Achieving success in a financial software proficiency test requires more than just understanding basic functions. It demands a clear grasp of key principles, practical experience, and the ability to navigate complex scenarios efficiently. With proper preparation, individuals can demonstrate their expertise and advance their career in financial management.

In this section, we’ll explore the essential steps to take before sitting for a professional qualification assessment. From understanding the core components of the software to mastering critical operations, every detail matters. Preparation not only involves theory but also hands-on practice, ensuring that you’re fully ready to handle any question that may arise.

Developing a comprehensive study plan is crucial. It’s not enough to simply memorize facts–candidates must be able to apply their knowledge to real-world challenges. By practicing with sample tasks and familiarizing oneself with the interface, individuals increase their confidence and readiness for the assessment.

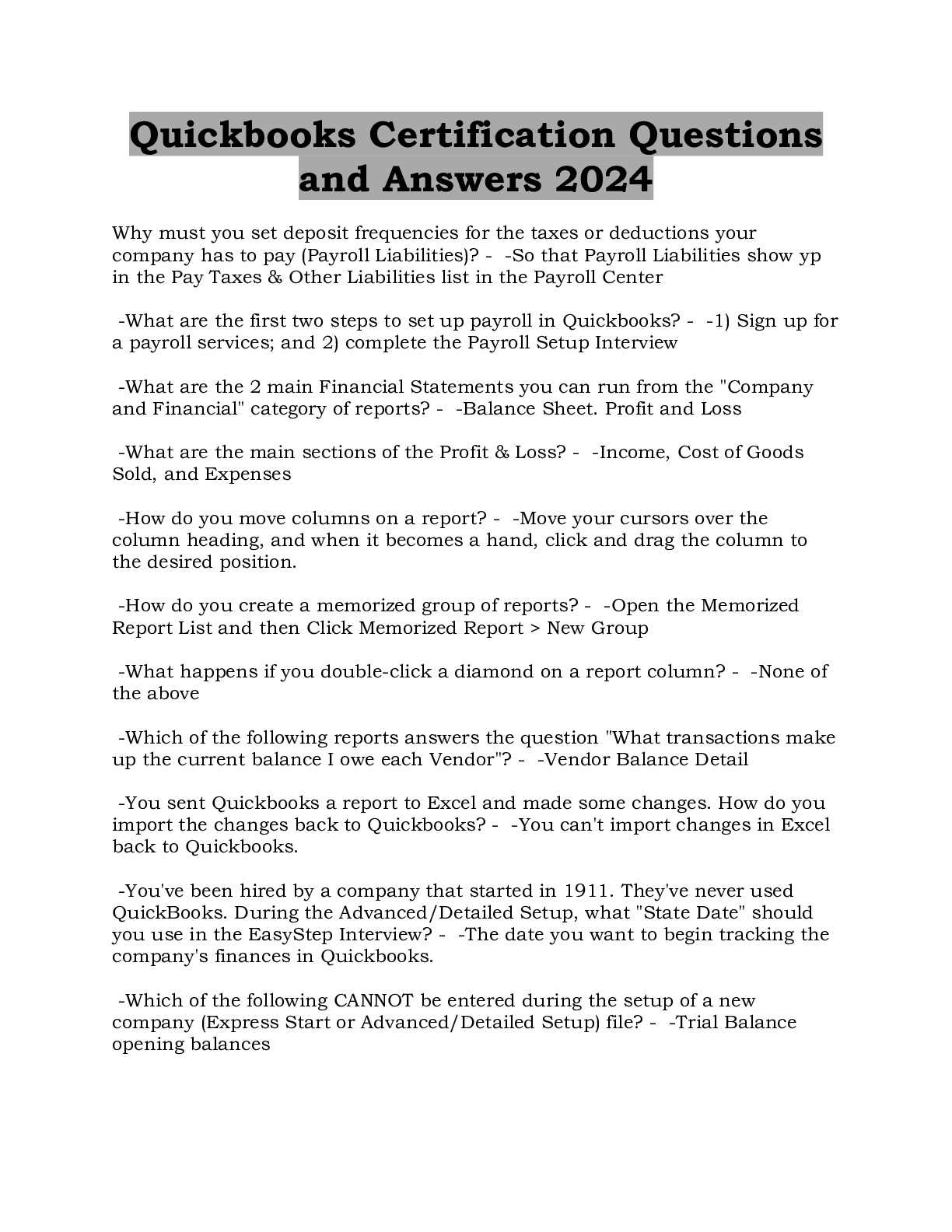

Answers to QuickBooks Online Certification Exam

Passing a proficiency test for financial management software is a key step in showcasing your expertise and readiness for professional tasks. The test evaluates a wide range of skills, including understanding the software’s functions, handling accounting tasks, and interpreting complex financial data. Proper preparation is essential to ensure success, as candidates must demonstrate both theoretical knowledge and practical experience.

Key Areas to Focus On

To excel in the assessment, focus on the most important areas that are frequently tested. These include managing financial transactions, generating reports, and reconciling accounts. A solid understanding of these operations is crucial, as they form the foundation of the software’s core functions. Furthermore, candidates must be prepared to apply this knowledge to real-world scenarios, where problem-solving skills are essential.

Effective Study Strategies

One of the most effective strategies for preparing for this test is to practice with sample tasks that mirror the types of questions you will encounter. Hands-on experience is invaluable, as it enables you to become familiar with the interface and the processes involved in completing typical accounting functions. In addition, reviewing case studies or practice exams can help identify any knowledge gaps and reinforce key concepts.

How to Prepare for Financial Software Proficiency Test

Proper preparation is key when it comes to successfully completing an assessment for financial management tools. Achieving proficiency involves understanding both the theoretical aspects and the practical application of the software. It’s important to focus on key skills, study effectively, and utilize available resources to increase your chances of passing the test.

Essential Steps for Effective Preparation

Start by reviewing the core functions of the software and understanding how they are applied in real-world accounting tasks. The following steps can help guide your study process:

- Familiarize yourself with the software’s interface and common features.

- Understand basic accounting principles and how they apply within the system.

- Practice using the software through exercises or simulations.

- Identify key tasks such as invoicing, payroll, and financial reporting.

Study Tips and Resources

In addition to hands-on practice, utilizing various study materials is crucial. Here are some tips to optimize your study time:

- Take advantage of free tutorials and courses available online.

- Work through practice exams to become familiar with the question format.

- Join forums or discussion groups where you can exchange tips and insights with other learners.

- Read up on common mistakes to avoid and best practices for using the software effectively.

Key Concepts to Master for Success

To achieve success in a financial software proficiency assessment, mastering several fundamental concepts is crucial. These core ideas will not only guide you through the test but also ensure that you can apply your knowledge efficiently in real-world scenarios. Understanding these key areas will build a strong foundation for tackling various tasks and solving problems effectively.

Essential Accounting Functions

One of the most important aspects of any financial software is its ability to manage essential accounting tasks. To perform well, it’s necessary to understand the following concepts:

- Recording and categorizing financial transactions accurately.

- Creating and managing invoices, bills, and receipts.

- Tracking expenses, revenue, and profits.

- Reconciling accounts and balancing ledgers.

Generating and Interpreting Reports

Another critical skill is the ability to generate and analyze various financial reports. These reports provide essential insights into the health of a business. Key areas to master include:

- Creating profit and loss statements.

- Generating balance sheets.

- Understanding cash flow reports and financial summaries.

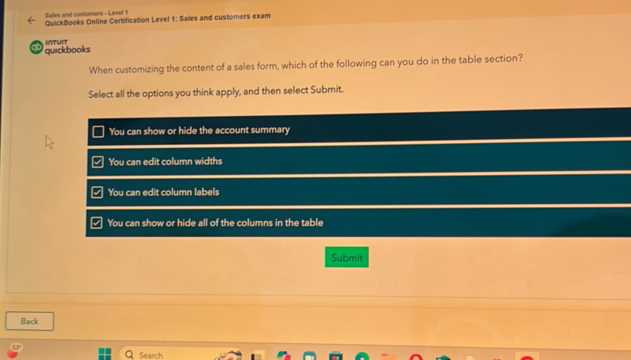

- Customizing reports to suit specific business needs.

Understanding Financial Software Features

In order to succeed in any proficiency assessment, it’s essential to fully grasp the key features of the financial management software. These tools are designed to simplify complex tasks such as tracking finances, managing transactions, and generating reports. A clear understanding of the software’s capabilities will enable users to perform tasks efficiently and accurately, ultimately leading to success in the test.

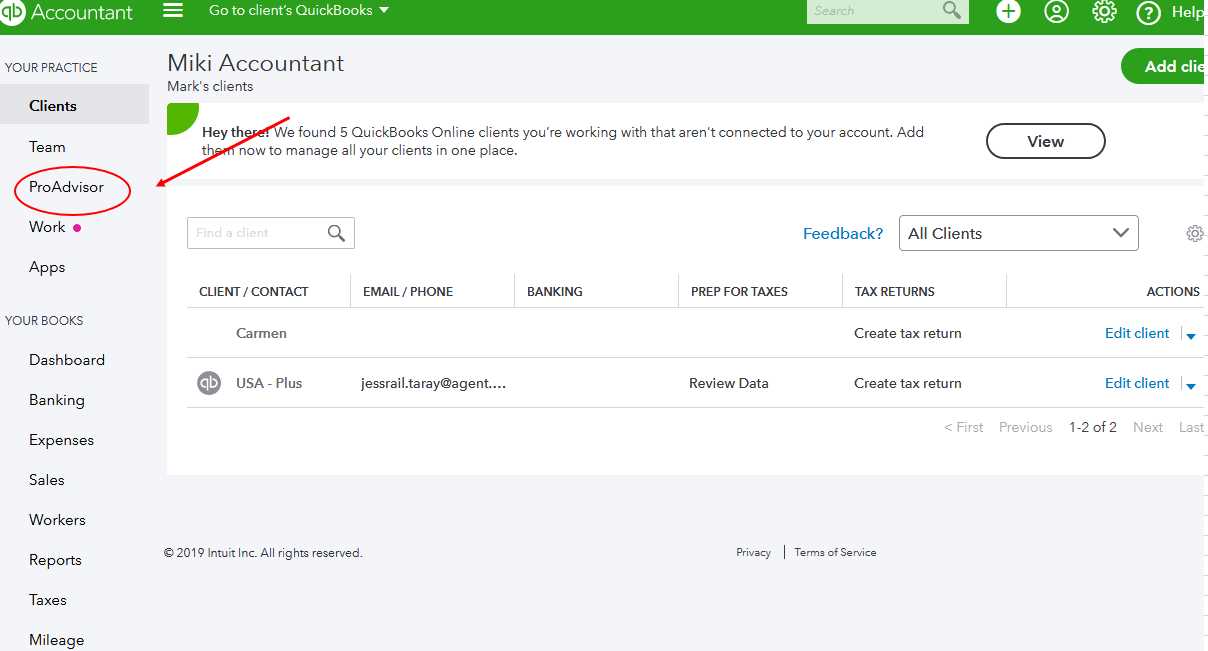

Key features include user-friendly interfaces for handling daily financial operations, customizable reports, automated processes for recurring tasks, and the ability to integrate with other business tools. Mastering these functionalities will not only help you navigate the test confidently but also prepare you for real-world accounting and financial management challenges.

Common Mistakes During the Assessment

During any proficiency assessment, it’s easy to make errors that can negatively impact your performance. These mistakes often arise from misunderstanding instructions, rushing through questions, or overlooking key details. Recognizing these common pitfalls and knowing how to avoid them can greatly improve your chances of success.

Many candidates fail to carefully read questions or misinterpret the tasks at hand, leading to incorrect answers. Others may focus too much on minor details while missing the bigger picture. Another common issue is inadequate time management, where individuals spend too long on a single section and fail to complete the rest. By being aware of these mistakes and practicing effective strategies, you can approach the test with more confidence and precision.

Time Management Tips for the Test

Effective time management is one of the most crucial aspects of performing well in any assessment. Without a proper strategy, it’s easy to run out of time, leaving important tasks incomplete. By planning ahead and allocating time wisely, you can ensure that you complete each section to the best of your ability.

Start by familiarizing yourself with the test structure so you can anticipate how much time to spend on each part. It’s important to pace yourself and avoid spending too much time on difficult questions. If you encounter a challenging task, consider moving on and coming back to it later. This approach allows you to maximize your efficiency and tackle easier questions first, boosting your confidence.

Another helpful tip is to set time limits for each section before you begin. Having a clear idea of how long you should spend on each task can help keep you focused. Regularly check the clock and stay aware of your progress throughout the test. By managing your time carefully, you’ll be able to approach the assessment with a clear and organized mindset.

Exploring Accounting Topics for Success

To master the financial management software and perform well on related assessments, it is essential to understand the various accounting topics it covers. These concepts form the backbone of the software’s functionality and are frequently tested in proficiency evaluations. Gaining a solid grasp of these areas will help you handle key tasks with confidence and precision.

The most important topics to explore include:

- Basic Accounting Principles: Understanding debits, credits, and the double-entry system is crucial for accurate record-keeping.

- Managing Financial Transactions: Learn how to record income, expenses, and other transactions efficiently.

- Invoicing and Billing: Get familiar with creating, sending, and tracking invoices for different clients or services.

- Bank Reconciliation: Master the process of comparing and matching internal financial records with bank statements.

- Payroll Management: Understand how to manage employee payments, tax deductions, and other payroll-related tasks.

Additionally, it is important to learn how to interpret and generate key financial reports:

- Profit and Loss Statements

- Balance Sheets

- Cash Flow Reports

- Custom Reports for business insights

Focusing on these fundamental topics will give you the knowledge required to excel in any financial management test, ensuring both accuracy and efficiency in your tasks.

Importance of Practical Experience

While studying theoretical concepts is essential, hands-on practice plays a critical role in mastering financial management tools. Practical experience allows you to apply what you’ve learned in real-world scenarios, helping to solidify your understanding and improve your problem-solving skills. The more you work directly with the software, the more confident and efficient you become in navigating its various features.

Bridging the Gap Between Theory and Practice

It’s easy to memorize steps or procedures, but without actual application, it’s difficult to grasp how those concepts function in everyday use. Practical experience offers a chance to work with live data, handle complex transactions, and understand how different tasks interrelate within the system. This hands-on approach ensures that you are well-prepared to tackle any challenge that may arise.

Building Confidence and Efficiency

When you gain experience through practice, you not only become more familiar with the software but also develop the ability to complete tasks more efficiently. Repeated exposure to various functions, such as generating reports or reconciling accounts, enables you to navigate them with ease. This confidence in using the software allows you to focus on the problem at hand rather than getting caught up in figuring out how to use the system itself.

What to Expect on the Assessment

Before taking any proficiency assessment, it’s important to have a clear understanding of what the process will entail. Knowing what to expect can help reduce anxiety and improve performance. This test will focus on evaluating your ability to effectively use financial management software and your understanding of key accounting concepts and practices.

The assessment typically includes a mix of multiple-choice questions, practical scenarios, and problem-solving tasks. You will be asked to demonstrate your knowledge of essential features such as managing transactions, generating reports, and handling accounting processes. Additionally, some sections may test your ability to work under time constraints, so it’s important to stay focused and manage your time wisely.

Top Resources for Learning Financial Management Software

To effectively prepare for proficiency assessments, it’s essential to utilize high-quality resources that help you master key concepts and tools. Whether you’re just starting or looking to deepen your knowledge, various materials can guide you through essential functions, best practices, and troubleshooting. Accessing the right resources can significantly enhance your learning experience and boost your confidence.

Some of the top resources include:

- Official Software Training – Many providers offer official tutorials, guides, and video lessons that cover everything from basic tasks to advanced features.

- Online Forums and Communities – Platforms such as user groups, discussion boards, and forums allow you to connect with other learners and professionals to exchange tips, tricks, and advice.

- Video Tutorials – Websites like YouTube feature comprehensive video tutorials that demonstrate step-by-step processes, helping you visualize the tasks you need to master.

- Books and E-Books – In-depth books often offer structured learning paths and provide explanations for more complex concepts. These can be great resources for both beginners and advanced learners.

- Practice Software – Using a practice version of the software lets you experiment in a risk-free environment, making it easier to understand how each tool works and how to use them effectively.

By tapping into these resources, you can develop the necessary skills and knowledge to succeed in any financial management task or proficiency assessment.

Preparing with Practice Assessments

One of the most effective ways to prepare for any proficiency evaluation is by practicing with mock tests. These simulations allow you to experience the format and difficulty level of the actual assessment, helping you become familiar with the types of questions and tasks you’ll encounter. Regular practice also aids in managing time and building confidence for the real test.

Here are a few benefits of using practice assessments as part of your preparation strategy:

- Familiarity with Question Formats: Practice assessments provide insight into the typical structure of questions, whether they are multiple choice, practical scenarios, or problem-solving tasks.

- Identifying Knowledge Gaps: Taking practice tests allows you to pinpoint areas where you may need to focus more attention, ensuring you address any weaknesses before the actual evaluation.

- Time Management: Practicing under timed conditions helps you become more efficient and ensures you don’t spend too much time on any one task during the real assessment.

- Reducing Test Anxiety: Regular exposure to the assessment format helps alleviate nervousness and boosts self-assurance, allowing you to perform your best on the actual day.

By incorporating practice assessments into your study routine, you can approach your proficiency evaluation with confidence, knowing that you’re well-prepared for whatever challenges may arise.

Assessment Format and Question Types

Understanding the structure and types of questions in any proficiency assessment is essential for effective preparation. Being familiar with the layout and the kinds of tasks you’ll be asked to complete can help you manage your time efficiently and approach the evaluation with confidence. The format is designed to assess both your theoretical knowledge and practical application of essential tasks.

Multiple-Choice Questions

One of the most common question formats used in proficiency evaluations is multiple-choice. These questions typically offer a scenario or problem, followed by several possible answers. Your task is to select the most accurate option based on your understanding of the tools and concepts. Multiple-choice questions test your ability to recognize correct solutions and your grasp of key functionalities.

Practical Scenarios and Case Studies

In addition to theoretical questions, many assessments include practical scenarios. These questions require you to apply what you’ve learned to real-world situations. You may be asked to solve problems, such as generating a financial report or reconciling accounts, using the software. These tasks test your ability to efficiently execute specific functions and demonstrate your hands-on experience.

Being prepared for a variety of question types ensures that you’re ready to tackle any aspect of the assessment, whether it’s theoretical knowledge or practical execution. A balanced approach to studying, covering both types of questions, will increase your chances of success.

How to Study Effectively for Proficiency

Studying for a proficiency evaluation requires a focused and strategic approach. To ensure success, it’s essential to balance theory and practical application while also managing time effectively. A well-structured study plan will help you cover all the necessary topics and retain the critical knowledge required for the assessment.

Here are some tips to help you study effectively:

- Set Clear Goals: Break down your study material into manageable sections and set specific goals for each study session. This will keep you on track and ensure you cover all essential areas.

- Practice Regularly: Regular practice with hands-on tasks is key to reinforcing concepts. The more you work with the software and simulate real-world tasks, the more comfortable you’ll become.

- Use a Variety of Resources: Don’t limit yourself to just one source of information. Use books, online tutorials, practice tests, and forums to gain a well-rounded understanding of the material.

- Take Breaks: Studying for long hours without breaks can lead to burnout. Take short breaks to recharge and avoid mental fatigue.

- Review and Revise: Go over what you’ve learned periodically to reinforce your memory. Revising key points will help you retain information long-term.

By following these strategies and staying consistent, you’ll increase your chances of achieving success in any proficiency assessment.

Understanding Reporting Functions

Effective financial management relies heavily on the ability to generate and interpret various reports. Reporting functions allow users to analyze business performance, track financial health, and make informed decisions. Mastering these tools is essential for anyone looking to demonstrate proficiency in managing financial data and operations.

Reports can be divided into several categories, each focusing on a different aspect of financial operations. These categories typically include profit and loss statements, balance sheets, cash flow summaries, and tax-related reports. Understanding how to generate, customize, and interpret these reports is key to unlocking insights and ensuring accurate financial management.

| Report Type | Purpose | Key Metrics |

|---|---|---|

| Profit and Loss | Summarizes revenue, costs, and expenses over a period | Revenue, Gross Profit, Net Income |

| Balance Sheet | Displays assets, liabilities, and equity at a specific point | Assets, Liabilities, Owner’s Equity |

| Cash Flow | Tracks the inflow and outflow of cash within a business | Cash Inflows, Cash Outflows, Net Cash Flow |

| Tax Reports | Generates necessary information for tax filings | Taxable Income, Deductions, Tax Liabilities |

By understanding and utilizing these reporting functions, individuals can ensure they have the data necessary to make sound financial decisions and maintain accurate records. Mastery of these tools is a critical component for achieving proficiency in financial management tasks.

Exam Day Tips for Certification

On the day of an important assessment, how you prepare and manage your time can make all the difference in achieving success. Proper preparation extends beyond studying and includes creating the right mindset and ensuring you’re physically and mentally ready. Effective strategies can reduce stress, improve focus, and help you perform to the best of your ability.

In addition to reviewing the material, there are key factors to consider on the day of the test itself. The environment you choose, the approach you take to time management, and how you handle difficult questions can all influence your results. Implementing the right techniques will maximize your chances of success.

Time Management Tips

Managing time during the assessment is crucial. It’s important to stay aware of how much time you are spending on each section to avoid rushing through the later questions. Here are some strategies:

| Tip | Description |

|---|---|

| Read Instructions Carefully | Ensure you understand the question before jumping to an answer. This saves time in the long run. |

| Don’t Get Stuck on One Question | If a question seems difficult, move on and return to it later if needed. |

| Allocate Time for Review | Set aside the last 10-15 minutes to go over your answers to ensure accuracy. |

Stress Reduction Techniques

Managing stress is essential for maintaining focus and performance. Here are a few helpful tips to stay calm and collected:

| Technique | Benefit |

|---|---|

| Deep Breathing | Taking a few deep breaths can calm nerves and clear your mind. |

| Positive Visualization | Visualizing success can boost confidence and reduce feelings of anxiety. |

| Take Breaks | Short breaks can help refocus your mind during longer assessments. |

By following these tips, you can approach your assessment day with confidence, ensuring that you are well-prepared, calm, and focused throughout the process.

Post-Exam Steps After Passing the Test

After completing an important assessment and receiving a passing score, there are several key actions to take that will help you capitalize on your achievement and prepare for the next steps in your professional journey. It’s essential to take a moment to reflect on your success, review your performance, and plan ahead for how to leverage your new qualifications.

The post-assessment phase is an important time for personal growth, whether it’s updating your resume, seeking new opportunities, or continuing your education. Here’s a guide to what you should do after passing your assessment:

Celebrate Your Achievement

Passing a challenging test is a significant accomplishment, and it’s important to take the time to celebrate your success. Whether it’s a small personal reward or sharing the news with friends and family, acknowledging your hard work and dedication can boost your confidence and motivation moving forward.

Review Your Performance

Even though you passed the assessment, it’s valuable to reflect on how you performed. Review any areas where you may have struggled or questions that seemed particularly challenging. Understanding where you excelled and where you can improve will help guide your future learning and professional development.

Update Your Resume and LinkedIn Profile

With a new achievement under your belt, it’s time to update your professional profiles. Add the relevant qualifications to your resume, LinkedIn, and any other platforms you use to highlight your skills and experience. This will help you stand out to potential employers and show your commitment to continuous growth.

Look for New Opportunities

Having passed the assessment, you’re now in a stronger position to pursue new career opportunities or take on more advanced responsibilities in your current role. Look for ways to apply the knowledge and skills you gained in your daily work or explore new job prospects that align with your career goals.

Continue Your Learning Journey

One test doesn’t mark the end of your learning journey. Consider pursuing further education, attending workshops, or engaging with communities related to your field to keep developing your expertise. The more knowledge you acquire, the more confident and capable you’ll become in your career.

By taking these steps after passing the assessment, you not only capitalize on your success but also continue to grow and evolve in your professional journey.