Preparing for a challenging test in the field of economics requires a solid grasp of various critical concepts and their real-world applications. This section will guide you through the most important topics that are often tested, helping you build a strong foundation for success.

Economic theory offers a broad range of topics, from national income and output measurement to the forces that drive inflation and unemployment. Understanding the intricacies of these subjects is key to solving complex problems efficiently. With a focus on theory and application, you’ll gain insights into the mechanisms that govern economies and influence decision-making.

To succeed, it is crucial to not only memorize key facts but also to understand the relationships between different concepts. Whether it’s the role of government policies or the impact of international trade, each concept connects to the next in a web of economic interactions. The goal is to develop a comprehensive understanding that can be applied to real-world scenarios and test questions.

Macroeconomics Exam 3 Study Guide

This guide is designed to help you navigate the most crucial topics covered in your upcoming assessment. By focusing on key concepts, it provides an overview of the material you’ll need to master to perform well. From understanding foundational principles to applying them in real-world scenarios, this section will give you the tools necessary for effective preparation.

Key Economic Theories and Concepts

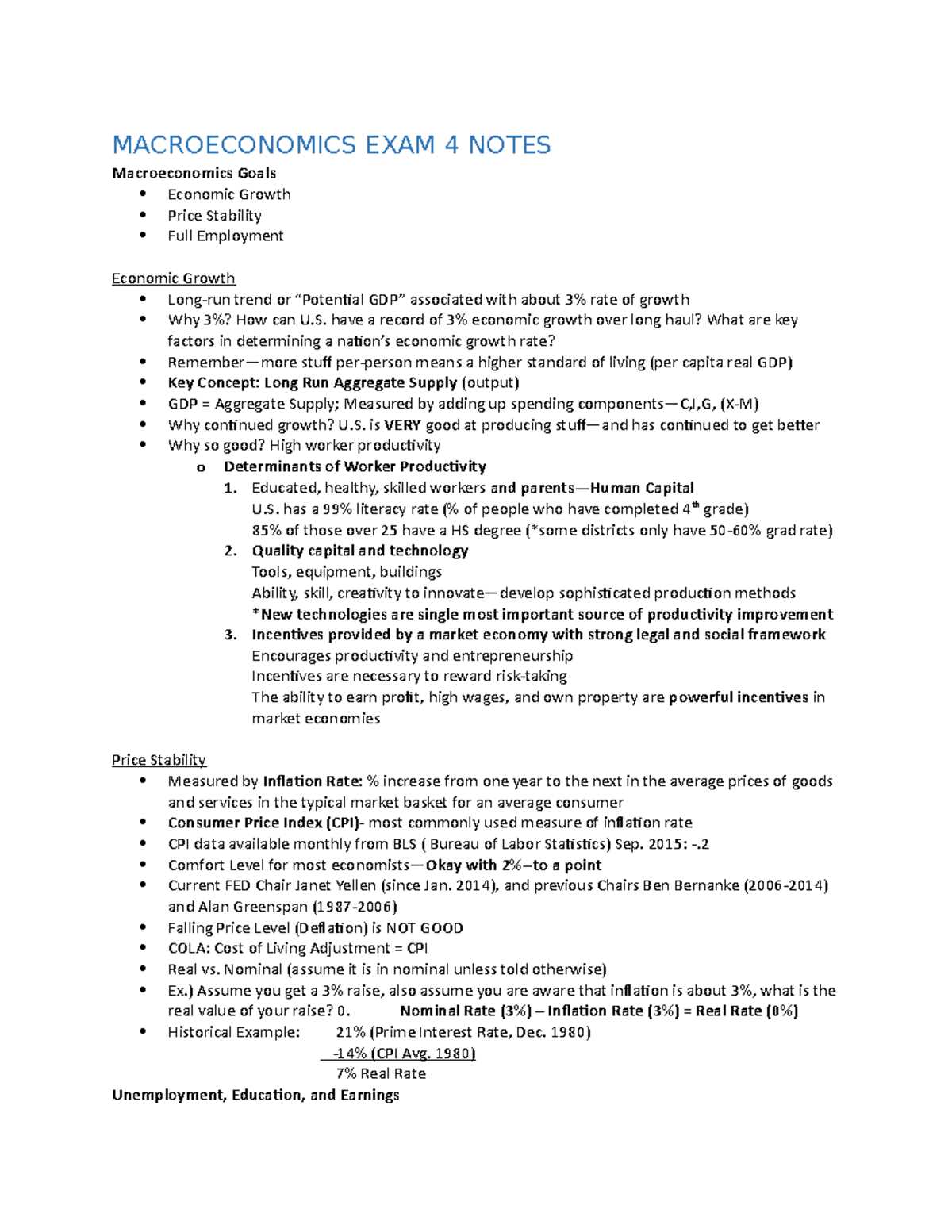

Familiarizing yourself with economic models and theoretical frameworks is essential for success. Concepts such as national income measurement, inflation, and unemployment all play a significant role in shaping your understanding. Be sure to focus on the relationships between these ideas and how they interact within an economy.

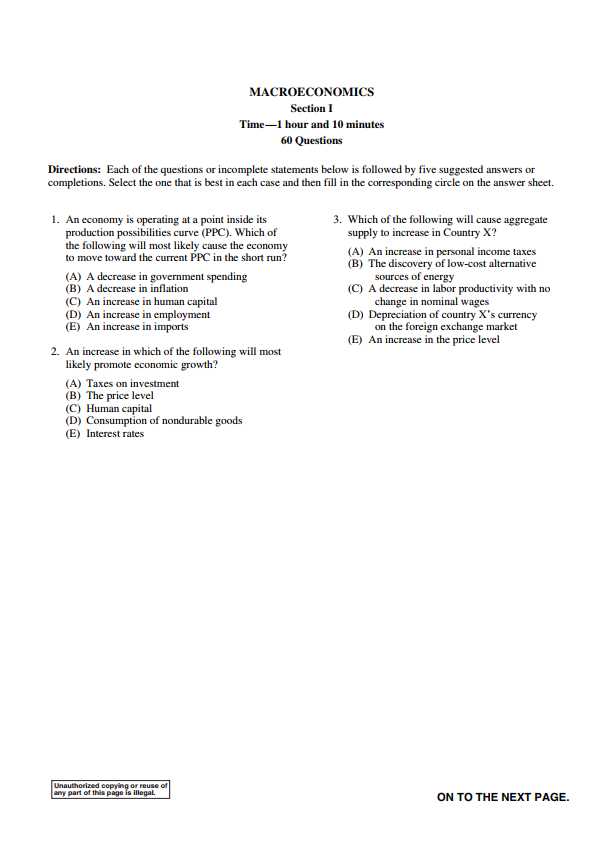

Practical Applications and Problem Solving

Application of theory is just as important as understanding the concepts themselves. Practice applying these ideas to real-life scenarios, such as policy impacts or economic shifts. The ability to analyze and interpret data will serve you well in answering complex questions. Focus on developing critical thinking skills and the ability to apply abstract ideas to concrete problems.

Overview of Key Macroeconomic Concepts

Understanding the foundational principles of economic theory is essential for grasping how markets and national economies function. In this section, we explore the most critical ideas that form the backbone of economic analysis. These concepts not only provide insight into how economic systems operate but also help in interpreting real-world financial events and government policies.

Gross Domestic Product (GDP) is a primary indicator of economic health, measuring the total value of goods and services produced within a country. Inflation reflects the rate at which prices rise, affecting purchasing power and cost of living. Similarly, unemployment rates indicate the proportion of people who are actively seeking work but cannot find employment, influencing overall economic productivity and stability.

Another critical area is monetary policy, where central banks manage money supply and interest rates to stabilize the economy. Understanding these key factors and how they interrelate is crucial for anyone looking to dive deeper into economic studies and analysis.

Important Theories for Exam Preparation

To perform well in any assessment, it is essential to have a deep understanding of the core theories that explain economic behavior and decision-making. In this section, we will focus on the most important theoretical frameworks that are crucial for navigating complex questions and real-world applications. Familiarity with these theories will not only help you understand economic dynamics but also improve your ability to tackle a wide range of problems effectively.

Key Economic Theories to Study

- Classical Economics – Focuses on the idea that free markets regulate themselves without government intervention, emphasizing the importance of supply and demand.

- Keynesian Economics – Suggests that government intervention is necessary to manage economic fluctuations and ensure stable growth, especially during periods of downturn.

- Monetarism – Emphasizes the role of governments in controlling the amount of money in circulation to influence economic activity and maintain price stability.

- Supply-Side Economics – Argues that reducing taxes and regulations will stimulate investment, job creation, and economic growth.

- New Economic Growth Theory – Focuses on the importance of technological innovation and human capital as drivers of long-term economic growth.

Applications of Economic Theories

- Understanding macroeconomic cycles and how policies can influence recessions or booms.

- Recognizing the impact of government fiscal policies and monetary strategies on national economies.

- Applying international trade theories to understand global economic interdependence and its effects on domestic markets.

Understanding GDP and Its Calculations

Gross Domestic Product (GDP) is a fundamental measure of an economy’s total output, reflecting the overall value of goods and services produced within a country over a specific period. It serves as a crucial indicator of economic health, providing insights into the size and growth of an economy. Understanding how GDP is calculated and the factors influencing it is essential for analyzing national economic performance and making informed decisions.

Methods of Calculating GDP

There are three primary approaches to calculating GDP, each offering a different perspective on economic activity:

- Production Approach – Calculates GDP by adding the value of all goods and services produced within a country, adjusting for intermediate goods to avoid double-counting.

- Income Approach – Focuses on the total income earned by individuals and businesses in the economy, including wages, profits, and taxes minus subsidies.

- Expenditure Approach – Measures GDP based on the total expenditure on final goods and services, broken down into consumption, investment, government spending, and net exports.

Interpreting GDP Data

While GDP provides a snapshot of a country’s economic activity, it is important to consider additional factors, such as population size and inflation, when interpreting the data. For example, GDP per capita gives a more accurate measure of living standards, while adjustments for inflation (real GDP) offer a clearer picture of long-term economic growth. GDP is not only a reflection of economic performance but also a tool used by policymakers to design fiscal and monetary strategies.

Inflation and Its Economic Impact

Inflation is a critical economic phenomenon that affects the purchasing power of money, influencing everything from individual budgets to national policies. Understanding its causes and consequences is essential for analyzing economic stability and the overall well-being of a society. This section explores the various ways in which rising prices impact both individuals and economies at large.

Causes of Inflation

Inflation can occur for several reasons, often due to a combination of factors. The most common causes include:

- Demand-pull inflation – Occurs when demand for goods and services exceeds the economy’s capacity to produce them, driving up prices.

- Cost-push inflation – Results from increases in production costs, such as wages and raw materials, which businesses pass on to consumers in the form of higher prices.

- Monetary inflation – Happens when there is an excessive increase in the money supply, typically due to central bank policies, leading to too much money chasing too few goods.

Economic Consequences of Inflation

Inflation has several direct and indirect effects on an economy:

- Decreased purchasing power – As prices rise, each unit of currency buys fewer goods and services, reducing consumers’ ability to purchase the same amount.

- Uncertainty in investment – High inflation creates uncertainty, making it more difficult for businesses to plan and invest for the future, potentially slowing economic growth.

- Income redistribution – Inflation can benefit borrowers (as the real value of debt decreases) while harming savers, particularly those with fixed-interest savings accounts.

- Wage-price spiral – When inflation leads to higher wages, which in turn causes higher production costs, further driving up prices and leading to more inflation.

Unemployment and Its Types Explained

Unemployment is a key indicator of an economy’s health, reflecting the number of people actively seeking work but unable to find employment. It is influenced by various factors, including economic cycles, technological advancements, and government policies. Understanding the different types of unemployment is essential for analyzing labor market dynamics and crafting effective policies.

Types of Unemployment

There are several distinct types of unemployment, each stemming from different economic factors. The following table outlines the main categories:

| Type of Unemployment | Description |

|---|---|

| Frictional Unemployment | Occurs when individuals are temporarily between jobs or entering the workforce for the first time. |

| Structural Unemployment | Results from changes in the economy, such as technological advancements, which make certain skills obsolete. |

| Cyclical Unemployment | Linked to the economic cycle, this type rises during periods of economic downturn and falls during periods of growth. |

| Seasonal Unemployment | Occurs when industries or sectors experience fluctuations in demand at different times of the year (e.g., agriculture, tourism). |

Impact of Unemployment on the Economy

High levels of unemployment can have severe economic consequences, leading to reduced consumer spending, lower overall productivity, and higher government spending on social support programs. On the other hand, understanding the underlying causes of different types of unemployment can help policymakers address specific issues more effectively and reduce the negative impact on society.

Monetary Policy Tools and Functions

Monetary policy plays a crucial role in managing a country’s economy by influencing the money supply and interest rates. Central banks use various tools to achieve their goals, which often include controlling inflation, stabilizing the currency, and fostering economic growth. By adjusting these levers, central banks can steer the economy through different phases, from expansion to recession, and maintain overall financial stability.

One of the primary functions of monetary policy is to regulate the amount of money circulating in the economy. This is done by controlling inflation, ensuring that prices remain stable over time. Another important function is to influence interest rates, which affects consumer borrowing and spending as well as business investment. Through these mechanisms, monetary policy can encourage or dampen economic activity as needed to meet the country’s objectives.

In addition to stabilizing the economy, monetary policy can help address financial crises by providing liquidity to the banking system and supporting confidence in the financial markets. The effective use of these tools requires a deep understanding of economic conditions and a careful balancing act to avoid unintended consequences such as excessive inflation or stagnation.

Fiscal Policy and Government Spending

Government spending and fiscal strategies are fundamental tools used by policymakers to influence economic conditions. By adjusting the level of government expenditure and taxation, fiscal policy aims to either stimulate the economy during a downturn or cool it down when inflation is too high. This section explores the relationship between government spending and economic stability, as well as the methods used to achieve specific economic goals.

Components of Fiscal Policy

Fiscal policy involves two main components: government spending and taxation. Both of these elements work together to manage overall economic activity.

- Government Spending – Refers to the expenditure by the government on goods, services, infrastructure, and social programs. It can be directed towards stimulating demand in times of economic slowdown or maintaining public services during growth periods.

- Taxation – By adjusting taxes, governments can either increase disposable income for individuals and businesses or reduce it to cool an overheated economy. Tax cuts are often used to promote spending and investment, while tax increases can help curb inflation.

Impact of Government Spending on the Economy

The scale and allocation of government spending have a direct impact on economic growth and stability. Increased public expenditure can stimulate economic activity by boosting demand for goods and services, creating jobs, and encouraging investment. However, excessive spending can lead to budget deficits and inflation. On the other hand, reduced spending can help control inflation but may also slow economic recovery during times of recession.

- Stimulating Economic Growth – Targeted government spending can spur innovation, improve infrastructure, and promote social welfare, all of which help enhance the economy’s productive capacity.

- Controlling Inflation – By scaling back on spending or increasing taxes, the government can reduce aggregate demand, thereby preventing prices from rising too rapidly.

International Trade and Economic Effects

International trade is a vital component of the global economy, enabling countries to exchange goods, services, and resources. By participating in trade, nations can access products they may not be able to produce domestically and benefit from specialized industries. This interaction drives economic growth, fosters innovation, and creates opportunities for both consumers and businesses worldwide.

The impact of trade extends beyond the exchange of goods; it influences various aspects of economic performance, such as employment, income levels, and market competition. While trade can lead to increased prosperity, it also introduces challenges, including the risk of economic dependency and imbalances in trade relationships. Understanding these effects helps in shaping policies that maximize the benefits of global trade while mitigating its potential downsides.

Positive Economic Effects of Trade

Engaging in international trade has several advantages for countries involved. These include:

- Increased Market Access – Trade opens up new markets for businesses, allowing them to expand their reach beyond national borders and increase sales.

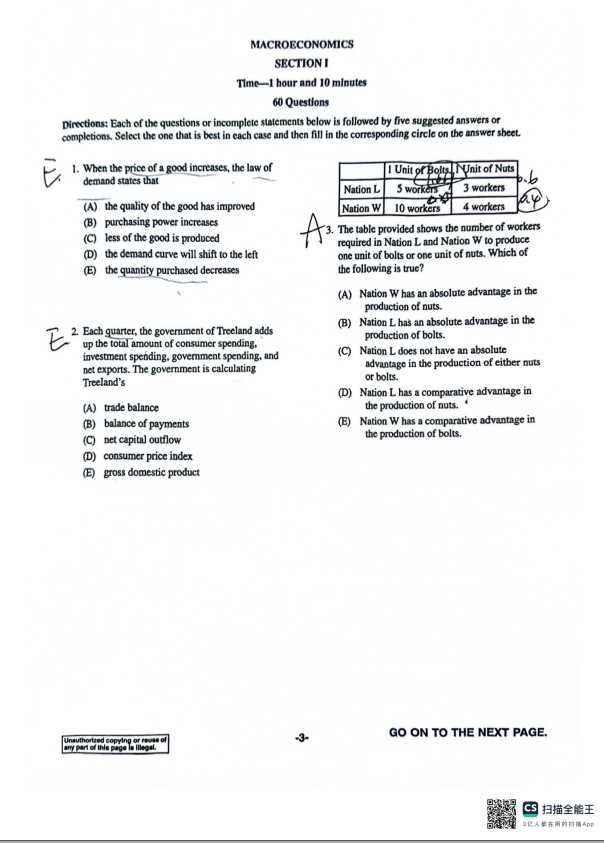

- Higher Efficiency and Specialization – Countries can focus on producing goods and services where they have a comparative advantage, leading to more efficient resource allocation and better-quality products.

- Job Creation – The expansion of trade often leads to the creation of new jobs, especially in industries that cater to international demand.

Challenges and Risks of Trade

Despite the benefits, international trade can also present challenges and risks, including:

- Trade Imbalances – Persistent trade deficits or surpluses can lead to economic instability, affecting currency values and creating tensions between trading nations.

- Dependency on Global Markets – Overreliance on international trade can expose economies to fluctuations in global demand, making them vulnerable to external shocks.

- Job Displacement – While trade creates jobs in certain sectors, it can also lead to job losses in industries that face competition from cheaper foreign products.

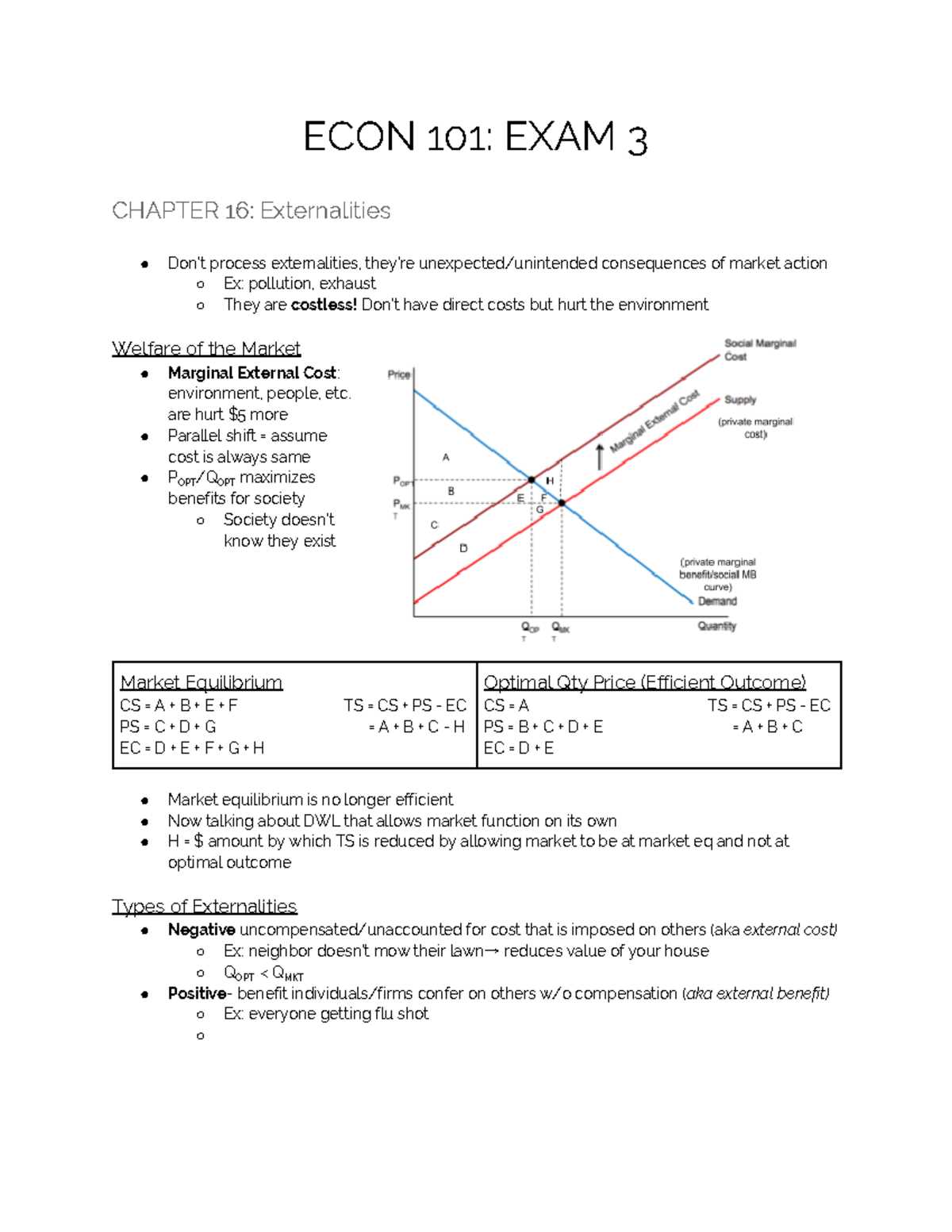

Supply and Demand in Economic Theory

The forces of supply and demand are fundamental concepts that drive economic activity. These forces determine the price and quantity of goods and services exchanged in markets, influencing everything from the production of goods to consumer behavior. By understanding the dynamics between the quantity of goods available and the desire for those goods, economies can achieve balance, promote efficiency, and address market fluctuations.

When demand for a product increases, it typically leads to higher prices if supply remains unchanged. Conversely, when supply increases without a corresponding rise in demand, prices tend to decrease. These interactions are influenced by various factors such as consumer preferences, income levels, technology, and external events like natural disasters or economic policies. Understanding these principles is essential for predicting market trends and crafting policies that support stable growth.

Factors Affecting Demand

Demand for a good or service can be influenced by a wide range of factors. Some of the most important include:

- Consumer Income – As consumers’ incomes rise, their purchasing power increases, which can lead to higher demand for various goods and services.

- Price of Substitutes – If the price of a substitute product decreases, demand for the original product may decrease as well.

- Consumer Preferences – Shifts in consumer tastes or trends can have a significant effect on demand, as preferences change over time.

- Expectations of Future Prices – If consumers expect prices to rise in the future, they may increase current demand in anticipation of higher costs later on.

Factors Affecting Supply

On the other hand, the supply of goods and services is influenced by factors that can either increase or decrease the quantity available for sale. Key factors include:

- Production Costs – An increase in the cost of production, such as higher raw material prices, can reduce supply as producers may find it less profitable to produce at current prices.

- Technology – Technological advances can make production more efficient, leading to an increase in supply.

- Number of Sellers – If more producers enter the market, supply tends to increase, leading to greater availability of goods and services.

- Government Policies – Taxes, subsidies, and regulations can either encourage or discourage production, affecting the overall supply in the market.

Understanding Economic Growth Models

Economic growth is a key indicator of a nation’s prosperity and long-term development. Several models have been developed to explain how economies grow over time, identifying the factors that contribute to increased output and improved living standards. These models provide a framework for understanding the complex interactions between labor, capital, technology, and policy decisions. By analyzing these models, policymakers can design strategies to foster sustainable economic expansion.

Growth models often focus on the role of capital accumulation, technological progress, and human capital in driving an economy forward. Each model offers a different perspective on how economies expand, from focusing on the accumulation of physical capital to emphasizing the importance of innovation and education. Understanding these theories helps clarify the pathways that economies can take to achieve sustained and inclusive growth.

Key Economic Growth Models

Several notable models have shaped the way economists view long-term growth. Some of the key models include:

- Solow-Swan Model – This model emphasizes the role of capital accumulation and technological progress as the primary drivers of economic growth. It suggests that growth can be sustained through increased investment and innovation, though it acknowledges diminishing returns to capital over time.

- Endogenous Growth Theory – Unlike the Solow-Swan model, this theory focuses on the factors within an economy that drive long-term growth, such as human capital, innovation, and knowledge accumulation. It suggests that investment in research and education can lead to perpetual growth.

- Harrod-Domar Model – This model connects economic growth with the level of investment in an economy, emphasizing the importance of saving and investment for increasing the capital stock and driving output growth.

Factors Driving Economic Growth

Regardless of the model, there are several common factors that contribute to economic growth:

- Capital Investment – Increased investment in physical capital, such as infrastructure, machinery, and equipment, enables higher productivity and output.

- Technological Advancement – Innovations in technology improve efficiency, reduce costs, and create new opportunities for production and consumption.

- Human Capital – Education, training, and the development of skills in the workforce contribute to greater productivity and adaptability in the labor market.

- Policy Environment – Government policies, including trade, taxation, and monetary policy, can either stimulate or hinder growth by influencing investment decisions and economic stability.

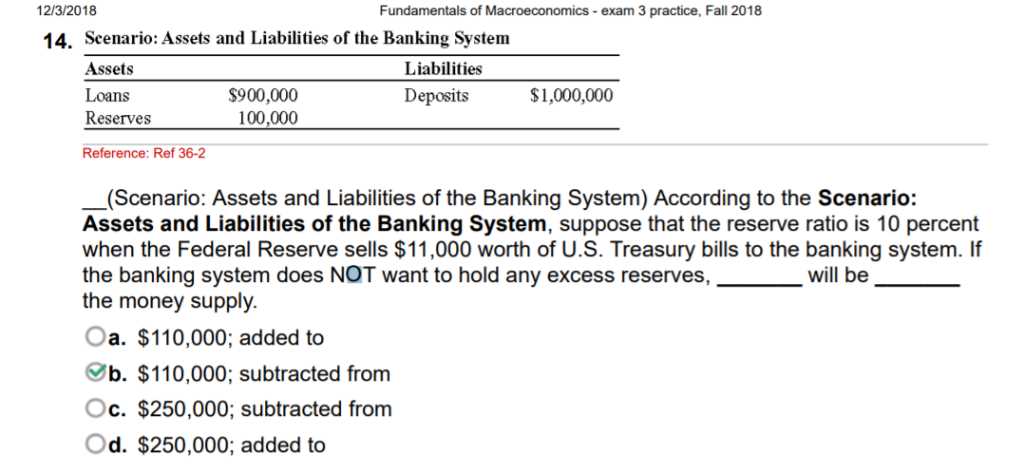

The Role of Central Banks in Economies

Central banks play a pivotal role in shaping the stability and health of national economies. Their primary function is to regulate the money supply, manage inflation, and ensure the financial system remains efficient and secure. Through their actions, central banks influence key economic factors such as interest rates, currency stability, and overall economic growth. By implementing various monetary policies, these institutions guide economic activity and help mitigate financial crises.

Central banks are responsible for maintaining price stability and promoting full employment by controlling inflation and managing the availability of credit. Their decisions on interest rates, as well as their ability to provide liquidity to the banking system, have a profound impact on consumer spending, business investments, and overall economic performance. Understanding the mechanisms behind central banking is crucial to understanding how modern economies function and respond to both domestic and global financial challenges.

Key Functions of Central Banks

The central bank’s role extends beyond basic financial regulation. Some of its key functions include:

- Monetary Policy – Central banks control inflation and influence economic growth by adjusting interest rates and manipulating the money supply.

- Currency Issuance – They have the authority to issue national currency, ensuring that the economy has a stable and trusted medium of exchange.

- Banking Supervision – Central banks oversee commercial banks, ensuring they operate under safe and sound conditions to prevent financial instability.

- Lender of Last Resort – In times of financial distress, central banks provide emergency funding to financial institutions to prevent collapse and preserve the stability of the financial system.

Impact on Financial Markets and Inflation

Central banks directly influence financial markets by adjusting interest rates and participating in open market operations. Their decisions on these matters can cause significant shifts in investor behavior, the value of currencies, and the performance of various asset classes. Additionally, central banks use inflation targeting to ensure that prices remain stable over time, which is critical for long-term economic planning. By carefully balancing the economy’s demand and supply of money, they work to prevent both inflationary and deflationary pressures that can disrupt economic activity.

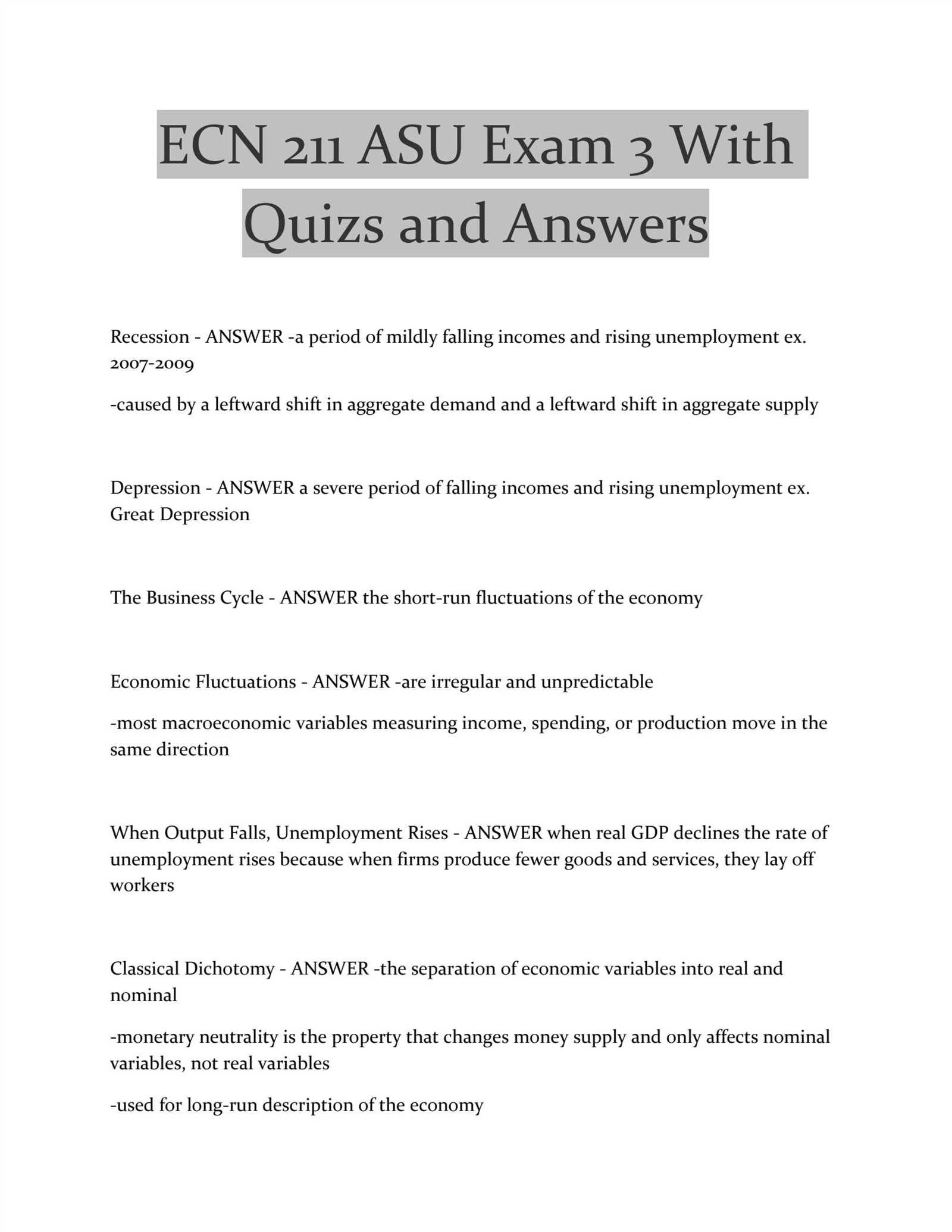

Business Cycles and Their Phases

Business cycles refer to the natural fluctuations in economic activity over time. These cycles are characterized by periods of expansion and contraction in the economy, affecting key factors such as production, employment, and overall economic output. Understanding the various phases of these cycles is crucial for businesses, policymakers, and investors, as they help in forecasting future economic conditions and making informed decisions.

The cycle typically consists of four distinct phases: expansion, peak, contraction, and trough. Each phase has its own unique characteristics that influence the broader economic environment. These phases are not fixed in length and can vary depending on various internal and external factors, including government policies, market conditions, and global economic trends.

The Phases of Business Cycles

Here is an overview of each phase of the business cycle:

| Phase | Description | Economic Indicators |

|---|---|---|

| Expansion | During this phase, economic activity grows, with rising production, employment, and consumer demand. | Increased GDP, falling unemployment, rising consumer spending |

| Peak | The economy reaches its maximum output. Economic growth slows as it approaches its highest point. | High GDP, low unemployment, but slowing growth |

| Contraction | In this phase, economic activity begins to decline. Businesses reduce production, leading to layoffs and reduced spending. | Falling GDP, rising unemployment, reduced consumer spending |

| Trough | The economy reaches its lowest point before beginning to recover. Economic activity starts to stabilize and show signs of improvement. | Low GDP, high unemployment, stabilization of economic indicators |

Impact of Business Cycles on the Economy

The effects of business cycles can be profound on both businesses and individuals. During periods of expansion, businesses may experience increased sales, leading to higher profits and employment. However, during contractions, businesses may face reduced demand, lower profits, and the need for cost-cutting measures. For workers, economic downturns often lead to layoffs and job insecurity, while periods of growth offer opportunities for job creation and wage increases.

Policymakers, particularly central banks and governments, monitor these cycles closely to implement policies that can smooth out extreme fluctuations. By adjusting interest rates, changing tax policies, and providing fiscal stimulus during downturns, they aim to reduce the negative effects of recessions and promote sustainable growth in the long term.

Deflation and Its Consequences

Deflation refers to a sustained decrease in the overall price levels of goods and services within an economy. While it might seem beneficial to consumers at first glance due to lower prices, it can have significant negative effects on economic growth and stability. When deflation occurs, the value of money increases, leading consumers and businesses to delay purchases and investments in anticipation of even lower prices in the future. This shift in behavior can cause a decrease in overall economic activity, creating a cycle that is difficult to break.

The primary consequence of deflation is the reduction in consumer and business confidence. As prices fall, consumers may postpone purchases, waiting for even lower prices. This leads to a drop in demand, which in turn causes businesses to reduce production, lay off workers, and cut wages. This cycle of falling prices and rising unemployment can deepen the economic downturn, resulting in prolonged recessions or even depressions.

Furthermore, deflation increases the real burden of debt. When the value of money rises, the cost of repaying loans becomes more expensive, even if the nominal amount of debt remains the same. Individuals and businesses with significant debt burdens may find themselves unable to meet their financial obligations, leading to defaults and bankruptcies, which can further harm the economy.

Governments and central banks typically take action to combat deflation by implementing policies aimed at increasing demand. This can include lowering interest rates, increasing government spending, or employing quantitative easing measures to encourage borrowing and investment. However, once deflation takes hold, it can be challenging to reverse the negative effects without significant intervention.

Key Consequences of Deflation:

- Decreased consumer spending: As people expect prices to keep falling, they delay purchases, which reduces overall demand.

- Increased real debt burden: The value of debt rises in real terms, leading to higher costs for borrowers.

- Business closures and job losses: Reduced demand leads to lower production, causing layoffs and bankruptcies.

- Stagnant economic growth: The economy enters a vicious cycle of reduced spending, investment, and growth.

Deflation, while less common than inflation, is a dangerous economic phenomenon that can lead to widespread economic distress. By understanding its causes and effects, policymakers can better prepare and respond to prevent a deflationary spiral that could have long-lasting consequences for the economy.

Macroeconomic Indicators to Watch

Understanding the key indicators that reflect the overall health of an economy is essential for making informed decisions. These metrics provide insights into trends, potential challenges, and areas of growth. Monitoring the right indicators can help businesses, investors, and policymakers assess economic stability, predict future movements, and adjust strategies accordingly.

One of the most widely used measures is the Gross Domestic Product (GDP), which quantifies the total value of goods and services produced within a country. A growing GDP typically signals economic expansion, while a decline can indicate a slowdown or recession. Another critical indicator is the unemployment rate, which tracks the percentage of the workforce actively seeking employment. A high unemployment rate is often a sign of economic distress, while a low rate indicates a healthy labor market.

Inflation Rate

The inflation rate is a measure of how quickly the general level of prices for goods and services is rising. Moderate inflation is typically seen as a sign of a growing economy, but excessive inflation can erode purchasing power and reduce consumer confidence. Deflation, the opposite of inflation, can also be problematic as it may lead to lower consumer spending and a stalled economy.

Interest Rates

Interest rates are set by central banks and play a critical role in the overall economic environment. Low interest rates can stimulate borrowing and investment, while high rates can slow down economic activity. Monitoring interest rate changes is essential for understanding the potential for inflation or deflation and anticipating shifts in the business cycle.

By tracking these indicators–along with others such as consumer confidence, trade balances, and wage growth–economists can gain a comprehensive picture of an economy’s performance and prospects. For individuals and businesses, understanding these metrics is vital for making strategic decisions and adapting to the economic landscape.

Common Mistakes to Avoid in Exam

When preparing for and taking an important assessment, it’s easy to fall into certain traps that can negatively impact performance. Understanding the common pitfalls and being proactive in avoiding them is crucial for achieving the best possible outcome. These mistakes can range from poor time management to failing to grasp key concepts, but with the right approach, they can be minimized or entirely avoided.

One frequent error is poor time management. Many individuals spend too much time on one question while neglecting others, leading to incomplete answers or rushing at the end. It’s important to allocate time wisely across all sections of the assessment, ensuring that each part receives the attention it deserves. Additionally, not reading the instructions thoroughly can cause misunderstandings and lead to answering questions incorrectly, even when the material is known well.

Neglecting to Review Your Work

Another common mistake is not reviewing your responses before submitting the assessment. Skipping this step can result in simple errors that could have been easily corrected, such as miscalculations, overlooked details, or unclear explanations. Reviewing your answers allows you to spot mistakes, refine your responses, and ensure that you’ve addressed each question fully.

Relying Too Much on Memorization

Many candidates focus on rote memorization rather than truly understanding the underlying principles of the material. While memorizing facts can be useful, it’s equally important to understand how to apply them in different scenarios. This deeper understanding can help avoid confusion during complex questions and lead to more thoughtful and accurate responses.

By being aware of these common errors and taking steps to prevent them, candidates can improve their performance, feel more confident during assessments, and ultimately increase their chances of success. Proper preparation, strategic time management, and a clear understanding of the material are key elements in avoiding these mistakes.