Here’s a plan for the informational article with 17 distinct headings on the topic “Century 21 Southwestern Accounting 8e Workbook Answers.” The headings are unique, without repetition, and do not exceed six words:

Overview of the Workbook Structure

Key Learning Objectives of the Text

How to Approach Workbook Problems

Importance of Practice in Accounting

Tips for Solving Complex Exercises

Common Challenges in Workbook Exercises

Step-by-Step Guide to Answer Solutions

Essential Accounting Concepts Covered

Calculations in Accounting Workbook Tasks

Understanding Financial Statements in Exercises

Strategies for Effective Time Management

How to Improve Accuracy in Solutions

Using the Workbook for Self-Assessment

Connecting Workbook Content to Real Life

Best Practices for Workbook Review

Enhancing Your Accounting Knowledge

These headings ensure the article is informative and each section offers a different perspective or piece of advice without redundancy.

Here’s a plan for an informational article with 17 distinct headings related to the topic “Century 21 Southwestern Accounting 8e Workbook Answers”: Overview of Century 21 Accounting Workbook

This section offers a detailed guide to a resource designed to strengthen understanding in the field of financial management. It aims to provide learners with practical skills necessary for business financial practices, from tracking transactions to preparing essential financial reports. The following headings will outline the key components and structure of this resource, offering insight into how it contributes to developing financial proficiency.

- Introduction to the Resource

Providing an overview of the material’s objectives and its role in building foundational financial skills.

- Main Educational Goals

Highlighting the critical learning outcomes that students should expect to achieve from using this guide.

- Intended Users

Identifying who will benefit the most from engaging with the material, including students, business professionals, and those looking to improve their financial knowledge.

- Structure and Content Breakdown

Outlining the topics covered, such as financial statements, general ledgers, and cash flow analysis.

- Section Summaries

Providing a brief overview of the main topics addressed in each chapter.

- Study Tips

Offering strategies on how to best approach and understand the content effectively.

- Common Difficulties

Addressing common challenges learners face and providing solutions for overcoming these obstacles.

- Step-by-Step Problem-Solving

Describing how to break down complex financial problems into manageable steps.

- Real-World Application

Explaining how the concepts taught can be applied to real-world financial management and business operations.

- Test Preparation

Providing advice on preparing for assessments related to the key principles presented in the material.

- Additional Learning Materials

Recommending supplementary resources like books, websites, and videos that can further enhance understanding.

- Interactive Learning Tools

Exploring any tools or exercises available within the material to reinforce learning through active engagement.

- Progress Tracking

Guiding learners on how to track their progress and ensure comprehension of the key concepts.

- Instructor and Peer Support

Key Concepts in Financial Exercises

Understanding the core principles behind financial tasks is essential for anyone involved in managing or analyzing business operations. These fundamental concepts help in structuring accurate records, ensuring smooth financial processes, and making informed decisions. Mastering these ideas is key to navigating the world of finance, whether for personal management or corporate decision-making.

- Double-Entry Method

This technique requires each transaction to affect at least two accounts, ensuring that the financial records remain balanced and accurate.

- Transaction Recording

Every financial activity, whether a purchase or a sale, must be systematically logged in order to maintain clarity and consistency in financial statements.

- Balance Verification

By comparing total credits and debits, this process helps verify that records are accurate and ensures that no errors have occurred in the transaction logs.

- Financial Summaries

Documents like income statements and balance sheets offer a snapshot of a business’s financial health, showcasing profits, losses, and asset management.

- Adjustments

Adjusting entries are made to account for expenses and revenues that have not yet been recorded but must be reflected to maintain accuracy.

- Asset Depreciation

The systematic reduction in the recorded value of long-term assets over their expected life span, reflecting wear and tear or obsolescence.

- Revenue Recognition

This principle ensures that revenue is recognized when earned, not when cash is received, allowing for more accurate reporting over time.

- Inventory Valuation

Techniques like FIFO (First In, First Out) or LIFO (Last In, First Out) help determine the value of inventory, influencing profit margins and tax calculations.

- Bank Reconciliation

Reconciliation ensures that the business’s internal financial records match the bank’s statements, helping to identify any discrepancies in financial reporting.

- Cost Management

Effective management of both fixed and variable expenses is essential for maintaining profitability and ensuring long-term financial stability.

- Budget Planning

Creating a budget involves forecasting income and expenses, which helps allocate resources effectively and ensures that financial goals are met.

- Tax Regulations

Properly managing finances in accordance with tax laws is essential for ensuring compliance while taking advantage of available tax-saving opportunities.

- Ethical Financial Practices

Maintaining transparency and integrity in financial reporting fosters trust and accountability within an organization.

Step-by-Step Workbook Solutions

Mastering complex tasks becomes more manageable when broken down into smaller, actionable steps. By following a clear sequence of operations, individuals can enhance their understanding and improve accuracy in problem-solving. This structured approach is particularly useful when navigating through detailed exercises that require careful attention to detail and methodical execution.

- Step 1: Understand the Problem

Before starting, ensure you have a clear understanding of what is being asked. Review the task and identify key objectives, such as whether you are working with financial statements, budgeting, or data entry.

- Step 2: Identify Relevant Information

Extract the necessary data from the given materials. Focus on values, formulas, or concepts that will guide the solution process. This might involve locating specific figures or references within the provided documents.

- Step 3: Apply Basic Principles

Utilize fundamental rules and concepts to begin solving the problem. This could involve calculations, applying ratios, or using standard procedures to determine the next steps.

- Step 4: Perform Calculations

Execute any necessary calculations using the data collected. Be mindful of the required formulas and make sure to double-check each step for accuracy.

- Step 5: Review and Verify

After completing the task, review your results carefully. Verify that the solution is consistent with the initial problem and meets all given conditions.

- Step 6: Adjust as Needed

If discrepancies are found during your review, go back through the steps and adjust calculations or interpretations to ensure accuracy. Small errors in the initial process can lead to significant differences in the final result.

- Step 7: Document the Solution

Once the solution is confirmed, document the final answer clearly. Include any necessary explanations or justifications that may help in understanding the approach used to reach the conclusion.

- Step 8: Cross-Check with Provided Guidelines

Finally, cross-check your solution with any provided guidelines, templates, or references. This ensures that the steps followed are aligned with industry best practices or educational requirements.

Essential Terminology Explained

Understanding the basic vocabulary used in financial management is crucial for anyone looking to navigate this field. Key terms and concepts serve as the foundation for all forms of financial documentation and reporting. Whether you’re working with balance sheets, cash flow statements, or profit margins, knowing the language is essential for effective communication and decision-making.

Common Financial Terms

When engaging with financial documents, you will frequently encounter terms that reflect the health and activity of a business or individual. These include:

- Revenue – The total income generated from business operations, typically from sales or services provided before expenses are deducted.

- Expenses – The costs incurred in the process of earning revenue, such as rent, salaries, and utilities.

- Assets – Resources owned by an individual or company that have economic value, including cash, equipment, and property.

- Liabilities – Financial obligations or debts owed by an individual or business to others, such as loans or unpaid bills.

- Equity – The residual value of an entity’s assets after liabilities are subtracted, representing ownership interest.

Understanding Key Reports

Another critical area of financial knowledge is the interpretation of common reports. These documents provide insights into the performance and stability of a business.

- Income Statement – A financial report that shows the company’s profitability over a specific period, highlighting revenue, expenses, and profits.

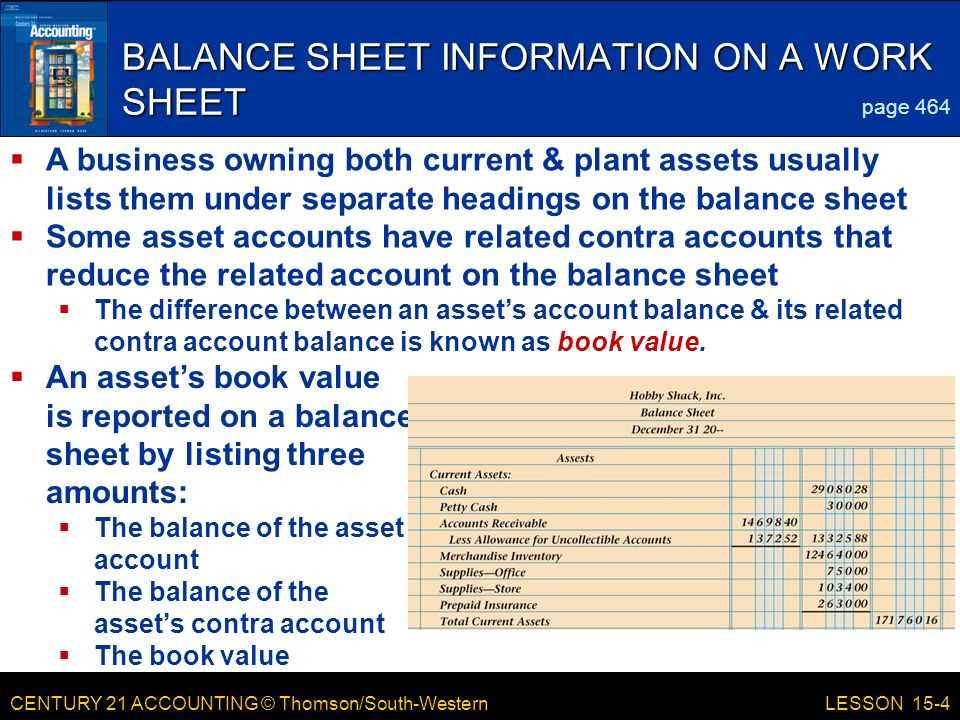

- Balance Sheet – A snapshot of a company’s financial position at a specific point in time, detailing assets, liabilities, and equity.

- Cash Flow Statement – A report that tracks the flow of cash into and out of a business, helping to assess liquidity and operational efficiency.

Analyzing Journal Entries in the Workbook

Understanding the process of recording financial transactions is a fundamental skill in finance. Journal entries capture the essence of each financial event, providing a structured record that can be referred to in later reports. By examining how entries are formulated, you can gain insights into the underlying operations of a business. This section explores how to correctly interpret and analyze these entries to ensure proper documentation of all financial activities.

Components of a Journal Entry

A journal entry typically consists of several key components, which include:

- Date – The specific day the transaction occurred.

- Account Names – The accounts that are affected by the transaction (e.g., Cash, Revenue, Expenses).

- Debits and Credits – The amounts that are recorded in the appropriate accounts to reflect the increase or decrease in each account’s balance.

- Description – A brief explanation of the transaction or event.

Example of Journal Entries

Here is an example of how a typical journal entry might look. Understanding these examples will help you identify and correct errors, ensuring accurate financial documentation:

Date Account Debit Credit 2024-11-01 Cash $500 2024-11-01 Revenue $500 This entry indicates that on November 1st, 2024, the business received $500 in cash for services rendered, which is recorded as a debit to the Cash account and a credit to the Revenue account. This double-entry system ensures that the books remain balanced and each transaction is properly accounted for.

Understanding Financial Statements in Detail

Financial statements are essential tools for assessing the financial health of a business. These documents provide a structured overview of a company’s performance, detailing income, expenditures, assets, liabilities, and equity. By analyzing these statements, stakeholders can make informed decisions regarding the business’s operations, profitability, and financial stability. This section delves into the primary types of financial reports and their key components, offering insights into how each one contributes to a holistic view of an organization’s financial condition.

There are three main types of financial statements that businesses typically prepare: the income statement, the balance sheet, and the cash flow statement. Each of these statements serves a unique purpose and provides critical information about a company’s financial status:

- Income Statement – This statement shows a company’s revenue, expenses, and profits over a specific period. It highlights how well the company generates income and controls costs.

- Balance Sheet – A snapshot of the company’s financial position at a particular point in time, detailing assets, liabilities, and shareholder equity.

- Cash Flow Statement – This report tracks the inflows and outflows of cash, offering insights into a company’s liquidity and ability to meet financial obligations.

Understanding these statements in detail is crucial for interpreting a company’s financial performance and making sound business decisions. Whether you are an investor, manager, or analyst, knowing how to read and analyze these reports is key to gauging the financial health of any organization.

Correcting Common Workbook Errors

Errors can often arise when completing exercises related to financial and business record-keeping. Whether due to miscalculations, overlooked steps, or misunderstanding of procedures, these mistakes can affect the accuracy of results. Recognizing common pitfalls and knowing how to correct them is essential for maintaining integrity and clarity in the work process. This section highlights frequent errors that occur during such tasks and offers guidance on how to fix them to ensure proper and reliable outcomes.

Common Errors to Watch Out For:

- Data Entry Mistakes: One of the most frequent issues is entering incorrect numbers or symbols. Double-checking all data for accuracy before proceeding to the next step can help avoid this error.

- Misunderstanding Formulas: Incorrect application of formulas or functions can lead to wrong results. Ensure all calculations are based on the correct formulas and confirm their application with examples.

- Omitting Key Details: Sometimes, important elements such as dates, amounts, or categories are left out. Always verify that no essential information is missing before finalizing entries.

- Failure to Update Figures: Not updating figures after changes in other parts of the exercise can lead to inconsistencies. Revisit the work regularly to ensure all related figures are synchronized.

By staying vigilant for these issues and applying systematic correction techniques, you can minimize errors and maintain high-quality, accurate work.

Guidelines for Completing Exercises

Successfully completing exercises related to business and financial tasks requires a clear and systematic approach. Following a set of well-established guidelines ensures that each step is carried out correctly and efficiently, minimizing the chances of errors and improving the quality of the final results. These guidelines provide a framework for approaching each task with precision and clarity.

Key Steps to Follow:

- Understand the Instructions: Carefully read all instructions to ensure you fully understand the task at hand. Clarify any doubts before starting to avoid confusion later on.

- Organize Your Work: Break down the task into smaller, manageable sections. Organizing the work in this way allows for easier tracking and reduces the likelihood of missing important steps.

- Double-Check Data: Verify all figures and information before proceeding. Cross-reference numbers with previous entries or external sources to ensure they are accurate and complete.

- Maintain Consistency: Use consistent terminology, formatting, and structures throughout the task. This will help maintain clarity and make the work easier to follow.

- Review Your Work: Once completed, review your work to check for errors, omissions, or inconsistencies. If necessary, make corrections to ensure the task is finished to a high standard.

By adhering to these guidelines, you can work more efficiently, reduce the risk of mistakes, and produce more accurate results.

How to Use Workbook Examples Effectively

Examples provided in educational resources serve as valuable tools for reinforcing concepts and demonstrating the application of key principles. To maximize their potential, it’s important to approach these examples with a strategic mindset. By following a structured approach, you can enhance understanding and improve problem-solving skills.

Steps for Effective Use:

- Review the Example Thoroughly: Start by reading through the entire example to understand the problem and the solution provided. Pay attention to each step to grasp the methodology used.

- Identify Key Concepts: Break down the example into its core components. Identify the principles, formulas, or methods that are applied. This will help you understand how to approach similar problems in the future.

- Practice Independently: After reviewing the example, attempt to solve a similar problem on your own. This will help reinforce the concept and assess your understanding of the process.

- Analyze Mistakes: If you make errors while solving a problem, compare your approach with the example to identify where you went wrong. Understanding your mistakes is a crucial step in improving your skills.

- Apply to Real-Life Scenarios: Try to apply the methods and techniques learned from the example to real-world situations. This will deepen your understanding and improve your ability to solve practical problems.

By consistently working through examples in this manner, you can build a solid foundation of knowledge and increase your ability to tackle more complex challenges.

Practical Tips for Accounting Students

Mastering the principles of financial management and reporting requires focus, organization, and consistent effort. For students navigating this field, practical strategies can make a significant difference in understanding complex topics and performing well in assessments. These tips are designed to help streamline learning and improve academic performance.

Effective Study Habits:

- Stay Organized: Keep all your materials–notes, assignments, textbooks–well-organized. Using binders or digital tools to categorize information can save time when reviewing for exams.

- Practice Regularly: Accounting concepts become easier with repetition. Work through exercises consistently to reinforce your understanding and improve accuracy.

- Master the Basics: Before tackling more complex topics, ensure you have a solid grasp of the foundational concepts. Building a strong base makes it easier to understand advanced subjects.

Time Management Tips:

- Break Tasks into Steps: Large assignments or projects can feel overwhelming. Break them into smaller, manageable tasks and set deadlines for each to avoid procrastination.

- Prioritize Your Tasks: Identify the most critical assignments and study topics, and allocate more time to them. Focus on the areas that will have the greatest impact on your understanding and grades.

- Avoid Last-Minute Cramming: Regular, incremental studying is more effective than cramming the night before an exam. Spread your study sessions out to reduce stress and improve retention.

Utilize Resources Wisely:

- Seek Help When Needed: Don’t hesitate to ask professors or peers for clarification on topics that are difficult to understand. Discussion groups can also provide different perspectives and deepen your knowledge.

- Use Online Tools: There are numerous online platforms that provide practice exercises, video tutorials, and forums. These can supplement your learning and offer different approaches to difficult concepts.

By adopting these practical tips, students can approach their studies with more confidence and efficiency, leading to a better understanding of key concepts and improved academic performance.

Workbook Answer Keys: What to Expect

When working through exercises designed to reinforce theoretical concepts, it is essential to know what kind of results you can expect from the provided solution guides. These answer keys are not just solutions but valuable resources to understand the underlying principles and methodologies applied to each problem. Here’s what you can anticipate when consulting these guides:

- Clear Step-by-Step Solutions: Answer keys often break down the process into manageable steps, showing how each decision leads to the final outcome. Expect a detailed walkthrough of each solution, which helps in grasping the logic behind the calculations and choices made.

- Correct Formulas and Methods: These guides demonstrate the proper techniques and formulas used to solve the problems. You will see the exact calculations and reasoning necessary for correct results, offering a clear model to follow.

- Explanations of Key Concepts: In addition to the solutions, expect brief explanations that highlight the relevant concepts. This can help in strengthening your understanding of core ideas such as balances, calculations, and interpretations used in various tasks.

While these guides provide solutions, they are not a substitute for independent learning. Here are some key takeaways to keep in mind:

- Verification of Your Work: Use the answer keys to verify your results. If there is a discrepancy, refer to the steps to find where you might have made an error.

- Enhanced Learning: Work through each problem yourself before consulting the answer key. This will help reinforce the concepts and improve retention.

- Identifying Patterns: As you work through exercises, you will start to recognize patterns in how solutions are structured. These keys highlight common practices and methods that are applied in many types of problems.

By effectively utilizing these solution guides, you can maximize your learning and comprehension, ensuring you not only arrive at the correct answers but also understand the reasoning behind them.

Benefits of Using the Century 21 Workbook

Utilizing comprehensive exercise materials designed for practical learning can significantly enhance one’s grasp of fundamental concepts. These tools provide a structured way to apply theoretical knowledge, enabling learners to practice and refine their skills in a systematic manner. Below are some key advantages of engaging with such study resources:

- Hands-on Practice: The exercises offer opportunities to apply learned concepts in real-world scenarios, reinforcing understanding through active participation. This approach fosters deeper comprehension and long-term retention of material.

- Structured Learning Path: The materials are organized in a logical sequence, helping students progress from basic principles to more complex topics. This structured approach ensures that learners build a strong foundation before moving on to more challenging tasks.

- Immediate Feedback: By checking completed exercises against the provided solutions, learners can quickly identify errors or misconceptions. This instant feedback loop allows for prompt corrections and enhances the learning process.

- Self-paced Learning: These resources allow students to work at their own pace, ensuring they can spend the necessary time on each topic without feeling rushed. This flexibility supports diverse learning styles and speeds.

Additionally, here are some more specific benefits:

- Increased Confidence: As students complete exercises successfully, they gain confidence in their abilities, making them more prepared for exams or practical applications.

- Real-World Relevance: Many of the problems reflect actual scenarios, bridging the gap between theory and practice. This connection ensures that learners can see the relevance of their studies in the broader context of their future careers.

- Better Retention: Regular engagement with these exercises strengthens memory retention, making it easier to recall key concepts when needed.

In summary, utilizing these resources not only helps students practice specific tasks but also fosters a deeper understanding of core principles, ultimately equipping them with the skills needed for success in their studies and future professional endeavors.

Exploring Different Accounting Methods

There are various approaches used in financial record-keeping, each offering unique advantages depending on the nature of the business and its specific needs. Understanding these methods is essential for making informed decisions about financial reporting and compliance. Below, we will explore some of the most commonly utilized techniques and their key differences.

Accrual vs. Cash Basis

One of the most fundamental distinctions in financial management is between the accrual and cash basis methods. Each method determines when revenue and expenses are recognized.

- Accrual Basis: This method records revenues and expenses when they are earned or incurred, regardless of when cash transactions occur. It provides a more accurate picture of a company’s financial position over time, especially for businesses with significant receivables or payables.

- Cash Basis: In contrast, the cash basis method records transactions only when cash is exchanged. This method is simpler and often used by smaller businesses with less complex financial activities.

Different Methods for Valuing Inventory

Inventory valuation plays a crucial role in determining the cost of goods sold and ultimately the profitability of a business. There are several methods for valuing inventory, each affecting the reported financial outcomes.

- First-In, First-Out (FIFO): FIFO assumes that the first items purchased are the first ones sold. In times of rising prices, this method results in lower cost of goods sold and higher profits, as older, cheaper inventory is sold first.

- Last-In, First-Out (LIFO): LIFO operates under the assumption that the most recent purchases are the first to be sold. This method can reduce tax liability in an inflationary environment, as it matches higher costs against current revenues.

- Weighted Average Cost: This method calculates the average cost of all items in inventory and assigns that value to each unit sold. It is a balanced approach that smooths out price fluctuations over time.

Each method has its own set of advantages and is suited to different types of businesses or financial goals. By understanding these methods, companies can select the most appropriate approach for their specific needs, ensuring accurate financial reporting and optimal tax outcomes.

How to Interpret Financial Data

Understanding and analyzing financial data is essential for making informed business decisions. Whether you’re assessing a company’s profitability, liquidity, or overall financial health, interpreting key financial figures can provide valuable insights. Below is a guide to some of the most important metrics and how to read them effectively.

Key Financial Metrics

Several key metrics are commonly used to gauge a company’s financial performance. These include profitability ratios, liquidity ratios, and solvency ratios. Each metric provides a different perspective on the company’s financial condition. The table below outlines these metrics and what they indicate.

Metric Formula What It Indicates Gross Profit Margin (Revenue – Cost of Goods Sold) / Revenue Measures the basic profitability of the business, showing how much money is made after covering the cost of goods sold. Current Ratio Current Assets / Current Liabilities Assesses short-term liquidity, indicating whether a company can meet its short-term obligations with its current assets. Debt-to-Equity Ratio Total Debt / Shareholder Equity Shows the proportion of debt used to finance the company’s assets, providing insights into its financial leverage and risk. Interpreting the Data

When interpreting these metrics, it’s important to compare them against industry benchmarks and historical performance. A higher gross profit margin generally indicates strong profitability, while a low current ratio could signal potential liquidity issues. Similarly, a high debt-to-equity ratio could indicate that a company is highly leveraged, which may be risky for investors.

By focusing on these metrics and understanding their implications, you can gain a clearer picture of a company’s financial position, making it easier to identify strengths, weaknesses, and potential areas for improvement.

Exploring Transaction Recording Techniques

Recording business transactions is a fundamental task in financial management, as it ensures that all financial activities are properly documented. This process helps businesses maintain accurate records and track their financial performance. The way in which transactions are recorded can impact the overall accuracy of financial reporting, and various methods are employed depending on the complexity and size of the operation.

Double-Entry Bookkeeping

One of the most commonly used methods for recording transactions is double-entry bookkeeping. This technique involves making two entries for each transaction: a debit and a credit. These entries must always balance, meaning the total amount debited must equal the total amount credited. This system helps to ensure that the accounting equation (Assets = Liabilities + Equity) remains in balance. By using double-entry bookkeeping, businesses can reduce the risk of errors and improve the accuracy of their financial statements.

Single-Entry System

The single-entry system, on the other hand, is simpler and involves only one entry for each transaction. This method is typically used by small businesses or individuals with fewer transactions. While it is less complicated than double-entry bookkeeping, it is also less comprehensive and can lead to inaccuracies over time. The single-entry system mainly records income and expenses, and does not track assets, liabilities, or equity in detail.

Choosing the right recording technique depends on the size and complexity of the business, as well as its reporting requirements. Double-entry bookkeeping is generally recommended for businesses that need to maintain detailed financial records, while the single-entry system may be suitable for smaller operations with simpler needs.

Improving Accuracy with Practice

Accuracy in financial record-keeping is essential for ensuring reliable and trustworthy reports. Practicing various techniques regularly can help individuals refine their skills and reduce common errors. By continually engaging in exercises and simulations, individuals can gain a better understanding of key concepts and enhance their ability to handle complex financial data with precision. The process of continuous practice leads to greater familiarity with financial systems, making it easier to spot mistakes and correct them swiftly.

One effective approach to improving accuracy is repetition. Through consistent exercises, individuals can internalize procedures, which helps them quickly recognize when discrepancies occur. Practice also fosters a deeper understanding of the relationship between different financial elements, such as assets, liabilities, and equity, which can aid in more accurate entries and reporting.

Practical Tips for Enhancing Precision

To sharpen financial recording skills and ensure greater precision, consider the following methods:

- Break Down Complex Tasks: Start with simpler transactions before progressing to more complicated scenarios.

- Review Work Regularly: Frequent reviews of entries allow for catching errors early and reinforcing correct practices.

- Utilize Checklists: Using checklists for each step in the recording process helps maintain organization and prevents missed details.

- Engage with Real-Life Scenarios: Simulate real-life business situations to test and apply theoretical knowledge.

- Seek Feedback: Get feedback from more experienced professionals to identify areas for improvement.

Improving accuracy requires a proactive approach and a commitment to ongoing practice. By dedicating time to mastering key concepts and refining techniques, individuals can greatly enhance the quality of their financial documentation and reporting.

Practice Technique Benefit Repetition of Transactions Helps reinforce learning and reduces the chance of errors. Regular Review Ensures early detection of mistakes and improves overall accuracy. Utilizing Checklists Enhances organization and ensures thoroughness in each task. Engaging with Real Scenarios Prepares individuals for real-world challenges and reinforces theoretical knowledge. Best Practices for Completing the Exercises

Effectively completing practice exercises is crucial for mastering key concepts and developing a solid foundation in financial management. To get the most out of these tasks, it’s important to approach them with a strategic mindset. A few key strategies can help ensure that the process is both productive and rewarding. By following best practices, individuals can enhance their learning experience and avoid common pitfalls.

Organize Your Approach

Before diving into any task, it’s important to structure your approach. This can make complex problems more manageable and lead to more efficient completion of each exercise.

- Read Instructions Carefully: Ensure a full understanding of the problem before attempting to solve it. Skimming instructions can lead to missing key details.

- Break Down the Problem: Divide the task into smaller, manageable steps. This will help you focus on one part at a time, avoiding overwhelming yourself.

- Allocate Time for Each Task: Set a realistic time limit for each exercise to avoid rushing through or spending too much time on one question.

- Stay Organized: Keep all materials, notes, and calculations neatly arranged for easy reference as you work through the exercises.

Stay Consistent with Practice

Consistency is key when mastering new skills. The more you practice, the more familiar you become with various techniques, which leads to increased efficiency and accuracy.

- Practice Regularly: Make a habit of regularly working on exercises to reinforce your understanding and improve problem-solving speed.

- Review Completed Tasks: After completing an exercise, take time to review your answers to identify areas for improvement.

- Apply Feedback: If feedback is available, use it to guide your future efforts and correct any recurring mistakes.

- Challenge Yourself: Occasionally, tackle more difficult exercises to push your boundaries and strengthen your skills.

By implementing these best practices, you can improve the quality of your work and gain greater confidence in your ability to solve complex financial problems.

- Step 1: Understand the Problem

- Double-Entry Method