Successfully navigating complex scenarios in the world of taxation requires a combination of knowledge, strategic thinking, and careful analysis. The task at hand often involves applying theoretical concepts to real-world situations, demanding attention to detail and a clear understanding of various financial principles.

In this section, we will delve into practical approaches for tackling these challenges, providing insights into common pitfalls and offering expert tips to ensure thorough preparation. Whether you’re approaching this for the first time or refining your skills, the focus is on equipping you with the tools needed for confident decision-making and effective problem-solving in a variety of situations.

Tax Preparation Scenario Solution Guide

In the world of financial consulting, professionals often face a range of scenarios requiring detailed analysis and accurate application of tax regulations. The challenge is to assess each situation individually, determining the most efficient solutions based on current guidelines and practices. Understanding the intricacies of these tasks ensures successful outcomes and satisfied clients.

Understanding the Task at Hand

When preparing for a tax-related challenge, the key is breaking down the problem into manageable parts. This involves identifying all relevant factors, such as income sources, deductions, and credits, and applying the appropriate rules to ensure compliance with current tax laws. It’s essential to approach each case methodically and ensure that every detail is accounted for.

Common Approaches to Solution Development

Solving complex tax scenarios typically involves several steps, including gathering necessary documentation, analyzing the client’s financial status, and applying the correct tax framework. By systematically organizing the information, professionals can identify the most suitable actions and ensure that their solutions are both accurate and efficient.

| Step | Description |

|---|---|

| 1. Information Gathering | Collect all relevant documents and financial data from the client to understand the full scope of their situation. |

| 2. Problem Breakdown | Identify key factors such as income types, deductions, and applicable tax laws to determine the approach. |

| 3. Solution Development | Apply the necessary rules and frameworks to develop a comprehensive solution for the client. |

| 4. Final Review | Double-check calculations and ensure all aspects of the solution are correct and meet legal requirements. |

By following a structured approach, professionals can confidently tackle even the most complicated tax-related scenarios, ensuring accurate and effective solutions for their clients. Each step plays a vital role in achieving the desired outcome, making it crucial to stay organized and detail-oriented throughout the process.

Overview of Tax Preparation Challenge

In the realm of financial consulting, professionals frequently encounter complex scenarios where tax regulations and procedures must be applied to diverse situations. These scenarios test an individual’s ability to interpret financial data accurately, make informed decisions, and provide tailored solutions to clients. The goal is to navigate through these challenges efficiently, ensuring compliance with the latest standards while maximizing benefits for those involved.

Key Aspects of the Task

When faced with these types of scenarios, several key factors must be considered to determine the most effective course of action. A thorough understanding of the relevant tax laws, combined with a structured approach to problem-solving, ensures the best possible outcome. Some critical elements to evaluate include:

- Financial situation analysis

- Identification of eligible deductions and credits

- Application of tax rules and regulations

- Optimization of outcomes for the client

Approach to Solving Complex Tax Issues

Professionals handling such challenges follow a systematic approach to ensure accuracy and compliance. This approach typically includes:

- Collecting and verifying all financial data from the client

- Assessing potential deductions, credits, and income sources

- Applying relevant tax codes and guidelines to the scenario

- Finalizing the solution through thorough review and adjustment

By following these steps, professionals can effectively navigate intricate tax scenarios and provide clients with the most efficient and compliant solutions. Each step plays a crucial role in ensuring that all aspects of the financial situation are addressed properly.

Key Concepts to Understand for Success

To effectively tackle complex financial scenarios, it is crucial to grasp several fundamental concepts that guide decision-making and ensure accurate solutions. A deep understanding of these core principles allows professionals to navigate through challenges with confidence and precision. Mastering these concepts is essential for both applying theoretical knowledge and making practical decisions in real-world situations.

Among the most important areas to focus on are tax regulations, financial analysis, and optimization strategies. A solid grasp of each will enable individuals to assess situations comprehensively, identify potential issues, and apply the most suitable solutions. Below are key concepts that play a pivotal role in ensuring success:

| Concept | Description |

|---|---|

| Tax Laws and Regulations | Understanding the rules and frameworks that govern tax calculations and client eligibility for various deductions and credits. |

| Financial Analysis | The process of examining financial data to identify trends, assess performance, and make informed decisions based on the client’s situation. |

| Optimization Strategies | Techniques used to maximize tax benefits, reduce liabilities, and ensure compliance with current laws while achieving the best results for clients. |

| Risk Management | Identifying potential financial risks and understanding how to mitigate them while ensuring tax strategies remain effective and legal. |

By focusing on these core concepts, professionals can ensure they are well-equipped to handle complex situations and deliver accurate, efficient solutions. A deep understanding of these areas will lay the foundation for success in tackling any financial challenge that arises.

Preparation Tips for Tax Assessment Success

Successfully navigating a comprehensive financial assessment requires careful preparation, thorough understanding of relevant principles, and the ability to apply knowledge under pressure. Effective preparation involves both mastering the key concepts and developing a strategy to approach complex scenarios efficiently. By focusing on the right areas and staying organized, you can greatly improve your chances of achieving a strong result.

Key Areas to Focus On

To perform well in the assessment, prioritize the following areas:

- Understanding of tax rules and regulations

- Familiarity with financial documents and data interpretation

- Efficient problem-solving techniques and time management

- Practice with real-life scenarios to apply theoretical knowledge

Effective Study Techniques

When preparing for an assessment, incorporating the following study strategies can improve retention and performance:

- Review past examples and practice exercises regularly

- Focus on understanding principles rather than memorizing details

- Use time limits during practice sessions to simulate real conditions

- Form study groups to discuss complex scenarios and clarify doubts

By concentrating on these key aspects, you will not only be well-prepared but also confident in your ability to handle the challenges presented. Careful planning and consistent effort are the keys to achieving success in a tax-related assessment.

Understanding the Tax Filing Process

Accurately preparing and submitting tax returns involves a systematic process that ensures compliance with tax laws and maximizes the benefits available to individuals and businesses. This process requires a thorough understanding of financial records, deductions, credits, and the applicable tax codes. By following the right steps and staying organized, tax professionals can help clients navigate through the complexities of filing.

Steps to Successfully File Taxes

To ensure a smooth and error-free filing, several critical steps must be followed:

- Gathering all relevant financial documents such as income statements, expense receipts, and records of previous filings.

- Reviewing the applicable tax regulations to determine eligible deductions, credits, and other adjustments.

- Accurately completing the necessary forms based on the client’s financial situation.

- Submitting the completed tax return to the appropriate tax authority within the required time frame.

Common Pitfalls to Avoid

While the process may seem straightforward, there are common mistakes that can lead to issues during the filing process:

- Overlooking potential deductions or credits that could reduce tax liability.

- Errors in data entry, such as incorrect income figures or missed tax information.

- Failure to submit necessary supporting documents, which can delay processing or result in penalties.

- Not adhering to deadlines, which can lead to late fees and interest charges.

By understanding these steps and being aware of potential pitfalls, tax professionals can ensure accurate and timely filings that meet all legal requirements and optimize financial outcomes for their clients.

Common Challenges in Tax Cases

When navigating through financial situations, tax professionals often encounter several obstacles that can complicate the preparation and filing process. These challenges can arise from various factors, including incomplete documentation, misinterpretation of laws, or unexpected changes in tax regulations. Addressing these issues effectively requires a combination of expertise, attention to detail, and problem-solving skills.

Some common difficulties encountered in tax-related matters include the following:

- Missing or Inaccurate Documentation: Incomplete or incorrect financial records can hinder the process of preparing accurate returns, leading to errors or delays.

- Complex Tax Laws: The constant evolution of tax laws and regulations makes it challenging to stay up to date, which can lead to confusion or mistakes in applying the correct rules.

- Eligibility for Deductions and Credits: Determining which deductions or credits a client qualifies for can be a complex task, especially when dealing with unique financial situations.

- Unforeseen Audits or Inquiries: Sometimes, tax authorities may flag certain returns for audits or further investigation, which can delay the filing process and cause stress for both clients and professionals.

- Incorrect Filing Deadlines: Missing key deadlines or submitting incomplete returns can lead to penalties or additional fees for clients, adding pressure to the preparation process.

Understanding these challenges and implementing strategies to address them proactively can ensure a smoother tax filing process. Tax professionals must be well-prepared to adapt to changing circumstances, resolve discrepancies, and provide accurate solutions to clients in a timely manner.

Breaking Down the Assessment Structure

Understanding the structure of a comprehensive evaluation is essential for efficient preparation and successful performance. By familiarizing yourself with the components and expectations of the assessment, you can better strategize your study plan and focus on key areas that require attention. Each section of the evaluation serves to test specific skills and knowledge, so knowing what to expect allows you to approach each part with confidence.

The assessment typically consists of multiple sections designed to assess different aspects of financial knowledge and problem-solving abilities. These sections may include practical tasks, theoretical questions, and scenario-based challenges, all of which require careful analysis and application of key principles.

Each segment of the assessment is carefully structured to evaluate proficiency in various areas, including:

- Comprehension of tax laws and regulations

- Ability to interpret and analyze financial data

- Practical application of strategies to solve real-world tax challenges

- Attention to detail in ensuring compliance with relevant guidelines

By breaking down the structure in advance, you can prioritize your studies, practice specific tasks, and develop a thorough understanding of what is expected from each part of the assessment. This approach will help ensure a smoother experience when it’s time to complete the evaluation.

Essential Skills for Solving Case Studies

To effectively solve complex scenarios in professional assessments, it is crucial to develop a set of core skills that allow you to analyze information, think critically, and apply theoretical knowledge to real-world situations. These skills not only help in providing accurate solutions but also enhance the ability to identify key issues and suggest practical approaches for resolution.

Key Analytical Skills

Strong analytical skills are essential for breaking down complex problems and understanding the various factors at play. Key abilities include:

- Critical Thinking: The ability to assess situations logically and consider multiple perspectives before drawing conclusions.

- Problem Solving: Identifying the root causes of issues and proposing effective solutions based on available information.

- Attention to Detail: Carefully reviewing all data, ensuring accuracy and avoiding common errors that could lead to incorrect conclusions.

Practical Application of Knowledge

Equally important is the ability to apply theoretical knowledge to practical scenarios. These skills enable you to translate abstract principles into actionable steps:

- Real-World Application: Using knowledge of laws, regulations, and financial principles to develop feasible strategies in practice.

- Adaptability: The ability to adjust your approach when new information emerges or when faced with unexpected challenges.

- Communication: Effectively conveying your findings, reasoning, and solutions to stakeholders or clients in a clear and concise manner.

By mastering these essential skills, professionals are better equipped to tackle any complex scenario and provide well-rounded, effective solutions. These abilities are fundamental to success in assessments and real-world applications alike.

How to Approach the Test

Successfully completing a challenging assessment requires a well-thought-out approach that emphasizes preparation, time management, and a strategic method for tackling different types of questions. Understanding the structure of the test and anticipating the areas where you may need to apply your knowledge is essential for navigating the process efficiently. With the right mindset and techniques, you can ensure that you’re fully prepared and able to perform at your best.

Preparation Tips

Before the assessment begins, it’s important to thoroughly review all relevant materials and key concepts. Here are some strategies for preparing:

- Understand the Requirements: Familiarize yourself with the topics and types of questions that will be covered. Know what to expect and focus on the areas where you feel less confident.

- Practice Real-World Scenarios: Engage with practical examples or simulations that reflect the challenges you might face in the test. This will help you apply theoretical knowledge to real-life situations.

- Review Key Guidelines: Study any tax-related rules or financial regulations that may be tested, ensuring you understand how to apply them in various contexts.

During the Test

Once the test begins, manage your time effectively and remain calm. Here are some strategies for navigating the test:

- Read Carefully: Make sure you understand each question before answering. Take your time to avoid misinterpretation.

- Organize Your Responses: Structure your answers logically, especially for complex problems, breaking them down step by step to make your thought process clear.

- Stay Focused: Avoid rushing. If you encounter a difficult question, move on and return to it later to ensure you complete the test within the time limits.

By following these preparation and test-taking strategies, you will be well-equipped to approach the assessment with confidence and maximize your performance.

Common Mistakes to Avoid in Assessments

In any evaluation, small mistakes can significantly impact your performance. Being aware of common pitfalls and knowing how to avoid them is crucial to achieving success. Many errors stem from misinterpretation, poor time management, or overlooking important details. By understanding these common mistakes, you can prepare yourself to approach the assessment more effectively and minimize the risk of errors.

Here are some common mistakes that candidates often make and tips on how to avoid them:

- Skipping Instructions: Not reading the instructions carefully can lead to misunderstandings about what is expected. Always take the time to read all instructions thoroughly before starting each section.

- Mismanaging Time: Poor time management can result in rushing through difficult questions or leaving them incomplete. Allocate time for each section and keep track of it throughout the test.

- Overlooking Key Details: Sometimes, the smallest details can make the biggest difference in your answers. Pay close attention to every piece of information provided in the questions, as even seemingly minor points can affect the outcome.

- Guessing Without Reasoning: While it might seem tempting to guess when unsure, always try to use logic and reasoning before providing an answer. Random guesses can lead to incorrect solutions.

- Not Reviewing Your Work: Failing to review your answers can result in missed mistakes or overlooked opportunities to improve your responses. Make sure to leave time at the end to double-check your work.

Avoiding these mistakes will not only help you perform better but also build your confidence during the assessment. Preparation and focus are key to navigating any challenge successfully.

Practical Examples from Previous Scenarios

Real-world examples play a significant role in understanding the complexities of problem-solving in assessments. Reviewing past instances allows candidates to see how theoretical concepts are applied in practical settings, offering insight into how different challenges are tackled. These examples not only enhance understanding but also prepare you for similar situations that may arise in the future.

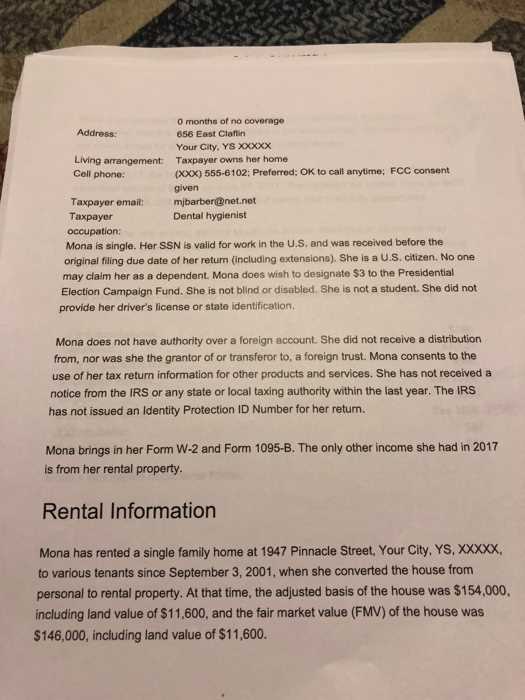

Example 1: Tax Calculation for Individuals

In one example from a previous scenario, individuals were tasked with calculating their total taxable income based on various income sources, including salary, investments, and deductions. The key challenge here was determining which deductions applied under current regulations, as tax laws frequently change. By carefully reviewing the applicable rules and applying them methodically, the issue was resolved, leading to an accurate calculation.

Example 2: Identifying Financial Discrepancies

Another practical example involved identifying discrepancies in a business’s financial reports. The challenge was to spot inconsistencies between reported income and expenses, which required a deep understanding of accounting principles. After a detailed review of the documents, including cross-checking income statements and balance sheets, the discrepancies were identified, and corrective actions were taken to ensure compliance.

These examples demonstrate the importance of applying learned knowledge to practical situations. Reviewing past scenarios helps sharpen your problem-solving skills and prepares you for similar challenges in your own assessments or professional tasks.

Exploring Common Tax Issues in 2025

As tax regulations evolve year after year, new challenges arise for both individuals and businesses. Understanding the common issues faced in the current tax year is crucial for accurate filing and compliance. With shifting rules, it’s essential to stay informed about the key concerns that may impact financial planning and reporting.

Key Issues to Watch in 2025

Several tax concerns are particularly relevant for 2025, ranging from updated deductions and credits to changes in reporting requirements. Below is a table that outlines some of the most common issues and potential solutions for taxpayers this year:

| Issue | Description | Suggested Actions |

|---|---|---|

| Changing Tax Brackets | New tax brackets can affect your overall liability, making it essential to calculate taxes accurately. | Review your income and expenses regularly to adjust withholdings and plan for any changes. |

| Impact of New Deductions | Increased standard deductions may reduce the need for itemizing, but understanding eligibility is crucial. | Consult with a professional to ensure you’re taking advantage of all available deductions. |

| Remote Work Taxation | The rise of remote work has introduced complications in state and local tax rules. | Ensure you’re aware of where you are considered a tax resident and adjust accordingly. |

| Cryptocurrency Reporting | Tax authorities are placing more focus on cryptocurrency transactions, making accurate reporting crucial. | Keep detailed records of all crypto transactions and seek advice on proper reporting methods. |

Addressing the Challenges

To navigate these issues successfully, it’s essential to stay updated on any changes in the tax code. Proactive planning and timely consultations with tax experts can ensure that you avoid common pitfalls and take full advantage of available opportunities. By addressing these challenges head-on, you can mitigate risks and optimize your tax strategy for the year ahead.

Role of Technology in Tax Solutions

As the financial landscape becomes increasingly complex, technology plays a pivotal role in streamlining and improving tax-related processes. From automated filing systems to advanced software that can calculate tax obligations, technological innovations have revolutionized the way individuals and businesses approach tax planning and compliance.

The integration of digital tools in tax preparation offers enhanced accuracy, efficiency, and accessibility. Advanced algorithms and artificial intelligence now assist in detecting errors, optimizing deductions, and ensuring that filings adhere to the latest regulations. These tools can analyze vast amounts of financial data and offer tailored recommendations that reduce human error and minimize the risk of audits.

Additionally, technology has made it easier to access real-time tax information and communicate with professionals remotely. Cloud-based systems allow for secure document sharing, enabling users to track their tax status and make adjustments as needed. This level of connectivity has become essential in a time when both individuals and businesses must navigate frequently changing tax laws.

Overall, technology has transformed the tax landscape by offering solutions that are faster, more accurate, and more accessible. With these advancements, both taxpayers and professionals can streamline the tax process, minimize stress, and improve their financial outcomes.

Steps to Analyze Tax Scenarios Effectively

Analyzing financial situations related to taxation requires a structured approach to ensure that all aspects are considered and accurate decisions are made. Whether it’s for an individual or a business, the process involves understanding the various components of the scenario, including income, expenses, deductions, and applicable tax laws. A systematic approach helps identify opportunities for optimization and areas of potential concern.

The following steps outline a clear process for analyzing tax situations effectively:

- Gather Relevant Financial Information: Collect all necessary financial data, including income statements, expense records, and previous tax filings. This foundation provides the basis for accurate analysis.

- Identify Taxable Events: Determine which financial transactions or activities are taxable, such as wages, investments, or business profits. Understanding these helps establish the scope of the analysis.

- Review Applicable Deductions and Credits: Identify potential deductions or tax credits that may reduce the taxable amount. These could include deductions for medical expenses, mortgage interest, or educational credits.

- Evaluate Tax Implications: Assess how the tax laws and rates apply to the specific scenario. This includes considering federal, state, and local tax rates, as well as any special tax rules that may be relevant.

- Calculate Potential Outcomes: Use tax software or manual calculations to estimate the tax liability or refund. This step should include comparisons of different approaches, such as standard versus itemized deductions.

- Review for Errors or Missing Information: Double-check all inputs for accuracy. Small mistakes in data entry can lead to significant discrepancies in tax filings.

- Make Informed Recommendations: Based on the analysis, provide suggestions for reducing tax burdens or maximizing tax efficiency. This could involve adjusting withholding, making tax-deductible contributions, or optimizing business expenses.

By following these steps, individuals and businesses can effectively navigate the complexities of tax scenarios and ensure that their decisions are informed and accurate. This approach minimizes the risk of errors, ensures compliance, and often results in significant financial benefits.

Importance of Attention to Detail

In the world of financial analysis and tax preparation, the ability to focus on the smallest details can make a significant difference in achieving accurate results. Often, it is the finer points of a scenario–such as overlooked deductions, misclassified expenses, or incorrect data–that lead to costly mistakes or missed opportunities. Paying careful attention to every aspect ensures that all relevant information is considered and helps avoid errors that could affect the overall outcome.

Why Precision Matters

When working with financial data, the smallest oversight can have large repercussions. These errors can result in inaccurate tax calculations, missed savings, or even legal consequences. Attention to detail is essential to ensure compliance and maximize the potential benefits available. Some of the key reasons why precision is critical include:

- Accurate Tax Reporting: Ensuring that all deductions, credits, and income are properly accounted for minimizes the risk of errors that could lead to penalties.

- Optimizing Financial Outcomes: By reviewing every detail carefully, individuals and businesses can uncover hidden opportunities for tax savings or financial improvements.

- Maintaining Credibility: Mistakes, especially those that are easily avoidable, can harm one’s reputation. Accuracy is key to maintaining trust with clients, regulators, and auditors.

- Compliance with Tax Laws: Failing to follow tax laws precisely could lead to costly legal issues. By focusing on every detail, tax obligations can be met correctly.

How to Improve Attention to Detail

Improving one’s ability to pay attention to detail can be achieved through both mindset and practice. It requires being thorough and methodical, as well as utilizing tools and techniques to ensure nothing is overlooked:

- Organize Your Work: Break down tasks into manageable steps and tackle them one at a time. Organization helps reduce the chance of overlooking important elements.

- Double-Check Your Calculations: Always recheck figures and entries to ensure accuracy before finalizing any reports or submissions.

- Use Technology: Take advantage of tax software or tools designed to catch common mistakes, flag inconsistencies, and provide reminders.

- Stay Focused: Avoid distractions that can compromise your ability to catch important details. A quiet, focused environment leads to better results.

- Ask for Feedback: Have a colleague or expert review your work. A fresh set of eyes may spot issues you might have missed.

Mastering the art of attention to detail is a key skill for anyone involved in tax-related fields or financial analysis. It leads to greater accuracy, higher quality of work, and ultimately, better financial outcomes.

Effective Time Management for Exam Day

On the day of an important evaluation, the ability to manage time efficiently is crucial for maximizing performance. Effective time management ensures that you can tackle all tasks without feeling rushed or overwhelmed. The goal is to allocate time wisely, prioritize key areas, and approach each section with focus and clarity. By using a structured plan, you can reduce stress and optimize your chances of success.

Preparation Before the Day

Time management doesn’t start on the day of the test itself. It begins in the days or weeks leading up to it. Proper preparation ensures that you enter the evaluation well-organized and ready to perform:

- Set Clear Goals: Identify the key topics or areas that need attention and prioritize them. Break down complex material into manageable chunks.

- Create a Study Schedule: Plan out your study sessions in advance. Allocate enough time for each topic and stick to the schedule.

- Practice Time-Bound Questions: Simulate exam conditions by practicing questions with a timer. This helps build familiarity with time constraints and boosts confidence.

- Prepare Your Materials: Organize all necessary materials, such as notes, calculators, or reference sheets, ahead of time to avoid scrambling on the day.

Time Management During the Evaluation

Once the test begins, the key to success lies in how you manage the time allocated for each task. Here are some strategies to stay on track:

- Read Instructions Carefully: Spend a few minutes at the start reading the instructions to ensure you understand the requirements of each section.

- Divide Your Time: Break down the total time available for each section. For example, if the test is divided into three parts, allocate a set number of minutes per part based on its difficulty and length.

- Start with Easy Tasks: Begin with the questions you find most straightforward. This can build momentum and boost confidence early on.

- Monitor the Clock: Regularly check the time to ensure you are not spending too long on any single question or section.

- Leave Time for Review: Save a few minutes at the end to review your answers. Double-check for any errors or missing information that could impact your score.

By managing your time effectively during the evaluation, you ensure that every part of the test receives the attention it deserves, helping to maximize your overall performance and minimize stress.

Using Available Resources During the Test

When faced with a challenging evaluation, knowing how to effectively use available tools and materials can make a significant difference in your performance. Resources such as notes, calculators, or reference materials can help clarify concepts and guide you through difficult questions. Understanding when and how to access these resources will allow you to stay focused and work more efficiently, ultimately improving your chances of success.

Identifying Useful Resources

Before diving into the task at hand, take a moment to identify all the resources at your disposal. These can include both physical and digital aids that are permitted during the evaluation:

- Reference Materials: This can include guides, charts, or textbooks that are available to assist you in answering complex questions.

- Online Tools: Some evaluations may allow access to specific online tools or calculators. Ensure you are familiar with how to use them effectively.

- Formula Sheets: If allowed, a pre-provided formula sheet can be a helpful resource for tackling technical problems.

- Notepaper or Scratch Pads: These tools are ideal for jotting down quick calculations, outlining answers, or organizing your thoughts as you work through problems.

Strategies for Effective Resource Use

Once you’ve identified the resources available to you, it’s important to use them strategically to maximize their benefits:

- Use Resources as a Safety Net: When unsure about an answer, check your notes or reference materials for guidance. Avoid relying on them too much, as this can slow you down.

- Stay Organized: Keep your resources organized for quick access. Avoid wasting time searching for a specific chart or section during the evaluation.

- Prioritize Key Resources: Focus on the most relevant resources first, such as formula sheets or key notes that can help solve problems quickly.

- Practice with Resources: Before the test, practice using the available materials in a timed environment to become accustomed to using them under pressure.

By efficiently utilizing the resources at your disposal, you can reduce uncertainty, save time, and increase your confidence while tackling the test. The key is to use them wisely, ensuring that they assist rather than hinder your progress.

Final Thoughts on Passing the Test

Successfully navigating any assessment requires a combination of preparation, strategy, and mindset. While the process may feel daunting at times, maintaining a clear focus and utilizing the right techniques can significantly improve your performance. In the end, the key to success lies in how well you manage your time, resources, and approach to each task.

Essential Tips for Success

As you prepare for the evaluation, consider these important strategies to enhance your chances of success:

- Stay Organized: Organize your materials and notes in a way that allows for quick access during the evaluation. Being able to locate information swiftly will save you valuable time.

- Time Management: Allocate time for each section of the assessment and stick to your schedule. Avoid spending too much time on any one question.

- Understand the Requirements: Be sure you understand what is being asked in each question. Clear comprehension of the task will prevent unnecessary mistakes.

- Don’t Rush: While managing your time is important, rushing through questions can lead to careless errors. Take your time, but stay mindful of the clock.

Maintaining a Positive Mindset

Your mental attitude plays a significant role in your ability to perform well. Stay calm and confident, even when faced with challenges. Keep the following in mind:

- Stay Calm: Stress can impair your judgment and slow your thinking. Practice relaxation techniques if you feel overwhelmed.

- Keep a Positive Outlook: Believe in your abilities and approach each question with confidence. A positive mindset can help you tackle even the toughest challenges.

- Learn from Mistakes: If you encounter a mistake, don’t dwell on it. Learn from it and move forward with the task at hand.

With the right preparation, strategies, and mindset, you’ll be well on your way to achieving success. Remember that each challenge is an opportunity for growth, and every step forward is progress towards mastering the material.