Preparing for a professional certification in the finance sector requires focus, discipline, and a well-structured approach. With the right tools and resources, you can increase your chances of success and deepen your understanding of key financial concepts. Whether you’re aiming to enhance your career or demonstrate expertise, the preparation process can be both challenging and rewarding.

Effective study techniques play a significant role in mastering complex topics. A combination of practical experience, theory, and timed practice sessions ensures you are well-prepared for any challenges that might arise during testing. By leveraging available resources and maintaining a consistent study routine, you can build confidence and refine your skills.

Success is not just about knowing the material; it’s also about mastering the method of approaching problems, managing time effectively, and staying calm under pressure. Developing a strategic plan for your preparation will help you navigate through various topics with ease and set you on the path to success.

Bloomberg Exam Preparation Essentials

Achieving success in a professional finance certification requires a comprehensive understanding of the material and a well-thought-out study plan. It’s essential to focus on core concepts while balancing practical application and theoretical knowledge. This approach will ensure that you’re not only familiar with the content but also able to apply it effectively in real-world scenarios.

To start, familiarizing yourself with the structure and format of the assessment is crucial. Knowing what to expect helps reduce anxiety and allows you to allocate time more efficiently. Additionally, utilizing available resources such as study guides, practice tests, and interactive tools can provide invaluable support during your preparation journey.

It’s equally important to prioritize time management. Break down the study material into manageable sections, setting clear goals for each session. Consistency is key, so establishing a daily routine and sticking to it will make the learning process more structured and less overwhelming. Finally, periodically reviewing progress and adjusting strategies as needed will help you stay on track and boost your confidence as you approach the certification.

Understanding the Certification Process

Achieving a professional finance certification involves more than just completing a set of tasks. It is a structured process that tests your knowledge and skills in various areas of financial markets and tools. Understanding how the process works can help you approach your studies with confidence and clarity, allowing you to better prepare for the challenges ahead.

Steps in the Certification Journey

The certification process typically starts with registering for the program and gaining access to the necessary learning materials. After familiarizing yourself with the content, it’s important to focus on mastering key topics and functions that are commonly tested. This includes understanding both theoretical concepts and the practical application of these concepts through various software tools. After completing the study phase, you will be ready to take the final assessment, which will evaluate your overall proficiency.

What to Expect During the Process

Throughout the certification process, you will encounter both individual study and interactive practice sessions designed to strengthen your understanding. The process is designed to be rigorous and thorough, ensuring that those who pass the assessment have a solid grasp of essential financial concepts. As you work through the material, keeping track of your progress and identifying areas for improvement is key to staying on course and ensuring success.

Key Topics Covered in Financial Assessments

When preparing for a professional certification in finance, it’s crucial to understand the core subjects that are tested. These topics are designed to evaluate both your theoretical knowledge and practical skills, covering a broad range of areas within the financial markets. Mastery of these concepts will help you navigate the certification process successfully and equip you with the expertise needed in your career.

Core Financial Concepts

Several fundamental areas form the backbone of any financial assessment. These topics are essential for understanding how markets function and how financial tools are used. Key areas include:

- Market Fundamentals: Understanding financial markets, trading systems, and their global impact.

- Investment Strategies: Knowledge of different asset classes, portfolio management, and risk management techniques.

- Financial Analysis: Proficiency in analyzing financial statements and understanding key performance indicators.

- Economic Indicators: Familiarity with economic data, its interpretation, and how it affects markets.

Practical Application of Financial Tools

In addition to theoretical knowledge, practical application is a critical part of the certification. This includes:

- Using financial software: Navigating tools designed for market analysis and data visualization.

- Real-time decision making: Applying learned strategies to simulated market conditions.

- Understanding financial instruments: Gaining expertise in derivatives, bonds, equities, and other investment vehicles.

Effective Study Strategies for Financial Certification

Successfully preparing for a professional finance certification requires a focused and organized approach. The right study strategies can make all the difference, ensuring that you cover all necessary material, retain key concepts, and build the confidence to apply your knowledge effectively. With the right methods, you can optimize your preparation time and increase your chances of success.

Create a Structured Study Plan

One of the most important steps in preparing for any financial certification is creating a detailed study plan. A clear plan will help you break down the material into manageable sections, ensuring you cover all topics in a systematic way. Some useful tips include:

- Set specific goals for each study session to stay focused.

- Prioritize difficult or unfamiliar topics early on to give yourself more time.

- Include regular review sessions to reinforce learning and identify areas for improvement.

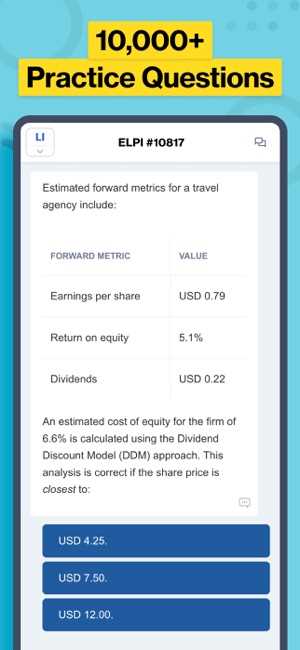

Utilize Practice Tests and Real-World Scenarios

Practical experience is a key component of effective preparation. Practice tests are invaluable for familiarizing yourself with the format and timing of the assessment. They also help you identify knowledge gaps that need to be addressed. Additionally, applying your learning to real-world scenarios or case studies can deepen your understanding and improve your problem-solving abilities under pressure.

- Take practice tests regularly to gauge your progress and adjust your study plan accordingly.

- Engage with simulated scenarios to enhance your ability to make quick, accurate decisions in real situations.

Common Mistakes to Avoid During Preparation

When preparing for a professional certification in finance, it’s easy to fall into certain traps that can hinder your progress. Recognizing and avoiding these common mistakes can help ensure that your study sessions are efficient and effective. By addressing these pitfalls early on, you can stay on track and avoid wasting time and effort.

Neglecting Time Management

One of the most significant mistakes is failing to plan your study time properly. Without a structured schedule, it’s easy to fall behind or become overwhelmed by the volume of material. To avoid this, break down the study material into smaller, manageable segments and allocate specific time for each. Regularly assess your progress and adjust your schedule as needed to stay focused.

Overlooking Practical Application

While theory is important, focusing solely on memorization without practical application can be detrimental. Many candidates neglect to practice using the tools and techniques that are critical to the certification process. Engage with interactive tools, practice tests, and case studies to strengthen your ability to apply concepts in real-world scenarios. This will not only enhance your knowledge but also prepare you for the practical aspects of the certification.

How to Use Financial Terminal for Practice

One of the most effective ways to prepare for a professional certification in finance is by utilizing a financial terminal. This tool provides access to real-time market data, analytics, and a wide range of financial instruments, making it an invaluable resource for hands-on practice. By familiarizing yourself with the features and functionalities of the terminal, you can gain practical experience and reinforce your theoretical knowledge.

Explore Key Functions and Features

The first step in using the financial terminal effectively is to understand its core functions. Key features such as market analysis tools, financial reporting, and portfolio management capabilities allow you to interact with live data and simulate real-world financial scenarios. Begin by:

- Learning how to search for and analyze market data using various commands.

- Familiarizing yourself with tools for analyzing stocks, bonds, and other financial assets.

- Practicing with charting and reporting tools to interpret trends and forecast potential outcomes.

Simulate Real-World Scenarios

To fully benefit from the terminal, practice using it in real-world scenarios. Create mock portfolios, simulate trades, and assess market conditions using the available data. This hands-on experience will allow you to develop critical skills such as decision-making, risk management, and financial analysis. Using the terminal regularly will help you become more confident and efficient, giving you an edge during the certification process.

By integrating these practical exercises into your study routine, you’ll not only understand theoretical concepts but also gain the practical knowledge necessary for success in the field.

Time Management Tips for Financial Certification

Effective time management is crucial when preparing for a professional finance certification. Balancing the vast amount of material to cover, while ensuring that you have enough time to absorb and practice, requires careful planning and discipline. With the right approach, you can maximize your study efficiency and avoid unnecessary stress.

Create a Study Schedule

Start by breaking down the topics into manageable sections and allocate specific time slots for each. A well-structured study plan will help you stay organized and ensure that you cover all necessary material. Consider the following tips:

- Prioritize difficult subjects early in your schedule when you have more energy and focus.

- Break long study sessions into shorter, focused intervals, allowing for regular breaks to maintain concentration.

- Review progress regularly and adjust your schedule if needed to stay on track.

Set Time Limits for Each Task

Setting time limits for each study task can prevent procrastination and help you maintain a steady pace. For example, allocate a fixed amount of time for reading through chapters or completing practice questions. By doing this, you’ll avoid spending too much time on one topic and ensure that you progress through the material at a consistent rate. Here’s how to implement this:

- Use a timer or app to track study sessions and remind yourself when to move to the next task.

- Focus on completing one task at a time instead of multitasking, which can decrease efficiency.

- Review the most challenging areas in shorter, more frequent sessions to keep information fresh.

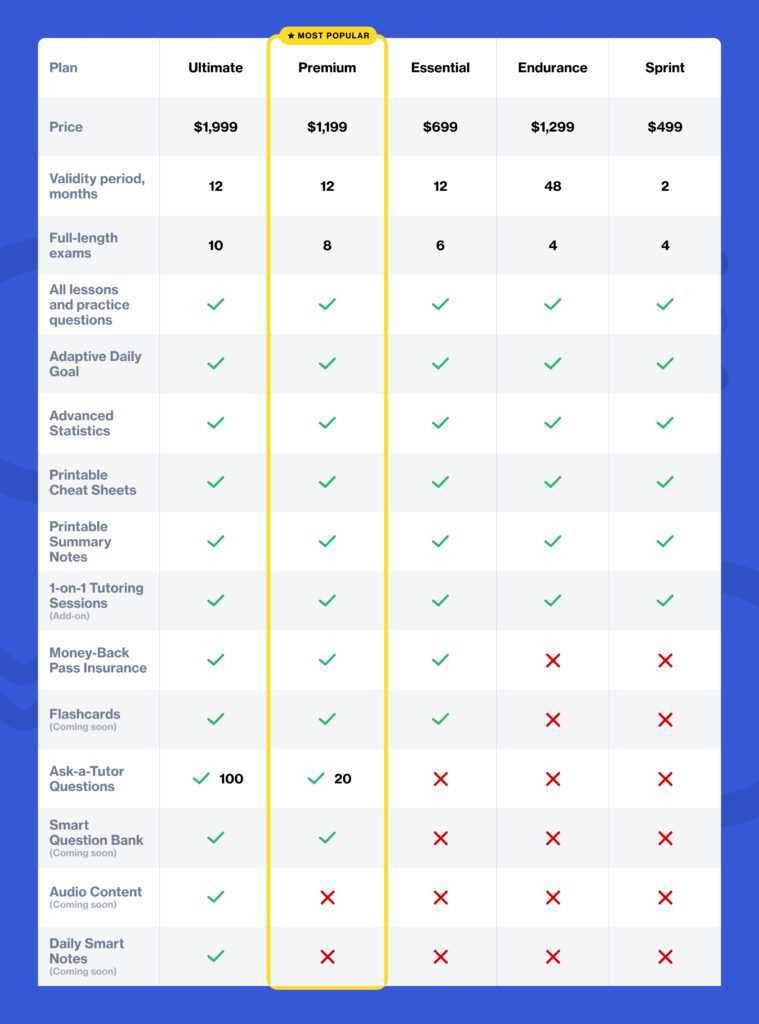

Top Resources for Financial Certification Preparation

Preparing for a professional finance certification requires access to high-quality resources that will help you understand complex concepts, practice key skills, and track your progress. The right materials can make a significant difference in your preparation process. By utilizing a combination of textbooks, online platforms, and real-world tools, you can ensure a comprehensive study experience.

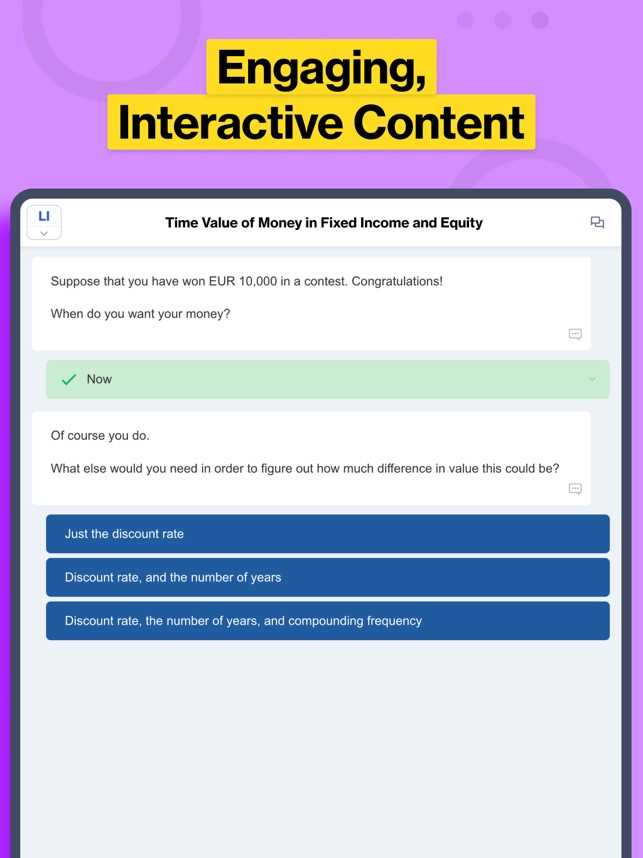

Online Learning Platforms

There are numerous online platforms designed to help candidates prepare effectively by offering interactive lessons, practice tests, and quizzes. These resources cater to various learning styles and allow you to work at your own pace. Some key benefits of using online platforms include:

- Access to a variety of study materials, including video tutorials, flashcards, and practice exams.

- Interactive exercises to help reinforce theoretical knowledge and apply it practically.

- The ability to track progress and identify areas that require more focus.

Study Guides and Textbooks

In addition to online platforms, traditional study guides and textbooks remain valuable resources. These materials offer in-depth explanations of key financial concepts and provide structured learning paths. They often include practice questions at the end of each chapter to test your understanding. Look for books that offer:

- Comprehensive coverage of essential topics, from market fundamentals to investment strategies.

- Clear explanations of complex concepts, with examples and case studies for better understanding.

- End-of-chapter quizzes and summaries to test retention and review key takeaways.

Using both online platforms and traditional study guides allows you to combine theory with practical exercises, providing a well-rounded approach to your preparation.

Understanding Market Concepts for Financial Certification

Mastering key market concepts is a crucial aspect of preparing for a finance-related certification. A strong understanding of financial instruments, market dynamics, and investment strategies forms the foundation of your professional knowledge. Grasping these concepts allows you to interpret real-world data, make informed decisions, and apply theoretical knowledge to practical scenarios.

Core Financial Instruments and Their Functions

Understanding the various types of financial instruments is essential for any finance professional. These include equities, bonds, derivatives, and commodities. Each of these instruments serves a distinct purpose in the market, and knowing how to analyze them will help you navigate the financial landscape. Here are some of the key instruments you should be familiar with:

- Equities – Represent ownership in a company, providing shareholders with voting rights and dividends.

- Bonds – Debt securities issued by entities to raise capital, with fixed or variable interest payments.

- Derivatives – Financial contracts whose value depends on the performance of underlying assets, such as options and futures.

- Commodities – Physical goods like oil, gold, or agricultural products that are traded on exchanges.

Market Trends and Economic Indicators

To effectively navigate the financial markets, it’s important to understand how macroeconomic trends and indicators influence market behavior. Key indicators such as inflation rates, GDP growth, and employment statistics can provide valuable insights into market movements. Analyzing these factors helps in making informed predictions about future market conditions and investment opportunities.

- Inflation Rates – Indicate the rate at which prices for goods and services rise, affecting purchasing power.

- GDP Growth – A measure of a country’s economic health, influencing investment sentiment.

- Employment Data – Reflects the health of the labor market and can influence consumer spending and economic growth.

By mastering these fundamental market concepts, you will be better equipped to analyze financial data, assess risk, and make strategic decisions that align with market conditions.

Building a Financial Certification Study Schedule

Creating an effective study schedule is essential for successfully preparing for a finance-related certification. By organizing your time efficiently, you can ensure that you cover all necessary topics, balance review sessions with practice, and avoid unnecessary stress. A well-structured study plan not only keeps you on track but also helps maximize your learning potential.

Prioritize Key Topics

When building your study schedule, it’s important to identify the most challenging and critical topics and prioritize them. Focus on areas where you feel less confident and spend more time mastering these concepts. Start by:

- Identifying complex concepts such as financial analysis, market mechanics, and economic indicators.

- Breaking down large topics into smaller, manageable sections.

- Allocating extra time for difficult subjects while maintaining a balance with easier ones.

Incorporate Regular Review and Practice

A successful study plan should not only include new learning but also regular review and practice. Reinforcing what you’ve learned through practice tests and reviewing key material will help solidify your understanding. Here are some tips for incorporating review into your schedule:

- Daily Reviews: Set aside time each day to revisit concepts you’ve already covered, reinforcing your retention.

- Practice Questions: Include practice tests at regular intervals to assess your understanding and improve your test-taking skills.

- Mock Scenarios: Simulate real-world situations where you apply the concepts in practice to test your problem-solving abilities.

By following a well-rounded study schedule, you will stay organized, reduce last-minute cramming, and increase your chances of success in your certification journey.

Test Day Tips for Success

The day of the assessment is crucial for demonstrating all the knowledge and skills you’ve worked hard to acquire. Proper preparation in the days leading up to the test is essential, but equally important is how you manage the day itself. By following some practical tips and maintaining a calm mindset, you can approach the test confidently and perform at your best.

Stay Calm and Confident

It’s natural to feel a bit anxious before the assessment, but staying calm is key to performing well. Focus on managing your nerves by taking deep breaths and reminding yourself of your preparation. Here are some ways to maintain composure:

- Positive Visualization: Visualize yourself successfully navigating through the test and recalling key information effortlessly.

- Mindfulness Techniques: Practice deep breathing or simple mindfulness exercises to reduce stress before the test begins.

- Trust Your Preparation: Remind yourself that you’ve put in the effort and are well-prepared for the challenges ahead.

Be Strategic During the Test

Once the test begins, it’s essential to manage your time wisely and approach each question methodically. Here are a few strategies to help you succeed:

- Read Instructions Carefully: Take a moment to read the directions thoroughly to avoid misunderstandings during the test.

- Time Management: Keep an eye on the clock and pace yourself. Don’t linger too long on any single question–move on and come back if needed.

- Answer Easy Questions First: Begin with the questions you find easiest to build momentum and boost your confidence.

By staying composed and using a thoughtful approach during the test, you can increase your chances of success and demonstrate your knowledge effectively.

How to Review Practice Tests Effectively

Reviewing practice tests is a critical step in solidifying your understanding and preparing for any certification. It’s not just about completing the questions, but about carefully analyzing your performance to identify areas for improvement. Effective review strategies can enhance your retention and help you learn from mistakes, ensuring you’re better prepared for the actual test.

Analyze Mistakes and Learn from Them

After completing a practice test, take the time to go over each mistake. Understanding why you got a question wrong is essential for growth. Focus on the following aspects:

- Conceptual Understanding: Did you miss the question because of a misunderstanding of a key concept? Revisit the material and clarify the point of confusion.

- Test-Taking Strategy: Was the mistake due to poor time management or misreading the question? Adjust your approach for future tests.

- Patterns in Errors: Look for patterns in the types of questions you struggle with–are they related to a specific topic or concept? Focus on those areas for improvement.

Reinforce Learning through Targeted Review

Once you’ve identified areas for improvement, create a targeted review plan to reinforce those weak spots. Some effective methods include:

- Focused Practice: Work on additional problems related to the concepts you struggled with.

- Review Key Material: Revisit notes or resources that cover the most challenging topics, ensuring you fully understand the content.

- Simulate Real Test Conditions: Practice under timed conditions to improve both accuracy and speed.

By carefully analyzing your practice test results and making adjustments to your study plan, you can maximize your learning and improve your overall performance.

Staying Motivated During Test Preparation

Maintaining motivation during the preparation phase can be one of the most challenging aspects of any learning journey. It’s easy to feel overwhelmed or lose focus, especially when progress seems slow. However, staying motivated is crucial to ensure consistent study habits and successful results. There are several strategies that can help keep your energy up and your goal in sight.

One effective way to stay motivated is to set clear, manageable goals and break down the preparation process into smaller, achievable tasks. This not only makes the workload feel less daunting but also provides a sense of accomplishment as you tick off each task. Additionally, tracking your progress can provide motivation and help you see how far you’ve come.

| Motivation Tip | Benefit |

|---|---|

| Set Small, Achievable Goals | Helps break down overwhelming tasks and creates a sense of accomplishment. |

| Reward Yourself | Gives you something to look forward to after completing study milestones. |

| Maintain a Study Routine | Establishing consistency reduces procrastination and builds momentum. |

| Stay Positive and Visualize Success | Focusing on the end goal can keep you inspired and motivated during tough times. |

By following these strategies, you can boost your motivation and stay on track, even when faced with challenges. Keep your end goal in mind, and don’t forget to celebrate small victories along the way.

Overcoming Test Anxiety

Test anxiety is a common challenge that many individuals face during preparation and on the day of an assessment. The pressure to perform well can lead to feelings of nervousness, stress, and self-doubt. However, it is possible to manage and overcome these feelings by adopting effective techniques and strategies to stay calm and focused throughout the process.

One of the most important steps in managing test anxiety is preparation. The more confident you are in your understanding of the material, the less room there is for worry. In addition to preparation, it’s essential to incorporate relaxation techniques into your routine. These practices can help you reduce stress and maintain a clear, calm mindset when it’s time to face the test.

Relaxation Techniques to Combat Stress

- Deep Breathing Exercises: Focus on slow, deep breaths to calm your nervous system and reduce anxiety levels.

- Mindfulness Meditation: Spend a few minutes daily practicing mindfulness to stay in the present moment and avoid overwhelming thoughts.

- Progressive Muscle Relaxation: This technique involves tensing and releasing muscle groups to alleviate physical tension.

- Visualization: Visualize yourself successfully completing the test, which can boost confidence and reduce anxiety.

Effective Strategies for Staying Calm on Test Day

- Prepare Ahead of Time: Ensure you have everything you need for the test the night before, reducing last-minute stress.

- Practice Stress-Reducing Activities: Engage in light exercise or take a walk before the test to release pent-up tension.

- Stay Positive: Focus on positive affirmations and remind yourself of your preparation and readiness.

- Manage Time Wisely: Arrive early to avoid feeling rushed, and pace yourself during the test to avoid panic.

By incorporating these strategies into your routine, you can significantly reduce test anxiety and approach the assessment with a calm, confident mindset.

Understanding Data and Functions

In financial and market analysis, access to accurate and up-to-date information is crucial. Being able to navigate and understand various tools and data sets allows users to make informed decisions and streamline their workflows. These platforms provide a wide range of functions that cater to different aspects of data analysis, helping users retrieve, analyze, and interpret market movements effectively.

The key to mastering these resources is to first understand the types of data available and how to use specific functions to interact with this information. Whether it’s market trends, economic indicators, or real-time data feeds, having the ability to quickly and efficiently access the right data can greatly enhance decision-making abilities. Furthermore, understanding how to interpret this data and apply it to real-world scenarios is an essential skill for success.

Types of Data Available

- Real-Time Market Data: Information on stock prices, exchange rates, and commodities updated continuously.

- Historical Data: Past financial data that allows users to analyze trends over different time periods.

- Economic Indicators: Data on unemployment rates, inflation, and GDP, which influence market behavior.

- Corporate Financials: Data related to company performance, including balance sheets, income statements, and cash flow reports.

Popular Functions for Analysis

- Function A: A tool for tracking market movements and identifying price fluctuations in real-time.

- Function B: A feature for comparing historical data across multiple time frames to identify trends and patterns.

- Function C: A financial modeling tool that helps project future performance based on current and historical data.

By gaining a deeper understanding of these data types and functions, users can enhance their ability to analyze complex market conditions and make better-informed decisions. Mastering these tools is vital for anyone aiming to succeed in the financial or investment industries.

Post-Assessment: What to Do Next

Completing an assessment is just one step in the learning process. Once the test is over, it’s crucial to take time to reflect, evaluate your performance, and plan your next steps. Whether you’ve passed or need to retake the assessment, what you do after the test can significantly impact your future success.

First, assess your performance objectively. Did you meet your goals? Were there any areas where you struggled? Taking the time to analyze your strengths and weaknesses will provide valuable insights for further improvement. Additionally, reviewing any mistakes and understanding why they occurred will help you prepare for future challenges more effectively.

Immediate Steps After the Test

- Relax and Recover: Give yourself time to unwind and relieve any stress accumulated during preparation.

- Review Your Results: Carefully examine your performance report to understand which areas you excelled in and where you need improvement.

- Seek Feedback: If available, seek feedback from peers, mentors, or instructors to get a clearer understanding of your results.

Planning for Future Success

- Identify Weak Areas: Focus on any sections where you struggled. Consider taking additional courses or reviewing materials to strengthen these areas.

- Set New Goals: Based on your performance, set realistic and achievable goals for your next steps, whether it’s taking another test or advancing your skills further.

- Continue Learning: Learning doesn’t stop after an assessment. Keep up with new trends, practice regularly, and stay current in your field to maintain your competitive edge.

By taking these steps, you can turn your post-assessment period into a valuable learning experience, whether you’re preparing for another challenge or simply refining your skills for future opportunities.

Long-Term Benefits of Certification

Acquiring a professional certification can open many doors and provide long-term advantages that extend well beyond the immediate recognition of your achievement. Whether you’re looking to advance your career, increase your earning potential, or gain specialized knowledge, certification serves as a solid foundation for future success in your field. Its value continues to grow as you develop new skills and expand your professional network.

One of the most significant benefits of certification is enhanced career prospects. Professionals with recognized credentials often have an edge in competitive job markets. Certification demonstrates a commitment to excellence and expertise, which can make you more attractive to potential employers or clients. Furthermore, it can help you stand out in promotions and advancement opportunities within your current organization.

Another key benefit is the increase in earning potential. Certified professionals typically command higher salaries due to their advanced knowledge and qualifications. Employers value individuals who can bring specialized skills and expertise to the table, and they are often willing to reward this with better compensation packages.

Key Long-Term Benefits

| Benefit | Description |

|---|---|

| Career Advancement | Certification can lead to higher-level positions and increased responsibilities, accelerating career growth. |

| Higher Earning Potential | Professionals with certifications often earn more than those without, thanks to their specialized expertise. |

| Increased Job Security | Certified professionals are more likely to be valued by their employers, leading to greater job stability. |

| Industry Recognition | Certification can help you gain credibility in your industry and build a strong professional reputation. |

| Continuous Learning | The process of achieving and maintaining certification encourages lifelong learning and skill development. |

These long-term benefits can significantly impact your career trajectory, leading to increased satisfaction, growth opportunities, and professional fulfillment. Whether you’re just starting or looking to further your expertise, a certification can provide the tools and recognition necessary to propel you forward in your chosen field.