks, reduce the risk of errors, and improve overall business performance.

| Benefit | Description |

|---|---|

| Efficiency | Automates data transfers between platforms, saving time and reducing manual entry errors. |

| Accuracy | Ensures data consistency by linking all relevant systems, minimizing discrepancies. |

| Scalability | Facilitates the growth of the business by allowing systems to expand and adapt to new needs. |

| Real-Time Data | Offers up-to-date data across all departments, helping decision-makers act on current information. |

Considerations for Successful Integration

To ensure that financial tools integrate effectively with other platforms, businesses must consider several factors. Choosing the right software that supports integration, understanding the technical requirements, and ensuring proper training for staff are all critical elements in the process. With careful planning and implementation, organizations can optimize their workflows and gain better control over their financial management processes.

Key Terms You Need to Know for Exams

Understanding key terminology is crucial when preparing for assessments in any field. A solid grasp of essential terms not only enhances comprehension but also helps in articulating concepts effectively during tests. This section highlights some of the most important terms you should be familiar with to excel in evaluations related to business management and operational processes.

Core Concepts to Remember

Familiarity with fundamental concepts can significantly improve your performance by allowing you to approach complex scenarios with confidence. These terms are central to understanding various processes and will likely appear in any related evaluation.

- Data Integrity: Ensuring the accuracy and consistency of data throughout its lifecycle.

- Risk Management: The identification, assessment, and prioritization of potential risks to mitigate their impact on business operations.

- Compliance: Adhering to regulations, standards, and laws governing business practices and procedures.

- Automation: Using technology to perform tasks without human intervention, improving efficiency and reducing errors.

- Scalability: The ability of a process or system to handle increased workload or grow with the needs of the business.

Advanced Terminology to Master

As you progress in your studies, you may encounter more specialized terminology related to business processes. Understanding these advanced terms will help you tackle more complex situations and demonstrate a deeper level of expertise.

- Blockchain: A decentralized ledger used to securely store transaction data across multiple devices.

- Cloud Computing: Using remote servers hosted on the internet to store, manage, and process data.

- Business Intelligence (BI): Technologies and strategies used by organizations to analyze data and improve decision-making.

- Enterprise Resource Planning (ERP): Software used to manage core business processes and integrate various functions into a unified system.

- Data Encryption: The process of converting data into a secure format to prevent unauthorized access.

Accounting Information Systems and Auditing

The relationship between business management tools and auditing is fundamental in ensuring accuracy and compliance across all financial operations. Effective management platforms provide detailed records that auditors rely on to assess the integrity of financial data. This section explores how such platforms contribute to the auditing process by providing transparency, traceability, and accuracy, ultimately enhancing the reliability of financial reports.

Role of Technology in Auditing

Technological tools enable auditors to perform more efficient and thorough assessments. These platforms offer a variety of functions, from data validation to automated checks, that help auditors identify discrepancies, fraud, and errors. The integration of such tools streamlines the auditing process, reducing human error and enhancing the overall effectiveness of audits.

- Data Validation: Ensures that the records within the system are accurate and meet predefined standards.

- Automation of Auditing Tasks: Automates routine tasks, allowing auditors to focus on more complex issues and improving efficiency.

- Traceability: Provides a clear record of changes and transactions, making it easier to track data across various stages of the auditing process.

- Real-Time Monitoring: Facilitates ongoing supervision, enabling auditors to detect issues as they arise, rather than waiting for periodic checks.

Ensuring Compliance with Regulatory Standards

One of the critical functions of these platforms in the auditing context is ensuring that organizations comply with relevant regulations. Compliance features, such as automated reporting and audit trails, help maintain adherence to legal and industry standards. By offering built-in tools to monitor compliance, businesses can reduce the risk of non-compliance penalties and maintain a transparent financial environment.

- Audit Trails: Tracks every modification to financial records, ensuring transparency and helping auditors verify the integrity of the data.

- Regulatory Reporting: Generates reports that automatically align with the standards required by governing bodies.

- Compliance Checks: Regular assessments ensure ongoing adherence to industry-specific regulations and laws.

Data Privacy and Legal Considerations

Protecting sensitive data is paramount in today’s digital landscape, especially when handling vast amounts of personal and financial records. Legal frameworks are designed to ensure that organizations manage such data with the utmost care, safeguarding it from unauthorized access, misuse, or loss. This section delves into the importance of data privacy regulations, the responsibilities of organizations, and the legal implications of non-compliance.

Understanding Legal Obligations

Organizations must navigate a complex web of legal requirements to maintain the privacy and security of data. Various laws govern how data should be collected, stored, processed, and shared, with severe penalties for breaches. It is essential for businesses to understand these regulations and incorporate them into their daily operations to avoid legal consequences.

- General Data Protection Regulation (GDPR): A comprehensive law that governs data protection and privacy within the European Union, focusing on giving individuals more control over their personal data.

- California Consumer Privacy Act (CCPA): A state-level regulation in the U.S. that enhances privacy rights for California residents, ensuring they can access, delete, or opt out of the sale of their data.

- Health Insurance Portability and Accountability Act (HIPAA): U.S. legislation that sets the standard for protecting sensitive patient health information from breaches.

- Payment Card Industry Data Security Standard (PCI DSS): A set of security standards designed to ensure that all companies that process credit card information maintain a secure environment.

Risks of Non-Compliance

Failing to comply with data protection laws can result in significant financial and reputational damage. Organizations found to be negligent in safeguarding sensitive information may face fines, lawsuits, and loss of consumer trust. It is therefore critical for businesses to invest in secure infrastructure, conduct regular audits, and educate staff on the importance of privacy and compliance.

- Financial Penalties: Heavy fines imposed by regulatory authorities for non-compliance can severely affect an organization’s bottom line.

- Reputational Damage: Publicized breaches can erode trust with customers and partners, potentially leading to lost business opportunities.

- Legal Liabilities: Organizations may face lawsuits from affected individuals, resulting in costly legal battles and settlements.

Questions on Transaction Processing Systems

Understanding how organizations handle daily transactions is essential for ensuring operational efficiency. These systems are designed to capture, store, process, and report the data generated from routine business operations. In this section, we’ll explore common concepts and challenges related to transaction processing, as well as some key considerations when evaluating the effectiveness of such systems.

Key Components of Transaction Processing

Transaction processing involves several critical steps, which include data entry, validation, processing, and storage. The primary goal is to ensure accuracy, consistency, and speed when managing high volumes of transactions. Key components often include:

- Data Entry: The first step, where transaction details are entered into the system. This may involve manual or automated methods.

- Data Validation: Ensuring that all entered data is accurate and meets predefined criteria to avoid errors and inconsistencies.

- Processing: Performing necessary calculations, updates, or modifications to ensure that the transaction is recorded properly.

- Storage: Safely storing the processed data for future retrieval and analysis, while ensuring it is readily accessible when needed.

Challenges in Managing Transaction Processing

Although these systems are critical for day-to-day operations, there are several challenges organizations may face when managing transaction data. Ensuring the smooth operation of these systems requires ongoing attention to detail and adaptability to changing needs.

- System Integration: Ensuring seamless integration between transaction processing systems and other business software can be complex, requiring careful planning and technical expertise.

- Data Integrity: Maintaining accurate and reliable data throughout the transaction lifecycle is essential to avoid errors, fraud, or discrepancies in financial reporting.

- Scalability: As businesses grow, transaction volumes increase, and systems must be able to scale accordingly to handle higher loads without compromising performance.

- Security: Protecting transaction data from unauthorized access, theft, or manipulation is a constant concern, especially in industries dealing with sensitive customer information.

Evaluating Accounting Information Systems’ Efficiency

Measuring the effectiveness of business management platforms is crucial to ensure they meet the needs of an organization. An efficient system should streamline operations, reduce errors, and improve decision-making processes. This section explores how to assess the performance of such platforms by focusing on various criteria such as usability, speed, reliability, and integration capabilities.

Key Factors for Assessing System Performance

When evaluating a platform, it’s essential to focus on several core factors that directly impact its ability to support business operations:

- Usability: A system’s ease of use is one of the most critical aspects. If users find it intuitive and straightforward, the system will likely enhance productivity and minimize training costs.

- Speed: The speed at which data is processed and tasks are completed plays a significant role in overall efficiency. A slow system can cause delays, bottlenecks, and decreased user satisfaction.

- Reliability: A reliable platform operates consistently without frequent crashes or downtime. This ensures that business operations can continue smoothly without interruptions.

- Integration: The ability of the platform to integrate seamlessly with other tools and systems is essential for creating a unified workflow. This reduces manual entry and the potential for data inconsistencies.

Performance Metrics to Monitor

To properly evaluate the performance of a system, monitoring specific metrics can help track its effectiveness over time. These include:

- Transaction Volume: The ability of the system to handle increasing amounts of data without degradation in performance is essential for long-term success.

- Error Rates: Keeping track of errors, discrepancies, or data corruption incidents helps assess the accuracy and quality of the platform.

- User Satisfaction: Regular feedback from system users provides valuable insights into how well the platform meets their needs and expectations.

- Cost-Effectiveness: Evaluating the system’s ability to deliver value relative to its cost can indicate its overall effectiveness in supporting business objectives.

Best Practices for System Implementation

Successfully rolling out a new platform requires careful planning, clear communication, and strategic execution. To ensure that the system aligns with organizational goals and delivers value, several best practices should be followed throughout the deployment process. By adhering to these guidelines, businesses can minimize risks, optimize user adoption, and achieve long-term operational efficiency.

Planning and Preparation

The foundation of any successful implementation begins with thorough planning. Without a structured approach, even the best-designed platforms may encounter challenges. Key steps include:

- Define Objectives: Set clear, measurable goals for what the platform is meant to achieve, such as improving operational efficiency or enhancing decision-making capabilities.

- Stakeholder Engagement: Involve key stakeholders from various departments early in the process to ensure their needs and concerns are addressed from the outset.

- Assess Resource Requirements: Identify the necessary hardware, software, and personnel resources needed for the system’s implementation and ongoing support.

- Establish a Timeline: Set realistic milestones and deadlines for each phase of the implementation, including testing, training, and full deployment.

User Training and Support

A well-executed user training program is essential for ensuring the platform is used effectively across the organization. Training helps users adapt to the new environment and leverage its full potential. Key elements include:

- Hands-on Training: Offer practical, hands-on training sessions tailored to the specific roles of users, ensuring they are comfortable with the platform’s features and functions.

- Provide Documentation: Provide clear, easily accessible user guides and reference materials to support users as they become familiar with the platform.

- Offer Ongoing Support: Set up a dedicated support team or help desk to address any issues users may encounter post-implementation, ensuring a smooth transition and continued success.

Tips for Answering Complex Exam Questions

Tackling challenging assessments can be overwhelming, but with the right strategies, you can approach difficult prompts with confidence and clarity. By breaking down the problem, organizing your thoughts, and providing concise, well-supported responses, you increase your chances of success. Here are some effective techniques to help you navigate even the most intricate queries.

Understand the Prompt Thoroughly

Before diving into your response, take a moment to fully comprehend what is being asked. This helps ensure that your answer is relevant and addresses all parts of the query.

- Read Carefully: Take time to read the prompt multiple times to make sure you understand it completely. Look for key terms and phrases that highlight the main focus of the question.

- Identify Key Components: Break down the question into smaller sections, identifying what the question is asking for. Are you required to explain, analyze, compare, or evaluate something?

- Clarify Uncertainties: If you’re unsure about any aspect of the question, don’t hesitate to ask for clarification if it’s allowed.

Structure Your Response Clearly

A well-organized answer not only makes your response easier to follow but also demonstrates clear thinking and logical reasoning. Here’s how you can structure your response effectively:

- Introduction: Briefly introduce your main points, outlining the approach you’ll take in your response.

- Body: Address each part of the question systematically. Use paragraphs to separate different ideas or arguments, and provide evidence or examples where relevant.

- Conclusion: Summarize your key points and reiterate your answer to the original prompt, ensuring your response is cohesive and conclusive.

Be Concise but Detailed

While it’s important to be thorough, avoid overwhelming your response with unnecessary information. Stick to the point and make sure every sentence contributes to answering the question.

- Avoid Over-Explaining: Provide clear, relevant information without repeating yourself or going off-topic.

- Use Examples: Where appropriate, use specific examples to illustrate your points, but ensure they directly support your argument.

- Stay Focused: Ensure that every part of your response directly ties back to the question. If a point doesn’t contribute to answering the question, it’s best left out.

Understanding the Role of AI in Accounting

The integration of advanced technology has revolutionized various industries, and its influence in financial practices is no exception. Artificial intelligence (AI) has begun playing a pivotal role in streamlining operations, improving accuracy, and providing valuable insights within business environments. Understanding how this technology is applied can offer significant advantages in optimizing performance and decision-making processes.

Key Benefits of AI Integration

AI enhances various tasks that are critical to the effective operation of financial functions. By automating processes, businesses can not only reduce errors but also increase efficiency.

- Automation of Repetitive Tasks: AI can handle tasks such as data entry, report generation, and transaction processing with minimal human intervention, freeing up time for more strategic decision-making.

- Improved Accuracy: AI’s ability to detect patterns and anomalies in data leads to fewer mistakes and more precise outcomes in financial record-keeping.

- Real-time Data Analysis: AI can quickly analyze vast amounts of data, providing timely insights that assist with business forecasting and financial planning.

Applications of AI in Financial Processes

AI is used in a wide range of areas, from predictive analytics to fraud detection, all aimed at improving the overall financial workflow.

- Predictive Analytics: By analyzing historical data, AI models can forecast trends, helping businesses make informed predictions about future performance and market behavior.

- Fraud Detection: AI algorithms can monitor transactions in real-time, flagging unusual patterns or activities that could suggest fraudulent behavior.

- Risk Management: AI tools assess financial risks by analyzing large volumes of data, enabling businesses to proactively manage risks and avoid potential pitfalls.

Challenges and Considerations

While AI brings numerous advantages, its implementation comes with some challenges that need to be addressed for successful adoption.

- Data Quality: The effectiveness of AI relies heavily on the quality and accuracy of the data it processes. Poor data can lead to inaccurate results and skewed insights.

- Initial Investment: Implementing AI technology often requires significant upfront investment in both software and training.

- Security Concerns: The reliance on AI for sensitive data processing raises concerns over the protection of confidential financial information from potential breaches.

How to Study for Accounting Information Exams

Preparing for assessments in the field of financial systems requires a combination of understanding core concepts, applying theoretical knowledge, and practicing problem-solving techniques. Focusing on key areas and ensuring a comprehensive review can significantly enhance your ability to perform well during evaluations. A well-structured study plan is essential for mastering the necessary skills and gaining confidence.

Focus on Key Topics

Start by identifying the most important subjects that will likely appear during your assessment. Reviewing materials from previous lessons, textbooks, or notes can help highlight these crucial areas. Understanding the underlying principles and their practical applications will give you a solid foundation for tackling complex scenarios.

- Study Core Theories: Focus on foundational theories related to financial operations, such as asset management, transaction recording, and financial reporting.

- Understand Real-world Applications: Relate theoretical knowledge to actual practices used in various organizations to better grasp how these concepts function in a business context.

- Review Key Terms: Ensure you understand the terminology used, as clarity around specific terms will help you interpret questions more effectively.

Practice Problem-solving

To truly prepare for assessments, it’s vital to solve as many problems as possible. This helps develop critical thinking skills and enables you to apply theoretical knowledge to practical situations.

- Work on Sample Problems: Find practice questions or problems that cover a variety of topics. Try to solve them without referring to notes to test your understanding.

- Simulate Real Conditions: Practice under time constraints to replicate the pressure of actual assessments. This can help you manage time effectively during the test.

- Review Mistakes: After completing practice questions, carefully review your answers and understand where you went wrong. This will help you avoid similar mistakes in the future.