In any course that covers the broad field of economic principles, understanding the core ideas and frameworks is crucial. These essential topics shape the way economies function, influencing everything from government policy to individual financial decisions.

By focusing on fundamental theories, models, and key relationships, students can navigate complex scenarios with confidence. Grasping concepts like the behavior of markets, fiscal strategies, and the role of monetary systems will enhance both practical knowledge and analytical thinking.

Preparation requires not only theoretical comprehension but also the ability to apply these ideas to real-world situations. With a deeper understanding of how economic forces interact, one can develop the insight needed for academic and professional success.

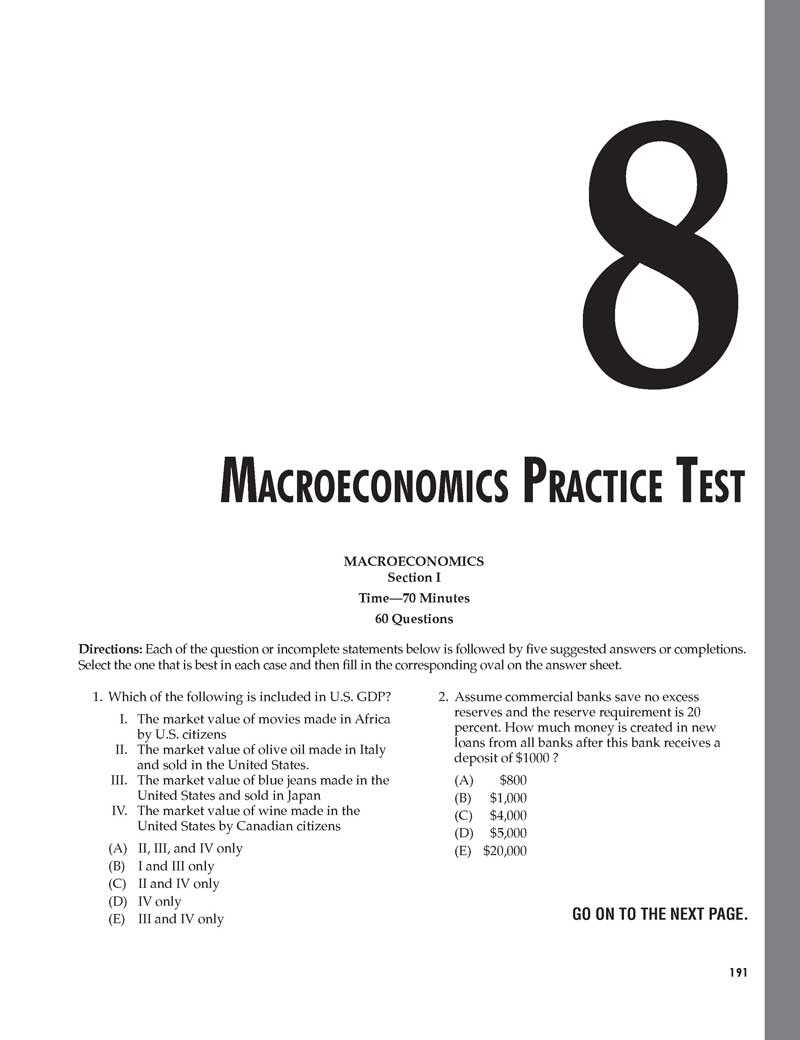

Macroeconomics Exam Answers

Successfully tackling a comprehensive assessment in this field requires more than just memorizing facts. It involves understanding key theories, applying models to real-world scenarios, and demonstrating the ability to analyze economic problems critically. Proper preparation enables you to approach questions with confidence and clarity, offering insightful responses backed by solid knowledge.

When responding to questions, it’s important to stay focused on essential concepts while presenting logical and structured answers. Below is a breakdown of some core topics that frequently appear in evaluations, helping you organize your thoughts effectively.

| Topic | Key Concept | What to Remember |

|---|---|---|

| Economic Growth | Factors influencing national development | Understand the role of investments, technology, and labor |

| Government Intervention | Fiscal and monetary policies | Know the impact of taxation, public spending, and interest rates |

| Inflation | Price level increases over time | Distinguish between demand-pull and cost-push inflation |

| Unemployment | Types of joblessness in the economy | Understand frictional, structural, and cyclical unemployment |

| International Trade | Global market interactions and exchange rates | Know how tariffs, quotas, and currency fluctuations affect trade |

Familiarizing yourself with these topics, along with their practical applications, will improve your ability to craft clear, precise, and well-supported responses. The more you practice integrating these concepts into everyday situations, the better you’ll perform when faced with complex questions.

Key Concepts for Your Exam

To perform well in your assessment, it’s essential to focus on the fundamental ideas that form the backbone of this field. These concepts are critical in analyzing how economies operate and interact on both a national and global scale. Mastering these topics will not only help you answer questions more effectively but also build a solid foundation for applying theory to real-world situations.

The following key ideas are vital for success and should be thoroughly understood:

- Economic Growth: Understand the factors that drive a nation’s development, including technological advancements, capital accumulation, and labor productivity.

- Inflation: Recognize the causes and consequences of rising price levels, and differentiate between different types of inflation, such as demand-pull and cost-push.

- Unemployment: Be familiar with various types of joblessness, including structural, frictional, and cyclical, and understand their impact on the economy.

- Government Policies: Comprehend the role of fiscal and monetary policies in regulating the economy, managing inflation, and promoting growth.

- International Trade: Understand the principles of trade between nations, including tariffs, quotas, and currency fluctuations.

- Market Structures: Be able to differentiate between different market types, such as perfect competition, monopoly, and oligopoly, and understand their economic implications.

Additionally, it’s important to grasp the relationship between these concepts and how they affect the overall functioning of the economy. By mastering these core ideas, you’ll be better prepared to analyze complex issues and develop well-rounded responses.

Understanding Economic Theories

A deep understanding of economic theories is crucial for analyzing how markets operate, how government policies shape national economies, and how global trade systems function. These theories provide the framework for interpreting various economic phenomena and help explain the relationships between different factors that influence economic behavior.

There are several key economic theories that you should be familiar with, each offering a distinct perspective on how economies grow and develop:

- Classical Theory: Focuses on the idea that markets are self-regulating and that economies naturally tend towards full employment without government intervention.

- Keynesian Theory: Emphasizes the role of government spending and fiscal policies in managing demand and stabilizing the economy, particularly during recessions.

- Monetarist Theory: Suggests that controlling the money supply is the primary way to regulate the economy, emphasizing the relationship between inflation and money supply.

- Supply-Side Economics: Proposes that reducing taxes and regulations on businesses and individuals will spur investment, economic growth, and job creation.

- Behavioral Economics: Combines psychological insights with traditional economic theory to better understand how individuals make economic decisions, often contradicting the assumption of rational decision-making.

By studying these theories, you will develop a comprehensive understanding of how different schools of thought approach key issues such as inflation, unemployment, and economic growth. This knowledge allows you to evaluate various policy proposals and their potential impact on the economy.

Supply and Demand Fundamentals

The relationship between the quantity of goods available and the desire for those goods is a cornerstone of economic theory. This balance determines not only the prices at which products are sold but also influences market behavior, production decisions, and overall economic stability. Understanding how supply and demand interact is key to analyzing market trends and predicting shifts in the economy.

In a simplified model, when demand for a product increases and supply remains constant, prices tend to rise, signaling producers to increase output. Conversely, when supply exceeds demand, prices typically fall, prompting a reduction in production. These shifts are influenced by numerous factors, such as consumer preferences, technological advancements, and external events like natural disasters or policy changes.

Mastering the basic principles of supply and demand allows you to analyze complex market scenarios and anticipate the effects of various economic changes on both a micro and macro scale.

Monetary Policy Insights

Central banks play a crucial role in managing the economy by controlling the money supply and influencing interest rates. These actions are vital in regulating inflation, stabilizing the currency, and promoting sustainable economic growth. By adjusting key levers such as interest rates or engaging in open market operations, authorities can either stimulate the economy or slow it down to prevent overheating.

For instance, when inflation is high, central banks may increase interest rates to reduce borrowing and spending, which in turn cools down demand. On the other hand, during periods of economic slowdown, lowering interest rates can encourage investment and consumption, boosting economic activity. The balance between these tools is essential for maintaining stability and fostering long-term growth.

Understanding how monetary policy affects various aspects of the economy, from unemployment to the cost of living, is essential for interpreting broader economic trends and evaluating the effectiveness of policy decisions.

Fiscal Policy and Government Spending

Government spending and taxation are powerful tools used to manage a nation’s economy. By adjusting these factors, policymakers can influence economic growth, control inflation, and reduce unemployment. The decisions made in this area have a direct impact on the public sector, businesses, and households alike, shaping both short-term recovery and long-term stability.

When the economy is slowing down, governments may increase public spending and reduce taxes to stimulate demand and boost economic activity. Conversely, during periods of high inflation or economic overheating, the government may reduce spending and increase taxes to cool down the economy. These fiscal measures are designed to balance supply and demand, ensuring that the economy operates smoothly without excessive price fluctuations or prolonged recessions.

Understanding how fiscal policy works is key to interpreting the impact of government actions on the broader economy, including job creation, income distribution, and overall economic health.

Inflation and Its Effects

Price increases across goods and services can have wide-reaching effects on an economy, influencing everything from consumer behavior to the stability of financial markets. As the cost of living rises, purchasing power declines, which can impact household budgets, savings, and investment strategies. Understanding the causes and consequences of price inflation is crucial for navigating economic shifts and formulating effective policies.

Inflation can be driven by various factors, including increased demand for goods, supply chain disruptions, or rising production costs. It can affect different sectors of the economy in diverse ways. Below is a breakdown of how inflation impacts various economic elements:

| Impact Area | Effect of Inflation |

|---|---|

| Consumer Spending | Higher prices reduce the purchasing power of consumers, leading to reduced consumption of goods and services. |

| Savings | As the value of money decreases, the real value of savings also diminishes, eroding long-term financial security. |

| Investment | Uncertainty about future costs may cause businesses to delay investments or reduce expansion plans. |

| Wages | Workers may demand higher wages to keep up with the rising cost of living, potentially leading to a wage-price spiral. |

| Interest Rates | Central banks may raise interest rates to control inflation, making borrowing more expensive and slowing economic activity. |

While mild inflation is often considered a normal aspect of a growing economy, excessive inflation can lead to significant challenges, including reduced economic confidence, higher living costs, and increased inequality. Monitoring and managing inflation is therefore a central concern for both policymakers and businesses alike.

Unemployment and Economic Impact

The level of joblessness in an economy is not only a social concern but also a critical indicator of economic health. When a significant portion of the labor force is unemployed, it can lead to a series of negative consequences that affect both individuals and broader economic stability. Understanding the various types of unemployment and their impact is essential for addressing this issue effectively.

High unemployment can create a ripple effect across different areas of the economy:

- Reduced Consumer Spending: Unemployed individuals have less disposable income, which decreases demand for goods and services, slowing down economic growth.

- Lower Tax Revenues: Governments collect fewer taxes when more people are out of work, leading to potential budget deficits and reduced ability to fund public services.

- Increased Government Spending: Higher unemployment rates often lead to greater demand for social assistance programs, such as unemployment benefits, increasing public expenditure.

- Skills Erosion: Prolonged joblessness can lead to a loss of skills and experience, making it harder for individuals to reenter the workforce at the same level.

- Social Consequences: High unemployment is linked to various social problems, including higher crime rates, increased poverty, and mental health issues.

While short-term fluctuations in unemployment are common in any economy, sustained high rates can lead to significant long-term problems, such as weaker economic growth and growing inequality. Addressing unemployment requires targeted policies, including job creation programs, education, and training initiatives, to help individuals transition back into the workforce and stimulate broader economic activity.

GDP Calculation Methods Explained

The measurement of a nation’s total economic output is vital for assessing its overall economic performance and standard of living. Gross Domestic Product (GDP) serves as the primary indicator of a country’s economic health. However, there are different ways to calculate this figure, each providing unique insights into the economy’s functioning. Understanding the various methods used to compute GDP can help clarify the economic processes and offer a more comprehensive view of economic activity.

There are three primary approaches to calculating the total output of an economy:

- Production (Output) Method: This method calculates GDP by adding the value of all goods and services produced within a country during a specific period. It focuses on the output generated by businesses, government, and other sectors of the economy.

- Income Method: GDP is calculated by summing up all the income earned by individuals and businesses within the economy, including wages, profits, rents, and interest. This method highlights the distribution of income across various economic agents.

- Expenditure Method: This approach determines GDP by summing all expenditures made in the economy, such as consumer spending, investments, government spending, and net exports (exports minus imports). It reflects the demand side of the economy.

Each method offers valuable perspectives, with the expenditure method often being the most commonly used in national accounts. By understanding how GDP is calculated through these different approaches, one can better interpret the economic conditions of a country and make informed decisions about policy and investments.

International Trade and Exchange Rates

Global commerce plays a crucial role in shaping the economic landscape of nations. The movement of goods, services, and capital across borders is influenced by a variety of factors, including the value of currencies and international policies. Exchange rates, which determine the relative value of one currency against another, are key to understanding the dynamics of global trade. These rates affect how countries conduct business with each other and can have significant implications for a nation’s economy.

The value of a country’s currency can make its exports more or less attractive to foreign buyers. When a currency is strong, exports become more expensive for other countries, potentially reducing demand. On the other hand, when a currency weakens, exports become cheaper and more competitive, stimulating trade. Similarly, exchange rates impact the cost of imports, which can influence the prices of goods and services within the domestic market.

In addition to market forces, governments and central banks may intervene in currency markets to stabilize their economies or achieve specific economic goals. Understanding the interaction between trade flows and exchange rates is essential for analyzing a nation’s economic position and its participation in the global market.

Market Structures and Competition

The way markets are organized plays a crucial role in shaping the behavior of businesses and the prices consumers pay. Different market environments, ranging from highly competitive to monopolistic, influence how companies operate, how products are priced, and how goods and services are distributed. Understanding the characteristics of various market types can help explain the dynamics of competition and market efficiency.

Market structures are typically categorized based on the number of firms, the type of products offered, and the level of competition. The main types include:

- Perfect Competition: A market with many firms offering identical products, where no single company can influence the price. Competition drives efficiency, and consumers benefit from low prices and innovation.

- Monopolistic Competition: Many firms offer similar but not identical products, allowing for differentiation. Businesses compete on product quality, branding, and pricing strategies.

- Oligopoly: A few large firms dominate the market. These companies often have significant control over prices and may engage in strategic behaviors like price fixing or collusion.

- Monopoly: One firm controls the entire market for a particular good or service, often leading to higher prices due to the lack of competition.

In competitive markets, firms must innovate and operate efficiently to attract consumers, while in less competitive environments, prices may be higher, and consumer choice can be limited. Understanding these structures helps explain why some industries are more competitive than others and why certain markets can lead to more favorable outcomes for consumers.

Business Cycles and Economic Fluctuations

The economy is rarely static, and its performance tends to experience periodic ups and downs. These fluctuations are a natural part of economic activity and can have significant impacts on employment, income, and production levels. Understanding the phases of these cycles helps to predict economic trends and prepare for potential challenges. Whether growth or contraction, these fluctuations are a constant in market-based economies.

Economists typically identify several phases within a business cycle, each representing different stages of economic activity:

- Expansion: This phase is marked by increasing economic activity, rising GDP, and falling unemployment rates. Consumer confidence tends to rise, and businesses increase production to meet demand.

- Peak: The economy reaches its highest point during this stage. Growth slows as resources become fully utilized, and inflationary pressures may begin to mount.

- Contraction (Recession): Economic activity begins to decline. Production slows, unemployment rises, and consumer spending decreases. A prolonged contraction may lead to a recession, affecting overall economic stability.

- Trough: The lowest point of the cycle, where economic activity hits its bottom. However, from this stage, the economy begins to recover, leading to the next expansion phase.

These cycles can be influenced by various factors, including shifts in consumer confidence, government policies, and global economic conditions. While business cycles are inevitable, understanding them allows policymakers and businesses to anticipate and mitigate their effects on the economy.

Factors Affecting Economic Growth

The pace at which an economy grows depends on a wide range of factors, each influencing its productivity and overall output. These factors are interconnected and can either stimulate or hinder economic development. A deeper understanding of what drives growth is crucial for policymakers and businesses aiming to create sustainable prosperity.

Key Drivers of Economic Growth

Several critical elements contribute to the expansion of an economy. Among the most important are:

- Capital Accumulation: Investments in physical infrastructure, technology, and machinery enable businesses to produce more efficiently. A well-developed capital base often leads to increased productivity and higher output.

- Human Capital: The skills, education, and health of the workforce directly impact economic growth. A highly educated and healthy population tends to be more innovative and productive, contributing to a stronger economy.

- Innovation and Technology: Breakthroughs in technology and new methods of production can significantly enhance efficiency and open up new markets. Technological progress often drives competitive advantages in both local and global markets.

- Natural Resources: Access to abundant natural resources can provide a country with the raw materials necessary for industrialization. However, sustainable management of these resources is critical to avoid depletion and long-term economic instability.

External Influences on Growth

Beyond internal factors, external elements also play a significant role in shaping an economy’s growth trajectory. These include:

- Global Trade: Participation in international markets can open up opportunities for exports, foreign investments, and access to a larger consumer base, all of which stimulate growth.

- Government Policy: Economic policies such as taxation, subsidies, and trade regulations can either support or constrain growth. Government investment in infrastructure and innovation can lead to long-term economic benefits.

- Political Stability: A stable political environment encourages investment and fosters confidence among businesses and consumers, which, in turn, supports economic expansion.

These factors collectively influence the long-term economic performance of a nation. While some are within the control of governments, others are shaped by global trends and external forces. By understanding these drivers, countries can implement strategies to sustain and accelerate their economic growth.

Understanding Keynesian Economics

The theory of economic management that emphasizes the role of government intervention in stabilizing the economy remains central to discussions about economic policy. At the heart of this approach is the idea that markets alone cannot always achieve full employment or economic stability. Instead, government spending and policies are seen as crucial tools for managing economic cycles, especially during periods of downturn.

Proponents of this view argue that during recessions, private sector demand is often insufficient to maintain full employment. As a result, public sector spending becomes necessary to fill the gap, stimulating demand, creating jobs, and encouraging investment. This approach contrasts with views that favor minimal government interference, advocating for the self-regulation of markets.

Keynesian economics suggests that during economic downturns, governments should increase spending and reduce taxes to boost demand. Similarly, when the economy is booming and inflationary pressures are rising, the government can reduce spending or increase taxes to cool down the economy. By adjusting fiscal policy in this way, it is believed that the economy can maintain stable growth and avoid the extremes of booms and busts.

While widely influential, Keynesian thought is not without criticism. Some argue that too much government intervention can lead to inefficiencies or long-term debt. Nonetheless, the core idea remains relevant in modern economic policy debates, particularly in times of economic instability.

Macroeconomic Models and Equations

In understanding the broader economic systems, various models and equations serve as tools for analyzing and predicting the behavior of national economies. These frameworks help economists simplify complex interactions and provide insights into key relationships between variables such as output, inflation, unemployment, and government policies. By using these models, economists can examine how different factors, such as changes in investment or fiscal policy, affect overall economic performance.

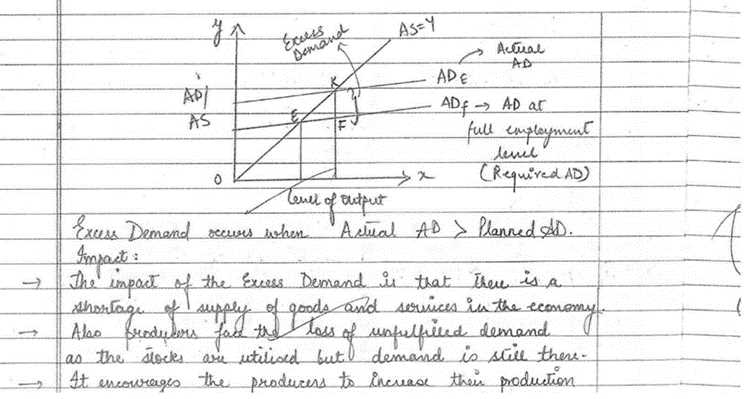

One of the most widely used approaches is the aggregate demand and aggregate supply model, which illustrates the total demand for goods and services within an economy and how it interacts with the supply side. This model helps to understand inflationary pressures, unemployment, and economic growth within a given period.

Another important tool is the IS-LM model, which stands for Investment Saving-Liquidity Preference Money Supply. This model is used to represent the interaction between the real economy and the monetary sector. It shows how interest rates and output are determined in the short run under different fiscal and monetary policies.

In addition to these, the Phillips Curve is another key concept in economic modeling. It represents the inverse relationship between inflation and unemployment, suggesting that lower unemployment rates tend to lead to higher inflation, and vice versa. This model is often used to explore the trade-offs that policymakers face when trying to balance growth and price stability.

Economic models are often expressed through equations that quantify these relationships. For example, the basic aggregate demand equation can be written as:

AD = C + I + G + (X - M)

Where:

- AD stands for aggregate demand,

- C represents consumption,

- I is investment,

- G refers to government spending,

- X – M is net exports (exports minus imports).

These models and equations form the foundation for much of economic analysis, helping economists and policymakers make informed decisions about managing an economy. They provide valuable insights into the impacts of changes in fiscal, monetary, and trade policies on overall economic health.

Exam Strategies for Success

Achieving success in any written assessment requires more than just knowledge of the subject matter. Effective strategies can help you approach the test with confidence and maximize your performance. The key lies in understanding how to organize your time, plan your approach, and manage any challenges that may arise during the process.

Planning Ahead

Preparation is essential for performing well. A well-organized study schedule ensures that all topics are covered thoroughly without last-minute cramming. Below are some tips for effective planning:

- Create a Study Plan: Break down the syllabus into manageable sections and allocate enough time for each one. This prevents overwhelming yourself as the assessment day approaches.

- Review Past Materials: Familiarize yourself with the format and types of questions typically asked. Reviewing past tests or mock assessments can provide valuable insights into what to expect.

- Use Active Recall: Instead of passively reading notes, engage with the material by actively recalling key concepts. This helps reinforce long-term retention.

- Group Study: Joining a study group can encourage discussion and offer different perspectives on complex topics, enhancing your understanding.

During the Test

Once the test begins, staying calm and focused is crucial. Applying effective techniques during the actual assessment can help you manage your time and approach questions strategically:

- Read Questions Carefully: Take the time to fully understand what each question is asking. Pay attention to keywords and ensure you address all parts of the question.

- Start with Familiar Questions: Tackle the questions you are most confident about first. This builds momentum and reduces anxiety.

- Time Management: Allocate a specific amount of time for each question and stick to it. If you find yourself stuck on a question, move on and return to it later if time permits.

- Review Your Work: If time allows, go back and double-check your answers. Look for any missed details or simple mistakes.

Incorporating these strategies can not only help improve your performance but also reduce stress and anxiety. By preparing effectively, staying focused, and managing your time well, you’ll be better equipped to achieve success in any assessment.