Achieving a professional certification in the field of anti-money laundering (AML) is a significant milestone for anyone looking to advance their career. This process involves demonstrating a deep understanding of compliance regulations, risk management, and the mechanisms for detecting and preventing financial crimes. Proper preparation is essential to ensure you have the knowledge required to pass the assessment successfully.

In this section, we will explore effective strategies for mastering the material needed for certification. By focusing on key topics, understanding exam structure, and practicing with realistic scenarios, candidates can build the confidence necessary for success. Utilizing the right resources and techniques will make the process smoother and more manageable.

Mastering the subject matter through focused study, coupled with regular review of typical challenges, is crucial. By honing in on the core concepts and familiarizing yourself with typical case studies, you will improve your ability to handle complex questions. Whether you’re just starting or nearing the final stages of preparation, a well-structured approach will help you achieve your certification goals.

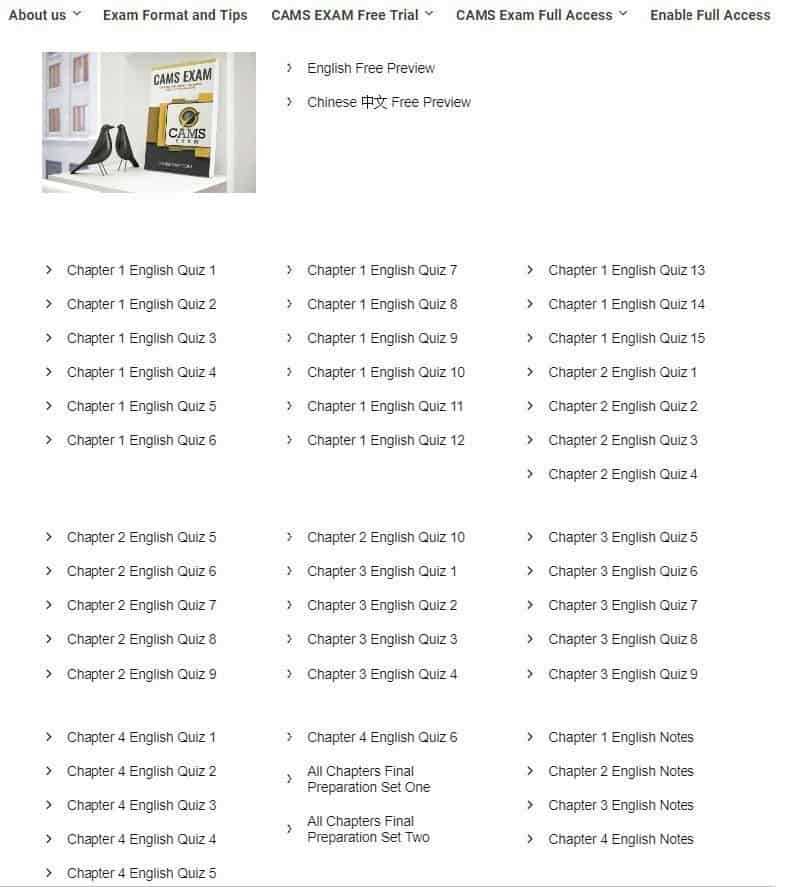

ACAMS Exam Questions and Answers Guide

To achieve success in the certification process, it’s essential to familiarize yourself with the key topics covered throughout the assessment. Understanding the structure and the types of content you will encounter is crucial for optimal preparation. This guide aims to provide you with valuable insights and practical tips that will help you navigate through the process with confidence.

Effective preparation involves more than just memorizing facts. It’s about developing a deep understanding of the concepts related to financial crimes, compliance regulations, and risk management. By practicing with realistic scenarios and reviewing commonly encountered material, you will enhance your ability to think critically under pressure.

Familiarizing yourself with the format and the types of problems that may arise will provide a strategic advantage. It’s important to pay attention to the nuances of the questions and understand how they are framed. This helps in recognizing key details and making well-informed decisions during the assessment.

Consistency in study is another critical factor. Regularly revisiting core topics and practicing problem-solving techniques will reinforce your knowledge and improve retention. Combining a disciplined study schedule with hands-on experience will put you in the best position to succeed.

Understanding the ACAMS Certification

Achieving professional recognition in the field of financial crime prevention demonstrates a commitment to expertise in managing regulatory compliance and anti-money laundering efforts. This certification provides individuals with a comprehensive understanding of the risks associated with financial institutions and equips them with the tools to identify and address potential threats. It is recognized globally and valued by organizations seeking professionals with specialized knowledge in compliance and risk management.

Core Knowledge Areas

The certification process covers a wide range of critical topics, including but not limited to money laundering techniques, risk assessment, regulatory frameworks, and the role of financial institutions in detecting suspicious activities. By gaining a deep understanding of these core areas, professionals are able to contribute meaningfully to preventing financial crimes and ensuring organizations adhere to the necessary legal standards.

Why Certification Matters

Holding a certification not only validates your expertise but also enhances your career prospects. It signals to employers that you have the knowledge and skills to manage compliance efforts effectively. For professionals working in high-risk industries, such as banking or insurance, this credential can be an important factor in advancing their career and securing higher-level roles.

Key Areas Covered in the Exam

Understanding the key topics assessed during the certification process is vital for anyone looking to succeed. The material focuses on critical areas within financial crime prevention, compliance frameworks, and risk management. Mastering these subjects ensures that candidates are well-prepared to handle the complexities of financial institutions’ responsibilities in combating illegal activities.

Regulatory Frameworks and Compliance

One of the primary areas covered includes global regulations and legal frameworks designed to prevent money laundering and terrorist financing. Candidates are tested on their knowledge of national and international standards, such as the Bank Secrecy Act, FATF recommendations, and other compliance requirements that guide financial institutions in managing risk.

Detection and Prevention Strategies

Identifying suspicious activity is another critical component. Candidates must demonstrate an understanding of the different methods used to detect fraudulent transactions, including transaction monitoring, due diligence, and customer identification programs. The goal is to recognize red flags and prevent illicit financial movements before they occur.

Additionally, the assessment explores the roles of various stakeholders within an organization and how they contribute to maintaining a secure financial environment. This includes the responsibilities of compliance officers, auditors, and senior management in shaping effective internal controls and risk mitigation strategies.

Effective Study Strategies for Success

Achieving success in the certification process requires a focused and disciplined approach to studying. Effective preparation is not just about covering a large volume of material but ensuring that the key concepts are understood deeply and can be applied in real-world situations. By developing the right study habits and using proven techniques, you can maximize your chances of success.

Structured Study Plan

Creating a detailed study schedule is essential for staying organized and on track. Break down the topics into manageable chunks, setting specific goals for each study session. Consistency is key, so allocate dedicated time each day or week to focus on particular areas. Prioritize the most challenging subjects and allow extra time for review to reinforce your understanding.

Active Learning Techniques

Passive reading is not enough to retain complex information. Instead, engage with the material actively by summarizing key points, making flashcards, or discussing the concepts with peers or mentors. Practicing with sample scenarios and applying your knowledge to hypothetical situations will further solidify your grasp of the subject matter.

Additionally, incorporating different learning styles–visual aids, audio resources, and interactive exercises–can help improve retention and keep you engaged. The more varied your approach, the better equipped you will be to recall and apply the material when needed.

Where to Find Reliable Resources

When preparing for any professional certification, having access to accurate and trustworthy materials is essential. The right resources can make a significant difference in how well you understand complex topics and apply that knowledge effectively. Finding reliable study aids ensures that you’re focusing on the most relevant and up-to-date information, which is key to success.

One of the most reliable sources is official publications and materials from recognized authorities in the field. Many organizations offer official study guides, practice exams, and instructional content that closely mirror the actual assessment. These resources are often curated by experts and provide the most accurate representation of what to expect.

Another valuable option is academic journals, professional blogs, and forums. Many professionals share insights, study tips, and recent updates on regulatory changes that can help deepen your understanding. Engaging with communities of like-minded individuals can provide additional perspectives and practical advice based on real-world experiences.

Common Challenges in ACAMS Exams

Preparing for a professional certification in financial crime prevention comes with its own set of challenges. Understanding the material, managing time effectively, and dealing with complex scenarios can make the process demanding. It’s important to recognize these obstacles in advance to better prepare for the journey ahead.

- Complex Terminology: One of the most common difficulties is mastering the specialized language used in the field. The terminology related to financial regulations, compliance procedures, and risk management can be overwhelming for newcomers.

- Volume of Material: With vast amounts of content to cover, it’s easy to feel lost in the sheer amount of information. Candidates often struggle to prioritize topics and allocate sufficient time to all areas.

- Scenario-Based Questions: Many tests include real-world scenarios that require critical thinking and the ability to apply knowledge in practical situations. These types of questions can be challenging, as they test not only recall but also problem-solving skills.

- Time Constraints: Managing time during the assessment is another significant challenge. With limited time to answer each question, candidates may feel rushed or pressured to make decisions quickly.

Recognizing these difficulties early on can help develop strategies to overcome them. Creating a solid study plan, practicing with sample scenarios, and breaking down complex terminology will help mitigate these challenges and improve overall performance.

How to Approach Multiple-Choice Questions

Multiple-choice items can be a challenge, especially when faced with complex topics. The key to answering these types of items effectively is to develop a systematic approach that helps identify the most accurate responses. Understanding how to approach each question strategically will increase your chances of selecting the correct answer.

Steps to Follow

Start by reading each item carefully to fully understand what is being asked. It is essential to focus on the details within the statement and options. A good practice is to try eliminating clearly incorrect choices first, narrowing down your options. Then, analyze the remaining choices based on your knowledge and judgment.

| Step | Action | Tip |

|---|---|---|

| 1 | Read the item carefully | Understand the context of the question before looking at the choices |

| 2 | Eliminate incorrect choices | Remove the options that are clearly wrong to focus on more plausible answers |

| 3 | Review the remaining choices | Compare them against your knowledge to determine which fits best |

| 4 | Trust your instincts | If unsure, select the answer that seems most logical |

Common Pitfalls to Avoid

Be cautious of choices that seem too extreme or absolute, as these are often incorrect. Additionally, avoid overthinking a question; trust the knowledge you’ve acquired. Lastly, always check if there is any specific wording in the item that could change the meaning, such as “always” or “never,” which can sometimes make a choice inaccurate.

Importance of Real-Life Case Studies

Incorporating real-world examples into your preparation can significantly enhance your understanding of complex concepts. By studying actual scenarios, you not only learn theoretical knowledge but also gain practical insights into how financial crime prevention methods are applied in diverse situations. This approach bridges the gap between theory and practice, making it easier to grasp critical concepts and apply them effectively.

Practical Application of Knowledge

Real-life case studies provide a unique opportunity to see how regulatory measures, compliance frameworks, and investigative techniques are put into action. By analyzing actual cases, you gain a better understanding of how professionals in the field handle challenging situations, which helps in making informed decisions in similar contexts. This practical application allows you to visualize the consequences of both correct and incorrect actions, reinforcing the importance of proper procedures and compliance.

Learning from Past Mistakes

Case studies also offer valuable lessons on the consequences of failing to follow proper protocols. By examining past mistakes, you can better understand the pitfalls that organizations and individuals face, making it easier to avoid common errors. These examples highlight the importance of vigilance, thoroughness, and ongoing education in the field of financial crime prevention.

Time Management Tips During the Exam

Managing time effectively during a testing process is crucial for success. The ability to allocate the right amount of time to each section, while ensuring that all tasks are completed, can make a significant difference in performance. Being mindful of time can help prevent unnecessary stress and allow you to focus on each task without feeling rushed.

Strategic Planning Before the Test

Before diving into the assessment, it’s important to take a few minutes to plan how you’ll allocate your time. A clear strategy can help you pace yourself and avoid spending too much time on any one section. Consider the following:

- Know the Total Time Limit: Be aware of the overall time allowed for the process. This will help you determine how much time to spend on each section.

- Divide the Time: Break down the available time based on the number of sections and the complexity of each. Prioritize sections that require more time and attention.

- Plan for Breaks: If allowed, schedule short breaks to refresh your mind and avoid burnout.

During the Test

Once you start, managing your time becomes even more important. Here are some techniques to maintain control over your pace:

- Start with Easy Tasks: Begin with the sections or tasks that are easiest for you. This will boost your confidence and leave more time for the challenging ones.

- Track Time Regularly: Keep an eye on the clock, but don’t obsess over it. Check the time at regular intervals to ensure you’re staying on track.

- Don’t Get Stuck: If you encounter a difficult item, move on and come back to it later if time permits. Avoid spending too much time on one question at the expense of others.

Exam Structure and Question Types

Understanding the layout and types of items you’ll encounter during an assessment is essential for effective preparation. Different formats assess various aspects of knowledge, critical thinking, and practical application. By familiarizing yourself with these structures, you can approach each section with confidence and maximize your performance.

Overview of the Structure

The assessment typically consists of multiple sections, each focusing on different areas of expertise. These may include theory, practical application, and scenario-based analysis. It’s important to understand how each section is structured to allocate time appropriately and prioritize tasks during the test.

- Multiple-Choice Format: This is the most common structure, where each item presents several options, and you need to select the correct one.

- Scenario-Based Items: These test your ability to apply knowledge in real-world situations, requiring more analytical thinking and decision-making.

- True/False Statements: These items assess your understanding of specific facts or concepts, requiring a quick decision based on your knowledge.

- Fill-in-the-Blanks: These tasks require you to complete missing information based on your understanding of the material.

Understanding the Question Types

Each question type has its own approach and requires specific strategies to answer correctly. Being aware of the different formats can help you strategize your responses and avoid common mistakes.

- Direct Knowledge: Questions that test your understanding of specific concepts or facts.

- Application: These items assess your ability to use knowledge in practical or hypothetical scenarios, often requiring deeper critical thinking.

- Conceptual Understanding: Focused on testing your grasp of underlying principles and frameworks, these questions often involve interpretation or analysis.

How to Stay Calm During the Test

Maintaining composure during a high-stakes assessment is essential for performing at your best. Anxiety and stress can interfere with your ability to think clearly, so it’s important to adopt strategies that help keep you focused and calm. By preparing mentally and adopting certain techniques, you can manage stress and approach each task with confidence.

- Deep Breathing: Taking slow, deep breaths helps activate your body’s relaxation response, reducing feelings of anxiety and helping you stay centered.

- Positive Visualization: Before the test begins, take a moment to visualize yourself calmly working through the process and succeeding. This can help you feel more confident and in control.

- Breaks and Pauses: If allowed, take short breaks to clear your mind. This can help you reset and refocus, especially if you begin to feel overwhelmed.

- Focus on One Task at a Time: Avoid getting distracted by thinking about the entire assessment. Focus on each section individually, which will make it feel more manageable.

- Stay Positive: Cultivate a positive mindset by reminding yourself of your preparation and ability to handle challenges. Confidence can significantly reduce stress.

Reviewing Commonly Asked Questions

One of the best ways to prepare for a rigorous assessment is to familiarize yourself with the types of topics and prompts that tend to appear frequently. By reviewing the most commonly covered subjects, you can gain a deeper understanding of the material and refine your responses. This approach will not only enhance your confidence but also improve your ability to handle similar challenges in the actual setting.

- Key Regulatory Frameworks: A large portion of the content often focuses on important laws, regulations, and compliance standards. Understanding the most relevant frameworks is essential for answering related items.

- Risk Management Strategies: Be prepared to discuss various risk management methods and best practices in your field. Reviewing case studies and applying concepts to real-life scenarios can be especially helpful.

- Fraud Detection Techniques: Items focused on identifying and mitigating fraud are common. Ensure you are familiar with the latest tools and strategies used to recognize suspicious activity.

- Ethical Dilemmas: You may encounter prompts that assess your ability to navigate ethical challenges in professional settings. Review situations that involve decision-making under pressure.

By consistently reviewing these frequently asked topics, you can develop a comprehensive understanding that will aid in your overall preparation.

Understanding AML Concepts for the Exam

Anti-Money Laundering (AML) is a critical area of focus for any certification related to financial crimes and compliance. It’s essential to have a thorough grasp of the core concepts that drive the strategies and regulations in this field. Familiarity with these principles not only aids in practical application but also ensures you are well-prepared for assessments focused on financial security and crime prevention.

- Money Laundering Stages: Understand the three primary stages of money laundering: placement, layering, and integration. Each stage represents a different phase in the process of moving illicit funds.

- Know Your Customer (KYC): Familiarize yourself with the KYC requirements, which ensure that financial institutions identify and verify the identity of their clients, a fundamental aspect of preventing illegal activities.

- Risk-Based Approach: Learn how organizations assess potential risks related to customers, transactions, and jurisdictions. This approach allows for more effective allocation of resources to combat financial crime.

- Red Flags and Indicators: Be able to identify common warning signs of suspicious activity, such as large, rapid transactions or unusual patterns of behavior that may suggest illicit activity.

By mastering these foundational AML concepts, you will not only be prepared for assessment questions but also gain insight into their real-world applications in preventing financial crimes.

ACAMS Exam Scoring System Explained

Understanding how assessments are scored is crucial for successful preparation and setting realistic expectations. The scoring system determines your performance based on the answers you provide and is designed to reflect your level of knowledge in the field. Knowing how points are allocated and what score is needed to pass can help you structure your study sessions effectively.

The overall score is calculated from a combination of correct answers across various sections, each focusing on different aspects of the subject. The higher the number of correct responses, the better your score will be. Additionally, it’s important to note that some topics may carry more weight than others, so mastering those areas is key to improving your final result.

Each assessment is scored on a scale, with a passing threshold set to ensure that you demonstrate a comprehensive understanding of the material. Review the scoring guidelines thoroughly to get a sense of how each section contributes to your overall success.

Using Practice Exams to Prepare

One of the most effective strategies for ensuring success in any assessment is using practice tests to reinforce your knowledge. These mock assessments simulate the actual conditions of the test, helping you familiarize yourself with the format and types of material that will be covered. By regularly engaging with these tools, you can identify areas where you may need further review and improve your test-taking strategy.

- Build Confidence: Taking practice tests helps reduce anxiety by giving you a sense of what to expect, making you feel more confident when facing the real challenge.

- Time Management: These simulations allow you to practice managing your time effectively, ensuring that you can complete the test within the allotted time frame.

- Identify Weak Areas: Review your performance after each practice session to identify areas where your knowledge is lacking. Focus your study efforts on these topics.

- Track Progress: Repeated practice tests offer a clear way to track your progress. Over time, you’ll see improvement, which boosts motivation.

Incorporating practice assessments into your preparation routine not only builds familiarity with the material but also fine-tunes your ability to tackle questions under pressure. This approach enhances both your knowledge and your ability to apply it effectively in a timed environment.

What to Do After the Exam

Once you have completed your assessment, it’s important to take a few steps to ensure that your efforts are properly evaluated and that you’re ready for the next phase, regardless of the outcome. Knowing how to proceed after the test can help you stay organized and focused while awaiting results. Here are some key actions to consider following the completion of any professional assessment.

| Action | Purpose |

|---|---|

| Review Performance | Analyze your responses to identify any areas where you may have struggled or misinterpreted questions. This can be useful for future learning. |

| Relax and Reflect | Take some time to unwind and detach from the pressure. Reflection on your preparation process can provide insights into what worked well. |

| Stay Prepared for the Outcome | Whether you pass or need to retake the assessment, staying mentally prepared for any result will allow you to handle the situation with confidence. |

| Check for Results | Follow the appropriate channels to get your results. Make sure to stay informed and prepared for any next steps. |

By focusing on these actions after the test, you’ll set yourself up for success, regardless of how the results turn out. It’s also important to consider how you can continue developing your skills and knowledge, regardless of the assessment outcome.

Additional Resources for ACAMS Preparation

Preparing for a certification in the field of anti-money laundering and financial crimes requires a comprehensive understanding of both theoretical concepts and practical applications. While studying the core materials is crucial, utilizing a variety of additional resources can enhance your knowledge and provide further insights. These resources can help you stay updated with current trends and deepen your grasp of key topics relevant to the certification.

Books and Study Guides

Books that specialize in anti-money laundering regulations and practices can be incredibly helpful. Look for publications that cover real-world scenarios, case studies, and detailed explanations of the compliance framework. Study guides tailored to the certification often come with practice exercises, sample scenarios, and helpful tips for tackling complex topics. Some highly regarded books in this domain are:

- AML Essentials: A Guide for Practitioners – A comprehensive reference guide that covers the fundamental concepts.

- The Anti-Money Laundering Handbook – A detailed overview of regulatory frameworks and international best practices.

Online Courses and Webinars

Enrolling in an online course or attending webinars is another great way to supplement your studies. Many platforms offer specialized courses that break down complex subjects into manageable lessons. Additionally, industry professionals often host webinars that cover recent updates, trends, and practical examples that can help reinforce your knowledge. Look for well-established education providers that are recognized within the field for their focus on compliance training.

- Online Learning Platforms – Websites like Coursera, Udemy, and LinkedIn Learning often feature AML-related courses.

- Webinars by Industry Leaders – Participate in live sessions where experts share their knowledge and experiences.

By utilizing a combination of books, courses, and professional webinars, you can broaden your understanding and prepare effectively for your certification journey. These resources offer a diverse approach to learning, ensuring you are well-equipped to succeed.