In the field of accounting, comprehending certain financial principles is essential for both practical application and academic evaluations. One of the most fundamental aspects of this subject involves calculating the decrease in value of long-term assets over time. Grasping the methods and techniques used to determine asset reduction can significantly impact one’s ability to tackle related topics in various assessments.

The process of tracking how assets lose value throughout their useful life can appear complex at first glance, but with the right approach, it becomes more manageable. By focusing on different methods and the calculations involved, students and professionals alike can enhance their understanding and increase their confidence in solving related problems. These core principles are not just vital for assessments but also for real-world financial decision-making.

Effective preparation for these topics involves studying common approaches, familiarizing oneself with important formulas, and learning how to apply them in diverse scenarios. By breaking down these techniques step by step, one can develop a clear and structured approach to solving related challenges. With practice, it becomes easier to approach this area with confidence and accuracy.

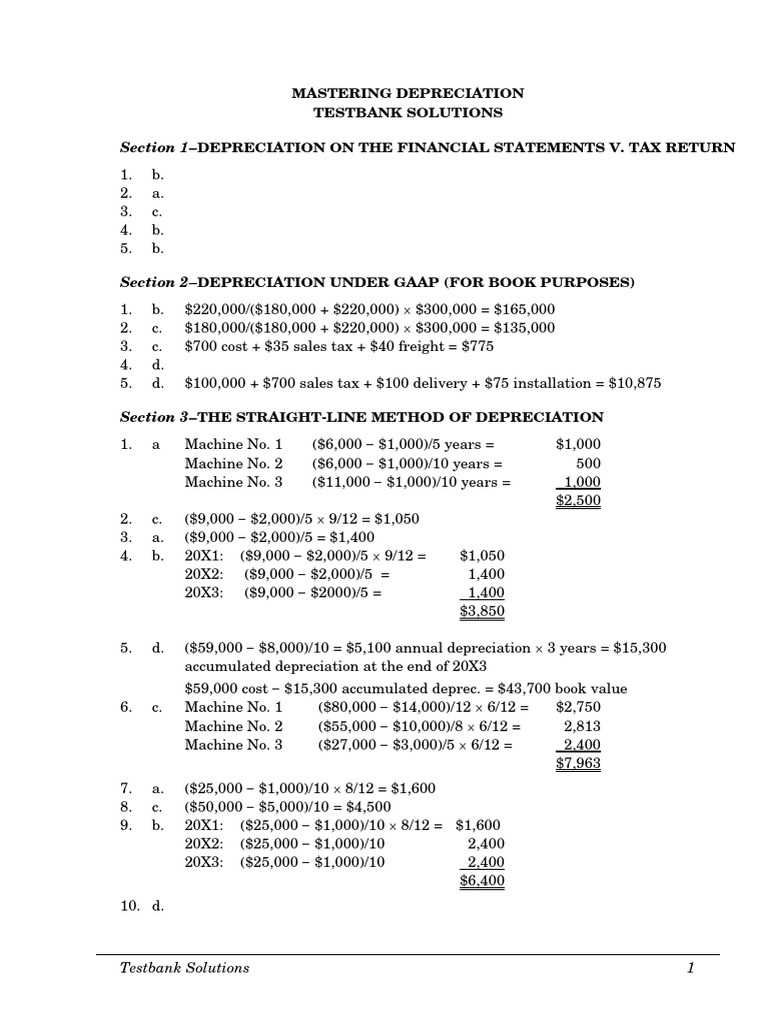

Mastering Depreciation for Final Exams

In accounting, understanding how to calculate the reduction in value of long-term assets is a crucial skill. This process is not only foundational for real-world financial management but also an essential topic in academic assessments. To excel in this area, it’s important to get familiar with various methods, learn the formulas, and practice applying them in different scenarios. The following guide will help you build a strong foundation to confidently handle related questions during any evaluation.

Key Methods for Asset Valuation

Different approaches to calculating the reduction in asset value provide various benefits and are used in specific situations. Below are the most common techniques, each serving a unique purpose in accounting practice:

| Method | Overview | When to Use |

|---|---|---|

| Straight-Line | Distributes the cost evenly over the asset’s useful life. | Ideal for assets with consistent value loss. |

| Declining Balance | Reduces the asset’s value by a fixed percentage each year. | Suitable for assets that lose value more rapidly in the early years. |

| Sum-of-the-Years’-Digits | Accelerates depreciation in the initial years based on the total years of the asset’s life. | Used for assets that depreciate quickly early on. |

Calculating Asset Reduction in Value

Once you are familiar with the methods, it’s important to master the calculation process for each one. For each method, specific formulas are applied. For example, the straight-line approach uses the simple formula:

Annual Reduction = (Cost of Asset – Residual Value) / Useful Life

Practicing these formulas in different scenarios will help you gain a deeper understanding of how to approach problems efficiently. The more you familiarize yourself with each method and its application, the easier it becomes to perform well in any evaluation related to asset value reduction.

Understanding Depreciation Concepts Clearly

In accounting, it’s essential to understand how the value of long-term assets decreases over time. This concept is fundamental to managing financial records and plays a key role in both theoretical learning and practical application. To approach this topic with clarity, it’s important to first grasp the basic principles that govern how and why assets lose value.

Key Principles of Asset Value Reduction

At the heart of this process lies the concept of asset reduction, which involves a systematic way of recognizing the decrease in an asset’s worth. To understand it fully, consider the following important ideas:

- Time-Based Reduction: The value of an asset decreases steadily over a defined period.

- Value Allocation: The loss in value is spread out evenly or unevenly, depending on the method chosen.

- Useful Life: Each asset has a set period during which it remains valuable for business operations.

Types of Asset Reduction Methods

There are several ways to calculate the decrease in asset value, each offering distinct benefits and applications. Some common methods include:

- Straight-Line Method: Spreads the asset’s reduction evenly over its useful life.

- Accelerated Methods: Decreases the asset’s value faster in the initial years of its useful life.

- Sum-of-the-Years’-Digits: A variant of the accelerated method, where a higher portion of the cost is expensed in the earlier years.

By understanding these basic principles and methods, you’ll be able to tackle related questions with ease and gain a deeper insight into how these calculations impact financial statements.

Types of Depreciation Methods Explained

In accounting, there are various ways to calculate how an asset’s value decreases over time. Each method serves a specific purpose depending on the asset type, its usage, and the financial strategy of a business. Understanding these different approaches is crucial for both accurate reporting and effective financial decision-making. Below are the most widely used methods for calculating asset value reduction.

| Method | Description | When to Use |

|---|---|---|

| Straight-Line Method | Spreads the total cost of an asset evenly over its useful life. | Ideal for assets that lose value consistently over time, such as office furniture. |

| Declining Balance | Applies a fixed percentage rate to the asset’s remaining value each year. | Best for assets that experience rapid depreciation in their early years, like computers or vehicles. |

| Sum-of-the-Years’-Digits | Accelerates depreciation by applying a decreasing fraction of the asset’s total cost each year. | Suitable for assets that lose most of their value early on, such as machinery used in production. |

| Units of Production | Depreciates the asset based on its usage or output rather than time. | Effective for assets whose value is closely tied to their level of use, like manufacturing equipment. |

By understanding the different methods and their applications, you can choose the most appropriate approach for each situation, leading to more accurate financial reporting and better asset management.

Straight-Line vs. Declining Balance Comparison

When calculating how an asset’s value reduces over time, two popular methods are commonly used: the straight-line approach and the declining balance method. Both techniques serve the same purpose but differ in how the reduction is applied. Understanding these differences is essential to choosing the right method for specific business scenarios and asset types.

The straight-line method spreads the total cost of an asset evenly over its useful life. This approach is straightforward and works well for assets that lose value consistently, such as office furniture or buildings. On the other hand, the declining balance method accelerates the reduction of value in the earlier years of an asset’s life. This method is ideal for assets that lose value quickly, like machinery or technology.

Here is a comparison of the two methods based on key factors:

| Factor | Straight-Line Method | Declining Balance Method |

|---|---|---|

| Depreciation Pattern | Even reduction over time | Faster reduction in earlier years |

| Ideal Asset Type | Long-term, consistent-use assets | Assets that lose value quickly |

| Ease of Calculation | Simple and straightforward | More complex due to varying reductions |

| Financial Impact | Even expense allocation | Higher expense in early years |

Choosing between these methods depends on the nature of the asset and how quickly it loses value. The straight-line method is typically preferred for stability and simplicity, while the declining balance method is more suitable for assets that require accelerated expense recognition.

Calculating Depreciation for Fixed Assets

For businesses, tracking the value reduction of long-term assets is essential for both financial reporting and tax purposes. The process involves determining how much of an asset’s value is used up over its useful life. Fixed assets, such as machinery, buildings, or vehicles, lose value gradually, and understanding the calculation process is crucial for accurate financial management.

Steps for Calculating Value Reduction

There are several steps to follow when calculating how much of a fixed asset’s value should be recorded as an expense. These steps may vary depending on the method chosen, but the overall approach is generally similar:

- Determine the Asset’s Initial Cost: This includes the purchase price and any additional costs to prepare the asset for use (e.g., installation, transportation).

- Estimate the Asset’s Useful Life: This is the period over which the asset is expected to be in service, typically measured in years.

- Calculate the Residual Value: This is the estimated value of the asset at the end of its useful life, often referred to as salvage value.

- Choose a Calculation Method: Select the most appropriate method for your asset (e.g., straight-line or accelerated).

- Apply the Formula: Use the chosen method to determine the annual reduction in value.

Example of Calculation

Let’s take a practical example to demonstrate how the straight-line method works:

- Initial Cost: $10,000

- Residual Value: $2,000

- Useful Life: 5 years

Using the straight-line method, the annual expense is calculated as follows:

Annual Reduction = (Cost of Asset – Residual Value) / Useful Life

Annual Reduction = ($10,000 – $2,000) / 5 = $1,600 per year

Thus, the asset will reduce in value by $1,600 annually over the next five years, until it reaches its residual value.

Impact of Depreciation on Financial Statements

The reduction in value of long-term assets has a significant effect on a company’s financial reports. This process not only impacts the balance sheet but also plays a crucial role in shaping the profit and loss statement. Understanding these effects is vital for interpreting financial results and making informed decisions. The allocation of value loss influences both the reported profitability and the asset base of a business.

How Value Reduction Affects the Balance Sheet

On the balance sheet, the value of fixed assets is adjusted over time to reflect their decreasing worth. As assets lose value, their carrying amount (book value) decreases, which impacts the overall financial position of the company. This is particularly important when assessing the total value of assets owned by a business.

- Asset Reduction: The net book value of assets decreases as depreciation is recorded.

- Liabilities and Equity: While assets decrease, liabilities and equity remain unchanged unless other adjustments are made.

Effect on Profit and Loss Statement

On the profit and loss statement, the expense associated with the loss in asset value is recorded as a cost. This expense reduces the company’s taxable income, and consequently, its tax liability. The impact is most noticeable in the early years of an asset’s life, especially with accelerated depreciation methods.

- Expense Recognition: Depreciation is treated as a non-cash expense, meaning it doesn’t directly affect cash flow, but it does reduce net income.

- Tax Benefits: By lowering taxable income, depreciation can lead to tax savings, which may improve cash flow in the short term.

Overall, the way in which an asset’s value is reduced impacts the financial health and profitability of a business. Proper management of depreciation ensures that these effects are accurately represented and that businesses make decisions based on realistic asset valuations.

Common Depreciation Mistakes to Avoid

Calculating the reduction in value of assets can be complex, and small errors can lead to significant financial reporting issues. Whether you are new to asset management or have years of experience, avoiding common mistakes ensures more accurate financial statements and better decision-making. Recognizing these pitfalls helps in ensuring that the value reduction process is correctly implemented, benefiting both the company and its stakeholders.

Here are some of the most frequent mistakes made when calculating and recording asset value reductions:

- Incorrect Asset Classification: Failing to classify assets properly can lead to applying the wrong calculation method. For instance, treating assets with a short lifespan like long-term assets can result in miscalculated reductions.

- Using the Wrong Useful Life: Estimating an asset’s useful life too conservatively or too optimistically can drastically affect how much value is reduced each year. This can either overstate or understate the true value of the asset.

- Omitting Residual Value: Inaccurately estimating or ignoring the residual (salvage) value leads to errors in the total amount depreciated, which can distort the financial outcomes.

- Not Reviewing Assumptions Regularly: As the asset’s usage and market conditions change, it’s important to review the initial assumptions about its lifespan and residual value. Failing to adjust these assumptions over time can result in outdated depreciation figures.

- Using the Same Method for All Assets: Not all assets should be depreciated in the same way. For instance, an asset with a high initial cost that loses value quickly should use an accelerated method, while assets with steady wear and tear might benefit from a straight-line method.

- Ignoring Tax Implications: Different depreciation methods can have different effects on a company’s tax obligations. Not understanding the tax benefits or consequences of the method chosen can result in missed savings or overpayment.

By understanding and avoiding these common mistakes, businesses can ensure that they are calculating value reduction accurately, which ultimately leads to more reliable financial statements and better-informed management decisions.

Important Formulas for Depreciation Calculations

When it comes to allocating the reduction in asset value, knowing the correct formulas is essential. These formulas allow businesses to calculate how much value is lost over time, providing a clearer picture of the asset’s remaining worth and the expenses associated with it. Different methods require different calculations, and understanding these is crucial for accurate financial reporting.

Common Calculation Methods

There are several common methods used to determine the amount of value reduced each year. Below are some of the most frequently used formulas in asset value allocation:

| Method | Formula | Explanation |

|---|---|---|

| Straight-Line | (Cost of Asset – Residual Value) / Useful Life | Distributes the reduction evenly over the asset’s useful life. |

| Declining Balance | Book Value at Beginning of Period × Depreciation Rate | Calculates larger reductions in the earlier years of the asset’s life. |

| Sum of the Years’ Digits | Depreciation Expense = (Remaining Life / Sum of the Years) × (Cost – Residual Value) | Accelerates depreciation, with larger expenses in the earlier years. |

| Units of Production | (Cost – Residual Value) × (Units Used / Total Estimated Units) | Links depreciation directly to the usage of the asset. |

Key Points to Remember

Each method has its own benefits depending on the nature of the asset and its expected use. For instance, the straight-line method is best for assets that experience a consistent reduction in value, while the declining balance method is suitable for assets that lose value more quickly in their earlier years. The units of production method is ideal for assets whose value is tied to usage rather than time.

By understanding these formulas and their applications, businesses can accurately track the value reduction of their assets and reflect it appropriately in their financial statements.

How to Prepare for Depreciation Exam Questions

Preparing for questions on the reduction of asset value involves more than just memorizing formulas. A deep understanding of the concepts and methods behind these calculations is crucial for answering questions accurately. The key to success is practicing a range of problems and familiarizing yourself with different calculation techniques. With the right approach, you can confidently tackle any question related to asset value allocation.

Here are some steps to effectively prepare for questions on asset value reduction:

- Understand Key Concepts: It’s important to grasp the underlying principles, such as the purpose of allocating asset value loss and how different methods work. Focus on understanding why certain methods are used for specific types of assets.

- Learn the Common Formulas: Master the key formulas used to calculate value reduction. Practice applying them to different scenarios, so you can quickly identify the correct formula during a test.

- Work Through Sample Problems: Regular practice with various problems will help solidify your understanding. Try problems that use different methods, and ensure you can switch between them as needed.

- Know the Impact on Financial Statements: Be prepared to explain how these calculations affect the financial reports, including how value reduction impacts both the balance sheet and profit and loss statement.

- Review Mistakes: Take time to review your errors and understand where you went wrong. This will help you avoid similar mistakes in the future.

By focusing on these strategies, you will be well-prepared for questions related to asset value reduction. With practice and understanding, you will be able to approach these types of questions with confidence and accuracy.

Real-World Examples of Depreciation Calculations

Understanding how asset value reduction works in real-life scenarios can provide valuable insight into how businesses manage their finances. By applying the principles of value loss to practical examples, you can see how different methods affect the financial health of an organization. These examples demonstrate the practical side of asset management and the importance of accurate calculations in business operations.

Here are a few real-world examples that highlight how businesses handle asset value reduction:

Example 1: Office Equipment Using Straight-Line Method

Let’s say a company purchases office equipment for $10,000. The equipment has an estimated residual value of $1,000 and a useful life of 5 years. To calculate the annual reduction in value using the straight-line method, the formula is:

Annual Depreciation = (Cost of Asset – Residual Value) / Useful Life

In this case, the calculation would be:

Annual Depreciation = ($10,000 – $1,000) / 5 = $1,800 per year

This means the company will expense $1,800 each year for the next five years, reflecting the value reduction of the office equipment on their financial statements.

Example 2: Vehicle Using Declining Balance Method

A business purchases a delivery truck for $20,000. The truck has an estimated residual value of $3,000 and a useful life of 8 years. The company chooses to use the declining balance method with a depreciation rate of 25%. The first year’s depreciation calculation would look like this:

Depreciation Expense = Book Value at Beginning of Period × Depreciation Rate

For the first year:

Depreciation Expense = $20,000 × 25% = $5,000

In the second year, the book value is reduced to $15,000 (i.e., $20,000 – $5,000), so the depreciation expense for the second year would be:

Depreciation Expense = $15,000 × 25% = $3,750

This method results in a higher depreciation expense in the earlier years, which can be beneficial for businesses looking to reduce their taxable income more quickly.

Example 3: Machinery Using Units of Production Method

Imagine a company that buys a piece of machinery for $50,000. The machinery has a residual value of $5,000 and is expected to produce 500,000 units over its life. In the first year, the machine produces 100,000 units. The depreciation expense for the first year would be calculated as follows:

Depreciation Expense = (Cost – Residual Value) × (Units Produced / Total Estimated Units)

Depreciation Expense = ($50,000 – $5,000) × (100,000 / 500,000) = $9,000

In this case, the depreciation expense is directly tied to how much the machine is used, making it a good choice for assets where wear and tear is based on usage rather than time.

These examples illustrate how different methods of value allocation impact financial statements and business operations. By understanding these real-world applications, businesses can make more informed decisions about their asset management and reporting strategies.

Key Differences Between Capital and Expense

When managing a company’s finances, it’s essential to distinguish between two fundamental types of financial transactions: capital expenditures and expenses. These categories play a significant role in how businesses record and report their financial activities. While they might appear similar at first glance, understanding the key differences is crucial for accurate accounting and financial planning.

Capital expenditures refer to investments made in acquiring or improving long-term assets that will be used for several years, such as equipment, buildings, or machinery. These assets are expected to generate value over time and are depreciated or amortized across their useful life. On the other hand, expenses are costs incurred in the day-to-day operations of a business and are typically recorded in the same period they are incurred. Expenses usually cover things like utilities, wages, or supplies that don’t provide long-term value.

Characteristics of Capital Expenditures

- Long-Term Benefits: Capital expenditures provide benefits for many years, such as purchasing property or upgrading machinery.

- Asset Creation: These purchases result in the creation of assets that are recorded on the balance sheet.

- Depreciation or Amortization: Capital items are depreciated or amortized over time, reflecting their decreasing value as they are used.

- Impact on Cash Flow: Capital expenditures affect cash flow, but they are often spread out over several years.

Characteristics of Expenses

- Short-Term Costs: Expenses are incurred as part of the regular operation of the business and are consumed within the current accounting period.

- No Long-Term Value: Unlike capital expenditures, expenses do not create an asset that adds value in future periods.

- Immediate Deduction: Expenses are fully deducted in the period they are incurred, reducing the net income for that period.

- Impact on Profit: Expenses directly affect the profit or loss for the period, as they are subtracted from revenues.

Understanding the difference between capital expenditures and expenses is crucial for accurate financial reporting. Capital expenditures are capitalized and gradually expensed over time, while regular expenses are deducted immediately. This distinction affects both the balance sheet and income statement, influencing key financial ratios and a company’s overall financial health.

Depreciation in Different Industries

In various sectors, the approach to calculating and managing the gradual reduction in asset value can differ significantly. Each industry has its own set of rules, regulations, and considerations when it comes to accounting for the wear and tear of assets over time. Understanding how these sectors handle this process is crucial for business owners, accountants, and financial analysts.

For example, industries that rely heavily on machinery, such as manufacturing and construction, tend to apply different methods compared to industries with more intangible assets, such as technology or service sectors. While tangible assets like vehicles and equipment might lose value quickly in one field, others may experience a slower rate of decline, depending on their usage, technological advancements, and industry-specific regulations.

Manufacturing and Construction

In the manufacturing and construction sectors, where machinery and heavy equipment are central to operations, the loss of value is often rapid due to frequent use and physical wear. These industries frequently use accelerated methods to account for the quicker decline in the asset’s value, allowing for higher deductions in the earlier years. The straight-line method, though also common, may be less applicable given the faster rate of depreciation in these sectors.

Technology and Software Development

On the other hand, the technology and software development industries typically deal with assets like computers, servers, and software, which may become obsolete more quickly due to rapid advancements in technology. In these industries, the decline in value is not necessarily physical but rather due to changes in market demand and innovation. As a result, companies often favor more aggressive methods for depreciating their assets in a shorter period, reflecting the fast pace of technological change.

Real Estate and Property Management

Real estate and property management industries involve different considerations. Here, buildings and land are long-term assets, and their value doesn’t necessarily decrease at the same rate as machinery or technology. Depreciation in real estate is often calculated based on the structure of the building rather than the land itself, with longer periods and a more predictable pattern of value loss. Properties in high-demand areas may even appreciate, making the concept of depreciation less applicable in certain cases.

Each industry adapts its depreciation strategies to better reflect the nature of its assets and the specific challenges it faces. Understanding these differences is essential for proper accounting and financial planning, ensuring that businesses make the most of tax benefits and accurately report asset values.

Tax Implications of Depreciation Methods

The way a business accounts for the gradual reduction in the value of its assets can have significant effects on its tax obligations. Different approaches to calculating asset value loss lead to varying impacts on taxable income and, ultimately, on the amount of tax a company owes. Understanding the tax consequences of different methods is crucial for businesses aiming to optimize their financial strategies and reduce their tax liabilities.

Some methods allow businesses to claim larger deductions in the early years, lowering their taxable income and deferring tax payments. Others result in more evenly spread deductions, which could be beneficial for businesses looking for long-term tax planning. However, the choice of method should be carefully considered in light of both short-term and long-term financial goals, as well as regulatory requirements that vary by region and industry.

Accelerated Methods and Tax Benefits

Accelerated depreciation methods, such as the declining balance method, are particularly advantageous for businesses looking to minimize their taxable income in the short term. By writing off more of the asset’s value in the early years, companies can reduce their taxable income during periods when they may need to save on taxes or invest heavily in new projects. While these methods offer immediate tax relief, they may also result in smaller deductions in later years, impacting future tax planning.

Straight-Line Depreciation and Predictability

In contrast, the straight-line method spreads out deductions evenly over the asset’s useful life. While this approach may not provide the same immediate tax savings as accelerated methods, it offers more stability and predictability for companies that prefer consistent deductions year after year. This can be particularly useful for businesses seeking to balance their long-term financial plans and tax liabilities over time.

The choice of method affects more than just the business’s accounting entries–it also impacts cash flow, tax obligations, and the overall financial health of the company. Businesses must weigh the benefits of tax deferrals against the long-term implications of the method they choose to adopt. It is important to consult with tax professionals to make sure the selected approach aligns with both current business needs and future tax strategies.

How Depreciation Affects Business Valuation

The process of allocating the reduction in an asset’s value over time plays a crucial role in determining the overall worth of a company. As a company records its assets’ decreasing value, it affects both its balance sheet and the perceived value of the business itself. This can have significant consequences when it comes to valuation, especially during mergers, acquisitions, or investor assessments.

When a company applies methods for allocating asset wear and tear, it impacts its reported earnings, cash flow, and net worth. Depending on how these factors are handled, it can either inflate or reduce the apparent value of a business. Therefore, understanding the influence of these adjustments is essential for business owners, accountants, and potential investors.

Impact on Earnings and Profitability

One of the key effects of asset value reduction is the effect it has on reported earnings. The larger the annual deduction, the lower the taxable income, which leads to reduced profits on paper. Although this can help businesses save on taxes, it can also create the impression that a business is less profitable than it truly is. This can influence the company’s attractiveness to investors or potential buyers.

- Increased deductions lower profits, leading to lower perceived value in the short term.

- Smaller deductions allow higher profits to be reported, increasing apparent profitability.

Influence on Cash Flow and Net Worth

While depreciation impacts reported earnings, it does not directly affect a company’s cash flow. Cash flow remains unaffected by non-cash expenses such as asset value reduction, but potential investors or buyers may still consider these reductions when assessing the company’s worth. In turn, this could affect their willingness to invest or pay a premium for the business.

- Positive cash flow can offset the negative impact of large depreciation deductions.

- A higher book value of assets, reduced by depreciation, may lead to a lower valuation due to the perceived reduction in tangible assets.

In the end, the way depreciation is handled can influence not only the reported financial performance but also how a company is valued. Business owners should carefully consider the implications of their depreciation strategy, balancing short-term tax benefits with long-term financial positioning and valuation outcomes.

How to Handle Residual Value in Exams

Understanding how to incorporate the estimated remaining value of an asset at the end of its useful life is crucial when working through calculations in assessments. This value plays a significant role in determining how much of the asset’s cost should be allocated over its usage period. While residual value might not always appear in the simplest of scenarios, knowing how to account for it can greatly improve accuracy in problem-solving situations.

When faced with questions involving this concept, it’s important to recognize the impact of residual value on the overall calculation process. Whether it’s used to reduce the depreciation expense or adjust the total cost to be allocated over time, getting this step right can influence the results significantly. Let’s explore the approach to handling residual value effectively during assessments.

How Residual Value Affects Depreciation Calculations

In calculations, the residual value is subtracted from the total cost of an asset before determining how much should be depreciated each year. The formula is straightforward, but it’s important to remember that this value will impact the amount of expense allocated yearly. Typically, the greater the residual value, the lower the annual depreciation expense will be.

- For straight-line methods, the formula is: (Cost of Asset – Residual Value) ÷ Useful Life.

- For declining balance methods, the residual value can influence the percentage applied to the asset’s remaining book value.

Steps to Take When Residual Value Is Provided

When you’re given the residual value in a problem, make sure to follow these steps for accurate calculations:

- Identify the initial cost of the asset and its estimated residual value.

- Subtract the residual value from the cost to determine the total depreciable amount.

- Choose the appropriate method of depreciation and apply the formula accordingly.

- Remember that the residual value can change based on market conditions or updates provided in more complex scenarios.

By following these steps and ensuring that you account for the residual value correctly, you can ensure more accurate and effective solutions during assessments, especially when dealing with questions that require detailed financial calculations.

Advanced Depreciation Topics You Should Know

As you progress in understanding asset allocation and expense recognition, you’ll encounter more complex subjects related to asset valuation and its reduction over time. These advanced topics build upon basic principles and introduce more intricate methods, considerations, and strategies for handling specific scenarios. Gaining a deeper understanding of these concepts is crucial for solving more challenging problems and making informed decisions in a business or financial context.

In this section, we will explore key areas that are often covered in more advanced discussions, touching on unique methods, considerations for varying asset lifespans, and practical examples that illustrate the application of these techniques.

Compounding vs. Non-Compounding Methods

One important area to understand is the difference between compounding and non-compounding methods. These techniques can lead to vastly different results in terms of how an asset’s value decreases over time, especially when extended over long periods.

- Compounding methods: In this approach, the asset’s book value is recalculated every period based on its reduced value from the previous period. This results in a decreasing amount of depreciation over time.

- Non-compounding methods: Here, the amount of depreciation remains fixed over the asset’s useful life, regardless of how the asset’s value changes over time.

Impairment and Revaluation

In addition to regular reduction of asset value, there are situations where assets may be impaired or require revaluation. Understanding these adjustments can prevent errors and ensure financial statements accurately reflect the current value of assets.

- Impairment: If an asset’s value decreases significantly below its carrying amount due to external factors (e.g., market downturns), it may need to be written down to reflect its new fair value.

- Revaluation: Certain assets, such as real estate, may be periodically revalued to reflect market conditions. These adjustments can influence how depreciation is calculated moving forward.

Depreciation for Tax Purposes

Another advanced topic is understanding how asset reduction affects taxes. Different depreciation methods may have tax implications, especially when choosing between accelerated or straight-line methods. This can have a significant impact on cash flow and tax reporting for businesses.

- Accelerated methods: These methods allow businesses to claim more depreciation upfront, leading to tax deferrals.

- Straight-line methods: These provide a consistent depreciation expense throughout the asset’s life, leading to predictable tax impacts.

International Considerations

International accounting standards also play a role in how asset values are handled. Different countries may have distinct rules regarding the treatment of depreciation, which can affect multinational companies or those engaging in cross-border transactions.

- IFRS vs. GAAP: International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) may have different guidelines for calculating and reporting asset depreciation.

- Tax laws: Tax regulations regarding depreciation can vary greatly from country to country, affecting how businesses calculate and claim deductions.

Familiarizing yourself with these advanced topics will not only help you solve more complex problems but also give you a comprehensive understanding of how asset valuation impacts business operations across different sectors. Mastering these concepts is essential for anyone working in finance, accounting, or asset management.

Tips for Mastering Depreciation Exam Answers

When preparing for assessments that focus on asset valuation and cost allocation methods, it’s crucial to understand not only the core concepts but also the specific approaches that will help you effectively tackle complex questions. Mastering the application of key principles will enable you to respond with accuracy and confidence. This section will provide you with strategies to ensure you’re fully equipped to handle any related queries with ease and clarity.

Understand the Core Concepts Thoroughly

Before diving into specific calculations, ensure that you have a solid grasp of the fundamental concepts that form the basis of the subject. A deep understanding of how assets lose value over time and the various methods to measure that loss is essential. Focus on understanding the theory behind the different methods, such as straight-line, accelerated, and variable expense approaches. Recognizing when and why each method is appropriate will allow you to choose the best one for a given scenario.

Practice Calculation Problems Regularly

One of the most effective ways to prepare for related questions is through hands-on practice. Try solving various problems that cover all depreciation methods. Familiarity with different scenarios will help you become more comfortable with the calculations, ensuring you can handle questions that might involve multiple steps or variations in terms of asset life, residual values, or other factors.

Additionally, practicing under timed conditions will allow you to manage your time more efficiently, ensuring that you don’t spend too much time on any single part of the problem.

Master the Formulae and Methods

While memorization of formulas is important, understanding their applications and the context in which they are used is even more critical. Focus on mastering the key equations for each method so that you can apply them correctly when needed. A clear understanding of how each calculation works will enable you to determine which method best fits the problem at hand and how to adjust parameters such as asset lifespan and residual value.

- Straight-line method: This is one of the most straightforward formulas, where the same amount of expense is subtracted each year.

- Double-declining balance method: Used for assets that lose their value more quickly, this method accelerates depreciation during the asset’s early years.

Stay Organized and Detail-Oriented

Pay close attention to all the details provided in the question. It’s easy to overlook important information, such as asset lifespan, residual value, or any changes in the asset’s usage. Take the time to carefully note all relevant figures before beginning your calculations, and make sure to follow each step logically and in order. A clean and structured approach will minimize the risk of errors.

By adopting these tips and practicing regularly, you’ll be well on your way to confidently tackling any questions related to asset valuation and expense management, ensuring that you can respond with accuracy and efficiency.