Preparing for a professional qualification can be both exciting and challenging. A key part of the process is familiarizing yourself with the essential concepts and rules that will be tested. Understanding the structure and content of the assessment is crucial to ensure you are fully equipped for success. This section provides valuable insights into what to expect and how to approach the study process with confidence.

When tackling such an important evaluation, it’s essential to focus on areas that are commonly covered, such as specific policy details, regulations, and financial principles. Preparation is the key to reducing anxiety and improving your chances of passing. Through careful review and targeted practice, you can strengthen your understanding and enhance your performance.

In this guide, we’ll cover various strategies that can help you prepare effectively. We will focus on important topics, provide tips for managing your time during the test, and highlight the common pitfalls to avoid. By mastering these strategies, you will feel more prepared and confident as you approach the licensing challenge.

California Life Insurance Exam Overview

Passing the qualification test for a career in the financial services industry requires a thorough understanding of essential concepts. This evaluation assesses your knowledge of policies, rules, and regulatory requirements relevant to the profession. The purpose of the test is to ensure that all professionals are equipped with the expertise needed to advise clients accurately and manage their financial needs effectively.

The assessment covers a wide range of topics, including legal guidelines, contract terms, and financial strategies. You will be tested on your ability to interpret complex information and apply it in real-world scenarios. By gaining a solid foundation in these areas, you will be prepared to face questions related to the field’s standards and practices.

The format of the assessment is designed to challenge candidates on both their theoretical knowledge and practical application. A combination of multiple-choice and scenario-based questions ensures that test-takers can demonstrate a comprehensive understanding of the material. With proper preparation, you can approach the test confidently and increase your chances of success.

Key Concepts to Study for the Exam

To succeed in the qualification test for this field, it’s important to focus on the core areas that will be evaluated. Mastery of these fundamental topics will not only help you answer questions accurately but also give you a deeper understanding of the industry’s practices. Below are some of the most essential concepts to review:

- Regulations and Legal Principles: Familiarize yourself with the rules that govern the profession, including licensing requirements and compliance standards.

- Policy Types and Provisions: Understand the different types of contracts, their components, and how they function in various situations.

- Financial Fundamentals: Study the financial principles that drive the industry, such as risk management, premium calculations, and payout structures.

- Ethics and Professional Conduct: Be aware of the ethical standards and professional responsibilities required for effective client relationships.

- Claims Process and Procedures: Learn how claims are processed and the criteria that must be met for approval or denial.

- Underwriting Guidelines: Review the factors that underwriters consider when assessing applicants and determining eligibility for coverage.

In addition to understanding these concepts, you should also practice applying them to hypothetical scenarios. This will help reinforce your knowledge and prepare you for the types of questions you’ll encounter on the test.

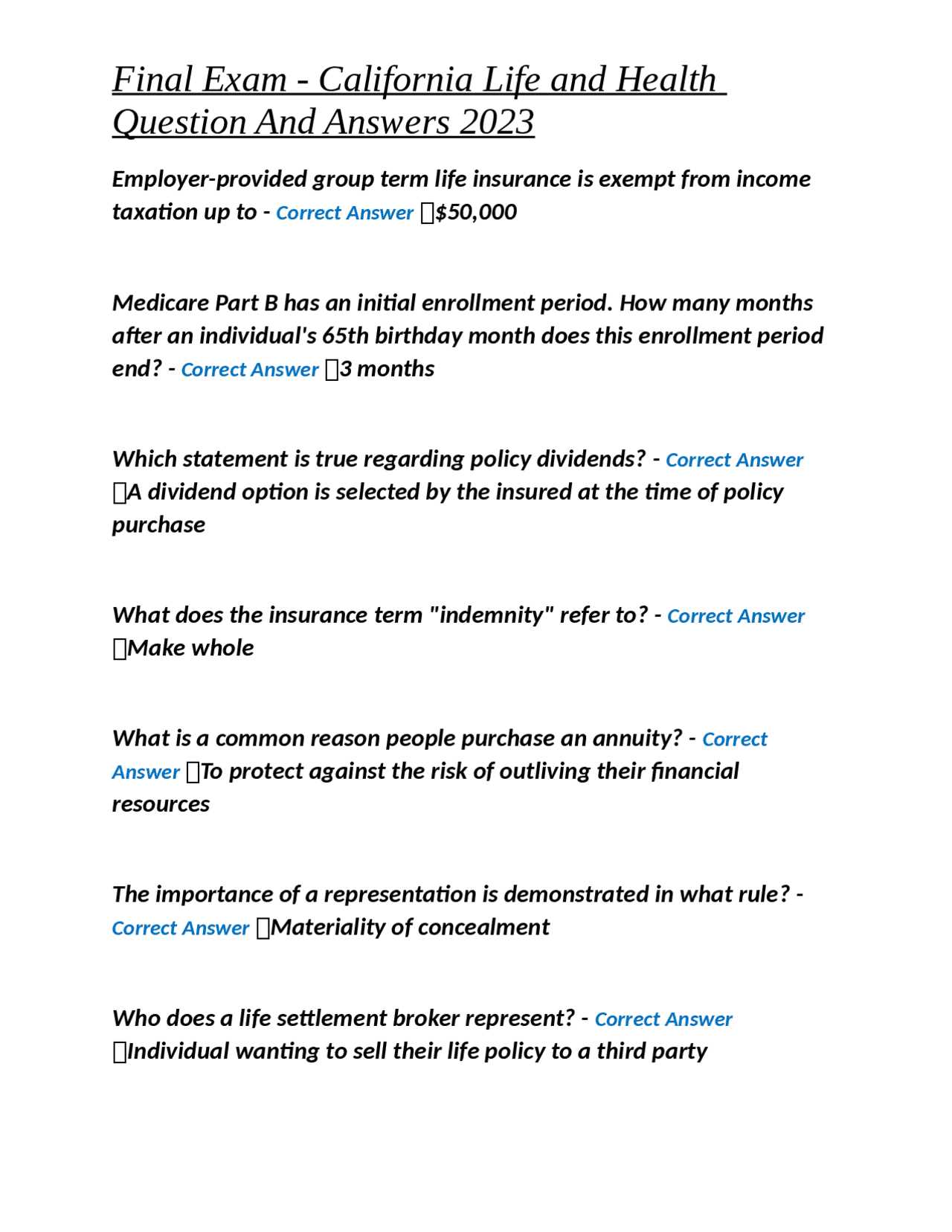

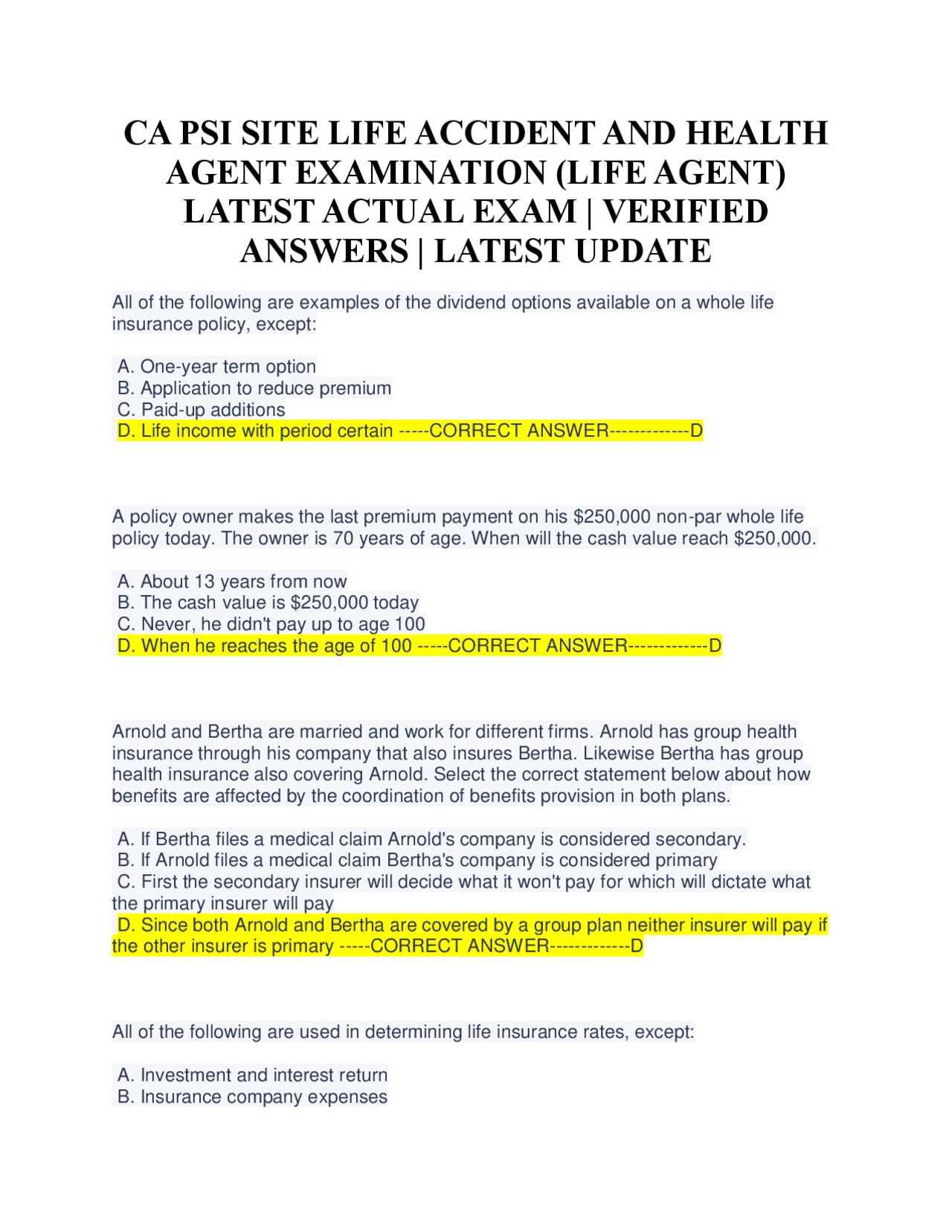

Common Questions on the Life Insurance Test

When preparing for this type of professional certification, it’s essential to familiarize yourself with the types of questions that frequently appear. Understanding these common queries can help guide your study efforts and ensure you’re well-prepared to address them during the assessment. Below are some of the most frequently asked questions on the test, which reflect the key areas of knowledge required in the field.

Questions on Policies and Coverage

One of the most common sections of the test involves questions related to policy structures and their coverage terms. You may be asked to identify the differences between various types of contracts, such as term vs. permanent policies, or how specific coverage provisions impact clients’ needs. These questions assess your understanding of how policies work and the factors that influence their benefits.

- What is the difference between term and whole policies?

- How do riders affect the terms of a policy?

- What factors determine coverage eligibility?

Questions on Legal and Regulatory Standards

Another key area of the test focuses on the legal aspects and regulatory standards that govern the industry. Questions often ask about the licensing requirements, consumer protection laws, and ethical practices expected of professionals. Understanding these principles is crucial for providing clients with accurate information and ensuring compliance with industry rules.

- What are the requirements for obtaining a professional license?

- What is the role of state and federal regulations in the field?

- How should conflicts of interest be handled?

Familiarizing yourself with these common questions will not only help you anticipate what you’ll encounter on the test but will also strengthen your ability to apply this knowledge in real-world scenarios.

Understanding Insurance Policies and Coverage

Having a clear understanding of how different types of coverage work and the provisions within various contracts is fundamental for anyone pursuing a career in this field. Policies can vary greatly depending on the needs of the policyholder, and it is essential to be able to explain these differences to clients effectively. This section breaks down the core elements of most policies and the key areas of coverage they provide.

Each type of coverage has specific features that determine its suitability for different situations. Understanding these elements will help you interpret the fine details of any contract and ensure that it aligns with the goals and requirements of the policyholder. Below is an overview of the most common policy types and their primary features:

| Policy Type | Coverage Duration | Common Features |

|---|---|---|

| Term | Temporary (set period, e.g., 10, 20, 30 years) | Lower premiums, no cash value, simple coverage |

| Whole | Lifetime | Higher premiums, builds cash value over time, fixed premiums |

| Universal | Lifetime (flexible) | Flexible premiums, cash value accumulation, adjustable death benefit |

| Variable | Lifetime | Investment options, fluctuating cash value, higher risk |

By thoroughly understanding the different options available, you can confidently explain the advantages and limitations of each policy to clients. Whether you’re dealing with basic coverage or more complex arrangements, knowing the details of what each policy offers will ensure that you can make the best recommendations based on individual needs.

How to Prepare for the Exam Effectively

Effective preparation for a professional qualification test requires a structured approach that combines understanding key concepts with strategic study techniques. By breaking down your preparation into manageable steps and focusing on the most important topics, you can increase your chances of success. Below are some proven strategies to help you prepare with confidence.

- Create a Study Schedule: Allocate specific times for each topic and stick to your plan. Consistency is key to retaining information over time.

- Use Study Materials: Invest in quality study guides and materials that cover the relevant subjects. These resources are designed to give you a comprehensive overview of what will be tested.

- Focus on Core Topics: Identify the areas that are most frequently tested, such as policy structures, legal regulations, and financial principles. Make sure you have a solid understanding of these concepts.

- Practice with Sample Questions: Completing practice questions can help you familiarize yourself with the question format and identify areas where you need more review.

- Join a Study Group: Collaborating with peers can enhance your understanding of complex topics and provide different perspectives on difficult material.

- Take Breaks and Rest: Don’t overexert yourself. Regular breaks will help you stay focused and retain more information in the long run.

By staying organized, focusing on key areas, and using effective study tools, you will feel more prepared when it comes time to take the test. With the right approach, you’ll be able to approach the assessment confidently and give yourself the best chance for success.

Tips for Passing the California Exam

Successfully passing a professional qualification test requires more than just knowledge of the material. It’s about strategy, preparation, and mindset. By following a few simple tips, you can maximize your chances of success and approach the assessment with confidence. Below are some key strategies to help you pass with ease.

Study Smart, Not Hard

Rather than cramming large amounts of information at once, focus on quality study techniques. Efficient studying involves breaking down complex material into manageable chunks and revisiting important concepts regularly. Stay organized and tackle difficult topics early, leaving time for review before the test.

| Strategy | Description |

|---|---|

| Active Recall | Test yourself regularly to ensure information is retained in your long-term memory. |

| Spaced Repetition | Review material over increasing intervals to strengthen memory retention. |

| Practice Tests | Simulate test conditions with practice exams to familiarize yourself with the format. |

Maintain a Positive Mindset

Your mindset plays a crucial role in your performance. Stay calm, confident, and focused during your preparation. Avoid stressing over individual mistakes or gaps in your knowledge. A positive attitude can boost both your motivation and ability to perform under pressure.

By implementing these strategies and maintaining a disciplined, positive approach, you’ll be well-prepared for the test. Success comes with persistence, focus, and the right preparation techniques.

Life Insurance Terminology You Should Know

Mastering the terminology related to this field is crucial for anyone pursuing a professional qualification. Understanding key terms and definitions not only helps you perform well on the test but also enhances your ability to communicate effectively with clients. Below are some essential terms that are frequently encountered in this industry.

Common Policy Terms

- Premium: The amount paid by the policyholder to maintain coverage, typically paid monthly or annually.

- Beneficiary: The individual or entity designated to receive the policy’s payout in the event of the policyholder’s passing.

- Death Benefit: The amount paid to the beneficiary upon the death of the policyholder.

- Underwriting: The process through which an insurance company evaluates an applicant’s risk factors before offering coverage.

- Rider: An additional provision that can be added to a policy to modify its terms or coverage.

Financial Terms to Understand

- Cash Value: The amount accumulated in a permanent policy that can be borrowed against or withdrawn.

- Dividends: A portion of the company’s profits paid to policyholders in certain types of contracts.

- Mortality Charge: A cost associated with the death benefit coverage in a permanent policy, based on the insured’s age.

- Cost of Insurance (COI): The amount charged by the insurer to provide coverage, which can vary over time depending on the policy type.

- Policy Lapse: The termination of a policy due to non-payment of premiums or failure to meet certain conditions.

By familiarizing yourself with these terms, you’ll be better equipped to understand the material covered on the test and improve your ability to navigate industry conversations and regulations with ease.

Best Study Resources for the Exam

To effectively prepare for a professional qualification assessment, using the right study resources is essential. The right materials will help you focus on key topics, understand complex concepts, and improve retention. Below are some of the most useful resources to consider when preparing for the test.

Books and Study Guides

- Comprehensive Textbooks: In-depth guides provide a detailed explanation of core concepts and terminology. They are an excellent resource for understanding the fundamentals and advanced topics.

- Practice Test Books: These books are packed with multiple-choice questions and answer keys, allowing you to simulate the testing experience and assess your knowledge.

- Flashcards: Flashcards are a great tool for quick review and memorizing important terms and definitions.

Online Platforms and Tools

- Online Courses: Websites like Coursera or Udemy offer structured online courses, often with video lessons, quizzes, and interactive elements to reinforce learning.

- Practice Test Websites: Websites such as Quizlet or Test-Guide provide free or paid practice tests that mimic the real exam format.

- Mobile Apps: Apps like Anki or Quizlet can be used on the go for reviewing key terms, taking quizzes, and practicing flashcards anytime.

Study Groups and Forums

- Study Groups: Joining a study group allows you to collaborate with others, ask questions, and gain new perspectives on difficult topics.

- Online Forums: Websites such as Reddit or specialized industry forums host communities where you can ask questions, share experiences, and exchange study tips with others.

By utilizing these resources, you can ensure a thorough understanding of the material and improve your chances of passing the assessment. Consistent practice, along with a strategic mix of study tools, will help you approach the test with confidence.

How to Manage Exam Time Wisely

Effective time management during an assessment is crucial for ensuring you have enough time to answer all questions thoroughly. By planning ahead and pacing yourself, you can avoid rushing through questions and make sure you give each one the attention it deserves. Below are some strategies to help you manage your time wisely during the test.

- Read Instructions Carefully: Before you start answering, take a moment to read through the instructions and understand the format of the questions. This will help you avoid wasting time on unnecessary steps.

- Allocate Time per Section: Divide the total time you have for the test by the number of sections or questions. Allocate a set amount of time to each section and stick to it, ensuring you don’t spend too long on any one part.

- Start with Easy Questions: Begin with the questions you are most confident about. This will build your momentum and save time for more challenging ones later on.

- Keep an Eye on the Clock: Regularly check the time during the test to ensure you are on track. If you notice you’re spending too much time on a question, move on and come back to it later if necessary.

- Don’t Overthink Answers: Trust your initial instinct and avoid second-guessing yourself too much. Overthinking can waste valuable time and cause unnecessary stress.

- Leave Time for Review: Set aside a few minutes at the end of the test to review your answers, especially if there are questions you found difficult or weren’t sure about initially.

By implementing these time management strategies, you can approach the assessment with a clear plan and feel more in control of your performance. Time management helps reduce stress, allowing you to focus on answering questions effectively and confidently.

What to Expect on Test Day

On the day of your assessment, it’s important to be fully prepared not only mentally but also logistically. Knowing what to expect can reduce stress and help you perform your best. Below are key aspects to consider so you can approach the day with confidence.

Arrival and Check-In Process

Arriving early is essential to ensure a smooth check-in process. When you get to the testing center, you will need to present identification and other required documentation. Be prepared to follow any security procedures, such as bag checks or fingerprinting, depending on the testing facility’s protocols. It’s a good idea to double-check all necessary documents the night before to avoid any last-minute stress.

During the Test

Once you’re seated and ready, the proctor will explain the rules and give instructions on how to complete the test. Most tests are either multiple-choice or involve written responses, so make sure you’re familiar with the format beforehand. You’ll also be given a set amount of time to complete the assessment, so it’s important to manage your time wisely from the start. If you encounter a difficult question, don’t panic–move on and return to it later if necessary.

Remember, you may have access to scratch paper or a calculator, depending on the test’s rules. Follow the instructions carefully to make sure you’re using the materials properly. And finally, stay calm and focused throughout the process, knowing that you’ve prepared as thoroughly as possible.

Exam Format and Question Types

Understanding the structure and types of questions on the assessment is crucial for effective preparation. The format of the test and the way questions are presented will help you tailor your study strategy and manage your time effectively during the test.

Question Structure

The majority of assessments will feature multiple-choice questions, where you are given several answer choices and must select the correct one. Some tests may also include true/false questions, matching items, or short-answer questions. Each question typically has one correct answer, though there may be instances where more than one option could appear to be correct, requiring careful analysis.

Time Management and Question Difficulty

While the overall time allotted for the test varies, it is essential to pace yourself throughout. Some questions may be straightforward, while others could require deeper thought and analysis. It’s important to quickly assess each question and move on if a question is taking too much time. You can always return to challenging questions if time allows.

Familiarizing yourself with these formats in advance and practicing with sample questions will give you confidence and help you navigate the assessment smoothly. Focus on understanding the core concepts, as the questions will often test your ability to apply knowledge to various scenarios.

Common Mistakes to Avoid During the Exam

During an assessment, there are several pitfalls that can undermine your performance if you’re not careful. Being aware of these common mistakes can help you avoid them and ensure you stay focused, efficient, and confident throughout the process.

Rushing Through Questions

One of the biggest mistakes is rushing through questions in an attempt to finish quickly. While it’s important to manage your time effectively, answering too hastily can lead to careless errors. Take a moment to read each question carefully, consider all options, and avoid second-guessing yourself too much. If you’re unsure, mark it and move on to come back to it later.

Ignoring Instructions

Not reading or understanding the instructions properly can lead to unnecessary mistakes. Always ensure you thoroughly understand what is being asked before answering. In many cases, tests will have specific instructions on how to approach certain types of questions (e.g., selecting multiple answers or choosing the best option). Pay attention to these details to avoid losing points for simple oversights.

By staying mindful of these common errors and following a well-thought-out strategy, you can avoid unnecessary mistakes and maximize your performance. Preparation, focus, and careful attention to the task at hand are key to success.

How to Get Your Exam Results

After completing the assessment, it’s essential to know how and when to expect your results. The process for receiving your score may vary depending on the testing organization, but typically, there are a few common ways to access your performance report.

Most testing centers or organizations offer online access to your results. After you finish the test, you may be provided with a link or instructions on how to check your score on their website. In many cases, your results will be available within a few hours or days after the test is completed. Be sure to have any necessary login information ready to access your account.

In some instances, your score may be sent to you through the mail if you prefer a physical copy. This can take a bit longer than online results, so if you need immediate feedback, checking your online account is typically faster.

It’s also important to keep in mind that if you do not pass, many organizations offer retake options. You can review the feedback provided with your results to understand where you might need additional preparation before attempting the test again.

Understanding the Licensing Process

Once you have successfully passed the necessary assessments, the next step is to understand the process of obtaining your professional credentials. This process ensures you meet all the legal requirements to practice in your chosen field and provides you with the necessary authorization to begin working in your desired profession.

Steps to Obtain Your License

The licensing process generally involves several key steps, including submitting an application, providing required documents, and paying any necessary fees. Once your application is reviewed and approved, you will receive your official credentials, allowing you to legally offer services to clients.

| Step | Description |

|---|---|

| Submit Application | Complete and submit the required application forms to the relevant authority. |

| Provide Documentation | Submit any necessary identification and supporting documentation, such as proof of education or training. |

| Pay Fees | Ensure you pay all required fees associated with processing your application and issuing your credentials. |

| Review and Approval | Your application will be reviewed, and if everything is in order, your license will be issued. |

Maintaining Your Credentials

After obtaining your license, it’s important to keep it active by adhering to any continuing education requirements or renewal procedures. Many professions require regular updates to ensure practitioners are staying current with industry standards and best practices. Be sure to stay informed about any necessary steps to maintain your qualifications.

Licensing Fees and Associated Costs

When pursuing a professional credential, it’s important to consider the financial investment required. There are several costs involved in the process, from application fees to additional charges for study materials and testing services. Understanding these expenses ahead of time can help you budget and plan for the entire journey.

The primary costs typically include the application fee, which is required to submit your documentation for review. This fee can vary depending on the jurisdiction or governing body overseeing your certification. In addition, there are often fees associated with the actual testing process, which may cover the cost of setting up, administering, and grading the assessment.

Additional costs may also arise from purchasing study materials or enrolling in preparatory courses. While not mandatory, many candidates choose to invest in these resources to improve their chances of success. These materials may include textbooks, online courses, or practice tests designed to help you prepare for the assessment.

Finally, once you pass the necessary assessments, you may need to pay for the license issuance, which grants you the legal authority to begin working in your field. It’s important to factor these fees into your overall budget, as they are essential steps in achieving your professional goal.

What Happens After You Pass the Exam

Once you have successfully completed the required assessment and achieved a passing score, there are a series of important next steps that mark the transition from candidate to licensed professional. This stage involves finalizing the necessary paperwork and fulfilling any remaining administrative tasks to officially earn your credentials.

The first thing you’ll likely encounter after passing the assessment is receiving your official results. Depending on the testing system, this may be delivered instantly or within a few business days. Once your results are confirmed, you can proceed to the next steps of the process, which typically include submitting an application for licensure and paying any associated fees.

License Issuance and Registration

Upon successful application, you will be granted your license, which gives you the legal right to practice in your chosen field. This license is often issued by the appropriate governing body or regulatory authority. The registration process may require you to complete additional forms or provide documents such as proof of identity or residency, depending on local regulations.

Next Steps After Licensing

After obtaining your official credentials, it’s time to begin applying your knowledge and skills in the professional environment. You can seek employment opportunities, start your own practice, or begin working as an independent contractor, depending on the nature of your field. It’s important to stay informed about any continuing education requirements or professional development programs that may be required to maintain your license in good standing.

With your certification in hand, you are now officially authorized to pursue career opportunities, serve clients, and contribute to the industry with confidence. Make sure to keep track of renewal dates and fulfill any ongoing requirements to ensure your credentials remain valid over time.