Preparing for a comprehensive evaluation in financial studies can be a daunting task. The key to success lies in understanding core principles, applying critical thinking, and reviewing practical examples. Whether you are dealing with calculations, analyzing reports, or interpreting trends, a clear grasp of the subject matter is essential for achieving your best performance.

Effective preparation is about more than just memorizing formulas and definitions. It’s about developing the ability to think analytically, solve problems efficiently, and recognize patterns that are crucial for real-world application. In this guide, we’ll explore strategies and techniques to help you tackle the assessment confidently.

Throughout this process, familiarity with core concepts will be your greatest asset. Mastering the material and knowing how to apply your knowledge under time pressure will make all the difference. This is your opportunity to review, practice, and refine your skills to ensure you are ready for the challenge ahead.

Essential Insights for Your Assessment

Achieving a strong performance in a comprehensive evaluation of financial concepts requires a deep understanding of key principles. This section provides guidance on how to approach various topics effectively, offering clarity on the most crucial areas to focus on. Success depends on your ability to connect theoretical knowledge with practical application under time constraints.

Preparation should involve not only reviewing key definitions and formulas but also practicing problem-solving techniques. By mastering the most commonly tested subjects and refining your analytical skills, you can boost your confidence and improve your chances of success. Focus on developing a strategic approach to tackling each question methodically.

Additionally, understanding the logic behind financial decisions, recognizing patterns in financial data, and interpreting results accurately will help you navigate complex scenarios. The more familiar you are with these core aspects, the more effectively you’ll be able to address different types of tasks presented during the evaluation.

Key Concepts for Financial Assessments

Mastering fundamental concepts is essential for excelling in any comprehensive evaluation of financial principles. A strong grasp of these core topics will not only help you understand the subject in depth but also enable you to apply this knowledge effectively to various problems. This section covers the most important areas to focus on during your preparation.

Key areas to review include understanding balance sheets, income statements, and cash flow analysis. These are the building blocks for interpreting the health of any organization and are often central to solving complex problems. In addition, familiarize yourself with financial ratios, as they are crucial tools for evaluating performance and making informed decisions.

Another critical concept is time value of money, which underpins many calculations in financial assessments. Understanding how to compute present and future values, as well as mastering discounting techniques, will allow you to tackle various scenarios confidently. Strengthening your knowledge in these areas ensures that you can address questions involving real-world applications with ease.

Understanding Financial Statements Basics

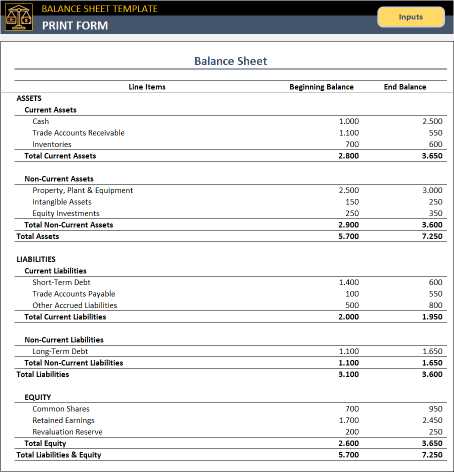

Grasping the fundamentals of financial statements is crucial for anyone looking to evaluate an organization’s performance and financial health. These documents provide a snapshot of an entity’s financial position, performance, and cash flows, offering insights into its ability to generate profit and manage expenses. The three primary statements to focus on are the balance sheet, income statement, and cash flow statement, each serving a unique purpose in the evaluation process.

The balance sheet reflects a company’s assets, liabilities, and equity, showing what the company owns and owes at a specific point in time. The income statement reveals the company’s profitability over a set period, detailing revenues, expenses, and net income. Lastly, the cash flow statement tracks the inflow and outflow of cash, providing a clear picture of liquidity and operational efficiency.

| Statement | Purpose | Key Components |

|---|---|---|

| Balance Sheet | Shows the company’s financial position at a specific point in time | Assets, Liabilities, Equity |

| Income Statement | Shows profitability over a specific period | Revenues, Expenses, Net Income |

| Cash Flow Statement | Tracks cash inflows and outflows during a period | Operating Activities, Investing Activities, Financing Activities |

By understanding the structure and function of these key documents, you will be able to analyze an organization’s financial performance more effectively and make more informed decisions based on its financial standing.

Mastering Financial Ratios and Analysis

Understanding and applying financial ratios is an essential skill for evaluating an organization’s performance and operational efficiency. These ratios provide insights into various aspects of a company, such as profitability, liquidity, solvency, and efficiency. With a solid grasp of these metrics, you can make informed judgments about the company’s financial health and its ability to generate returns for its stakeholders.

Key Financial Ratios to Know

Among the most important ratios to master are profitability ratios, such as return on assets (ROA) and return on equity (ROE), which measure how well a company generates profit relative to its assets or equity. Liquidity ratios, including the current ratio and quick ratio, assess the company’s ability to meet short-term obligations. Additionally, debt ratios, such as the debt-to-equity ratio, help evaluate a company’s financial leverage and risk.

How to Analyze Financial Ratios Effectively

It’s important not only to calculate these ratios but also to interpret them in the context of industry standards and historical performance. Comparing ratios over time can highlight trends, while benchmarking against competitors can offer valuable insights into a company’s relative performance. Always consider external factors, such as market conditions or economic shifts, when making your analysis.

By mastering the calculation and interpretation of key financial ratios, you will be better equipped to assess an organization’s financial health and make data-driven decisions.

Important Formulas for Financial Assessments

Mastering key formulas is vital when preparing for any evaluation involving financial analysis. These formulas are essential tools for calculating critical metrics that help assess the performance, profitability, and value of an organization. Having a solid understanding of these calculations can make a significant difference in achieving success during the assessment process.

Key Formulas for Profitability and Valuation

One of the fundamental formulas is the Return on Investment (ROI), which measures the efficiency of an investment. It is calculated as:

ROI = (Net Profit / Cost of Investment) × 100

Another critical formula is the Net Present Value (NPV), used to assess the profitability of a projected investment. It is calculated by discounting future cash flows to their present value:

NPV = Σ (Cash inflows / (1 + r)^t) – Initial Investment

Formulas for Liquidity and Solvency

Liquidity ratios, such as the Current Ratio, assess an organization’s ability to meet short-term liabilities. The formula is:

Current Ratio = Current Assets / Current Liabilities

Another important formula is the Debt-to-Equity Ratio, which measures the financial leverage of a company. It is calculated as:

Debt-to-Equity Ratio = Total Debt / Shareholders’ Equity

By mastering these essential formulas and understanding their applications, you can quickly and accurately analyze financial data during any assessment.

Common Mistakes in Financial Assessments

When tackling a comprehensive test involving financial analysis, many individuals make similar mistakes that can negatively affect their performance. Recognizing and avoiding these errors is crucial to achieving the best results. Common mistakes often arise from misinterpreting concepts, rushing through calculations, or overlooking key details in questions.

One frequent error is misunderstanding the meaning of financial ratios or misapplying the formulas. For example, confusing the current ratio with the quick ratio or applying the wrong time period in calculations can lead to incorrect conclusions. It’s essential to thoroughly understand each concept and its appropriate application to avoid such pitfalls.

Another mistake is failing to manage time effectively during the assessment. Rushing through questions without double-checking calculations or skipping over more complex problems can result in missed opportunities to score higher. Taking the time to review your work and ensure that all steps are followed correctly can make a big difference.

Additionally, neglecting to interpret the results of your calculations in context is a common mistake. It’s important to connect the numbers to the broader financial picture, understanding how they impact the overall health of an organization. Without this perspective, even accurate calculations may not provide useful insights.

Tips for Time Management During Assessments

Effective time management is one of the most crucial skills to master when preparing for any assessment. Without a solid strategy, it’s easy to become overwhelmed by the number of tasks or questions, leading to rushed decisions and incomplete answers. A well-planned approach ensures that you allocate sufficient time to each section, ultimately improving both your efficiency and performance.

Start by reading through the entire assessment to get a clear understanding of the questions. Identify the ones that require more time and the ones that can be tackled quickly. This allows you to prioritize and set a reasonable pace throughout the test. Don’t spend too much time on a single question if it’s holding you back from completing others.

Practice under timed conditions before the actual assessment. By simulating the real environment, you can gauge how long it takes to solve various types of problems. This practice will help you become more comfortable with time pressure and allow you to adjust your pacing accordingly during the actual assessment.

Another useful tip is to break down complex problems into smaller steps. Tackling each part of a problem methodically ensures that you don’t get stuck and helps you avoid wasting valuable time on unnecessary details. Lastly, always leave a few minutes at the end to review your answers and check for any mistakes.

How to Interpret Financial Data Correctly

Interpreting financial data accurately is essential for making informed decisions based on an organization’s performance. Raw numbers can often be misleading if not understood within the proper context. To interpret this data effectively, it’s crucial to understand the story behind the numbers and analyze them with a comprehensive perspective.

Understanding Key Metrics

Start by focusing on key metrics, such as profitability, liquidity, and solvency. Each of these offers valuable insights into different aspects of a company’s operations. For instance, profitability ratios show how efficiently a company generates profit, while liquidity ratios help assess the ability to meet short-term obligations. Understanding what each ratio measures and how it relates to the company’s overall health is fundamental in proper interpretation.

Contextualizing the Data

Numbers alone don’t tell the whole story. Always compare financial data to industry benchmarks or historical performance. This gives a clearer picture of whether a company is performing well relative to its peers or in comparison to its past results. Additionally, consider external factors, such as market conditions or economic shifts, which may affect financial outcomes.

By interpreting financial data with both precision and context, you can make well-informed decisions and gain a deeper understanding of an organization’s financial position.

Study Strategies for Financial Subjects

To excel in any subject involving financial analysis, having a structured study plan is essential. The right strategies not only help you grasp complex concepts but also improve your ability to solve problems effectively under pressure. A well-organized approach enables you to cover all the necessary material and retain key information for later application.

Effective Study Techniques

- Break down complex concepts: Divide large topics into smaller, manageable parts to focus on specific areas at a time.

- Practice regularly: Working through example problems helps reinforce your understanding and improves problem-solving speed.

- Create a study schedule: Set aside dedicated time for each topic, balancing your study sessions to avoid cramming.

- Utilize study aids: Use flashcards, summary notes, and online resources to reinforce key formulas and concepts.

- Teach others: Explaining concepts to peers or friends can strengthen your understanding and highlight areas needing more focus.

Preparing for Success

- Review past assessments: Analyzing previous tests or quizzes can provide insights into the types of questions typically asked and identify knowledge gaps.

- Focus on application: Rather than memorizing formulas, practice applying them in real-world scenarios to gain a deeper understanding.

- Stay organized: Keep track of your progress and review regularly to ensure all areas are covered before the assessment.

By using these strategies, you can not only improve your understanding of key financial principles but also feel more confident when applying them in assessments or real-life situations.

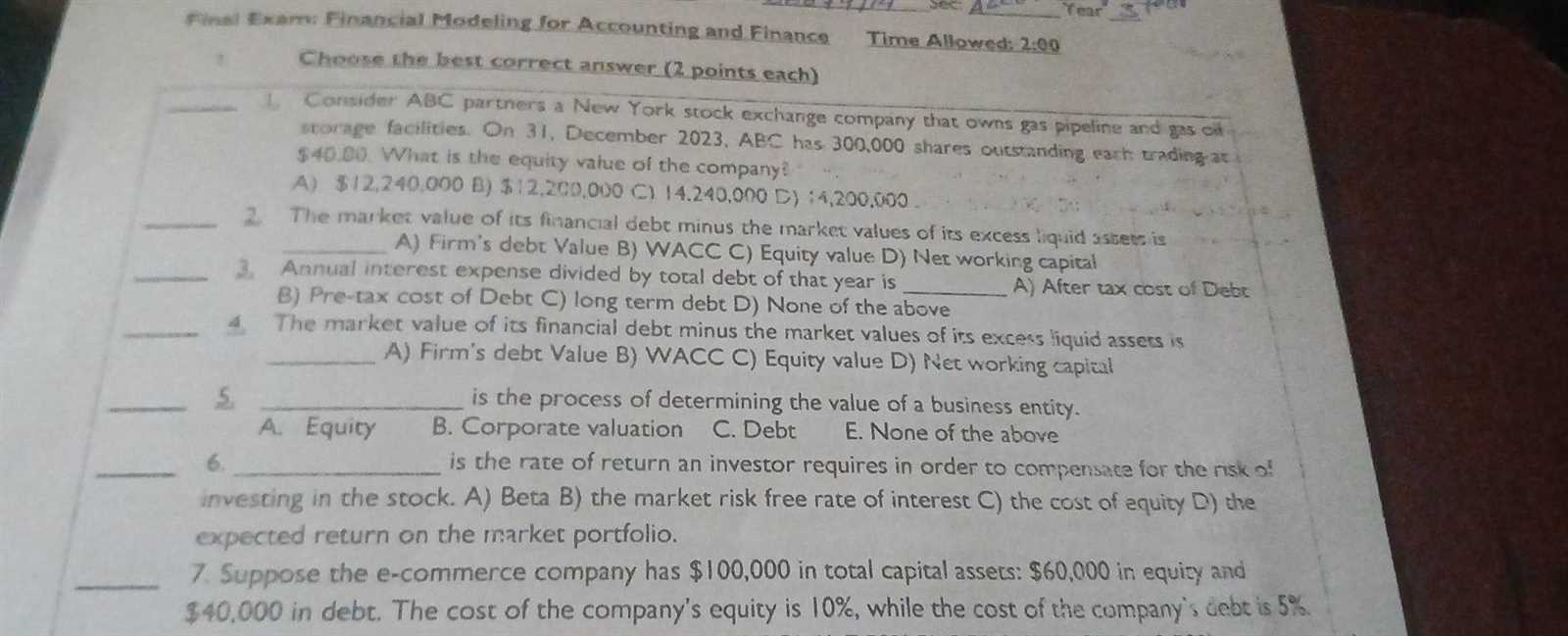

Preparing for Multiple Choice Questions

Multiple choice questions can be challenging, but with the right preparation and approach, you can tackle them effectively. These types of questions often test your ability to recall specific details and apply concepts in various contexts. Preparing for them requires understanding key topics, practicing question formats, and developing strategies for selecting the correct answer.

Understanding Question Structure

Each multiple choice question typically presents a question followed by several possible answers. One of these answers is correct, while the others are distractors designed to test your knowledge. It’s important to carefully read the question and each option to avoid falling for misleading choices. Focus on keywords in the question that help you identify the right answer, such as “most likely,” “least,” or “best explains.”

Effective Preparation Techniques

- Practice with sample questions: Familiarize yourself with the types of multiple choice questions that might appear by practicing with sample tests or past papers.

- Master key concepts: Focus on the most important topics that are frequently tested, such as formulas, definitions, and principles.

- Eliminate obviously incorrect answers: When unsure, start by eliminating the choices that are clearly wrong, which increases the chances of selecting the correct one.

- Watch out for tricky wording: Pay attention to questions that use negative terms like “not” or “except,” which can change the meaning of the question entirely.

By practicing and refining your approach to multiple choice questions, you can improve your ability to analyze the options and select the correct answer efficiently.

How to Approach Financial Calculations

Financial calculations often require careful attention to detail and a methodical approach. Whether you’re working with ratios, percentages, or complex formulas, it’s important to stay organized and focused throughout the process. Breaking down each problem into smaller steps helps ensure accuracy and efficiency, allowing you to approach even the most complex calculations with confidence.

Step-by-Step Approach

- Understand the problem: Begin by carefully reading the question and identifying what is being asked. Pay attention to any specific values or variables that need to be calculated.

- Identify the correct formula: For each type of calculation, make sure you know which formula is applicable. This will save time and reduce the risk of errors.

- Plug in the values: Substitute the known values into the formula, ensuring all units are consistent. Double-check your numbers before performing any calculations.

- Perform the calculation: Use a calculator or do the math manually, step by step. Check each operation to minimize mistakes.

- Interpret the result: Once you’ve obtained an answer, interpret its meaning within the context of the question. Does it make sense? If not, review your steps to find any errors.

Common Calculation Mistakes

- Forgetting to convert units: Always make sure that all units in the formula are compatible, such as percentages, currencies, or time periods.

- Using the wrong formula: Ensure you are using the correct formula for each type of calculation. Sometimes, similar formulas can lead to confusion.

- Rushing through calculations: Avoid hurrying. Taking time to double-check your steps ensures that the final result is accurate.

By following a structured approach and avoiding common pitfalls, you can handle financial calculations more effectively and confidently.

Key Terms to Remember for Financial Studies

Mastering key terminology is crucial when tackling any subject involving monetary management and analysis. Understanding core terms and their applications allows you to navigate complex problems with ease and ensures clarity when applying concepts. These terms often form the foundation for solving calculations and interpreting data correctly, making them essential for anyone looking to excel in this field.

Important Terminology

- Liquidity: The ability of an entity to meet its short-term financial obligations. It is a critical concept when assessing the financial health of a company.

- Asset: Resources owned by an individual or organization that are expected to provide future economic benefits.

- Liability: Financial obligations or debts owed by an individual or organization to another party.

- Equity: The value of an owner’s interest in a business, calculated as assets minus liabilities.

- Revenue: The total income generated from the sale of goods or services before expenses are deducted.

- Depreciation: The reduction in the value of an asset over time, primarily due to wear and tear or obsolescence.

Key Ratios and Indicators

- Profit Margin: A measure of profitability calculated by dividing net income by revenue. It indicates how much profit a company makes on each dollar of sales.

- Return on Investment (ROI): A performance measure used to evaluate the efficiency of an investment, calculated by dividing net profit by the cost of investment.

- Current Ratio: A liquidity ratio calculated by dividing current assets by current liabilities. It measures a company’s ability to pay its short-term obligations.

- Debt-to-Equity Ratio: A measure of a company’s financial leverage, calculated by dividing total liabilities by shareholders’ equity.

By becoming familiar with these fundamental terms and ratios, you will be better equipped to analyze financial situations and make informed decisions, whether you’re solving problems or interpreting results.

Important Case Studies in Financial Analysis

Studying real-world examples provides valuable insights into how theoretical concepts are applied in practice. Case studies showcase the challenges faced by companies, their strategies for overcoming financial obstacles, and the outcomes of their decisions. These examples not only deepen understanding but also highlight the consequences of financial decisions, both successful and otherwise.

By examining key cases, students and professionals alike can learn how various factors–such as market conditions, economic shifts, and management decisions–affect the financial performance of businesses. These cases offer lessons in risk management, capital allocation, and strategic planning.

Key Case Studies

- The Collapse of Lehman Brothers: This case exemplifies the devastating effects of excessive leverage and poor risk management, which ultimately led to one of the largest bankruptcies in history and a global financial crisis.

- The Growth of Apple Inc.: Apple’s success story offers valuable lessons in innovation, strategic reinvestment, and brand development, demonstrating how financial strategy can drive market leadership.

- The Enron Scandal: This case is a stark reminder of the consequences of corporate fraud, highlighting the importance of transparency and ethical financial practices in maintaining investor trust.

- The Financial Crisis of 2007-2008: A global event that revealed the vulnerabilities in the global financial system, this crisis underscored the need for better regulation, risk management practices, and financial oversight.

Each of these case studies teaches important lessons about the impact of financial decisions on the economy, companies, and individuals. Analyzing such examples allows you to gain a deeper understanding of the practical applications of financial principles and their real-world consequences.

How to Review Past Papers Effectively

Reviewing previous tests is a strategic method to enhance your preparation. By revisiting past papers, you can identify recurring themes, understand the format of the questions, and assess your level of preparedness. This practice helps to recognize gaps in your knowledge and strengthens your ability to apply learned concepts under timed conditions.

Instead of passively reading through the past papers, active engagement is key. You should focus on understanding why particular answers are correct or incorrect, and work on solving problems without looking at the solutions first. This process will boost your problem-solving skills and allow you to manage time efficiently during actual assessments.

Steps to Review Past Papers Effectively

- Start with the Basics: Begin by revisiting core concepts and theories before attempting to solve the questions. This will ensure that you have a solid foundation before tackling more complex problems.

- Practice Under Timed Conditions: Set a timer and attempt to solve the questions as if it were a real situation. This will help you get used to working under pressure and managing your time.

- Analyze Mistakes: Review your mistakes carefully. Understand the reasoning behind correct answers and figure out why certain approaches didn’t work.

- Focus on Commonly Tested Topics: Identify recurring topics and prioritize them in your revision, as these are often the most critical areas for assessments.

Track Your Progress

It is helpful to track your progress over time. You can use a table to compare your performance across different past papers and identify areas where you need to focus more effort.

| Paper Number | Topic Covered | Accuracy (%) | Areas to Improve |

|---|---|---|---|

| Paper 1 | Capital Structure, Ratios | 85% | Debt Management |

| Paper 2 | Risk Management | 70% | Risk Assessment Techniques |

| Paper 3 | Investment Strategies | 90% | Portfolio Diversification |

By consistently practicing and reviewing past papers in a structured manner, you can improve both your confidence and your performance in future assessments.

Commonly Tested Topics in Business Finance

Certain topics tend to appear frequently in assessments, as they form the foundation of the subject. Recognizing these core areas allows students to prioritize their study efforts and focus on the material that is most likely to be tested. By understanding which concepts are most commonly covered, you can approach your preparation with more confidence and ensure a thorough understanding of key principles.

These commonly tested areas often include important financial concepts, valuation techniques, and analytical tools. Mastering these topics will not only help you perform well in assessments but also deepen your understanding of the subject as a whole.

Key Topics to Focus On

| Topic | Importance | Key Concepts |

|---|---|---|

| Time Value of Money | High | Present value, Future value, Discounting, Compounding |

| Investment Valuation | High | Net present value (NPV), Internal rate of return (IRR), Discounted cash flow (DCF) |

| Financial Ratios | Medium | Liquidity ratios, Profitability ratios, Leverage ratios, Efficiency ratios |

| Capital Budgeting | High | Payback period, NPV, IRR, Profitability index |

| Risk and Return | Medium | Expected return, Standard deviation, Portfolio theory, Capital Asset Pricing Model (CAPM) |

| Cost of Capital | High | WACC, Debt vs. equity financing, Capital structure decisions |

By dedicating time to mastering these essential areas, you can significantly improve your performance and build a solid foundation for solving more complex problems in future assessments.

How to Stay Calm During Finance Exams

Stress and anxiety can often overwhelm students during important assessments, but there are strategies to manage these emotions effectively. Staying calm not only helps in better concentration but also in recalling key information when needed. By adopting a few practical techniques, you can keep your composure and perform to the best of your ability during high-pressure situations.

Here are several tips to help maintain calmness and focus when facing a challenging test:

Effective Techniques to Manage Stress

- Practice Breathing Exercises: Deep breathing helps reduce anxiety and increase mental clarity. Try inhaling slowly for a count of four, holding for four, and exhaling for four.

- Stay Positive: Focus on your preparation and remind yourself that you’ve done your best. Positive affirmations can combat negative thoughts.

- Prioritize Tasks: Don’t spend too much time on one question. If you’re stuck, move on and come back to it later with a fresh perspective.

- Take Short Breaks: If allowed, take a brief pause to relax your mind, especially after completing a section. A moment to recharge can help refocus your energy.

Preparing Mentally Before the Test

- Visualize Success: Take a few minutes before the test starts to visualize yourself confidently answering questions.

- Prepare Your Environment: Ensure you have all necessary materials (pens, calculator, etc.) ready. A comfortable and organized space can contribute to a calm mindset.

- Get Adequate Rest: A good night’s sleep before the test can significantly improve your concentration and reduce anxiety.

By incorporating these strategies, you can create an environment that fosters focus, calmness, and confidence, allowing you to tackle the test with a clear mind and optimal performance.

Final Steps Before Your Business Finance Exam

As the assessment day approaches, there are several key actions you can take to ensure you’re fully prepared. These final steps focus on last-minute reviews, mental readiness, and logistical preparation. By following these steps, you can boost your confidence and maximize your performance during the test.

Here are the essential steps to take just before your assessment:

Review Key Topics and Formulas

- Go Over Important Concepts: Quickly skim through your notes to reinforce the most crucial concepts. Focus on areas that you find challenging or have been emphasized throughout the course.

- Review Formulas and Calculations: Make sure you’re comfortable with the formulas you’ll need. Rewriting key equations or making quick reference notes can help solidify your understanding.

- Practice with Sample Problems: Solve a few practice questions or problems to test your understanding and identify any areas that still require attention.

Prepare Mentally and Logistically

- Get Plenty of Rest: A well-rested mind is crucial for clarity and focus. Ensure you get a good night’s sleep before the day of the assessment.

- Stay Hydrated and Eat Well: Eating a healthy meal and staying hydrated will provide you with the energy needed to stay alert throughout the assessment.

- Prepare Your Materials: Double-check that you have all the necessary tools–pens, pencils, a calculator (if needed), and any other items you may require.

- Arrive Early: Arriving early gives you time to settle in and mentally prepare without feeling rushed.

By following these final steps, you’ll be in the best position to approach the test with confidence and clarity. The combination of review, mental readiness, and logistical preparation can make all the difference in achieving the results you’re aiming for.