The first assessment in this course covers essential concepts that form the foundation of economic theory and its application. It tests your ability to understand key principles and analyze real-world situations through the lens of economic models.

To succeed, it’s crucial to familiarize yourself with fundamental ideas such as market behavior, resource allocation, and the role of governmental policies. Understanding these topics will not only help you during the test but also deepen your overall comprehension of the subject.

Effective preparation requires a strategic approach, from reviewing key terms to practicing problem-solving techniques. Prioritize mastering core concepts and familiarize yourself with typical question formats. This way, you’ll be better equipped to navigate through complex scenarios with confidence.

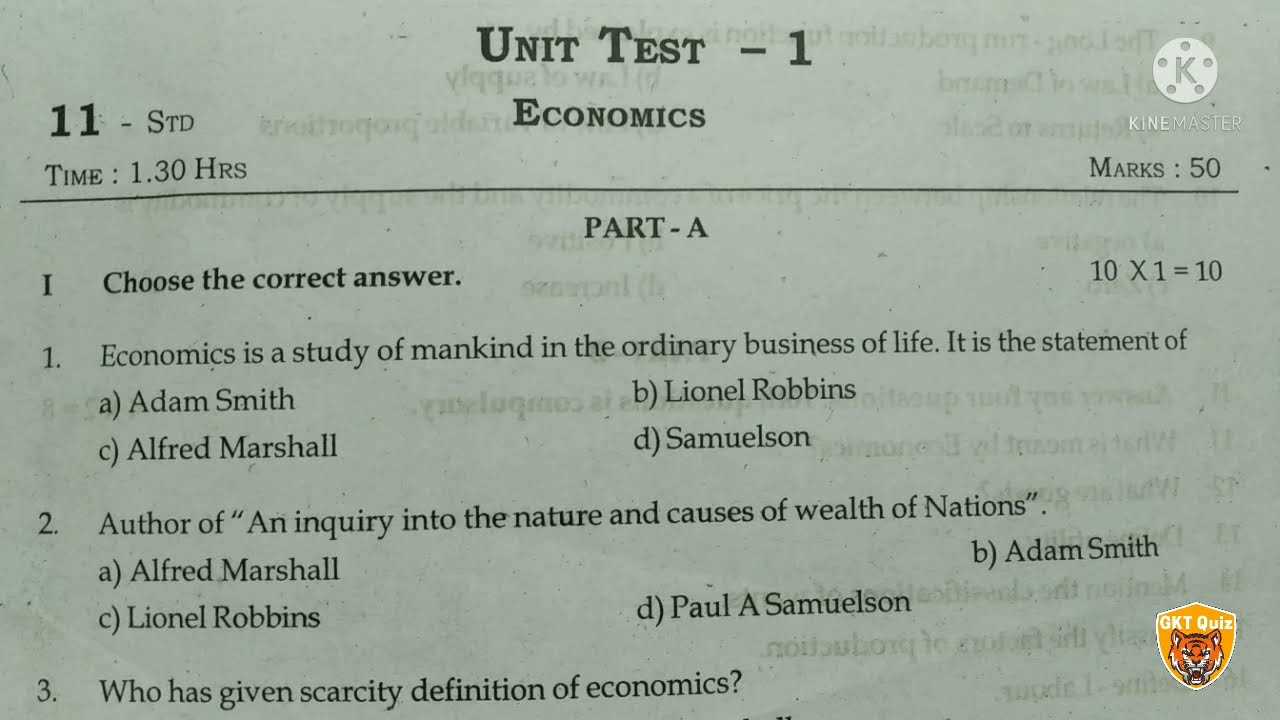

Economics Unit 1 Exam Overview

This section covers the fundamental concepts and principles essential for understanding how markets and economies function. It provides a comprehensive look at the core topics that form the basis of the subject, focusing on the application of theoretical knowledge in practical situations.

By mastering the key ideas, such as the behavior of consumers and producers, market dynamics, and the role of government intervention, you will gain a solid foundation for the rest of the course. The assessment tests your ability to analyze different scenarios, identify economic relationships, and apply learned concepts to real-world situations.

Preparation for this part of the course requires a balanced approach, with a focus on both theoretical understanding and practical problem-solving skills. Reviewing case studies and practicing application-based questions will significantly enhance your ability to perform well.

Key Concepts to Focus On

Understanding the fundamental principles of this subject is essential for success. Focusing on the core ideas will help you apply theoretical knowledge to practical situations, ensuring a solid grasp of the material. The key concepts form the building blocks for more advanced topics, making them crucial for overall comprehension.

Market Forces and Dynamics

The interaction between supply and demand is central to understanding how markets operate. Key concepts to study include:

- Supply and Demand: How changes in supply or demand affect prices and quantities in the market.

- Market Equilibrium: The point where supply and demand curves meet, determining the price and quantity of goods in the market.

- Elasticity: The responsiveness of quantity demanded or supplied to changes in price.

Government and Market Intervention

Another critical area is the role of government policies in influencing economic activities. Key points to review include:

- Price Controls: The impact of government-imposed price ceilings and floors on markets.

- Taxes and Subsidies: How taxation and subsidies can alter market behavior.

- Public Goods: Understanding the characteristics of goods that are non-rival and non-excludable.

Focusing on these concepts will provide a solid foundation for understanding more complex economic interactions and prepare you for future assessments.

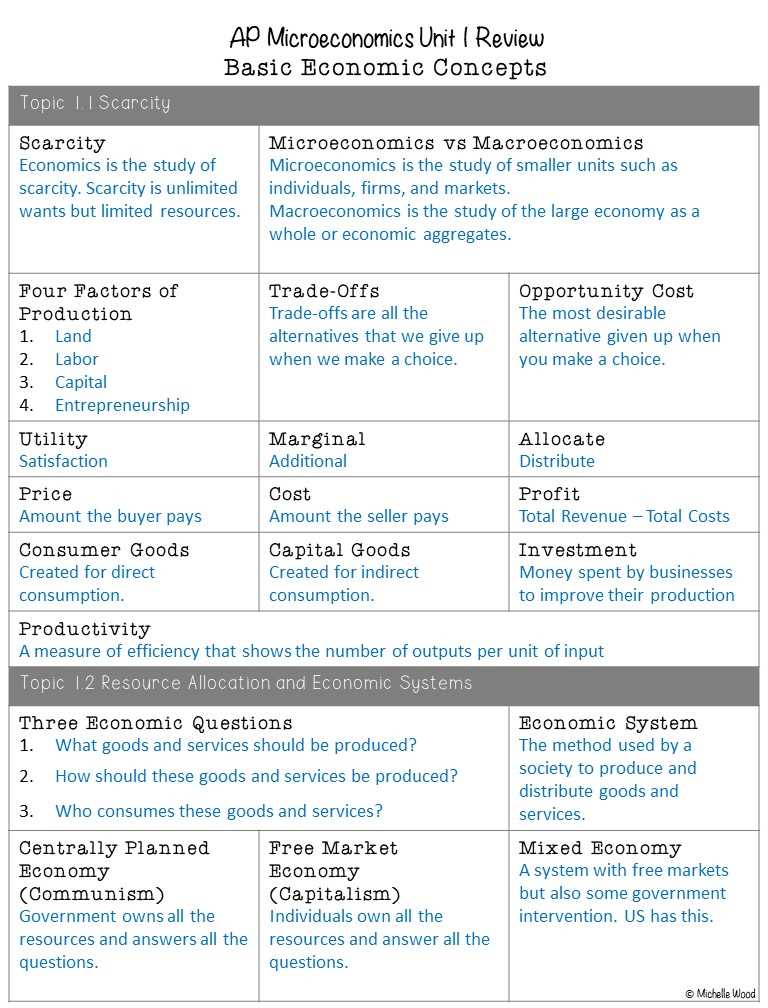

Understanding Economic Systems

Different societies organize their resources, production, and distribution of goods in various ways. The structure of these systems determines how decisions are made and how wealth is allocated. Understanding the types of systems helps clarify the relationships between individuals, businesses, and governments within an economy.

There are three primary systems that shape how economies function:

- Traditional Systems: Based on customs and traditions, where economic roles are often determined by ancestral practices and limited innovation.

- Command Systems: Here, the government makes most decisions regarding the production and distribution of goods and services. Resources are allocated centrally.

- Market Systems: In this system, decisions are largely made by individuals and businesses based on supply and demand forces, with minimal government interference.

Each system has its strengths and weaknesses, and often, countries use a mix of these models to address different economic challenges.

How Supply and Demand Impact Markets

The forces of supply and demand play a pivotal role in determining prices and the availability of goods and services. These fundamental concepts drive the decisions of producers and consumers, shaping how resources are allocated within a market. When either supply or demand changes, it has a ripple effect throughout the entire system.

Understanding how these two forces interact can help explain market fluctuations and price adjustments. Here are the key elements to focus on:

- Supply: Refers to the quantity of a good or service that producers are willing to offer at various price levels. As prices rise, producers are typically willing to supply more of the product.

- Demand: Represents the quantity of a good or service that consumers are willing to purchase at different price levels. As prices fall, demand generally increases.

- Market Equilibrium: The point where the quantity supplied equals the quantity demanded. At this price, there is no excess supply or demand, and the market is considered stable.

Changes in either supply or demand can lead to shifts in equilibrium, resulting in price changes. For example, an increase in demand with a constant supply will push prices higher, while an increase in supply with steady demand can lower prices.

Examining Elasticity in Economics

Elasticity is a crucial concept that helps measure how responsive the quantity demanded or supplied of a good is to changes in price or other economic factors. Understanding elasticity allows businesses and policymakers to predict the impact of price changes on overall market behavior, influencing decisions on production and pricing strategies.

Types of Elasticity

There are several types of elasticity to consider, each focusing on a different aspect of market behavior:

- Price Elasticity of Demand: Measures how sensitive the quantity demanded is to a change in price. If demand changes significantly with a small price change, the product is considered elastic.

- Price Elasticity of Supply: Indicates how the quantity supplied changes when the price of a good or service changes. Products with more flexible supply are considered elastic.

- Income Elasticity of Demand: Examines how demand changes with variations in consumer income. Products like luxury goods have a high income elasticity.

Factors Influencing Elasticity

Several factors influence the degree of elasticity in a market:

- Availability of Substitutes: If there are many alternatives to a product, demand tends to be more elastic, as consumers can easily switch to other options.

- Necessity vs. Luxury: Necessities tend to have inelastic demand because consumers continue to purchase them even at higher prices, whereas luxury goods are more elastic.

- Time Horizon: Over time, consumers and producers can adjust more easily to price changes, making demand and supply more elastic in the long term.

Understanding how elasticity works is essential for anticipating how changes in price or income will affect overall market outcomes and economic welfare.

The Role of Government in Economics

The government plays a critical role in shaping and regulating the functioning of the market by influencing the allocation of resources, maintaining economic stability, and ensuring fairness. Through various policies and interventions, the state aims to correct market failures, provide public goods, and address inequality within society.

Governments use a range of tools to intervene in the market, including taxation, subsidies, and regulation. These actions can impact both producers and consumers, helping to steer economic activity in desired directions. In some cases, government policies are designed to stimulate economic growth, while in others, they aim to reduce inflation or unemployment.

Some of the key functions of government involvement include:

- Regulation: Governments set rules to ensure that businesses operate fairly and that markets remain competitive. This includes enforcing antitrust laws and environmental standards.

- Redistribution of Wealth: Through taxation and social welfare programs, the government works to reduce economic disparities and provide a safety net for the most vulnerable populations.

- Provision of Public Goods: These goods, such as infrastructure, education, and healthcare, are essential for society but are not always efficiently provided by the private market.

- Stabilizing the Economy: Governments use fiscal and monetary policies to manage economic cycles, mitigating the effects of recessions and inflation.

Through these interventions, governments seek to balance economic efficiency with social equity, creating an environment that fosters both individual prosperity and collective well-being.

Market Structures and Their Characteristics

Market structures define the competitive environment in which businesses operate. These structures determine how firms interact with each other, how prices are set, and the level of innovation and efficiency in the market. Understanding the characteristics of different market types is essential for analyzing how resources are allocated and how consumers and producers make decisions.

There are several key market structures, each with unique features that influence the behavior of firms and consumers. The four main types are:

| Market Structure | Number of Firms | Type of Products | Market Power | Entry Barriers |

|---|---|---|---|---|

| Perfect Competition | Many | Identical | None | None |

| Monopolistic Competition | Many | Differentiated | Low | Low |

| Oligopoly | Few | Similar or Differentiated | Moderate | High |

| Monopoly | One | Unique | High | Very High |

Each market structure has distinct features that shape pricing strategies, the level of competition, and the overall efficiency of the market. For instance, in perfect competition, firms have no control over prices, while in a monopoly, the single firm has significant power over pricing. In oligopolies, firms often collaborate or compete based on strategic decisions, whereas in monopolistic competition, businesses differentiate their products to attract consumers.

Production, Costs, and Profit Maximization

In any business operation, the goal is to produce goods and services efficiently while minimizing costs and maximizing profits. This balance is essential for long-term sustainability and competitiveness. Understanding how production processes work, the relationship between costs and output, and the strategies for maximizing profit are key components of a firm’s decision-making process.

The process of production involves transforming inputs like labor, capital, and raw materials into finished goods. The way these inputs are combined affects both the efficiency and the cost structure of the business.

Costs can be categorized into various types, such as fixed costs, which remain constant regardless of the production level, and variable costs, which change in direct proportion to the amount of goods produced. Understanding these cost structures is vital for managing resources effectively and ensuring profitability.

Profit maximization occurs when a firm adjusts its production level to the point where the difference between total revenue and total cost is the highest. This involves finding the optimal balance between production costs and the price at which goods can be sold. Firms often use various strategies, such as:

- Economies of Scale: Reducing per-unit costs as production increases, allowing firms to lower prices or increase profit margins.

- Cost Reduction Techniques: Streamlining operations and improving productivity to reduce variable and fixed costs.

- Product Differentiation: Offering unique products or services that can command higher prices, leading to greater profit margins.

Ultimately, firms aim to find the production level at which their marginal cost equals marginal revenue, ensuring that every additional unit produced adds as much to revenue as it does to cost. This balance is the foundation of a firm’s long-term profitability and competitiveness in the market.

Monetary and Fiscal Policy Explained

Monetary and fiscal policies are tools used by governments and central banks to regulate economic activity, stabilize the economy, and achieve specific economic goals, such as controlling inflation and reducing unemployment. Both policies aim to influence the overall level of demand in the economy, but they operate through different mechanisms and agencies.

Monetary Policy

Monetary policy is primarily controlled by a country’s central bank and involves managing the supply of money and interest rates to influence economic conditions. The main objective of monetary policy is to maintain price stability, control inflation, and support economic growth.

- Interest Rates: By adjusting interest rates, the central bank can either encourage or discourage borrowing and spending. Lowering rates stimulates demand, while raising rates can help cool down an overheated economy.

- Open Market Operations: The central bank buys and sells government bonds to control the amount of money circulating in the economy. This impacts the money supply and helps achieve inflation targets.

- Reserve Requirements: Central banks may change the reserve requirements for commercial banks, affecting how much money they can lend and, in turn, influencing economic activity.

Fiscal Policy

Fiscal policy is managed by the government and involves adjusting public spending and taxation to influence the economy. The main goal is to either stimulate or contract economic activity, depending on the current economic situation.

- Government Spending: By increasing spending on infrastructure, education, or healthcare, the government can inject money into the economy, creating jobs and boosting demand.

- Taxation: Lowering taxes puts more money in the hands of consumers and businesses, increasing demand, while raising taxes can reduce spending and control inflation.

- Budget Deficits and Surpluses: Governments may run budget deficits (spending more than they earn) during economic downturns to stimulate growth or run surpluses to reduce public debt when the economy is strong.

Both monetary and fiscal policies play essential roles in shaping economic outcomes. While monetary policy is more focused on managing the money supply and interest rates, fiscal policy directly influences demand through government spending and taxation. Together, they form a powerful toolkit for managing economic stability.

Understanding Economic Growth and Development

Economic growth and development are two fundamental concepts that guide the progress of nations. While both terms are related, they focus on different aspects of an economy’s improvement. Growth generally refers to the increase in the production of goods and services, while development encompasses broader social, political, and environmental factors that contribute to the overall well-being of a society.

Growth is typically measured by the rise in a country’s output, often quantified by Gross Domestic Product (GDP). It indicates how much more a nation produces compared to previous periods, reflecting an increase in income, employment, and industrial capacity. However, growth alone does not capture the full picture, as it may occur without significant improvements in living standards or equality.

Development, on the other hand, focuses on enhancing quality of life. It involves improvements in healthcare, education, infrastructure, and income distribution. Sustainable development emphasizes long-term goals that improve both the economy and social conditions, such as poverty reduction, environmental sustainability, and access to basic services for all citizens.

While growth can occur rapidly, development is a more gradual process that often requires addressing deeper issues, such as inequality and access to resources. Achieving both growth and development requires effective policies and strategies that balance economic expansion with improvements in social and environmental well-being.

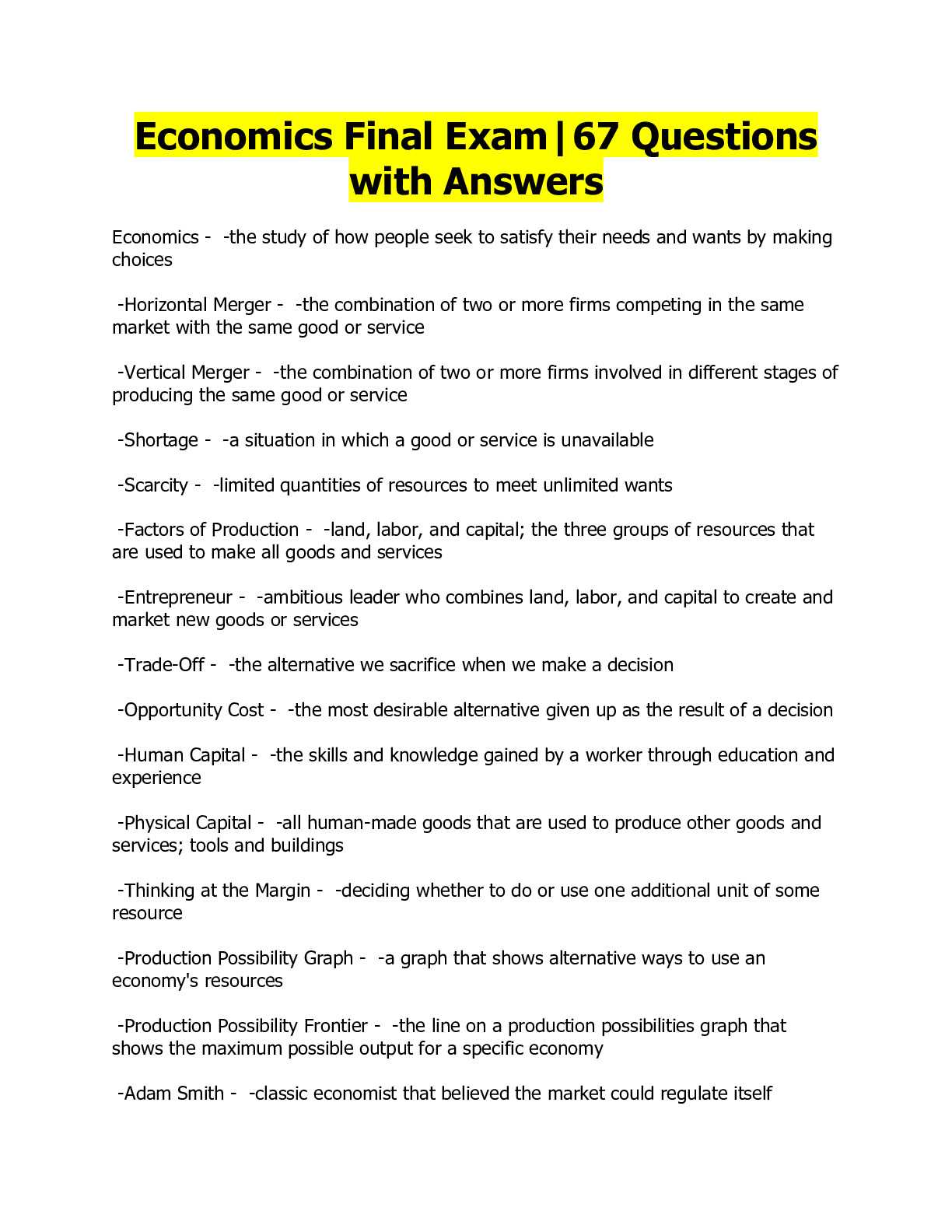

The Importance of Scarcity and Choices

Scarcity is a fundamental concept that shapes every economic decision. It arises from the fact that resources, such as time, money, and materials, are limited, while human desires and needs are virtually endless. This imbalance forces individuals, businesses, and governments to make choices about how best to allocate their limited resources.

When faced with scarcity, every decision comes with an opportunity cost, which is the value of the next best alternative that must be forgone in order to pursue a particular option. This concept highlights the need for prioritization, as each choice comes with trade-offs that must be carefully considered.

- Resource Allocation: Individuals and organizations must decide how to use their available resources efficiently, whether it’s spending time on work or leisure, or choosing between various investment opportunities.

- Opportunity Cost: The cost of choosing one option over another often involves sacrificing potential benefits. Understanding these trade-offs is crucial in making informed decisions that lead to better outcomes.

- Production Decisions: Producers face scarcity in their ability to create goods and services, forcing them to choose which products to make and at what quantity, based on demand and available resources.

Understanding scarcity and the choices it creates is vital for making decisions that optimize available resources. These principles not only apply to individuals but also to entire economies that must balance competing needs and wants in a world of limited resources.

Macroeconomics vs Microeconomics

In the study of economic systems, two broad fields examine different aspects of economic activity: the larger, overarching processes that affect the entire economy, and the smaller, more localized forces that influence individual markets and decisions. While both are intertwined, they focus on distinct areas and address different questions about resource allocation, production, and consumption.

Macroeconomics

Macroeconomics deals with the overall performance, structure, and behavior of an entire economy. It examines aggregated indicators, such as national income, unemployment rates, inflation, and economic growth, to understand how the economy operates on a large scale. Policymakers and central banks primarily use macroeconomic analysis to guide national economic policies and ensure stability in the broader economy.

Microeconomics

Microeconomics, on the other hand, focuses on the behavior of individual agents within the economy, such as households, firms, and industries. It analyzes the choices made by these entities and how they interact in specific markets. The study of supply and demand, market structures, and pricing mechanisms all fall under microeconomic theory. Microeconomic decisions ultimately aggregate into the broader outcomes analyzed in macroeconomics.

| Aspect | Macroeconomics | Microeconomics |

|---|---|---|

| Focus | Overall economy | Individual markets and decision-makers |

| Key Indicators | National income, inflation, unemployment | Price, demand, supply |

| Scope | Large-scale economic activity | Small-scale economic interactions |

| Policy Use | Government fiscal and monetary policy | Business strategy, pricing decisions |

Both macro and micro perspectives are essential for understanding how economies function. While macroeconomics provides insight into the bigger picture, microeconomics helps explain the behavior that drives those larger trends. Together, they form a comprehensive framework for analyzing economic systems and making informed decisions.

Key Economic Theories to Review

In the study of resource allocation and decision-making, various theories have been developed to explain how individuals, firms, and governments make choices within limited resources. These theories provide frameworks to understand the complex forces that drive markets, consumption, and production. Reviewing these fundamental ideas can help in analyzing how the world economy functions and how policies and decisions impact economic well-being.

Below are some of the key theories that serve as the foundation for understanding economic systems:

| Theory | Description |

|---|---|

| Supply and Demand | This theory explains how the price and quantity of goods and services are determined in a market. It emphasizes the interaction between the availability of products and the desire for them by consumers. |

| Classical Theory | The classical theory argues that markets operate best when left alone, with minimal government interference. It suggests that supply creates its own demand and that economies naturally move towards full employment. |

| Keynesian Theory | Keynesian economics focuses on the role of government intervention in managing economic cycles. It suggests that during recessions, increased government spending can help stimulate demand and reduce unemployment. |

| Monetarism | Monetarism emphasizes the role of money supply in determining economic stability. It argues that controlling inflation is primarily achieved by regulating the money supply, rather than through fiscal policy. |

| Behavioral Economics | Behavioral economics combines insights from psychology with traditional economic theory, exploring how cognitive biases and emotional factors affect decision-making and market outcomes. |

Each of these theories offers a different perspective on how economies function and the role of government in regulating them. By reviewing these concepts, one can better understand the underlying principles that guide economic decision-making and policy formation.

Exam Preparation: Time Management Tips

Effective time management is a crucial skill when preparing for any assessment. By organizing study sessions and allocating appropriate time for each task, students can enhance focus, reduce stress, and maximize performance. Planning ahead and sticking to a structured schedule is essential to ensure that all necessary material is covered before the test.

Create a Study Schedule

One of the most important steps in preparation is creating a detailed study plan. Break your study sessions into manageable blocks and assign specific topics or chapters to each block. This helps ensure that no subject is neglected and that you’re not overwhelmed by last-minute cramming.

Prioritize Your Tasks

Identify the areas that need the most attention and allocate extra time for these topics. Focus on the subjects that are more complex or carry more weight in the assessment. By addressing the hardest topics first, you can improve your confidence and ease your way into the rest of the material.

Utilize Breaks Effectively

Study for concentrated periods, followed by short breaks. This method helps maintain focus and prevents burnout. A typical approach is to study for 25-30 minutes, then take a 5-minute break to recharge. Longer breaks can be taken after every few study sessions.

Avoid Procrastination

Delaying your preparation can lead to unnecessary stress. Stay disciplined and avoid distractions such as social media or excessive entertainment. Dedicate your study time fully to the material at hand, and you will find that you accomplish more in less time.

By using these strategies, you can improve your study efficiency and approach the test with greater confidence and readiness.

Common Mistakes to Avoid in Assessments

When preparing for any assessment, avoiding common pitfalls can make a significant difference in performance. Many students unknowingly make mistakes during their preparation or while taking the test. Recognizing these errors early on can help improve focus and prevent unnecessary setbacks. Below are some common missteps to avoid in order to achieve a better outcome.

Rushing Through the Questions

One of the most frequent mistakes is rushing through the questions without fully reading or understanding them. It’s essential to take your time to ensure you comprehend what is being asked before attempting to answer. Hasty decisions often lead to mistakes that could easily have been avoided with a moment’s thought.

Not Managing Time Wisely

Improper time management is another common issue. Students may spend too much time on one question, leaving insufficient time for others. It is important to keep track of time throughout the test and allocate it appropriately to all sections, ensuring every question is addressed.

Overlooking Key Concepts

Failing to review important concepts before the test can hurt your performance. Make sure to go over the most critical topics, especially those that are most likely to appear in the assessment. This ensures that you are prepared for the majority of the questions and can answer them confidently.

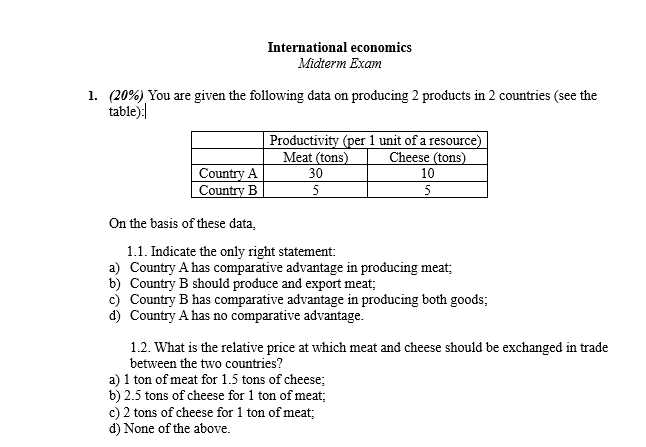

Misinterpreting Data or Graphs

Often, assessments include data or graphs that need to be analyzed and interpreted. Misreading or misinterpreting these visual elements can lead to incorrect answers. Always take extra care when examining charts or tables, ensuring that you fully understand the data before drawing conclusions.

Not Reviewing Your Answers

Once you’ve completed the test, it’s important to review your answers before submitting. This allows you to catch any mistakes you may have missed earlier. A final review ensures that all answers are as accurate as possible and gives you a chance to make any necessary adjustments.

By avoiding these common mistakes, you can improve your test-taking skills and approach assessments with greater confidence and effectiveness.

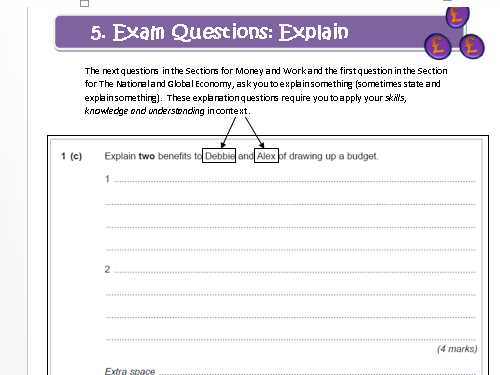

How to Analyze Assessment Questions Effectively

When facing a test, understanding the structure and intent behind each question is crucial for providing the most accurate and relevant answers. Effective analysis of the questions can guide your thought process, help you identify key points, and ensure you focus on the most important aspects. Here are several strategies to help you analyze assessment questions effectively.

Read the Question Carefully

The first step is to read each question thoroughly. Avoid skimming or rushing through it. Pay attention to specific wording, as small details can significantly change the meaning of a question. For example, words like “explain,” “describe,” “compare,” or “analyze” all require different approaches in your answer.

Identify Key Terms and Instructions

Look for key terms or phrases in the question that indicate what is being asked. Focus on verbs such as “define,” “discuss,” or “evaluate,” as these words provide clues on the format and depth of the answer. Understanding the instructions ensures that you don’t miss any essential components of the question.

Break Down Complex Questions

Some questions may be long or complex, containing multiple parts. In such cases, break the question into smaller, more manageable segments. Address each part separately to ensure that all aspects are answered correctly. This method helps avoid overlooking any critical elements and ensures a comprehensive response.

Consider the Context

Many questions are designed to test your understanding of specific concepts within a broader context. Take a moment to think about how the question relates to the course material. Reflect on the major topics or theories that might be relevant to the question. This can help you organize your thoughts and provide a more focused answer.

Formulate a Clear Plan

Before writing your answer, take a moment to outline your response. A clear plan will help you stay on track and ensure that you cover all necessary points. Consider the structure of your answer and how to present your ideas logically, with supporting evidence or examples where applicable.

By applying these techniques, you can approach each question with greater confidence and clarity, ultimately improving your performance during the assessment.

Using Practice Papers for Success

Practice papers are an essential tool for preparing effectively for any assessment. They provide an opportunity to familiarize yourself with the types of questions you may encounter, test your understanding, and improve your time management skills. By working through past questions and sample papers, you can pinpoint areas for improvement and build your confidence ahead of the actual assessment.

Benefits of Using Practice Papers

Practice papers simulate the actual assessment environment, helping you become more comfortable with the format and expectations. Here are some key advantages:

- Improved Understanding: Practice papers help you identify the most important concepts, topics, and skills that need to be mastered.

- Better Time Management: Working through these papers within a set time frame helps you improve your ability to manage time effectively during the real assessment.

- Confidence Boost: Completing practice papers successfully boosts confidence, reducing test anxiety.

- Identification of Weak Areas: By reviewing your responses, you can pinpoint any knowledge gaps or areas where you may need further study.

How to Use Practice Papers Effectively

Simply completing practice papers isn’t enough to guarantee success; how you use them is just as important. Follow these steps for maximum benefit:

- Start Early: Begin practicing well before the assessment date. This gives you enough time to review your answers and focus on areas that need improvement.

- Simulate Test Conditions: To get the full benefit, complete practice papers under timed conditions. Try to replicate the real test environment as closely as possible.

- Review Your Answers: After completing a practice paper, review your answers carefully. Look for mistakes or areas where you struggled, and focus on improving them.

- Seek Feedback: If possible, get feedback from a teacher or study group. This can help clarify any misunderstandings and ensure you’re on the right track.

- Track Your Progress: Keep track of your performance over time. As you complete more papers, compare your results to see how you’re improving.

By incorporating practice papers into your study routine, you can build familiarity, boost confidence, and increase your chances of success.

Final Revision Tips for Economics Unit 1

As the final days of preparation approach, it’s crucial to focus your efforts on refining your understanding and ensuring that you are ready for the assessment. This stage of revision is about consolidating knowledge, practicing application, and honing key strategies to maximize performance. Here are some practical tips to help you make the most of your last-minute review sessions.

Key Areas to Focus On

During the final revision phase, prioritize key areas that are most likely to appear in the assessment. Review essential concepts and try to connect them to real-world applications. Here’s a quick checklist:

| Topic | Focus Area |

|---|---|

| Supply and Demand | Understand the fundamentals of market forces and their impact on prices and quantity. |

| Market Structures | Review the characteristics and differences between perfect competition, monopolies, and oligopolies. |

| Government Intervention | Study the role of government in regulating markets, taxation, and subsidies. |

| Macroeconomic Indicators | Be familiar with GDP, inflation rates, and unemployment metrics and how they affect the economy. |

Effective Revision Strategies

In the final stretch, how you approach your revision matters just as much as what you revise. Here are some strategies to enhance the effectiveness of your last-minute preparations:

- Active Recall: Instead of passively reading notes, test your memory by trying to recall key concepts without looking at your notes. This will help reinforce your understanding.

- Practice Under Time Pressure: Set time limits for completing practice questions to simulate the actual conditions of the assessment.

- Teach Someone Else: Explaining concepts to others is a powerful way to reinforce your knowledge and identify gaps in your understanding.

- Review Mistakes: Look back at any mistakes you made during previous practice sessions and make sure you understand why you got them wrong.

- Stay Organized: Keep your revision materials neat and organized to avoid wasting time searching for information.

By focusing on key areas and using effective revision strategies, you can maximize your chances of success and enter the assessment feeling confident and prepared.