In today’s fast-paced world, understanding how to interpret numerical data is essential for making informed decisions. With the right knowledge, complex patterns can be uncovered, leading to more strategic planning and better outcomes. Whether it’s forecasting trends, assessing risks, or measuring performance, mastering data is crucial for success in any industry.

Numerical information holds the key to unlocking deeper insights into markets, consumer behavior, and operational efficiency. By learning how to analyze and apply these figures, professionals can optimize their strategies, adapt to changing conditions, and ultimately drive growth. Clear understanding of these concepts equips individuals to take calculated actions that impact long-term success.

Essential Statistics for Business Success

Understanding numerical data is a fundamental skill that can greatly enhance the decision-making process. It provides a clear view of trends, patterns, and potential risks, allowing companies to navigate challenges effectively. This insight helps organizations make strategic moves, align resources efficiently, and ultimately improve overall performance.

Key Metrics to Track Performance

To succeed in a competitive environment, it’s vital to track certain indicators that directly impact growth. Metrics such as profitability, market share, and customer satisfaction are invaluable in assessing how well an organization is performing. Analyzing these key figures helps in identifying areas for improvement, setting realistic goals, and measuring the success of implemented strategies.

Using Data to Forecast Future Trends

Accurate forecasting relies heavily on historical data and trends. By studying past patterns, companies can anticipate future shifts in demand, supply, or market behavior. This allows them to adapt their strategies proactively, ensuring they stay ahead of competitors. With the right approach, data can reveal underlying forces that influence long-term success and sustainability.

Understanding Key Economic Data Metrics

To effectively navigate the world of markets and financial systems, it’s crucial to grasp the most important indicators that influence growth and stability. These metrics offer valuable insights into the overall health of an economy or organization, helping individuals make informed decisions. By understanding these figures, one can interpret market dynamics and predict future movements.

Commonly Used Indicators

There are several key indicators that serve as the foundation for analysis in any financial context. These metrics provide a snapshot of performance and guide strategic decisions. Some of the most commonly used are:

- Gross Domestic Product (GDP): A measure of the total value of all goods and services produced within a country.

- Inflation Rate: The rate at which the general level of prices for goods and services rises, eroding purchasing power.

- Unemployment Rate: The percentage of people actively looking for work but unable to find employment.

- Consumer Price Index (CPI): A measure of the average change over time in the prices paid by urban consumers for a basket of goods and services.

Interpreting Economic Data for Strategy

While these metrics are critical, understanding their relationships and what they reveal about the broader picture is equally important. Interpreting these figures allows decision-makers to assess risk, optimize resource allocation, and refine long-term goals. Key factors to consider include:

- Trends over time: Analyzing data across multiple periods helps reveal underlying trends and patterns.

- Relative comparisons: Comparing key metrics against historical data or other economies can highlight strengths and weaknesses.

- External influences: Understanding how global events or policy changes affect these metrics can provide deeper insights.

How to Analyze Business Trends with Stats

Identifying patterns and shifts in performance is essential for staying ahead in any industry. By examining data over time, one can gain a clearer understanding of where a company is heading, recognize emerging opportunities, and spot potential risks. Analyzing these trends allows decision-makers to adapt strategies and improve outcomes.

One of the most effective ways to spot trends is by looking at historical data and comparing it to present conditions. This process involves collecting relevant figures and evaluating them for patterns such as growth, decline, or stability. Once these trends are identified, it’s important to interpret them in the context of external factors, such as changes in the market, consumer behavior, or technological advancements.

Key Tools for Trend Analysis

Several tools and methods can help in analyzing these movements effectively. Some of the most common include:

- Moving Averages: A technique used to smooth out short-term fluctuations and highlight long-term trends.

- Regression Analysis: A statistical method that helps predict the relationship between variables and forecast future outcomes.

- Trendlines: Graphical representations of data points that help visualize patterns over time.

Evaluating the Impact of Trends

Once a trend is identified, understanding its potential impact is crucial. It’s important to ask: How will this trend influence decision-making, resources, and overall performance? Will it lead to growth or pose a threat? By evaluating the implications of a trend, one can take proactive steps to leverage opportunities or mitigate risks, ensuring that strategies remain aligned with evolving circumstances.

Common Statistical Methods for Economists

Analyzing data to understand trends, relationships, and patterns is a cornerstone of informed decision-making. Economists often rely on various mathematical techniques to interpret large datasets and derive insights that can drive policy or guide investments. By using the right approaches, it’s possible to uncover hidden connections and forecast future behaviors accurately.

Descriptive Analysis

One of the most common methods used is descriptive analysis, which provides a summary of key data points. This approach focuses on central tendencies like averages and medians, as well as variability measures such as range and standard deviation. It allows economists to get a clear overview of the dataset without diving into complex modeling.

Inferential Techniques

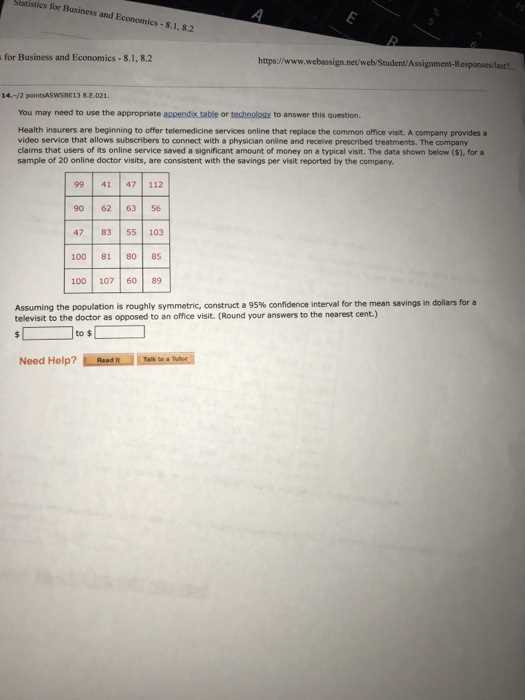

Inferential methods go beyond simple descriptions and aim to make predictions or generalizations based on sample data. Two popular techniques include:

- Hypothesis Testing: This method tests assumptions or theories to determine their validity by analyzing sample data and determining the likelihood of outcomes.

- Confidence Intervals: A technique used to estimate the range within which a population parameter is likely to fall, offering a degree of certainty about predictions.

Both techniques help economists to make decisions or form conclusions with a quantifiable level of confidence, based on limited data.

Using Data for Better Decision Making

Making informed choices is crucial in any field, whether it’s about allocating resources, setting strategies, or forecasting future developments. By analyzing available information, individuals can reduce uncertainty and improve the quality of their decisions. Data offers insights that help prioritize actions and minimize risks, ultimately leading to more effective outcomes.

The key to making smarter decisions lies in understanding how to process and interpret relevant information. By collecting, analyzing, and applying data, one can uncover trends, identify potential obstacles, and anticipate changes in the environment. This process enables decision-makers to act with greater precision and confidence.

Steps to Leverage Data for Better Choices

To harness data effectively, follow these critical steps:

- Identify Relevant Information: Start by gathering the most pertinent data that will impact your decision-making process.

- Analyze Patterns: Look for recurring trends or anomalies that can influence outcomes.

- Evaluate Risks: Assess potential risks associated with different choices based on historical data and predictions.

- Make Informed Predictions: Use trends and insights to forecast future scenarios and adapt plans accordingly.

Tools to Enhance Decision-Making

There are several tools that can help individuals make better decisions based on data, including:

- Data Visualization Software: Tools like charts, graphs, and dashboards make it easier to see trends and insights at a glance.

- Predictive Analytics: These techniques allow one to forecast future trends by analyzing patterns from past data.

- Decision Trees: A model used to map out various choices and their potential outcomes, helping to weigh options effectively.

Types of Economic Models and Their Use

Models are powerful tools that simplify complex real-world systems by focusing on key variables and relationships. By representing the interactions between different factors, these models help analysts predict outcomes, explore different scenarios, and inform decisions. Each model serves a unique purpose depending on the specific goals of the analysis, allowing decision-makers to test hypotheses or evaluate potential strategies.

Microeconomic Models

Microeconomic models focus on individual agents within an economy, such as consumers, firms, or industries. These models help understand how decisions are made at the small scale, influencing market behaviors and pricing strategies. Common examples include:

- Supply and Demand Model: This basic framework explains how the price and quantity of goods are determined in a market.

- Consumer Choice Model: This model examines how consumers make decisions about purchasing goods based on preferences and budget constraints.

- Production Possibility Frontier (PPF): A model that shows the trade-offs between two goods or services that an economy can produce given its resources.

Macroeconomic Models

Macroeconomic models deal with large-scale economic factors, focusing on broader trends such as national income, inflation, and unemployment. These models are essential for understanding the overall performance of an economy and guiding policy decisions. Key examples include:

- Aggregate Demand and Supply Model: This model explains how the total demand and total supply in an economy determine the overall level of prices and output.

- IS-LM Model: A tool used to represent the interaction between the real economy (investment and savings) and the monetary sector (liquidity and money supply).

- Solow Growth Model: This model focuses on long-term economic growth by examining factors such as capital accumulation, labor force growth, and technological progress.

Interpreting Business Data for Strategy

Analyzing available data is essential for developing effective plans and making informed decisions. By reviewing key metrics and trends, organizations can gain valuable insights that shape their direction. Understanding the stories behind the numbers allows decision-makers to adapt strategies, optimize operations, and align resources with long-term goals.

Interpreting data involves more than just looking at raw numbers; it requires understanding the context and drawing meaningful conclusions. The key is to identify patterns, assess performance, and predict future outcomes. When these insights are applied correctly, they can provide a competitive advantage and enhance organizational agility.

Identifying Key Performance Indicators

To create a focused strategy, it’s important to pinpoint the most relevant data points, often known as key performance indicators (KPIs). These metrics track progress toward specific objectives and offer a benchmark for evaluating success. Common KPIs might include:

- Revenue Growth: Measures the increase or decrease in revenue over a specific period, indicating overall financial health.

- Customer Retention Rate: Tracks the ability to keep existing customers, which is crucial for long-term success.

- Market Share: Indicates the percentage of an industry’s total sales that a company captures, reflecting competitive strength.

Using Insights for Strategic Decisions

Once key data points are identified, it’s important to interpret them in light of both current conditions and future projections. This requires understanding how various factors interact and influence outcomes. By integrating these insights into decision-making, leaders can optimize resource allocation, refine marketing approaches, and identify areas for improvement. Whether adjusting pricing strategies or entering new markets, data-driven decisions provide a clear path toward sustainable growth.

Statistical Tools Every Business Needs

In any organization, having the right set of tools to analyze data is crucial for making informed decisions. These tools help in understanding trends, forecasting future outcomes, and optimizing processes. With the ability to process large volumes of information, businesses can gain insights that guide strategic actions and ensure growth.

The importance of having efficient tools cannot be overstated. Whether it’s tracking performance, understanding customer behavior, or identifying market trends, the right instruments allow managers to make better decisions. From basic calculations to complex predictive models, these tools empower organizations to act with precision and confidence.

Essential Tools for Data Analysis

Some of the most essential tools include:

- Spreadsheets: Programs like Excel or Google Sheets are fundamental for organizing data, performing calculations, and creating basic visualizations. They allow quick analysis and are accessible to most users.

- Statistical Software: Tools like R, Python (with libraries such as Pandas and NumPy), and SAS provide advanced statistical functions, enabling deeper analysis and more complex modeling.

- Data Visualization Tools: Software like Tableau and Power BI makes it easy to create intuitive charts, graphs, and dashboards that help interpret large datasets visually.

Optimizing Processes with Statistical Tools

Using these tools effectively can improve operational efficiency, refine customer insights, and enhance decision-making. By leveraging predictive models, businesses can anticipate market changes and adjust strategies accordingly. These tools are not only about understanding past performance but also about shaping the future with informed, data-driven choices.

The Role of Probability in Business

In decision-making processes, understanding uncertainty is a key factor in achieving success. Probability provides a framework for evaluating risks, predicting outcomes, and making well-informed choices under uncertain conditions. By quantifying the likelihood of different scenarios, decision-makers can assess the potential for various actions and adjust strategies accordingly.

Whether forecasting market trends, estimating demand, or managing risks, probability offers valuable insights that guide planning and resource allocation. It helps organizations anticipate potential challenges, avoid pitfalls, and seize opportunities based on calculated chances. The role of probability is not just in predicting future events, but also in minimizing uncertainty in both short-term and long-term decisions.

Improving Forecasting with Statistical Analysis

Effective forecasting is essential for planning, budgeting, and strategy formulation. By utilizing data-driven insights, organizations can predict future trends with greater accuracy, reducing uncertainty in decision-making. Statistical methods allow businesses to analyze historical data, identify patterns, and make informed predictions about future events, helping to optimize resource allocation and manage risks.

Through the use of advanced techniques such as regression analysis, time series modeling, and hypothesis testing, organizations can refine their forecasting processes. These methods help distinguish between noise and meaningful signals in data, providing a clearer picture of future possibilities. When applied correctly, statistical analysis enhances the precision of predictions and enables proactive rather than reactive decision-making.

Key Techniques for Forecasting

Several statistical tools are commonly used to improve the accuracy of predictions:

| Technique | Application |

|---|---|

| Time Series Analysis | Used for predicting future values based on past trends, commonly applied to sales and financial data. |

| Regression Analysis | Helps identify relationships between variables and can predict outcomes based on these relationships. |

| Monte Carlo Simulation | Utilized to model the probability of different outcomes based on random variables, often used in risk management. |

Leveraging Predictive Models

By integrating these statistical techniques, companies can not only predict market trends but also optimize their strategies. This leads to more accurate forecasts, improved decision-making, and better preparedness for future challenges. Predictive models powered by statistical analysis can be adapted to various scenarios, making them invaluable tools for businesses seeking to stay ahead of the curve.

Essential Statistical Concepts for Economists

Understanding key principles of data analysis is crucial when interpreting economic trends and formulating policies. These concepts provide a framework for analyzing how variables interact, measuring relationships, and making predictions based on historical data. They help professionals navigate complex datasets, uncover patterns, and derive actionable insights that influence decision-making in various sectors.

The ability to apply these methods accurately allows economists to assess market behavior, forecast economic conditions, and recommend effective strategies. By grounding decisions in reliable data, these fundamental concepts enhance the precision of analyses and the reliability of forecasts.

Key Principles for Data Interpretation

Several concepts are foundational to analyzing data within an economic context:

- Correlation: A measure of the relationship between two variables, indicating how closely they move together.

- Variance: A statistical measure of the spread between numbers in a dataset, helping to assess the degree of variability in economic indicators.

- Standard Deviation: Used to measure the amount of variation or dispersion in a dataset, essential for understanding risk and uncertainty in economic forecasts.

Advanced Analytical Techniques

Economists also rely on more advanced methods to deepen their analysis:

- Regression Analysis: A tool for understanding the relationship between dependent and independent variables, often used to model economic behavior.

- Time Series Analysis: Essential for examining trends over time, allowing economists to make predictions based on historical data.

- Hypothesis Testing: Used to test assumptions and validate theories, ensuring that economic models hold true under various conditions.

How Data Shapes Business Performance

In today’s competitive landscape, the ability to harness information is a key factor in driving success. The insights derived from data allow organizations to identify trends, optimize operations, and make informed decisions that directly impact their bottom line. By interpreting relevant information, companies can understand market dynamics, customer behaviors, and internal processes, leading to more effective strategies and improved outcomes.

Data has the power to transform how businesses function, from streamlining day-to-day operations to shaping long-term strategic plans. Whether it’s customer feedback, sales figures, or market research, each data point plays a role in determining performance. This continuous flow of information empowers leaders to make adjustments quickly and stay ahead of emerging challenges.

Data-Driven Insights for Growth

Key areas where data significantly influences performance include:

- Customer Behavior Analysis: By tracking purchasing patterns and customer preferences, companies can tailor their offerings to meet demand more effectively.

- Operational Efficiency: Monitoring internal processes helps identify bottlenecks, streamline workflows, and reduce costs.

- Market Segmentation: Data allows businesses to target specific customer groups, ensuring that marketing efforts are more focused and impactful.

Leveraging Data for Decision-Making

Data-driven decision-making enables organizations to adjust strategies based on real-time insights. By continuously collecting and analyzing relevant metrics, companies can:

- Enhance Product Development: Data helps businesses innovate by providing insights into what works and what needs improvement.

- Optimize Marketing Campaigns: Understanding customer behavior enables companies to create more personalized and effective campaigns.

- Improve Risk Management: By analyzing trends and patterns, businesses can predict potential risks and take proactive steps to mitigate them.

Understanding Market Trends Through Stats

Identifying and interpreting patterns in the market is crucial for adapting to changes and making informed decisions. By analyzing data over time, organizations can uncover underlying trends that provide insights into consumer behavior, market demands, and the overall economic environment. These insights are instrumental in shaping business strategies and forecasting future developments.

Market trends are often driven by various factors, such as shifts in consumer preferences, technological advancements, or external economic conditions. Understanding these patterns allows companies to adjust their approach, stay competitive, and capitalize on emerging opportunities. By closely monitoring market dynamics, businesses can not only react to changes but also anticipate them, ensuring sustained growth and profitability.

Key Data Indicators for Tracking Trends

Several key metrics help track market trends effectively:

- Sales Growth: Observing sales figures over time reveals whether a company’s products or services are gaining traction in the market.

- Consumer Sentiment: Tracking how consumers feel about the economy and specific products can predict future buying behaviors.

- Market Share: This metric helps businesses assess their position relative to competitors and gauge overall industry performance.

Analyzing Data Trends in Practice

In order to make accurate predictions about the future, it is important to analyze historical data effectively. The following table outlines how key data points can be used to identify market trends:

| Data Point | Trend Indication | Possible Action |

|---|---|---|

| Sales Figures | Growing or declining sales | Adjust marketing strategies or expand product lines |

| Consumer Sentiment | Positive or negative outlook | Adapt product offerings or pricing strategies |

| Competitor Analysis | Gaining or losing market share | Identify areas for improvement or innovation |

Statistical Techniques for Risk Management

Managing risk is a fundamental aspect of any organization’s decision-making process. By leveraging data-driven insights, companies can identify potential threats and develop strategies to mitigate negative impacts. Various methods help in assessing the likelihood and severity of risks, enabling businesses to prepare for uncertain outcomes. These techniques help in predicting, analyzing, and reducing the effect of risks, providing a more secure environment for operations.

Effective risk management relies heavily on understanding the uncertainty and variability in different scenarios. With the right statistical tools, businesses can quantify risks, prioritize them based on their potential impact, and create targeted action plans. By using historical data and predictive models, decision-makers can anticipate possible challenges and make informed choices to safeguard their operations.

Common Statistical Methods for Risk Assessment

Several key techniques are widely used to assess and manage risk:

- Probability Distributions: These allow businesses to model the likelihood of different outcomes and evaluate the risk associated with each scenario.

- Monte Carlo Simulation: A technique used to simulate a wide range of possible outcomes based on random variables, helping to understand the risk of uncertain events.

- Value at Risk (VaR): A statistical measure that quantifies the maximum potential loss over a specified time frame with a given confidence level.

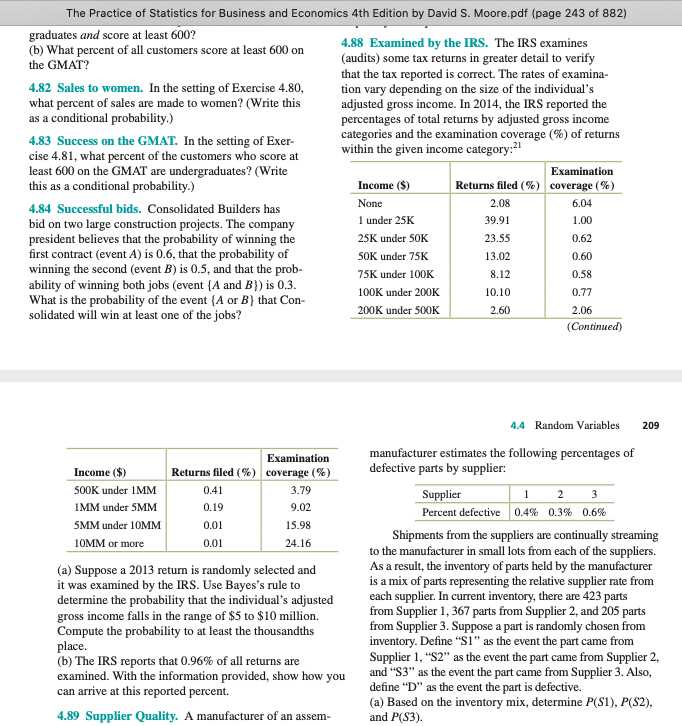

- Regression Analysis: Helps in predicting future outcomes based on historical data, which can be used to assess the likelihood of different risks occurring.

Application of Techniques in Practice

In practice, businesses implement these techniques to manage risk in various contexts. For example, in financial markets, VaR is often used to measure potential losses in an investment portfolio. Monte Carlo simulations are common in project management to assess the probability of meeting deadlines and budget estimates. Additionally, probability distributions help identify the chance of operational disruptions, allowing companies to create contingency plans.

Key Performance Indicators in Economics

In any sector, measuring success is essential to understanding how effectively goals are being met. By focusing on the right metrics, organizations can track their progress and adjust strategies accordingly. Key performance indicators (KPIs) provide quantifiable benchmarks that highlight the efficiency and impact of various processes. These metrics are crucial in analyzing trends, forecasting outcomes, and making data-driven decisions.

For economists, identifying the right KPIs is vital in assessing the performance of markets, industries, or entire economies. These indicators help evaluate growth, stability, and other factors that influence decision-making. By regularly monitoring these metrics, stakeholders can gain valuable insights into the underlying forces shaping the market landscape and plan accordingly.

Common KPIs Used in Economic Analysis

Several key metrics are used to gauge the overall health and trajectory of an economy. These include:

- Gross Domestic Product (GDP): Measures the total economic output within a country, providing a snapshot of its economic health and growth.

- Unemployment Rate: Indicates the percentage of the labor force that is jobless and actively seeking work, reflecting labor market conditions.

- Inflation Rate: Tracks the rate at which the general level of prices for goods and services rises, eroding purchasing power over time.

- Consumer Confidence Index (CCI): Measures the optimism of consumers regarding the economy’s future, influencing spending and investment decisions.

Applying KPIs for Economic Decision-Making

Using these key metrics, policymakers, businesses, and analysts can make informed decisions to shape their strategies. For instance, a rising unemployment rate may signal the need for stimulus measures or workforce development programs. Likewise, an increasing GDP can indicate a strong economic recovery, prompting further investments and expansion. Regularly evaluating these indicators ensures that adjustments can be made proactively, leading to more effective outcomes in the long term.

Making Predictions with Economic Data

Forecasting future trends is an essential part of decision-making in any field. By analyzing historical data, analysts can identify patterns and trends that help in making informed predictions about what is likely to happen next. These predictions guide policymakers, investors, and businesses in strategizing effectively and managing risks. In this section, we explore how data can be used to anticipate future economic conditions, identify potential challenges, and capitalize on opportunities.

When working with economic data, the primary goal is to turn raw numbers into actionable insights. This involves applying various techniques to interpret data trends, assess variables that may influence future outcomes, and build models that forecast potential scenarios. The ability to make accurate predictions is crucial, as it supports better planning and resource allocation in various sectors.

Common Methods for Prediction

Several methods are used to make predictions based on past data. The most commonly applied techniques include:

- Time Series Analysis: This method focuses on analyzing data points collected over time to identify patterns such as trends, cycles, and seasonal effects. It is particularly useful in forecasting future values based on historical behavior.

- Regression Analysis: Used to understand relationships between variables, regression analysis helps determine how different factors influence a specific outcome. This can help predict future outcomes based on these relationships.

- Machine Learning Models: More advanced techniques, such as machine learning, allow for creating models that can learn from vast datasets and improve over time. These models are capable of recognizing complex patterns and making predictions in real-time.

Example of Economic Data Prediction

To illustrate how predictions are made, consider the following table showing the historical growth rate of an economy over the past five years. By applying statistical methods like regression analysis or time series, we can predict future growth trends.

| Year | Growth Rate (%) |

|---|---|

| 2019 | 2.5 |

| 2020 | -1.2 |

| 2021 | 3.4 |

| 2022 | 2.1 |

| 2023 | 2.8 |

Using the above data, we can apply a variety of methods to project the growth rate for 2024 and beyond. By recognizing trends and understanding the impact of external factors, such as inflation or government policies, accurate predictions can be made to plan for future growth or downturns.

Applying Statistics to Business Operations

In any organization, data-driven decision-making plays a crucial role in improving efficiency, managing resources, and maximizing outcomes. By analyzing past performance, market behavior, and operational processes, companies can uncover patterns that help optimize strategies. Whether it’s forecasting demand, identifying areas for improvement, or optimizing pricing strategies, leveraging data is essential for success.

The application of analytical techniques can guide decisions at various levels, from everyday tasks to high-level strategic planning. Through proper data analysis, businesses can not only monitor current operations but also predict future trends and make informed choices. This approach leads to better risk management, cost reduction, and enhanced profitability.

Key Areas Where Data Analysis Can Enhance Operations

Data analysis can be applied in numerous aspects of operations to drive improvements. Some key areas include:

- Supply Chain Optimization: By analyzing historical data on inventory levels, lead times, and demand patterns, organizations can forecast future requirements and streamline their supply chain. This results in reduced stockouts, minimized excess inventory, and better supplier management.

- Customer Behavior Analysis: Understanding purchasing patterns, preferences, and demographics enables companies to segment customers effectively. This can help in crafting personalized marketing campaigns, improving customer retention, and increasing conversion rates.

- Quality Control: By applying statistical techniques to monitor production processes, businesses can identify variances that might lead to defects. This ensures that products meet quality standards, reducing waste and improving customer satisfaction.

- Financial Forecasting: Analyzing past financial data allows companies to predict revenue trends, cash flow, and profitability. This enables better budgeting, investment planning, and financial risk management.

Examples of Data Techniques in Operations

Different methods can be applied to optimize operations. A few examples of techniques include:

- Regression Analysis: Used to understand relationships between different variables. For example, a company may analyze the relationship between advertising expenditure and sales to determine the most effective marketing budget.

- Time Series Analysis: This method looks at data collected over time, such as sales figures or website traffic, to identify trends and predict future demand. It helps in inventory management and planning for peak seasons.

- Control Charts: Used in quality control, control charts monitor process stability and detect variations, helping organizations take corrective actions before issues escalate.

Incorporating these analytical methods into daily operations enhances decision-making, reduces uncertainty, and positions the company for long-term success. By turning raw data into actionable insights, organizations can continuously improve their operations and achieve strategic goals with greater efficiency.