When preparing for an assessment focused on business data interpretation, it’s crucial to understand the core principles that drive decision-making processes. Success in such evaluations requires a clear grasp of how to interpret key documents, identify trends, and apply theoretical knowledge in practical situations.

Examining various forms of company performance indicators helps build the foundation needed to succeed. Emphasis is placed on understanding not only the numbers but also the broader context they represent. Developing this expertise enables individuals to tackle complex tasks with confidence and precision.

Effective preparation involves a combination of theoretical learning and hands-on practice, ensuring a comprehensive understanding. By mastering the underlying principles and refining your ability to navigate through essential data, you can improve your skills and perform at your best.

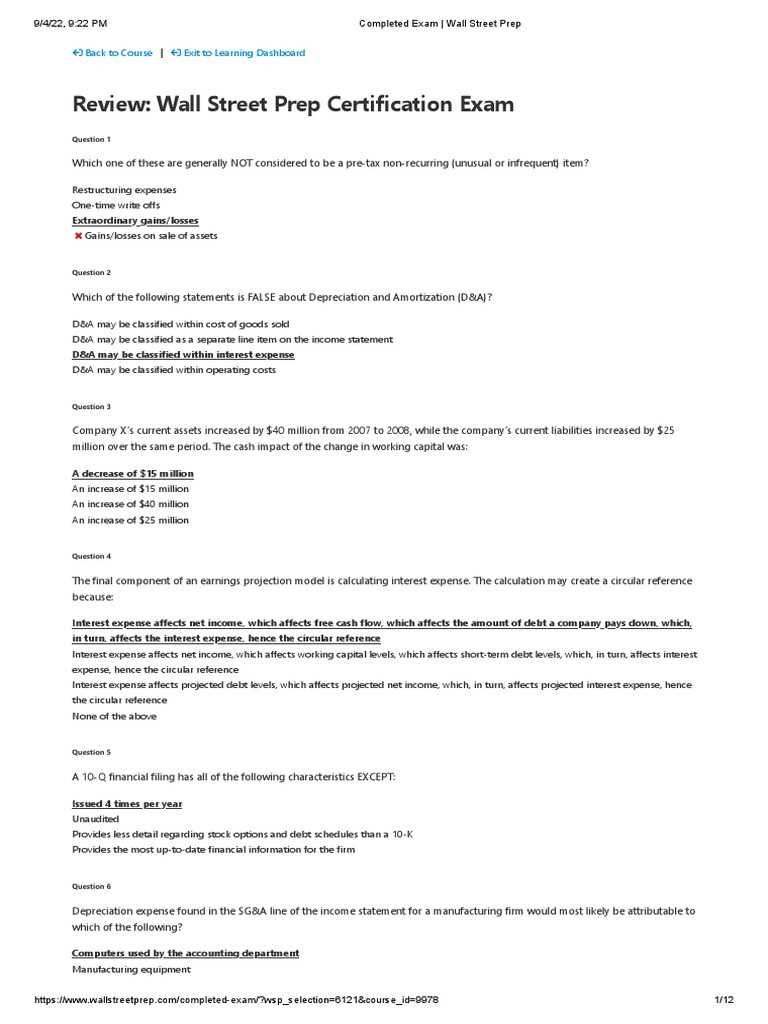

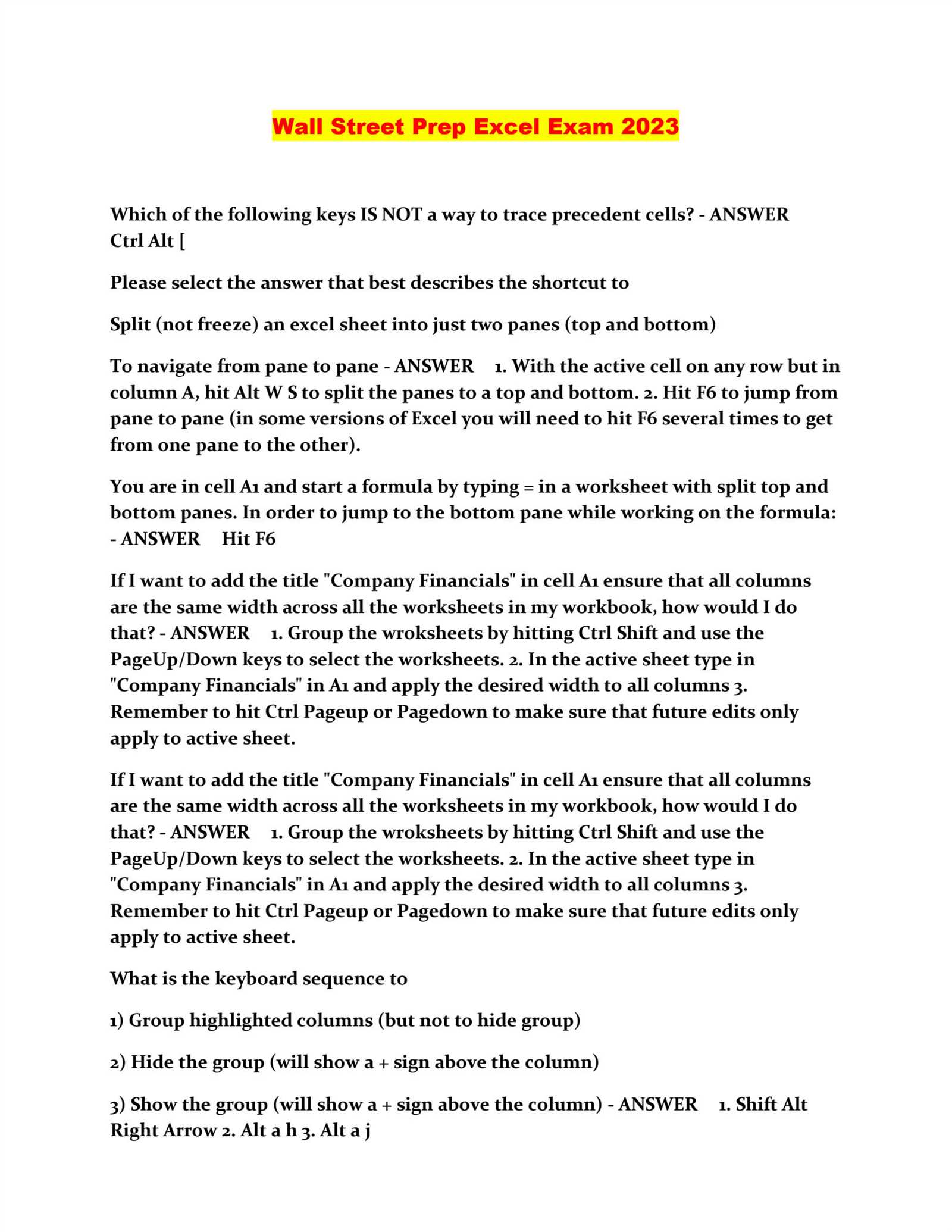

Wall Street Prep Exam Answer Guide

Preparing for a business data assessment requires a focused approach, where understanding the material and practicing the application of core concepts is essential. By reviewing key strategies and techniques, you can efficiently tackle complex problems and maximize performance in evaluations.

To guide your preparation, consider the following steps:

- Understand Core Concepts: Make sure you have a solid grasp of the fundamental principles involved in interpreting company performance indicators.

- Review Example Scenarios: Practice by working through real-world examples that reflect the type of content you’ll encounter in the assessment.

- Identify Key Metrics: Focus on the most important metrics that are likely to appear in questions. This includes ratios, trends, and comparisons.

- Analyze Case Studies: Case studies are a great way to apply your theoretical knowledge to practical situations, helping you sharpen your skills.

In addition to understanding the material, refining your test-taking skills is just as important:

- Manage Time Efficiently: Allocate appropriate time to each section, ensuring that you complete every task without rushing.

- Practice Problem-Solving: Focus on working through problems in a methodical manner to build speed and confidence.

- Stay Calm Under Pressure: Learning how to stay composed while tackling difficult problems can make a significant difference in performance.

By following these strategies and consistently practicing, you will be well-prepared for any assessment and ready to demonstrate your skills effectively.

Overview of Financial Report Analysis

In any business environment, understanding how to assess and interpret key performance data is essential for making informed decisions. The ability to extract meaningful insights from various documents enables professionals to evaluate a company’s health, predict future trends, and guide strategic choices.

At the core of this process is the ability to break down complex data into understandable components, focusing on vital indicators such as profitability, liquidity, and solvency. This analysis involves a detailed review of several documents, each providing unique insights into a company’s operations.

The most commonly reviewed documents include:

| Document Type | Description | Key Insights |

|---|---|---|

| Income Statement | Shows a company’s revenue and expenses over a period of time | Profitability and operating efficiency |

| Balance Sheet | Summarizes a company’s assets, liabilities, and equity | Financial stability and resource allocation |

| Cash Flow Statement | Displays cash inflows and outflows during a specific period | Liquidity and cash management |

By reviewing these documents, professionals can develop a comprehensive understanding of a company’s performance and its potential for future success. This process of breaking down data is crucial for anyone seeking to make data-driven decisions in a business context.

Key Concepts for Success in Exams

Achieving success in assessments that require data interpretation and decision-making is largely based on mastering essential principles. A deep understanding of the subject matter combined with effective problem-solving techniques can significantly enhance performance. To perform well, it’s not only about knowing the facts but also about how to apply them strategically under time constraints.

Grasping Core Principles

Before diving into solving problems, it’s important to have a clear understanding of the foundational concepts. Focus on key ideas such as financial health indicators, liquidity ratios, and profitability measurements. These fundamental elements provide the building blocks for interpreting any type of performance data effectively.

Effective Problem-Solving Strategies

Success also depends on honing your approach to solving complex problems. Break down each task step-by-step, ensuring that you identify and address each part of the problem. With practice, you’ll be able to recognize patterns and efficiently apply your knowledge, improving your speed and accuracy during the assessment.

Understanding Financial Statements Thoroughly

To make informed decisions and accurately interpret a company’s performance, it’s essential to have a deep understanding of the primary documents used in business analysis. These statements serve as a reflection of the organization’s operations, profitability, and overall health. By mastering these reports, you gain the ability to assess financial stability and identify key trends that can influence strategic decisions.

Income Statements provide insights into a company’s revenues and expenses over a specific period. By examining these figures, you can determine whether a company is effectively managing its costs and generating profit. It’s important to focus on net income and the company’s ability to maintain a sustainable margin.

Balance Sheets summarize a company’s assets, liabilities, and shareholder equity at a given point in time. These documents reveal the financial position of a business, showcasing its ability to meet obligations and leverage assets to generate future income. Key elements to analyze include the debt-to-equity ratio and working capital.

Cash Flow Statements are crucial for understanding the actual cash movements within the company. This document highlights the sources and uses of cash, giving insight into how well a company manages its liquidity. It is essential to distinguish between operating, investing, and financing activities to assess whether the company is generating sufficient cash from its core operations.

Mastering these key statements enables professionals to evaluate a business’s financial standing accurately and make informed predictions about future performance.

Common Challenges in Financial Report Exams

Assessments that require interpreting business documents often present a range of challenges. These difficulties stem from the complexity of the materials and the need to quickly analyze large amounts of data. Even seasoned professionals can find it difficult to navigate through intricate figures and derive meaningful conclusions under time pressure.

One common challenge is understanding complex data sets. In many cases, the information provided can be overwhelming, requiring careful attention to detail. Distinguishing between relevant and irrelevant data can be time-consuming, especially when faced with numerous variables that need to be assessed simultaneously.

Time management is another major obstacle. Many assessments have strict time limits, which can make it difficult to thoroughly analyze each section. Allocating time effectively between reading, interpreting, and answering questions is crucial to ensure you don’t miss important details.

Additionally, misinterpretation of key metrics can lead to incorrect conclusions. For instance, confusing profitability ratios with liquidity ratios can affect the overall analysis, leading to flawed assessments of a company’s health.

By recognizing these challenges in advance, you can develop strategies to overcome them and approach such tasks with greater efficiency and confidence.

How to Approach Income Statements

When faced with an income statement, it’s essential to break it down into its key components in order to understand a company’s profitability and performance over a specific period. These statements provide valuable insights into how well a business generates revenue, controls costs, and manages its expenses. A systematic approach can help uncover critical details that may otherwise be overlooked.

Start with the Top Line: Revenue

The first section to focus on is revenue, or sales. This represents the total income generated from goods or services provided. It’s important to assess whether the revenue is consistent over time and how it compares to previous periods or industry benchmarks. Pay attention to any significant fluctuations or trends that might signal potential issues or opportunities for growth.

Evaluate Costs and Expenses

Next, examine the expenses related to the company’s operations. These include both fixed and variable costs such as production costs, operating expenses, and administrative costs. Gross profit, calculated by subtracting the cost of goods sold from revenue, is an important indicator of operational efficiency. A deeper analysis of operating expenses can reveal whether the company is controlling its spending effectively.

Finally, focus on the net income at the bottom of the statement. This is the most important figure for evaluating profitability, as it reflects the company’s ability to generate profit after all expenses, taxes, and interest have been deducted. A positive net income indicates profitability, while a negative result suggests potential financial difficulties.

By following these steps, you can gain a clearer picture of a company’s performance and make more informed assessments based on the income statement.

Decoding Balance Sheets for Beginners

Understanding a balance sheet is essential for gaining insight into a company’s financial standing. It provides a snapshot of a business’s resources and obligations at a specific point in time, offering a clear picture of its stability. For beginners, breaking down the components into manageable sections is crucial to interpreting this document correctly.

Assets: What the Company Owns

The first part of the balance sheet is assets, which represent everything the company owns. These can be classified into current assets and non-current assets. Current assets include items expected to be converted into cash within a year, such as inventory, accounts receivable, and cash on hand. Non-current assets, on the other hand, include long-term investments like property, plant, and equipment, which are less liquid but contribute to long-term value.

Liabilities: What the Company Owes

On the other side of the balance sheet, you’ll find liabilities, which represent what the company owes to others. These also break down into current liabilities, due within a year, such as accounts payable or short-term loans, and non-current liabilities, such as long-term debt or pension obligations, which extend beyond a year. Understanding these figures is crucial for assessing whether the company is over-leveraged or managing its debts effectively.

Finally, the difference between assets and liabilities gives you the company’s equity, representing the ownership value left for shareholders. A healthy balance sheet should show a strong asset base and manageable liabilities, ensuring long-term financial stability.

Cash Flow Statements: What to Know

A cash flow statement provides a detailed view of a company’s cash inflows and outflows over a specific period. Unlike other documents that focus on profitability, this statement reveals how well a company is managing its cash to meet obligations and support ongoing operations. Understanding the flow of cash is vital for assessing the financial health of a business.

The statement is divided into three main sections: operating activities, investing activities, and financing activities. Each of these categories provides unique insights into the company’s financial actions.

Operating activities refer to cash generated or used in the company’s core business operations, such as revenue from sales or payments made to suppliers. This section reveals how efficiently the business is running on a day-to-day basis. Positive cash flow from operations is a strong indicator of financial health.

Investing activities include cash flows related to the purchase and sale of long-term assets like property or equipment. This section can show whether the company is investing in growth or divesting assets to raise cash. While some cash outflows for investment may be necessary, consistently negative cash flow in this section may raise concerns about future sustainability.

Financing activities encompass cash flows resulting from borrowing or repaying debt, issuing stock, or paying dividends. These activities give insight into how the company is managing its capital structure and whether it is relying on external financing to fund its operations and growth.

By reviewing each section of the cash flow statement, you can gain a deeper understanding of a company’s liquidity, its ability to generate cash, and its financial stability. This makes the statement a crucial tool for investors, analysts, and managers alike.

Top Tips for Analyzing Ratios

Ratios are powerful tools for evaluating a company’s performance and financial health. They provide quick insights into various aspects of a business, such as profitability, liquidity, and efficiency. By comparing these ratios over time or against industry benchmarks, you can uncover trends, strengths, and areas needing improvement. However, interpreting ratios effectively requires a methodical approach and a solid understanding of what each ratio represents.

Focus on Key Ratios

When analyzing financial performance, not all ratios are equally important. Prioritize the following key categories:

- Profitability ratios: These ratios, like the net profit margin and return on equity, help assess how well a company is generating profit relative to its revenue or equity.

- Liquidity ratios: Ratios like the current ratio and quick ratio indicate whether a company can meet its short-term obligations with its available assets.

- Efficiency ratios: Ratios such as inventory turnover and asset turnover highlight how effectively a company uses its resources to generate sales.

- Leverage ratios: The debt-to-equity ratio and interest coverage ratio provide insight into how much debt a company carries and its ability to meet debt obligations.

Compare Over Time and Against Peers

To truly understand the significance of any ratio, it’s essential to compare it across multiple periods or against industry competitors. Consider the following:

- Compare ratios over several quarters or years to identify trends. A sharp drop or increase may indicate underlying issues or improvements.

- Benchmark the company’s ratios against similar businesses in the same industry. This helps identify relative performance and competitive positioning.

By focusing on these key areas and conducting comparative analysis, you can make more informed assessments and draw accurate conclusions about a company’s financial situation.

Mastering Financial Metrics for Accuracy

Mastering key financial indicators is essential for obtaining an accurate view of a company’s performance. These metrics serve as benchmarks to measure a business’s profitability, efficiency, solvency, and overall financial health. Understanding how to calculate, interpret, and apply these figures is crucial for making informed decisions and identifying potential issues or opportunities for growth.

To ensure precision and reliability when using these metrics, follow these essential guidelines:

Understand the Components of Each Metric

Each financial metric is made up of specific components, and understanding these components is vital for accurate analysis. Here’s how to approach the most commonly used measures:

- Profit Margins: These ratios, like gross margin or operating margin, focus on how much profit is generated from revenue. They help assess how well a company controls its costs.

- Return on Investment (ROI): This metric indicates the profitability of investments relative to their costs. A high ROI suggests efficient use of resources, while a low ROI may signal the need for strategic adjustments.

- Debt Ratios: Leverage metrics, such as the debt-to-equity ratio, provide insights into how much debt a company has relative to its equity. These figures are crucial for assessing financial risk and long-term solvency.

- Liquidity Ratios: These ratios, like the quick ratio, are important for evaluating a company’s ability to cover short-term liabilities with available assets.

Ensure Consistency in Data Sources

For accurate analysis, it’s essential to use reliable and consistent data. When reviewing financial performance, always ensure that the figures come from the same source and time period. Variations in accounting practices or data discrepancies can lead to misinterpretations.

- Use audited financial statements whenever possible.

- Verify that the timeframes being compared are consistent (e.g., quarterly vs. yearly).

By paying attention to the details of each metric and ensuring consistency in the data, you can gain a deeper understanding of a company’s financial health and make more accurate assessments.

What the Assessment Focuses On

The assessment is designed to evaluate a candidate’s ability to comprehend and apply core principles of corporate finance, focusing on key metrics, methods, and practical scenarios. It is intended to test both theoretical knowledge and practical skills necessary for analyzing company performance, making informed decisions, and solving complex financial problems. Participants are expected to demonstrate a strong grasp of how various financial statements interconnect and how to interpret key figures that drive business success.

The main areas of focus include:

- Understanding Core Financial Metrics: Candidates need to be familiar with critical indicators such as profitability, liquidity, leverage, and efficiency ratios, and understand their relevance in assessing business performance.

- Mastering Financial Statement Interpretation: A large portion of the test focuses on the ability to extract meaningful insights from balance sheets, income statements, and cash flow statements, assessing both the structure and trends within these documents.

- Investment and Valuation Techniques: The assessment includes scenarios that require the use of valuation methods, such as discounted cash flow (DCF), to assess the value of companies or projects based on future cash flows.

- Risk Management and Forecasting: Participants are expected to evaluate financial risk and predict future trends based on historical data, employing forecasting techniques to guide decision-making processes.

Ultimately, the goal is to ensure that candidates have a well-rounded understanding of the key concepts and can apply them effectively in real-world situations, allowing them to make sound decisions under various business conditions.

Essential Tools for Financial Analysis

To conduct thorough assessments of a company’s financial situation, various tools are essential for collecting, organizing, and interpreting data. These tools allow professionals to evaluate performance, compare benchmarks, and make informed decisions based on key metrics. A well-equipped analyst uses a combination of software, frameworks, and techniques to gain comprehensive insights into a business’s operations and financial health.

Software and Spreadsheet Tools

Spreadsheet programs, particularly Excel, are indispensable in the financial world. They offer the flexibility to manipulate large datasets, create detailed financial models, and perform complex calculations. Some essential spreadsheet functions include:

- Pivot Tables: Used to summarize data and highlight trends across different categories.

- Formulas: Vital for calculating key financial ratios, such as return on assets (ROA) or quick ratio.

- Charts and Graphs: Visual representation of data that aids in comparing figures over time and across sectors.

Valuation and Analytical Frameworks

In addition to software, analysts rely on specific frameworks to assess the worth and risk of investments. These methodologies help professionals determine the value of a company or asset, as well as project future performance. Some commonly used approaches include:

- Discounted Cash Flow (DCF) Analysis: A method for valuing a business based on its expected future cash flows, adjusted for time value.

- Comparable Company Analysis (CCA): A technique for evaluating a company by comparing it with others in the same industry or market.

- Precedent Transaction Analysis: Involves reviewing historical deals in the market to estimate the value of a company based on past transaction data.

Using these tools, professionals can confidently assess a company’s current standing and predict its potential for future growth or risk, which is critical for investment, lending, or corporate decision-making.

How to Avoid Common Exam Mistakes

When preparing for an assessment, it’s easy to make avoidable errors that can negatively affect performance. Understanding the most common pitfalls and adopting strategies to avoid them is essential for success. Whether it’s misinterpreting questions, rushing through tasks, or overlooking key details, these mistakes can be minimized with careful planning and focus.

Here are some strategies to help you steer clear of common missteps:

- Understand the Question: Often, candidates rush to answer without fully grasping what is being asked. Take time to read the question carefully, ensuring you understand its requirements before responding.

- Double-Check Calculations: Simple mathematical errors can cost valuable points. Always review your calculations and ensure they align with the question’s context. Use a calculator or spreadsheet tool to avoid manual mistakes.

- Stay Organized: Jumping from one task to another without a clear structure can lead to confusion. Organize your work logically, tackling one section at a time. Use bullet points or numbered lists to clearly present your thoughts and analysis.

- Manage Time Effectively: Time management is critical. Allocate enough time for each section, and avoid spending too much time on any one question. Use a timer or watch to keep track of time, ensuring you have sufficient moments to review your answers at the end.

- Don’t Overcomplicate Answers: Keep your responses concise and to the point. Over-complicating answers or trying to include unnecessary details can confuse the reader and detract from the main idea you want to convey.

By implementing these techniques, you can minimize common mistakes and improve your chances of success in any assessment. Staying calm, focused, and methodical is the key to avoiding errors and ensuring accurate, high-quality responses.

How to Improve Your Financial Knowledge

Expanding your understanding of economic principles and investment strategies can significantly enhance your decision-making skills. Whether you’re a beginner or looking to deepen your expertise, there are various methods to strengthen your grasp of key concepts. With the right approach and resources, anyone can improve their knowledge and apply it effectively in real-world scenarios.

Here are several steps you can take to build a stronger foundation:

- Read Books and Articles: Start with foundational texts and articles that cover a broad range of topics, from budgeting to advanced investment theories. Books by well-known financial experts offer valuable insights and practical advice.

- Follow Industry News: Keep up with current market trends and developments. Subscribing to financial news websites, blogs, and newsletters helps you stay informed about the latest events and their potential impact on the economy.

- Take Online Courses: Many reputable platforms offer courses on topics like accounting, investment strategies, and business management. Structured learning provides you with a solid framework and helps you systematically build your knowledge base.

- Join Forums and Communities: Engaging with online communities allows you to discuss and debate topics with like-minded individuals. You can gain new perspectives, ask questions, and get feedback on your ideas.

- Use Financial Tools and Simulations: Take advantage of software and tools that simulate investment scenarios or allow you to track personal finances. These hands-on experiences can help reinforce your learning and provide practical insights into managing assets.

By consistently applying these strategies, you will enhance your ability to analyze markets, assess risks, and make informed decisions. Improving your knowledge is an ongoing process that requires time, practice, and dedication, but with persistence, it can lead to significant personal and professional growth.

Strategies for Time Management in Exams

Effective time management is crucial when preparing for and completing any type of assessment. Without a proper strategy, it’s easy to become overwhelmed by the pressure of time, resulting in rushed decisions and missed opportunities. A well-structured approach can help maximize your efficiency, ensuring that you allocate adequate time to each section and avoid last-minute panic.

Planning Ahead

Before starting, always allocate specific time slots to each part of the task. Break the entire process down into manageable segments and estimate how long you think each will take. Having a clear schedule in mind will prevent you from spending too much time on any one question or topic.

Prioritizing Key Areas

Some topics or questions may be more complex or carry a heavier weight in the overall assessment. Prioritize these areas, ensuring you address them first. This way, you can allocate more time to challenging aspects without feeling rushed later. For simpler tasks, allocate less time to maintain a steady pace throughout the process.

Another useful technique is to pace yourself throughout the assessment. Keep an eye on the clock, and if necessary, move on to the next section if you find yourself stuck for too long. Avoid dwelling on a single point, as it can cost you valuable time that could be better spent elsewhere.

Lastly, don’t forget to leave some time for reviewing your work. A final check can help catch mistakes, clarify unclear points, and ensure that you’ve answered everything to the best of your ability. By managing your time wisely, you increase your chances of completing the task effectively and confidently.

Real-World Applications of Financial Analysis

The ability to evaluate and interpret data plays a critical role in various industries. Whether you’re working with corporations, investments, or budgeting, the skills learned in assessments can be applied to make informed decisions that drive business success. Understanding how to extract meaningful insights from raw data empowers professionals to make strategic choices based on accurate projections and analysis.

In everyday business operations, these tools are invaluable for assessing the health of a company, forecasting future trends, and identifying potential risks. The application extends beyond just corporate settings; it also helps individuals manage their personal finances, from budgeting to making informed investment decisions. This versatility makes the skill set crucial in both professional and personal contexts.

Applications in Business Strategy

In corporate strategy, data interpretation guides decision-making. Managers use key metrics to determine profitability, evaluate project performance, and assess overall business health. By using this approach, businesses can optimize resources and refine their approach to marketing, sales, and product development. The table below highlights some key performance indicators (KPIs) used in strategic decision-making:

| Key Performance Indicator | Purpose | Example Use Case |

|---|---|---|

| Gross Profit Margin | Measures the profitability of core operations | Assessing product pricing strategy |

| Return on Investment (ROI) | Evaluates the efficiency of investments | Deciding on capital expenditure projects |

| Current Ratio | Indicates short-term financial stability | Ensuring liquidity for day-to-day operations |

Applications in Investment Decisions

Investors also rely heavily on these methods to make informed decisions about where to allocate resources. By analyzing market data and economic trends, professionals can assess potential risks and rewards before making significant financial commitments. These techniques help in evaluating stock prices, bond yields, and other investment opportunities, ensuring that investors make calculated and confident choices in an ever-changing market.

Ultimately, mastering these techniques enables individuals and organizations to reduce uncertainty, improve decision-making processes, and align business goals with achievable financial outcomes. The widespread application of these principles demonstrates their importance in today’s complex economic landscape.

Final Preparation Tips for Success

When it comes to excelling in any assessment, preparation is key. To ensure that you perform your best, it’s essential to focus on refining your knowledge, practicing time management, and mentally preparing for the challenges ahead. Success is not just about knowing the material, but also about approaching the test with confidence and strategy. In the final stages of your preparation, there are several key steps you can take to maximize your readiness.

Before the day of the test, ensure you’ve reviewed all the critical concepts and have practiced applying them. This approach helps in reinforcing your understanding and allows you to identify any gaps in your knowledge. Focus on the most important areas that are likely to appear, and make sure you have a clear strategy for how to manage your time during the assessment.

Effective Strategies for Review

In the final days leading up to the test, it’s crucial to structure your study sessions to get the most out of your time. Here are some practical tips to make your preparation as effective as possible:

| Strategy | Description |

|---|---|

| Focus on Key Areas | Review the most critical concepts and sections that are heavily tested. |

| Practice with Timed Questions | Simulate test conditions by practicing with time constraints to improve your time management. |

| Use Study Aids | Leverage summaries, flashcards, and practice exercises to reinforce your understanding of key topics. |

Preparing Mentally and Physically

Proper preparation extends beyond simply reviewing material. Make sure you’re physically and mentally ready for the challenge. Get enough rest, eat healthy meals, and maintain a positive mindset. On the day of the test, ensure you arrive well-rested, confident, and calm. Mental clarity will allow you to think critically and manage stress during the assessment.

By following these tips, you’ll be equipped with the knowledge, confidence, and skills needed to succeed. Remember, preparation is not just about how much you know but how effectively you can apply that knowledge under pressure. Take the time to prepare thoughtfully, and the results will reflect your effort.