Preparing for advanced assessments in finance and business requires a solid understanding of core principles and the ability to apply them in real-world situations. Mastery of key topics ensures success in the evaluation process and boosts confidence during challenging tests.

In this guide, you will find valuable insights into essential topics, strategies for solving complex problems, and tips for effectively reviewing the material. Understanding how to approach the different sections of your study materials will help you tackle the most demanding questions and perform at your best.

Key strategies include reviewing practical examples, reinforcing critical skills, and applying theoretical knowledge in various scenarios. By focusing on the most important concepts, you will be prepared to handle a wide range of challenges that often appear in comprehensive assessments.

Additionally, we provide support with practical exercises that allow you to test your understanding and refine your approach. The more familiar you become with the material, the better prepared you’ll be for success.

Comprehensive Study Guide for Business Assessments

Successfully navigating advanced evaluations in the field of finance requires more than just memorization. It involves a deep understanding of complex principles and the ability to apply them effectively to real-world scenarios. This guide is designed to help you prepare by focusing on the most critical topics and strategies for approaching the toughest challenges.

Understanding Key Concepts

Begin by familiarizing yourself with the fundamental principles that form the foundation of the subject. Focus on areas like financial statements, budgeting, and various forms of business analysis. A clear grasp of these areas will help you make connections between different sections of the material, allowing you to approach questions confidently.

Effective Problem-Solving Techniques

Problem-solving is a critical skill for success. Practicing with a variety of questions, especially those that require detailed calculations or the application of multiple concepts, will help you strengthen this ability. Work through problems systematically, ensuring you understand each step of the process and its relevance to the broader financial landscape.

Key Concepts to Master for the Assessment

Mastering essential topics is crucial for performing well in any comprehensive financial evaluation. Understanding the core principles, such as the preparation and interpretation of financial statements, as well as the intricacies of various business calculations, lays the groundwork for tackling more complex questions. A strong grasp of these concepts will allow you to approach the test with confidence and accuracy.

Core Financial Statements

One of the most important areas to focus on is understanding the structure and components of major financial documents. These statements reflect the health and performance of a business, and being able to read and analyze them effectively is essential. Pay attention to the relationships between the income statement, balance sheet, and cash flow statement, as well as the methods used for their preparation.

Valuation Methods and Calculations

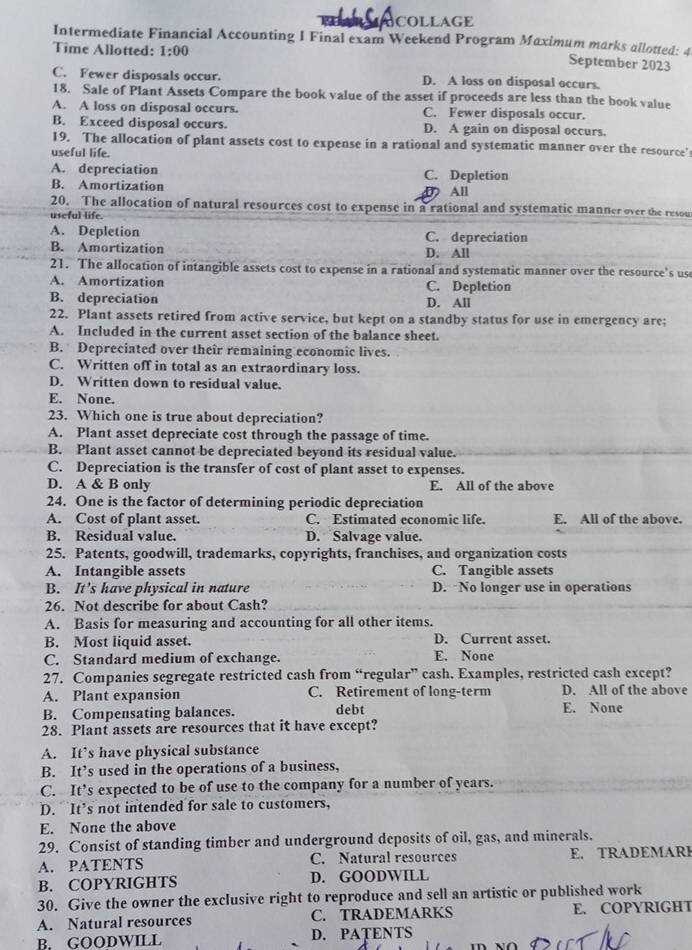

Another key area involves understanding how different business assets are valued and how to apply the appropriate calculations. Whether it is for depreciation, amortization, or asset impairment, the ability to select the right method and perform accurate calculations is critical for success. Regular practice with real-life examples will help reinforce these skills.

| Concept | Description | Importance |

|---|---|---|

| Income Statement | Summarizes a company’s revenues, expenses, and profits. | Crucial for assessing profitability. |

| Balance Sheet | Shows a company’s assets, liabilities, and equity at a specific point in time. | Essential for understanding financial stability. |

| Cash Flow Statement | Tracks the flow of cash in and out of a business. | Helps assess liquidity and operational efficiency. |

| Depreciation | Allocates the cost of an asset over its useful life. | Important for accurate financial reporting and tax calculations. |

Understanding Financial Statements in Depth

Financial documents play a central role in evaluating a company’s overall performance and financial position. Gaining a comprehensive understanding of how these documents are structured, what they represent, and how to interpret the information they provide is essential for anyone looking to excel in business and finance assessments. A deep knowledge of financial statements allows you to make informed decisions and accurately analyze a company’s health.

The three primary financial statements – income statement, balance sheet, and cash flow statement – are interrelated and provide a complete picture of a company’s activities. Each document serves a unique purpose, but together they offer a comprehensive view of profitability, financial stability, and liquidity. Understanding how to read and interpret each of these statements is crucial for tackling complex questions on any comprehensive evaluation.

To fully grasp the importance of these statements, it is vital to understand the key metrics and calculations involved. For instance, the income statement reflects the profitability of a business, detailing revenues, expenses, and net income. The balance sheet, on the other hand, provides a snapshot of a company’s financial position, showing its assets, liabilities, and equity at a specific point in time. Meanwhile, the cash flow statement tracks the inflow and outflow of cash, offering insights into a company’s ability to meet its short-term obligations.

Common Questions on Financial Principles

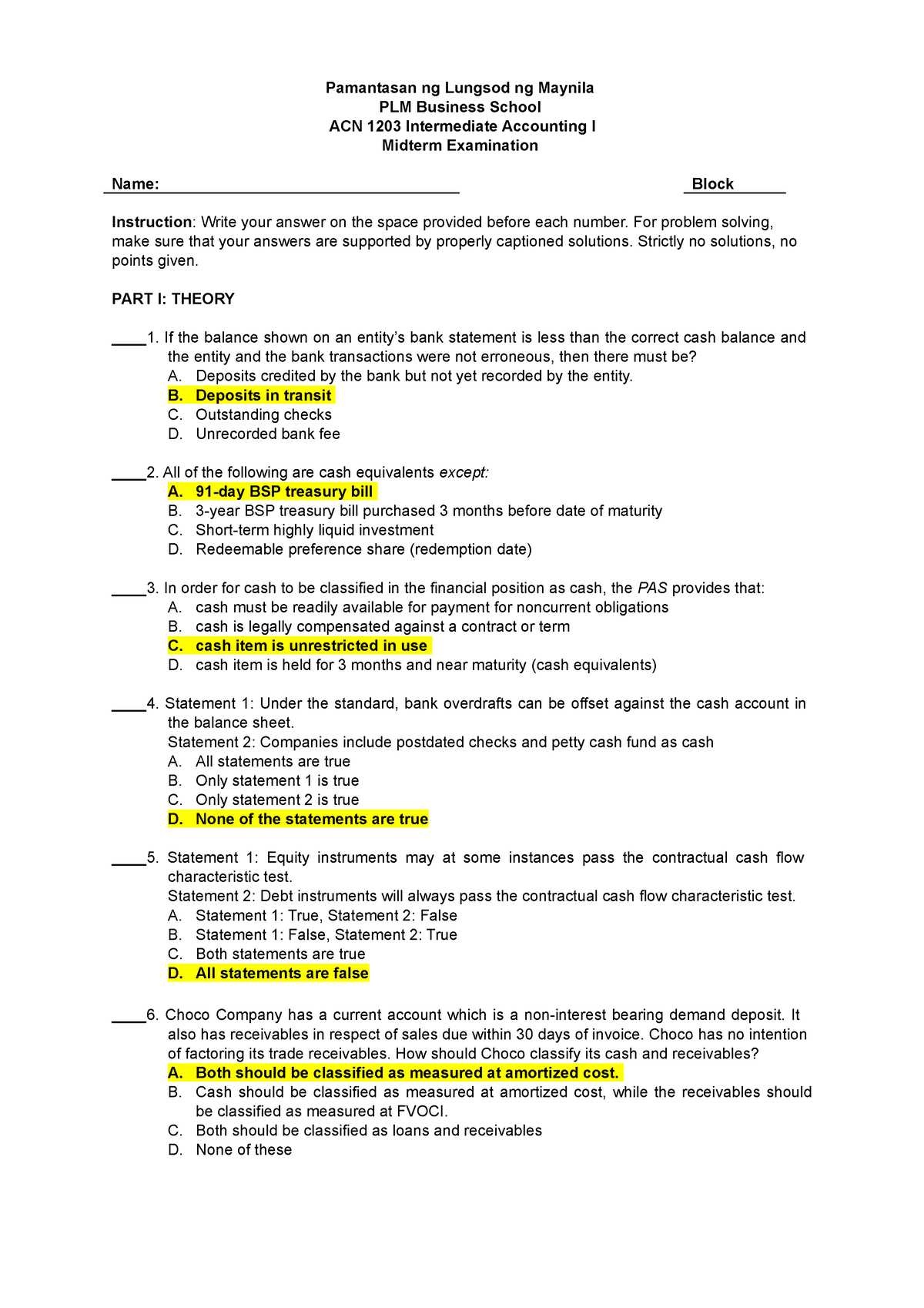

In business evaluations, understanding core financial principles is essential for answering a wide variety of questions. These questions often test your ability to apply foundational concepts to different scenarios, assessing how well you can translate theoretical knowledge into practical solutions. A solid grasp of key principles will help you navigate the complexities of financial analysis and reporting.

Below are some of the most common topics and types of questions that tend to appear:

- Financial Statement Preparation: How do you prepare a comprehensive income statement or balance sheet from provided data?

- Revenue Recognition: What are the criteria for recognizing revenue in different scenarios?

- Asset Valuation: How do you determine the value of assets, including both tangible and intangible items?

- Depreciation Methods: What is the difference between straight-line depreciation and accelerated methods?

- Cash Flow Analysis: How do you evaluate the liquidity of a company using the cash flow statement?

By practicing these types of questions, you will be better prepared for addressing challenges related to financial reports and evaluations. Understanding the underlying principles will enable you to respond with accuracy and confidence.

- Example 1: Given a set of financial figures, calculate net income and determine if the company is profitable.

- Example 2: Given a list of assets and liabilities, prepare a balance sheet using the correct format.

- Example 3: Explain how different revenue recognition methods impact a company’s reported earnings.

How to Approach Multiple-Choice Questions

Multiple-choice questions are designed to test your ability to identify the correct solution from a set of options. While they may seem straightforward at first glance, effectively approaching these questions requires strategy and focus. It’s not only about knowing the right answer but also about eliminating incorrect options and managing your time efficiently.

Effective Strategies for Answering

Here are some strategies to help you tackle multiple-choice questions:

- Read Carefully: Always read each question thoroughly before jumping to the options. Ensure that you understand what is being asked before selecting an answer.

- Eliminate Obvious Wrong Answers: If any options are clearly incorrect, eliminate them right away to narrow down your choices.

- Look for Clues in the Question: Often, the question itself will contain hints or context that point toward the right answer.

- Don’t Overthink: Trust your initial instinct, especially when you are unsure. Overanalyzing can sometimes lead to confusion.

Managing Time and Avoiding Mistakes

Time management is crucial when working through multiple-choice sections. Here are some tips to ensure you stay on track:

- Set Time Limits: Allocate a specific amount of time for each question and stick to it. Move on if you’re stuck on a question to avoid wasting too much time.

- Check for Keywords: Pay attention to keywords in the options such as “always,” “never,” “most likely,” or “least likely.” These words often provide insight into the correct choice.

- Review Your Answers: If time permits, go back and review your answers to ensure that you haven’t missed anything important.

- Example Question 1: What is the correct formula for calculating net income?

- Example Question 2: Which of the following is an example of a liability?

- Example Question 3: In the case of asset impairment, how should the loss be recorded?

By practicing these strategies, you will improve both your accuracy and speed when answering multiple-choice questions, ultimately helping you perform better in assessments.

Preparing for Journal Entries and Adjustments

One of the most important tasks in financial record-keeping is accurately preparing journal entries and making necessary adjustments. These processes are essential for ensuring that all transactions are properly documented and that financial reports reflect the true financial position of a business. Mastering the process of making these entries and adjustments is crucial for success in any financial analysis or reporting task.

Journal entries involve recording all business transactions in a systematic way, following accounting principles. Adjustments, on the other hand, are necessary to ensure that financial records are up to date and reflect the proper amounts at the end of a reporting period. These adjustments might involve accruals, deferrals, or corrections to previous entries.

It’s important to be familiar with common types of adjustments, such as:

- Accrued Revenues: Recording income that has been earned but not yet received.

- Accrued Expenses: Recording costs that have been incurred but not yet paid.

- Deferred Revenues: Recognizing income that has been received but not yet earned.

- Deferred Expenses: Recognizing expenses that have been paid in advance but will be used in future periods.

Practicing these entries will help you become comfortable with the necessary calculations and ensure that you can make adjustments efficiently when needed. A solid understanding of journal entries and adjustments is crucial for preparing accurate financial statements and ensuring compliance with accounting standards.

Calculating Depreciation and Amortization

Understanding how to calculate the reduction in value of assets over time is a fundamental aspect of financial reporting. Depreciation and amortization are essential concepts used to allocate the cost of long-term assets over their useful life. These calculations ensure that financial statements accurately reflect the expense associated with using these assets during a given period. Properly applying these methods allows businesses to maintain compliance and present realistic financial information.

Depreciation Calculation Methods

Depreciation is applied to tangible assets, such as equipment, buildings, or vehicles. There are several methods used to calculate how much of an asset’s cost should be expensed each period:

- Straight-Line Method: This method spreads the cost of the asset evenly over its useful life. The formula is: Depreciation Expense = (Cost of Asset – Salvage Value) / Useful Life.

- Declining Balance Method: This method accelerates depreciation, with higher expenses in the earlier years. The formula is: Depreciation Expense = Beginning Book Value x Depreciation Rate.

- Units of Production Method: This method ties depreciation to the asset’s actual usage. The formula is: Depreciation Expense = (Cost of Asset – Salvage Value) / Total Estimated Production x Units Produced.

Amortization for Intangible Assets

Amortization is similar to depreciation but applies to intangible assets, such as patents, copyrights, or trademarks. The process involves expensing the cost of an intangible asset over its estimated useful life. The most common method for amortization is the straight-line method, which assumes an equal expense each period. The formula for amortization is: Amortization Expense = Cost of Asset / Useful Life.

Both depreciation and amortization are crucial for accurately reflecting the costs associated with using assets and ensuring proper tax deductions. Mastering these calculations will help ensure the financial statements are precise and in compliance with accounting standards.

Key Ratios and Their Importance

Understanding and analyzing financial ratios is essential for assessing a company’s performance and overall financial health. These ratios provide valuable insights into various aspects of a business, such as profitability, liquidity, efficiency, and solvency. By examining these ratios, stakeholders can make informed decisions regarding investments, operations, and strategy.

Types of Key Ratios

There are several key financial ratios that are commonly used to evaluate a company’s financial standing:

- Profitability Ratios: These ratios measure a company’s ability to generate profit relative to revenue, assets, or equity. Examples include the Net Profit Margin and Return on Assets (ROA).

- Liquidity Ratios: These ratios indicate a company’s ability to meet short-term obligations. Key liquidity ratios include the Current Ratio and Quick Ratio.

- Efficiency Ratios: Efficiency ratios assess how effectively a company utilizes its assets to generate sales. Common examples include the Asset Turnover Ratio and Inventory Turnover Ratio.

- Solvency Ratios: These ratios measure a company’s ability to meet its long-term debt obligations. Important solvency ratios include the Debt-to-Equity Ratio and Interest Coverage Ratio.

The Role of Ratios in Decision Making

Financial ratios help to provide a clear picture of a company’s financial stability and growth potential. By comparing these ratios over time or against industry benchmarks, investors and management can identify trends and areas of concern. For example, a declining profitability ratio might indicate inefficiencies or increasing costs, while a low liquidity ratio could signal potential cash flow problems. Understanding these indicators allows for better strategic planning, forecasting, and resource allocation.

In summary, financial ratios are indispensable tools for analyzing a company’s operations, financial strength, and market position. Mastery of these ratios can significantly improve the accuracy of financial assessments and contribute to more effective decision-making.

Time Management Tips During the Exam

Effective time management is crucial when taking any type of assessment. Allocating sufficient time for each section, avoiding unnecessary delays, and staying focused on the task at hand can make a significant difference in achieving success. Proper planning ensures that you can complete all sections and review your work without rushing or feeling stressed.

Strategies for Efficient Time Use

Here are some practical tips to help you manage your time efficiently during an assessment:

- Understand the Format: Familiarize yourself with the structure of the test before you start. Knowing how many questions you need to answer and their weight can help you prioritize tasks.

- Set a Time Limit per Section: Allocate a specific amount of time to each section based on its complexity or point value. Stick to these limits to avoid spending too much time on one part.

- Start with Easy Questions: Begin with questions that you find easier or more familiar. This will help you build confidence and save time for more challenging ones.

- Stay Focused: Avoid distractions and stay focused on the task. If you get stuck on a question, move on and return to it later if time permits.

- Keep an Eye on the Clock: Regularly check the time to ensure you are on track. Make adjustments if necessary to avoid spending too long on any one question.

Review and Double-Check

After completing the main portion of the assessment, use any remaining time to review your answers. Double-check calculations, read questions again for accuracy, and ensure that all instructions have been followed. This final step can help you catch any mistakes you might have overlooked during the initial attempt.

By staying organized, practicing good time management, and following these strategies, you can approach assessments with greater confidence and improve your chances of success.

Studying Effectively with Practice Problems

One of the most effective ways to prepare for any type of assessment is through consistent practice. By solving problems that reflect the topics you’ll encounter, you reinforce your understanding and develop the problem-solving skills needed for success. Practice problems offer a hands-on approach to learning, allowing you to apply theoretical knowledge in a practical setting.

When studying for an assessment, focusing on practice problems provides several advantages. Not only do they help you identify areas of strength and weakness, but they also improve your time management and exam technique. Working through these problems will help you become more efficient and confident when faced with similar questions in the actual test.

How Practice Problems Enhance Learning

Using practice problems as part of your study routine offers multiple benefits:

- Reinforce Concepts: By actively applying what you’ve learned, you solidify key ideas and ensure a deeper understanding of the material.

- Improve Problem-Solving Skills: The more problems you tackle, the more you enhance your ability to approach new and unfamiliar questions with confidence.

- Identify Knowledge Gaps: Practice problems highlight areas where you may need further study or clarification, allowing you to focus your efforts more effectively.

- Increase Speed and Accuracy: Regularly practicing will help you become faster and more precise when answering questions under time constraints.

Maximizing the Impact of Practice Problems

To get the most out of practice problems, it’s essential to approach them strategically. Start by working through easier problems to build your confidence, then gradually move on to more complex ones. Additionally, review any mistakes you make and ensure you understand why the correct answer is what it is. This approach will not only help you improve your problem-solving skills but also deepen your comprehension of the subject.

Incorporating practice problems into your study routine is a powerful tool for improving your preparedness. By making them a regular part of your learning process, you can approach assessments with greater ease and confidence.

Common Pitfalls to Avoid on the Exam

When facing an assessment, it’s easy to fall into traps that can affect your performance. Many students unknowingly make mistakes that can be easily avoided with careful preparation and attention to detail. Recognizing and understanding these common errors can help you steer clear of them and improve your chances of success.

Here are some common pitfalls to watch out for during your assessment:

- Rushing Through Questions: One of the biggest mistakes is rushing through questions in an attempt to finish quickly. This often leads to careless errors or incomplete answers. Take your time to carefully read each question and think before you respond.

- Misunderstanding the Question: Always ensure you fully understand the question before answering. Misinterpreting what is being asked can lead to providing the wrong answer, even if you know the material well.

- Neglecting to Review Your Answers: Many students forget to leave time for reviewing their work. Even if you feel confident about your answers, taking a few extra minutes to check for mistakes or missed questions can make a big difference.

- Overthinking or Second-Guessing: While it’s important to think critically, second-guessing yourself too much can cause unnecessary confusion. If you’re unsure about an answer, trust your initial judgment unless you find clear evidence to change it.

- Ignoring Time Limits: It’s easy to get caught up in one question or section, but managing your time effectively is key. Allocate time to each section and move on if you get stuck on a particular question.

- Not Following Instructions: Ensure that you follow any specific instructions provided. Whether it’s formatting your answers or providing specific details, overlooking instructions can cost you valuable points.

- Skipping Difficult Questions: Avoid the temptation to skip questions you find difficult. Instead, mark them and return to them after finishing the rest. Skipping can lead to missed opportunities for partial credit.

By being mindful of these common mistakes, you can approach your assessment more strategically and avoid unnecessary pitfalls. Preparation, focus, and careful time management are essential for achieving the best possible outcome.

Tips for Reviewing Prior Exams and Assignments

Reviewing previous tests and assignments is one of the most effective strategies for reinforcing your knowledge and identifying areas for improvement. By revisiting past work, you can gain insight into the types of questions that are likely to appear again and better understand the patterns in the material that you need to focus on. This process also helps you recognize common mistakes and avoid them in the future.

Here are some practical tips to make your review sessions more productive:

- Analyze Mistakes: Go through every mistake you made on previous tests and assignments. Understand why you made each error, and determine whether it was due to a lack of understanding or simple oversight. This will help you avoid repeating the same mistakes.

- Focus on Weak Areas: If you notice recurring themes in your mistakes, devote extra time to reviewing these topics. Strengthening these weak points will boost your confidence and increase your chances of success on the next assessment.

- Look for Patterns: Often, questions on tests are phrased similarly, or certain concepts are tested repeatedly. Identify any patterns in the questions and try to anticipate what types of questions might appear in the future based on your past experiences.

- Review Feedback: If your instructor provides feedback on your work, take the time to carefully review it. Constructive criticism is valuable for improving your performance, so make sure you understand the reasoning behind any corrections or suggestions.

- Practice Timed Revisions: Try to review past tests and assignments under timed conditions. This will help you simulate the pressure of a real assessment and improve your ability to manage your time effectively.

- Create Study Guides: Use your reviewed assignments to create concise study guides. Summarize key points and concepts, and write out any formulas or processes you need to remember. This method will help you retain information and focus on the most important topics.

- Collaborate with Peers: Sometimes, discussing past assessments with classmates can provide new perspectives and insights. Consider studying together to compare notes on difficult topics or share study strategies.

By carefully reviewing prior work, you can identify areas that need improvement and solidify your understanding of key concepts. This process will not only help you perform better in future assessments but also enhance your overall knowledge of the subject.

How to Tackle Complex Financial Scenarios

When faced with intricate financial problems, it’s essential to approach them methodically to avoid feeling overwhelmed. Breaking down complex scenarios into smaller, manageable components allows you to clearly identify the key issues and apply the appropriate techniques for solving them. Whether it’s understanding intricate calculations, evaluating long-term strategies, or analyzing the impact of various financial factors, the right approach can make these challenges more navigable.

Here are some useful strategies for tackling complicated financial situations:

1. Identify and Break Down the Problem

The first step is to thoroughly read and understand the scenario. Identify the key elements and break them down into distinct categories, such as assets, liabilities, or revenues. By organizing the problem into manageable parts, you can focus on each element individually.

2. Use Financial Models and Frameworks

Many complex financial problems can be approached using established models and frameworks. These can guide you in structuring your analysis, ensuring you don’t overlook important details. Whether you’re using discounting techniques, financial ratios, or decision-making models, the right tools help you frame the problem accurately.

| Method | Use Case | Example |

|---|---|---|

| Discounted Cash Flow | Valuing investments over time | Calculating the present value of future cash flows |

| Financial Ratios | Analyzing company performance | Evaluating liquidity, profitability, and solvency ratios |

| Break-even Analysis | Assessing profitability thresholds | Determining the point where revenue equals expenses |

These methods not only provide clarity but also guide you to the most logical solution. Ensuring you’re comfortable with financial models is key to applying them effectively under time pressure.

By following these techniques, you can confidently tackle complex financial scenarios, break them down into manageable steps, and arrive at accurate solutions with greater efficiency. Practicing these strategies will improve your ability to analyze any difficult financial situation in the future.

Essential Textbook Resources for Revision

When preparing for a significant assessment, the textbook is often the most reliable resource to help consolidate understanding. A well-structured textbook provides not only theoretical insights but also practical examples, exercises, and summary sections that reinforce key concepts. The right materials allow you to clarify complex topics and ensure that your revision is both thorough and effective.

Here are some essential textbook resources to focus on for a successful revision process:

1. Chapter Summaries and Key Takeaways

At the end of each chapter, most textbooks provide concise summaries that highlight the essential points covered. These are incredibly useful for reviewing key concepts quickly and ensuring you’ve grasped the core ideas. Make sure to read these summaries after each chapter to reinforce your understanding.

2. Practice Problems and Solutions

Many textbooks include practice problems that allow you to apply the theories and methods discussed in the chapters. These problems are often structured similarly to those you will encounter on an assessment, making them invaluable for active revision. By solving these problems, you can identify areas that need further clarification.

Pro Tip: Always review the solutions provided for each practice problem. This will help you understand not only the correct answer but also the reasoning and steps involved in reaching it. This understanding is crucial for tackling similar questions in the future.

In addition to chapter summaries and practice problems, look for other resources like case studies, online resources, and companion workbooks that may be offered with the textbook. These can provide additional perspectives and alternative explanations that might help solidify your understanding of challenging topics.

What to Expect in the Exam Format

Understanding the structure and format of an assessment is key to preparing effectively. Knowing what types of questions to expect, how they are structured, and how they test your knowledge can help you approach your study sessions with more focus. Being familiar with the format also allows you to manage your time better during the test and feel more confident when facing it.

Here’s what you can generally expect in the structure of such an assessment:

1. Question Types

- Multiple Choice Questions: These questions test your ability to recall facts and apply principles. You will typically be asked to select the correct answer from a set of options.

- Short Answer Questions: You may be required to write brief responses, providing definitions, explaining concepts, or summarizing important ideas.

- Problem-Solving Questions: These assess your ability to apply your knowledge to solve practical scenarios. You’ll be asked to calculate figures, make adjustments, or analyze data.

2. Time Management

- Time Limit: Ensure you know the duration of the assessment so you can pace yourself accordingly. This helps in allocating enough time to each question type, especially those that require more calculation or explanation.

- Section-Based Time Allocation: Often, assessments are divided into sections, each focusing on a different topic or skill. Prioritize your time according to the complexity and weight of each section.

By understanding the general layout and types of questions that may appear, you can better prepare for your assessment. This knowledge allows you to practice more effectively, ensuring you’re fully prepared to tackle the test when the time comes.

Strategies for Achieving a High Score

To achieve a high score in any assessment, it is essential to combine strategic study techniques with effective time management. Success does not only rely on raw knowledge, but also on how well you prepare and apply your understanding under test conditions. Here are some practical strategies to help you perform at your best.

1. Focus on Key Areas

Identify the most important topics or concepts that are likely to appear. These may include foundational principles, complex calculations, or any areas where you have struggled in the past. Make sure to dedicate extra time to mastering these areas.

2. Practice Consistently

One of the most effective ways to improve your skills and boost your confidence is through regular practice. Working through practice problems and previous assignments will allow you to familiarize yourself with the format and types of questions you might encounter.

3. Time Management Techniques

Managing your time during preparation and on the test day is crucial. Allocate specific time slots for each topic based on its complexity and your level of understanding. During the test, pace yourself to avoid spending too much time on any single question.

4. Stay Calm and Confident

Test anxiety can impair your performance, so it’s important to stay calm and maintain a positive mindset. Practice relaxation techniques and ensure you’re well-rested before the test day. Confidence will help you approach each question with clarity and focus.

5. Learn From Mistakes

After completing practice problems or mock tests, carefully review your mistakes. Understand why you got a particular question wrong and make sure you address any gaps in knowledge before the actual test.

6. Effective Use of Resources

Leverage textbooks, online resources, and study groups to expand your understanding of difficult concepts. Discussing topics with peers can help you see them from different angles, which can enhance retention.

7. Keep a Positive Attitude

Stay focused on your progress and avoid getting discouraged by setbacks. A positive attitude will help you maintain motivation throughout the preparation period.

8. Use Test Strategies

On the test day, use smart strategies such as answering easier questions first to build momentum, and reviewing your answers before submitting the test. For calculation questions, double-check your work to avoid simple errors.

| Strategy | Key Action |

|---|---|

| Focus on Key Areas | Prioritize major concepts and practice key problems. |

| Practice Consistently | Work on past problems and practice exercises regularly. |

| Time Management | Plan study sessions and time limits during the test. |

| Stay Calm | Manage stress and keep a positive outlook. |

By following these strategies, you can increase your chances of achieving a high score and feeling confident throughout the assessment process. The key is consistent preparation, smart study habits, and the ability to remain focused during the test itself.