Planning ahead for your certification journey is crucial to ensure you meet all requirements and deadlines. Whether you’re aiming for the first time or retaking the assessment, understanding the timeline can make a significant difference in your preparation and overall success. Knowing when and how to schedule is the first step towards achieving your professional goals.

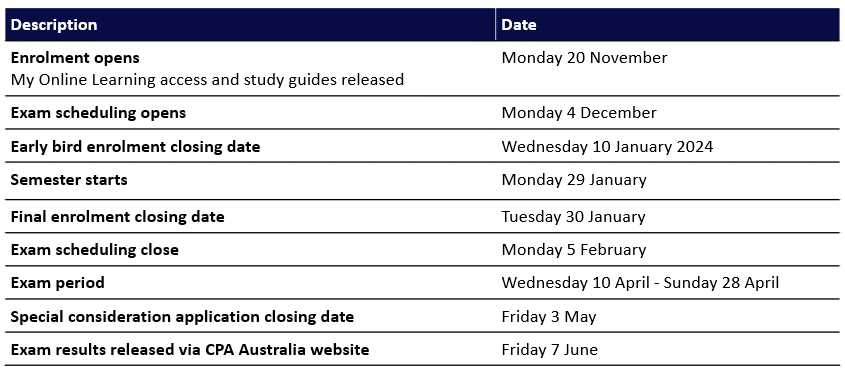

Key milestones are outlined throughout the year to help you stay on track. These timelines will guide you through essential periods when registration opens, when assessments are conducted, and when results are expected. Keeping an eye on these will allow you to organize your study plan and avoid any last-minute rush.

It’s important to note that certain changes can affect the usual schedule, so staying updated with the latest information is recommended. By preparing in advance, you ensure that your planning aligns with all official deadlines and requirements, helping you approach the process with confidence and clarity.

2025 CPA Exam Dates

Understanding the schedule for upcoming professional assessments is essential for anyone aiming to achieve their certification. These milestones are set throughout the year and mark the windows of opportunity to sit for the required tests. Staying informed on the official calendar ensures you can plan accordingly and meet necessary deadlines.

Test Window Overview

Each assessment cycle is divided into specific windows during which the tests are held. These windows are critical for managing your study sessions and registration timeline. Knowing the key periods for testing allows you to make informed decisions on when to schedule your attempt, depending on your preparation status.

| Testing Window | Start Date | End Date |

|---|---|---|

| First Quarter | January 1 | March 31 |

| Second Quarter | April 1 | June 30 |

| Third Quarter | July 1 | September 30 |

| Fourth Quarter | October 1 | December 31 |

Important Registration Deadlines

In addition to the test windows, there are specific registration deadlines that must be adhered to in order to secure your spot for the assessments. These deadlines ensure that all necessary arrangements are made in time for your test day. It is highly recommended to register as early as possible to avoid any issues or delays.

Key Dates for the 2025 CPA Exam

For those planning to sit for the certification assessments, it is crucial to track key milestones throughout the year. These important periods mark when you can register, when testing windows open, and when all necessary actions must be taken to stay on track for successful completion. Knowing these milestones in advance allows for proper preparation and ensures that you do not miss any essential steps.

Important Registration Periods

Timely registration is vital for securing your spot in the desired testing window. The registration periods are typically broken into several phases during the year. Here’s what to keep in mind:

- Early registration opens approximately three to four months before each testing period.

- Late registration is available closer to the test window but may incur additional fees.

- Registrations must be completed by the designated deadlines to guarantee participation in the assessment.

Test Window and Deadlines

The assessment process is divided into several testing periods throughout the year. These are the times when you can actually sit for the required portions. Be sure to mark these periods in your calendar to avoid missing any opportunity:

- First Window: January 1 – March 31

- Second Window: April 1 – June 30

- Third Window: July 1 – September 30

- Fourth Window: October 1 – December 31

Staying on top of these key dates helps you manage your study schedule and plan the most efficient approach to your preparation. Make sure to confirm these deadlines with official sources to avoid missing any critical requirements.

Understanding the CPA Exam Calendar

Familiarizing yourself with the official schedule for certification assessments is essential to staying organized throughout the preparation process. This calendar outlines the critical periods when registration opens, when testing windows are available, and the deadlines you must meet to secure your place. By understanding the structure of the schedule, you can plan your study time more effectively and avoid any last-minute surprises.

The calendar is typically divided into multiple testing periods throughout the year, each lasting a few months. These periods are your opportunity to take the required assessments. It is important to be aware of the registration windows as well, as they determine when you can officially sign up to participate. Missing these windows can result in delays, forcing you to wait for the next available opportunity.

Additionally, the calendar includes key milestones, such as when registration opens, when it closes, and when results are expected. These milestones allow you to pace your study and ensure you’re ready by the time your test window arrives.

How to Register for the CPA Exam

Registering for the certification assessments is a crucial step in your professional journey. The process is typically completed online through an official portal, and it requires meeting specific eligibility criteria and deadlines. Proper registration ensures that you’re placed in the correct testing window and that all necessary paperwork is processed before the assessment.

Steps to Complete the Registration

The registration process generally involves the following steps:

- Step 1: Verify your eligibility by meeting all educational and professional requirements.

- Step 2: Create an account on the official registration website.

- Step 3: Select your desired testing period based on your preparation timeline.

- Step 4: Submit your application along with any required documentation and fees.

- Step 5: Receive confirmation of your registration and a seat in your chosen testing window.

Important Considerations

When registering, make sure to double-check the deadlines for registration and payment. Missing these can delay your ability to take the assessments. Additionally, certain states or jurisdictions may require extra steps, so be sure to check the local rules to avoid complications.

Important Deadlines for 2025 CPA Exam

To successfully navigate the certification process, it’s essential to keep track of all important deadlines. These include registration cutoffs, payment deadlines, and the final dates for submitting necessary documentation. Adhering to these deadlines ensures that you can take the required assessments without delay and remain on track for your certification goals.

Key Registration Deadlines

Each testing period has its own set of deadlines that must be met for successful registration. Missing these deadlines can result in delays or additional fees. Below is an overview of typical registration timelines for each assessment cycle:

| Registration Period | Start Date | End Date |

|---|---|---|

| First Testing Window | December 1 | January 15 |

| Second Testing Window | March 1 | April 15 |

| Third Testing Window | June 1 | July 15 |

| Fourth Testing Window | September 1 | October 15 |

Other Crucial Deadlines

In addition to the registration deadlines, there are other critical milestones you must meet:

- Application Submission: Submit your application and documentation well in advance of the registration period.

- Payment Deadline: Ensure your payment is processed by the registration cutoff to avoid delays or issues with securing your seat.

By keeping track of these dates and planning accordingly, you can stay ahead of the process and avoid any last-minute stress. Make sure to consult the official calendar regularly to ensure you are meeting all deadlines.

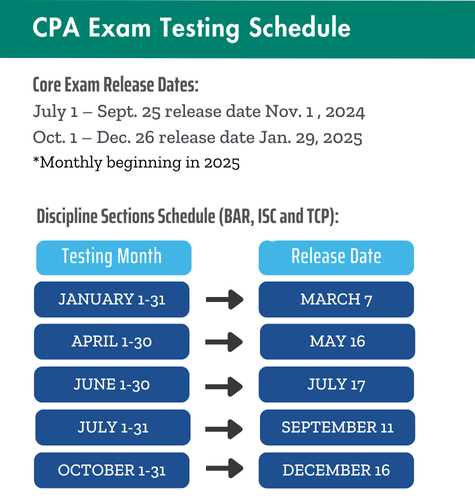

Test Window Schedule for 2025

The schedule for the upcoming assessment windows is an essential part of your preparation strategy. These timeframes are when you are eligible to take the required portions of the certification process. Knowing the exact start and end dates for each period helps you plan effectively and avoid last-minute rushes. Understanding these windows is vital for scheduling study time and coordinating other activities related to your professional goals.

Overview of Testing Periods

Each year, there are several key periods during which the assessments are conducted. The testing windows are typically organized into four distinct blocks, spread throughout the year. Below is a breakdown of these important periods:

- First Testing Window: January 1 to March 31

- Second Testing Window: April 1 to June 30

- Third Testing Window: July 1 to September 30

- Fourth Testing Window: October 1 to December 31

Maximizing Your Preparation Within Test Windows

To make the most of each testing window, it’s important to schedule your preparation around these key timeframes. Align your study sessions with the start of each window and ensure that all necessary prerequisites are completed well before testing begins. With proper planning, you can approach each window with confidence and be fully prepared for the assessments.

How to Plan Your CPA Exam Date

Choosing the right time to take the required certification assessments is crucial for ensuring optimal performance. Planning your test date involves balancing your preparation schedule, personal commitments, and the specific testing windows available. By carefully selecting the best date for your situation, you can maximize your chances of success and reduce unnecessary stress.

The key to planning effectively is to start by reviewing your study progress and estimating how much time you will need to fully prepare. Once you have a clear idea of your readiness, align it with the testing periods and registration deadlines. This way, you can secure your spot at a time that works best for your schedule while ensuring that you have enough time to focus on your preparation without distractions.

Additionally, consider any personal obligations or other professional commitments that may affect your ability to fully dedicate time to studying. Factor in any potential challenges that could arise and choose a testing window that gives you the flexibility to manage your time effectively.

What Affects CPA Exam Scheduling

Several factors can influence when and how you schedule your certification assessments. Understanding these factors is essential for selecting the right time to take the required portions and ensuring you are fully prepared. From registration availability to personal commitments, a number of elements play a role in shaping your scheduling decisions.

The following are the key factors that can affect the timing of your assessments:

- Registration Deadlines: Each testing period has specific registration cutoffs. Failing to meet these deadlines may result in having to wait for the next available window.

- Testing Window Availability: The assessment process is divided into multiple testing windows throughout the year. Availability in these periods is limited, and choosing the right one requires careful planning.

- Preparation Time: Adequate preparation is crucial. You need to assess your readiness before selecting a testing window. This involves evaluating your study schedule and ensuring you have enough time to cover all topics.

- Personal and Professional Commitments: Personal obligations, vacations, or work-related responsibilities can impact your ability to dedicate time to study and take the assessment. Be sure to choose a period that does not conflict with important commitments.

- Availability of Testing Centers: Depending on your location, the availability of testing centers may influence when you can take the assessments. Popular locations may have limited slots, especially during peak periods.

By considering these factors, you can better align your schedule with your preparation needs, ensuring a smoother and less stressful certification process. Planning ahead is the key to achieving your goals on time.

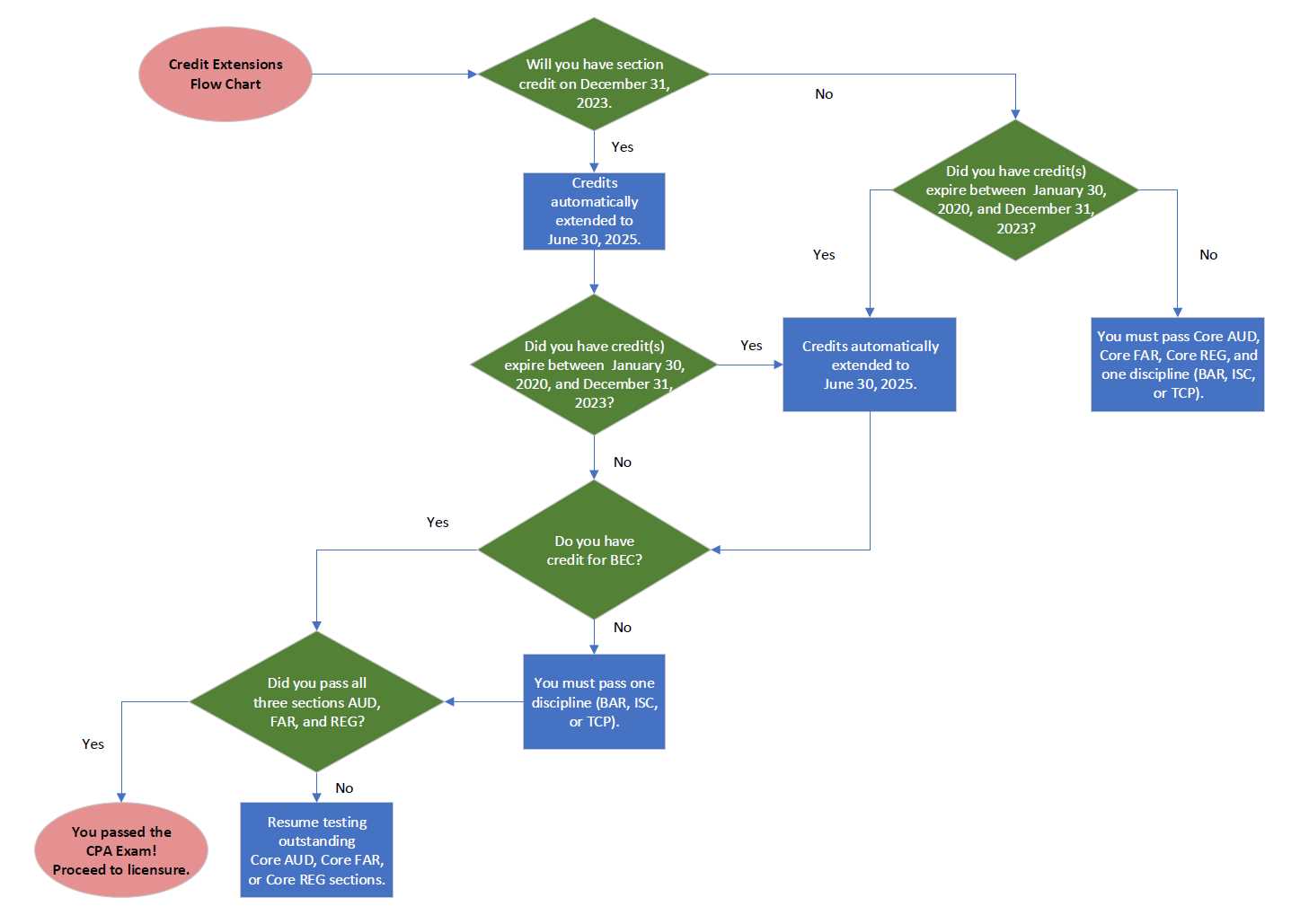

Changes to 2025 CPA Exam Schedule

Each year, adjustments to the testing schedule may occur due to various factors, such as new policies or changes in regulations. These alterations can impact when and how you approach the assessment process, so it is essential to stay informed about any modifications to ensure that your plans remain on track. Understanding these shifts allows for better preparation and prevents unnecessary surprises.

In 2025, several key changes may affect how the assessments are scheduled:

- New Testing Windows: The introduction of additional testing windows or shifts in existing ones could offer more flexibility, allowing candidates to choose from a wider range of dates.

- Changes to Registration Deadlines: Deadlines for registration might be adjusted, which could impact when you need to submit your application and payment.

- Adjustment to Testing Locations: Some regions may see a change in the availability of testing centers, influencing where and when candidates can take their assessments.

- Updated Scheduling Policies: New rules regarding scheduling or rescheduling tests could affect how easily you can modify your chosen test date, should you need to do so.

It is important to stay updated by regularly checking official announcements and reviewing the schedule changes as they are published. By doing so, you can ensure that your test preparation and registration plans are aligned with the latest updates and policies.

Location Availability for the 2025 Exam

When planning for the required assessments, one of the most crucial aspects is determining where you can take the test. Availability of testing centers can vary based on location, and understanding these options is essential for ensuring a smooth process. Factors such as regional demand, infrastructure, and the timing of the testing periods all influence where you can sit for the required portions of the certification.

Factors Affecting Location Availability

The availability of testing locations is determined by several factors:

- Regional Demand: Some areas have a higher demand for test slots, especially during peak periods, which may lead to limited availability. Early registration can help secure a spot in these high-demand areas.

- Proximity to Test Centers: In more remote areas, there may be fewer testing centers available, which can affect your scheduling options and require additional travel time.

- Scheduling Conflicts: Certain testing locations may be booked for other events or maintenance during specific timeframes, reducing the available windows for assessments in those areas.

How to Check Availability

Before finalizing your registration, it is crucial to check the availability of test locations in your area. Most testing agencies provide an online tool where you can search for open centers based on your preferred dates and location. Make sure to plan ahead, as popular locations tend to fill up quickly, especially during high-demand periods.

CPA Exam Format and Dates for 2025

Understanding the structure of the certification assessments and the available time slots for 2025 is essential for effective planning. The format of the certification process is divided into specific sections, each testing distinct knowledge areas. By familiarizing yourself with the structure and timing, you can better allocate your study efforts and plan for the right testing window that fits your schedule.

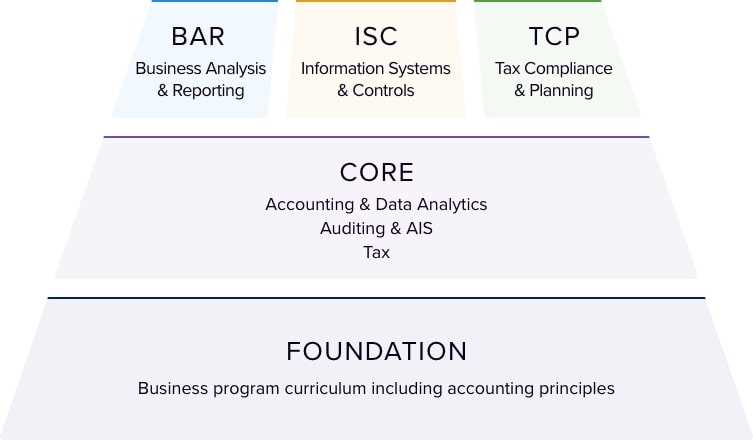

Structure of the Certification Process

The certification process typically includes multiple sections, each designed to evaluate different aspects of your professional expertise. Each section consists of a combination of multiple-choice questions, task-based simulations, and written communication tasks. Below is a general breakdown of the structure:

- Multiple-Choice Questions: These questions assess your theoretical knowledge and understanding of key principles and practices.

- Task-Based Simulations: These are designed to test your practical application of knowledge in real-world scenarios.

- Written Communication Tasks: These assess your ability to clearly communicate complex ideas in writing, which is an essential skill in the profession.

Available Testing Windows and Scheduling

It is important to be aware of the testing windows throughout the year to ensure you can take the assessment at a time that suits your preparation. Testing is typically divided into specific windows with set registration deadlines. Carefully review the available windows and schedule your assessment well in advance to secure your preferred time and location.

Common Mistakes in CPA Exam Scheduling

When planning for professional assessments, careful scheduling is crucial to avoid unnecessary stress or missed opportunities. Many candidates make common errors during the process that can lead to complications later. Recognizing and understanding these mistakes beforehand can help ensure a smoother experience and prevent setbacks during the testing cycle.

Some of the most frequent mistakes include:

- Waiting Too Long to Register: Procrastination often leads to limited testing options. Delaying registration can result in fewer available slots or having to choose a less ideal testing window.

- Not Considering Test Center Availability: It’s important to check availability at your preferred test centers. Some locations may have limited slots, especially during peak periods, so it’s wise to book early.

- Overlooking Rescheduling Policies: Life circumstances may require rescheduling, but candidates often forget to review the policies and fees related to changes in their testing plans.

- Underestimating Preparation Time: Many candidates underestimate the amount of study time required before their scheduled assessments. Failing to account for adequate preparation can lead to rushed studying and lower performance.

- Not Staying Updated with Changes: Regulations and scheduling policies can change, and failure to stay informed about these updates can cause issues in the registration process.

By avoiding these common pitfalls, you can better manage your schedule and approach the assessment process with confidence and clarity.

How to Reschedule Your CPA Exam

Sometimes unexpected events can prevent you from attending your scheduled assessments. In such cases, it’s essential to know how to reschedule your testing appointment without facing unnecessary delays or additional fees. The process of rescheduling is straightforward, but it requires attention to detail and adherence to the policies set by the testing organization.

Steps for Rescheduling Your Appointment

To reschedule your assessment, follow these key steps:

- Check Rescheduling Policies: Review the rescheduling guidelines provided by the testing authority. Most organizations allow changes to the schedule but have specific rules regarding timing and fees.

- Log into Your Account: Access the online portal where you registered. This will allow you to modify your appointment or find alternative dates that fit your schedule.

- Choose a New Slot: Once logged in, select a new date and time that works better for you. Keep in mind that some locations may have limited availability, so be prepared for the possibility of fewer options.

- Confirm and Pay Fees: After selecting your new time, confirm the change and make any necessary payments, especially if there are additional rescheduling fees.

Considerations Before Rescheduling

Before rescheduling, take the following factors into account:

- Time Constraints: Ensure that your new chosen date allows you enough time for preparation. Avoid choosing a slot that’s too close to your desired completion deadline.

- Test Center Availability: Be aware that some testing locations may not offer open slots in your preferred timeframe, especially during busy periods.

- Extra Costs: Some testing organizations charge a fee for rescheduling. Review the cost and factor it into your decision.

Rescheduling can be a simple process when handled early. Staying on top of policies and timing will ensure that you can select a new appointment with minimal disruption to your study plans and goals.

CPA Exam Timing and Duration in 2025

Understanding the time constraints and total duration for your professional assessments is crucial for effective preparation and performance. Each testing section is carefully structured, with specific time limits that candidates must adhere to. By knowing how long you have for each part of the process, you can plan your study sessions and pace yourself appropriately during the assessment.

Breakdown of Testing Time

The total time required for each section of the assessment varies, but it typically consists of multiple parts that candidates need to complete within a set period. Below is an outline of the approximate durations:

- Section 1: Typically lasts around 3 hours, with a combination of multiple-choice questions and task-based simulations.

- Section 2: Requires approximately 4 hours to complete, including both multiple-choice and scenario-based tasks.

- Section 3: Can take up to 2.5 hours, involving specialized tasks that require critical thinking and problem-solving abilities.

Preparation for Timed Conditions

To maximize your efficiency and manage your time effectively during the testing process, consider the following tips:

- Practice Time Management: Familiarize yourself with the time limits by practicing under timed conditions. This helps build confidence and ensures you’re prepared for the pressure of a limited timeframe.

- Prioritize Questions: In time-sensitive assessments, it’s essential to prioritize questions that are easier or quicker to answer, leaving more challenging ones for later.

- Take Strategic Breaks: For long sessions, small breaks can help maintain focus. Understand the rules about when and how long you can take a break during testing.

Properly managing the allotted time for each section is vital for success. By planning ahead and practicing under real conditions, you can approach your assessment with confidence and complete it within the time constraints.

Preparing for CPA Exam Dates

Effective preparation is the key to performing well in any professional assessment. Knowing when and how to schedule your sessions is only part of the process–being thoroughly prepared for each part is equally important. In order to succeed, you need a structured approach that aligns with your study schedule and ensures you are well-equipped on the day of your assessment.

Creating a Study Plan

One of the first steps in preparation is to design a study plan. This plan should outline the amount of time you will dedicate to each subject area and detail the topics to cover. Ensure that your study plan is:

- Realistic: Set aside enough time for each topic based on its complexity.

- Flexible: Account for any unexpected events or changes in your schedule.

- Balanced: Focus on weak areas without neglecting strengths.

Understanding the Format and Timing

It’s essential to be familiar with the format and timing of each segment. This helps reduce any surprises on the day of your assessment and allows you to pace yourself effectively. Consider the following:

- Time management: Know how long each section will take and practice completing tasks within that time frame.

- Question types: Be prepared for multiple-choice questions, simulations, and other formats that may appear.

- Breaks: Understand when you can take breaks and how they fit into your time management strategy.

By carefully planning ahead and staying consistent in your preparation, you’ll feel more confident and perform better when the time comes.

What to Expect on Your Exam Day

The day of your professional assessment is crucial to your success. Proper preparation and understanding of what to expect will help reduce anxiety and set you up for a positive experience. On the day of your test, you’ll need to be prepared both mentally and physically for the challenges that lie ahead.

Arriving at the Testing Center

It’s important to arrive early to the testing center. Here’s what you can expect when you arrive:

- Identification: Bring proper identification with you as required by the testing agency. Without it, you may not be allowed to take the test.

- Check-in process: Expect a security check, including biometric scanning or other identity verification procedures.

- Waiting time: Arrive with plenty of time to account for any waiting periods before you enter the exam room.

During the Assessment

Once you begin the assessment, there are several key factors to keep in mind:

- Time management: You’ll be given a set time limit for each section, so stay aware of the clock.

- Testing environment: The environment will be controlled, with no outside distractions, but you may be monitored for security purposes.

- Breaks: You’ll likely have scheduled breaks. Use them wisely to recharge without rushing.

Remember, staying calm and focused throughout the process is essential. By being well-prepared, you can navigate each step with confidence and ease.

Post-Exam Process and Next Steps

After completing your professional assessment, the next phase involves several important steps. This period is crucial for reviewing your performance and understanding the next actions required for continuing your journey toward certification. While waiting for results, it’s essential to stay informed and take proactive measures.

Receiving Your Results

Results are typically delivered within a few weeks after you complete your test. Here’s what to expect:

- Result notification: You will be notified through the official platform once your scores are available.

- Score review: Carefully review your score report to identify areas where you may need improvement.

- Score validity: Ensure that your results are valid for the required timeframe to maintain eligibility for certification.

Next Steps After Receiving Results

Once you receive your results, here are the possible next steps:

- Pass: Congratulations! Now you can focus on preparing for the next steps in your career, including any further professional requirements.

- Fail: If you didn’t achieve the desired score, take time to analyze your performance and plan your retake. Consider additional study materials or courses.

- Retaking the Test: If necessary, plan your retake, following the guidelines provided by the testing organization. Ensure to review your weak areas to improve your chances next time.

Stay focused, whether you’re moving forward or preparing for a retake. The post-assessment process plays a key role in ensuring you’re on the right track toward achieving your professional goals.