In any field that involves dealing with clients, trust is paramount. Professionals are often faced with situations where their decisions and actions must align with a set of core principles that ensure fairness and transparency. These principles guide individuals in maintaining a high standard of conduct, which ultimately leads to a more responsible and trustworthy relationship with clients and colleagues alike.

Upholding integrity is not merely about following rules, but about fostering a culture where honesty, accountability, and respect are the cornerstones of every interaction. In this context, professionals must be equipped to navigate complex challenges, making choices that not only comply with legal standards but also reflect a commitment to doing what is right.

Adherence to these standards plays a crucial role in ensuring that the industry remains reputable and that clients feel secure in their decisions. Whether dealing with contracts, customer service, or internal policies, each action taken is an opportunity to demonstrate a commitment to upholding these essential values, thereby contributing to long-term success and public trust.

Ethical Standards in Insurance Exams

In any sector involving complex decision-making, maintaining a high level of integrity is crucial. The role of individuals within such industries demands a strong moral compass, especially when it comes to handling sensitive information and making decisions that affect both clients and the organization. This concept is particularly important when individuals are preparing for professional assessments, where adherence to certain moral standards ensures fairness and reliability in the field.

During the assessment process, it is vital to uphold a set of core principles that guide individuals in making choices that align with the values of honesty, transparency, and accountability. These standards are intended to create a level playing field, ensuring that all participants are judged based on their true abilities and ethical conduct, rather than external factors or unfair practices.

Key principles that professionals should focus on during the evaluation include:

| Standard | Description |

|---|---|

| Integrity | Ensuring that all actions and responses are truthful and accurate, reflecting the individual’s true capabilities. |

| Confidentiality | Maintaining the privacy of any sensitive or personal information encountered during the process. |

| Fairness | Ensuring that no unfair advantages are taken, and that all participants are treated equally under the same rules. |

| Respect | Demonstrating respect for others, whether colleagues or clients, in all aspects of the assessment process. |

| Accountability | Taking responsibility for actions and decisions made during the evaluation, and ensuring that they align with established standards. |

By focusing on these values, individuals can ensure that they are not only complying with industry expectations but are also contributing to a culture of professionalism that prioritizes trust and long-term success.

Core Principles of Insurance Ethics

At the heart of every reputable profession lies a set of essential values that guide individuals in making responsible and fair decisions. These values help establish trust, ensure compliance, and promote accountability in all actions. When preparing for assessments in this sector, understanding these key principles is crucial for maintaining the integrity of both the profession and the individuals involved.

Key Values to Uphold

- Integrity: Acting with honesty in all situations and ensuring transparency in all interactions.

- Accountability: Taking full responsibility for actions, ensuring that every decision made can be justified.

- Fairness: Treating all individuals equally, avoiding discrimination, and ensuring equal opportunities for everyone.

- Confidentiality: Protecting sensitive information and respecting the privacy of clients and colleagues alike.

Impact of Core Principles on Practice

These core principles are not just theoretical; they must be actively implemented in daily work and decision-making. Whether interacting with clients, processing claims, or reviewing policies, professionals must consistently reflect these values in their work. When these principles are applied effectively, they contribute to a stronger reputation, improved customer satisfaction, and long-term success in the field.

By adhering to these values, individuals ensure that their actions align with the highest standards of conduct, fostering a more ethical and responsible environment for all involved.

Importance of Honesty in Insurance Practices

Honesty serves as the cornerstone of any profession that deals with people’s trust, especially in areas involving financial matters. When individuals rely on experts to guide them through complex decisions, they expect transparency and truthfulness in every interaction. In this field, maintaining honesty not only helps build lasting relationships but also ensures that all parties involved are treated fairly and with respect.

Why Truthfulness Matters

In this sector, the need for truthfulness goes beyond simple accuracy–it is about fostering trust, minimizing misunderstandings, and ensuring that clients are well-informed about their options. Misleading information or intentional misrepresentation can lead to serious consequences, including legal repercussions, loss of business, and damage to reputation.

Key Areas Where Honesty is Essential

| Area | Importance |

|---|---|

| Client Communication | Clear and honest communication prevents confusion and ensures clients fully understand their rights and obligations. |

| Policy Terms | Accurate representation of policy features and limitations allows clients to make informed decisions without hidden surprises. |

| Claims Handling | Being transparent about the claims process and expectations helps prevent disputes and establishes a sense of reliability. |

| Financial Reporting | Honesty in financial matters ensures that all statements and transactions reflect the true situation, building credibility and trust. |

By upholding honesty, individuals ensure not only their own success but also contribute to the overall integrity of the industry. When truth is prioritized, it strengthens the reputation of the field as a whole, ensuring long-term trust and stability in client relationships.

Confidentiality and Data Protection Guidelines

In any field where sensitive information is shared, safeguarding personal data is a top priority. Ensuring that client details, financial records, and other confidential information remain secure is essential to maintaining trust and compliance with legal standards. Professionals must be aware of the significance of privacy and the measures required to protect this data from unauthorized access or misuse.

Protecting sensitive data goes beyond simply following legal requirements; it is about fostering a culture of respect and responsibility. Clients rely on individuals to handle their personal information with care, and failure to do so can result in serious consequences, including financial penalties and loss of reputation.

Key Practices for Data Protection

- Secure Storage: Ensuring that all sensitive data is stored in a secure manner, whether digitally or physically, to prevent unauthorized access.

- Data Encryption: Encrypting information to safeguard it during transmission and ensure that it cannot be intercepted or read by unauthorized parties.

- Access Control: Limiting access to confidential data to only those individuals who need it to perform their duties, and ensuring proper authentication methods are in place.

- Data Minimization: Collecting and retaining only the minimum amount of data necessary to complete tasks, and securely disposing of data when no longer required.

Legal and Regulatory Requirements

- Compliance with Laws: Adhering to local, regional, and international laws governing data protection, including the General Data Protection Regulation (GDPR) in the EU or similar regulations elsewhere.

- Client Consent: Obtaining explicit consent from clients to collect, store, and process their data, ensuring they are fully aware of how their information will be used.

- Data Breach Protocol: Establishing clear procedures to follow in the event of a data breach, including notification to clients and regulatory bodies within specified timeframes.

By consistently applying these practices, individuals can ensure the protection of sensitive information, thereby maintaining client trust and meeting regulatory requirements. Data security is not just about compliance; it is about upholding the responsibility to keep clients’ information safe and confidential at all times.

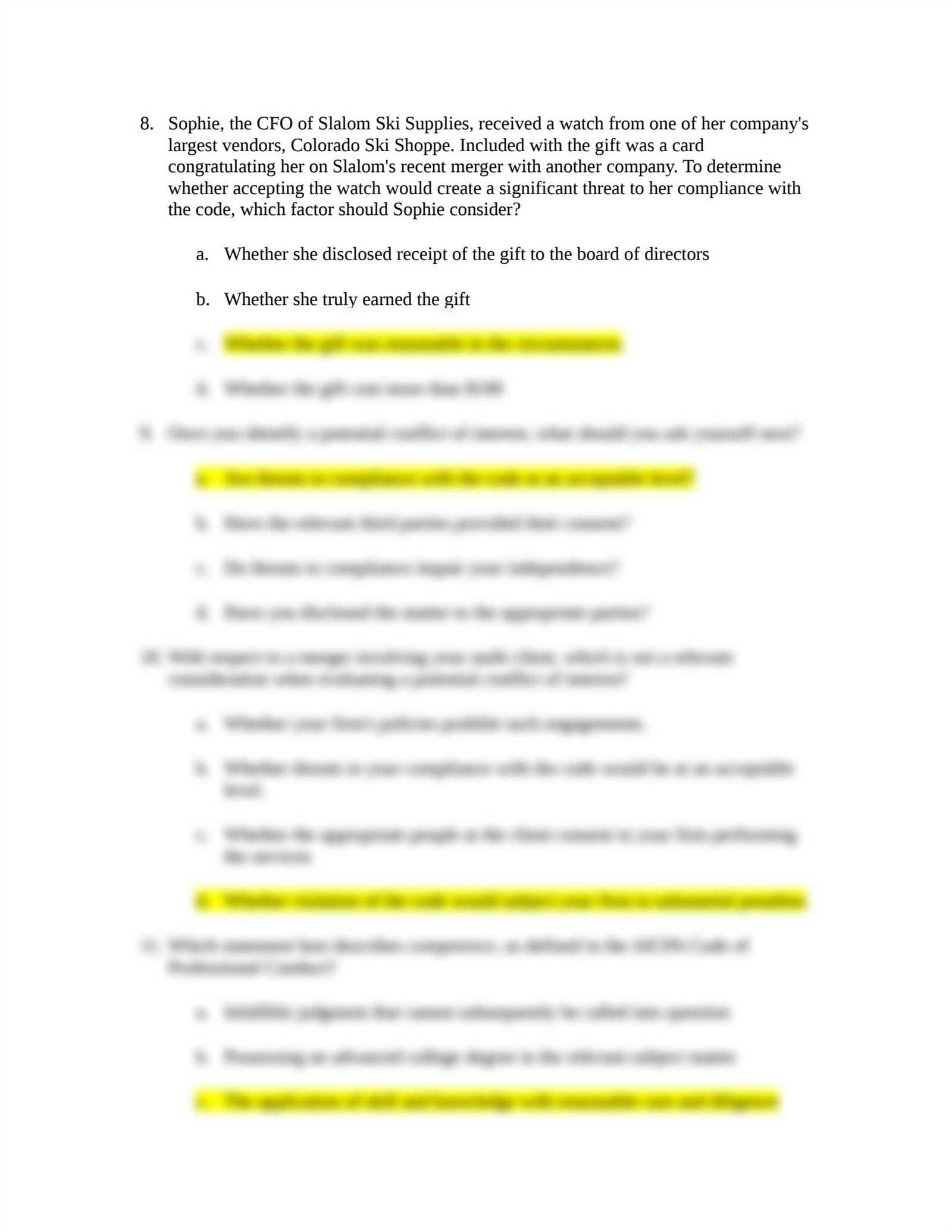

Conflict of Interest in Insurance Exams

In any situation where individuals are assessed based on their knowledge and abilities, it is crucial to ensure that no external factors influence the outcomes. A conflict of interest arises when personal interests or outside relationships have the potential to interfere with objectivity and fairness. This is particularly important when dealing with evaluations that affect professional credentials and public trust.

Recognizing and addressing conflicts of interest helps maintain the integrity of the process, ensuring that all participants are judged solely on their merits and capabilities. Any form of bias or undue influence undermines the credibility of the system and can lead to unfair advantages or disadvantages for certain individuals.

Common Sources of Conflict

| Source | Impact |

|---|---|

| Personal Relationships | Familiarity with an evaluator or other participants may unintentionally lead to preferential treatment or biased decision-making. |

| Financial Interests | Ownership or financial stakes in related organizations can lead to conflicts when decisions may benefit personal investments. |

| Previous Experience | Prior involvement in similar situations could create bias in evaluating others, especially when outcomes could affect personal reputation. |

| External Pressures | Influence from third parties, such as employers or stakeholders, can create situations where fairness is compromised for the sake of personal gain or favoritism. |

Managing and Mitigating Conflicts

- Disclosure: All participants should be required to disclose any potential conflicts of interest before the assessment process begins.

- Impartial Evaluation: Assessments should be conducted by independent parties who have no personal stake in the results.

- Transparency: Clear policies should be in place to identify and address any conflicts that arise during the process.

- Monitoring: Continuous oversight ensures that no biases or undue influences are affecting the integrity of the assessment.

By proactively addressing conflicts of interest, the evaluation process can remain fair and unbiased, helping to maintain trust in the system and ensuring that all individuals are evaluated on equal terms.

Guidelines for Fair Treatment of Clients

Ensuring that all individuals are treated equally and with respect is a fundamental aspect of maintaining trust and integrity in any field. Professionals must focus on fairness when interacting with clients, making sure that every decision is made impartially and transparently. This approach helps build strong, long-lasting relationships and creates an environment where clients feel valued and supported.

To achieve this, it is important to avoid any actions or decisions that could result in bias, discrimination, or unfair advantage. Each client should be treated according to their unique needs and circumstances, ensuring that no one is given preferential treatment over another. By doing so, the overall quality of service improves, and trust in the process strengthens.

Key Principles for Fair Treatment

- Equality: All clients must be given the same level of attention and respect, without bias or favoritism.

- Transparency: Providing clear, accurate information so that clients can make well-informed decisions based on their individual needs.

- Responsiveness: Addressing client concerns and inquiries in a timely and professional manner, ensuring that no one is left unanswered or ignored.

- Confidentiality: Safeguarding client information and ensuring privacy, ensuring that sensitive data is not shared or used improperly.

Ensuring Compliance and Accountability

- Adherence to Policies: Following internal rules and regulations that promote fairness and integrity in all interactions.

- Ongoing Training: Regularly educating and training staff to recognize and combat unconscious bias and to uphold the principles of fairness in all dealings.

- Client Feedback: Actively seeking client input to ensure their needs are being met and that they feel their concerns are being addressed.

By prioritizing fairness in every interaction, professionals ensure that their clients are treated with the dignity and respect they deserve, while also fostering a positive reputation for integrity and trustworthiness.

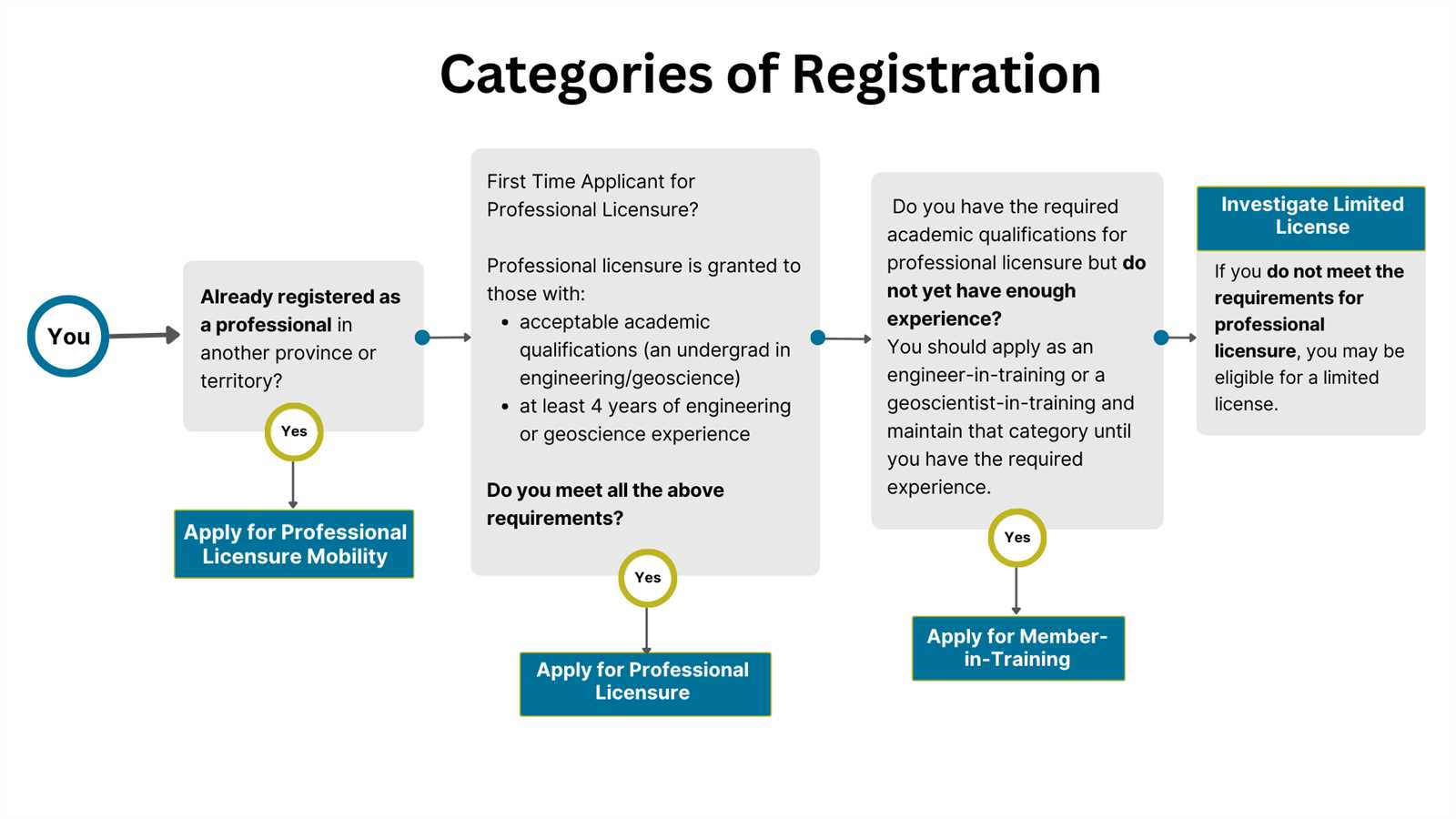

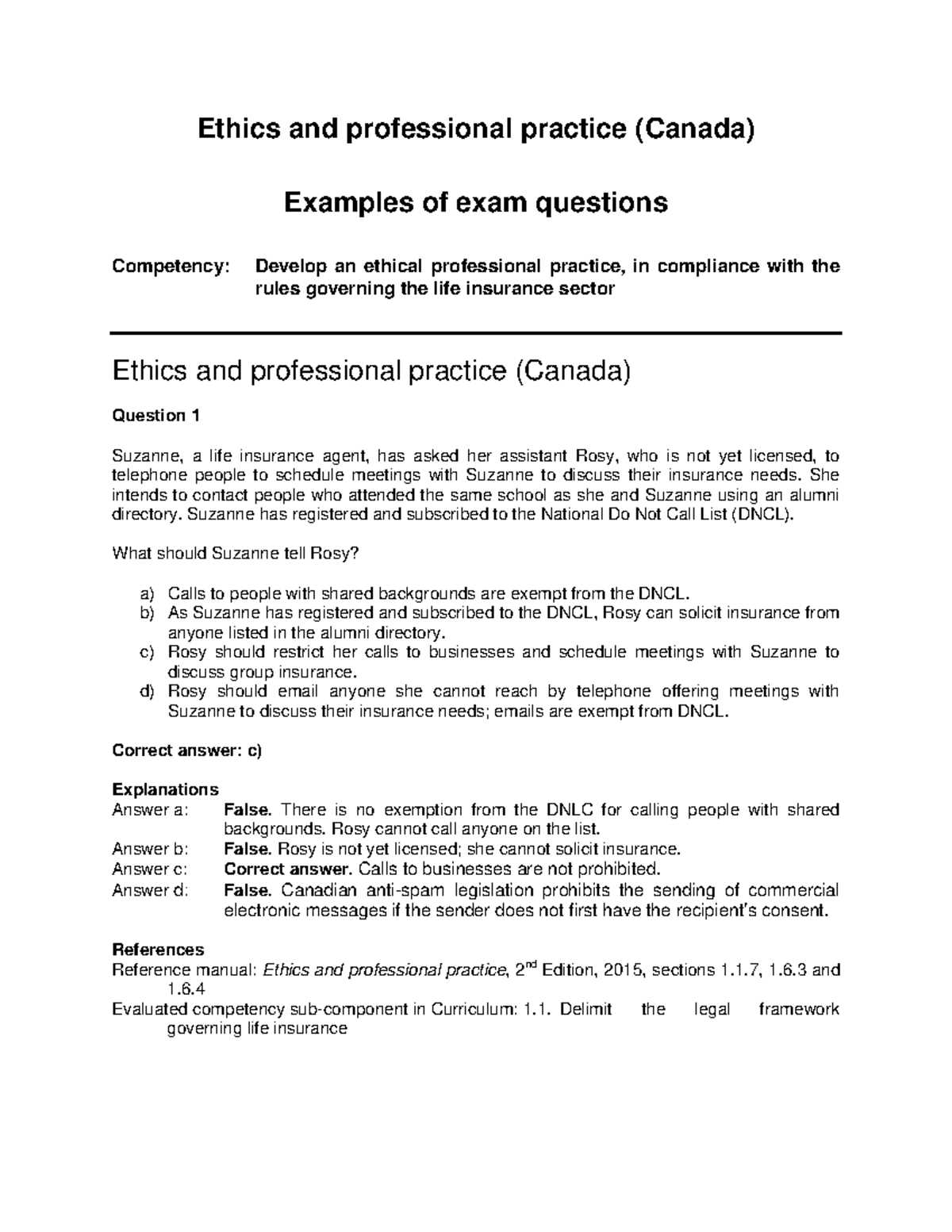

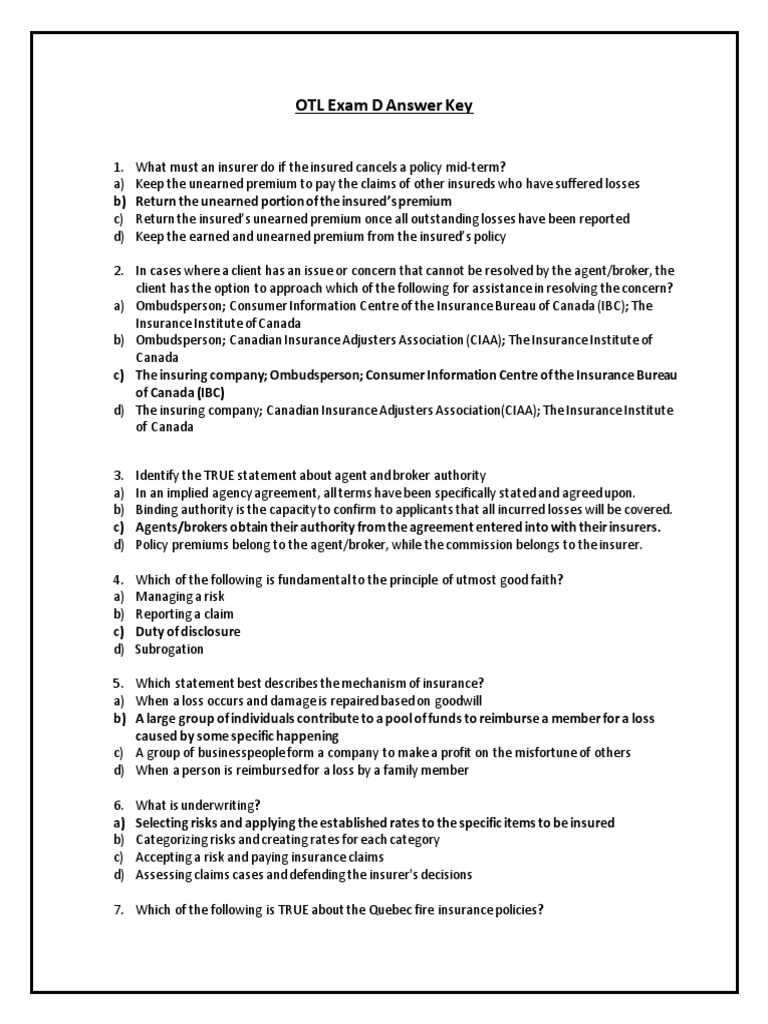

Understanding Legal Compliance in Insurance

Adhering to the law is essential for maintaining the integrity of any professional field. In areas where individuals are entrusted with managing financial resources and guiding clients through complex processes, compliance with legal standards ensures fairness and accountability. Professionals must understand the legal framework that governs their actions, not only to avoid penalties but also to maintain the trust and confidence of clients and the public.

Legal compliance is about following the rules set forth by regulatory bodies, which may vary across regions and jurisdictions. These laws are designed to protect all parties involved, ensuring that operations are transparent and that client interests are safeguarded. By understanding and adhering to these requirements, individuals ensure the long-term success and credibility of their practices.

Key Legal Requirements

- Licensing: Professionals must obtain and maintain the necessary credentials to operate legally within their jurisdiction.

- Disclosure: Transparency in all dealings with clients, including full disclosure of terms, conditions, and any potential conflicts of interest.

- Fair Treatment: Ensuring that all clients are treated equitably and that no unfair or discriminatory practices take place.

- Data Protection: Adhering to privacy laws to ensure that sensitive information is kept confidential and used appropriately.

Compliance with Industry Regulations

- Consumer Protection Laws: Laws that protect clients from misleading information and unfair business practices.

- Anti-money Laundering Laws: Regulations designed to prevent financial crimes by ensuring that proper checks and records are maintained.

- Auditing and Reporting: Regular audits and reporting requirements to ensure compliance and to identify any potential issues before they become legal problems.

Staying compliant requires a proactive approach, with professionals continually educating themselves on evolving laws and regulations. By doing so, they not only avoid legal risks but also build a reputation for responsibility and trustworthiness in the field.

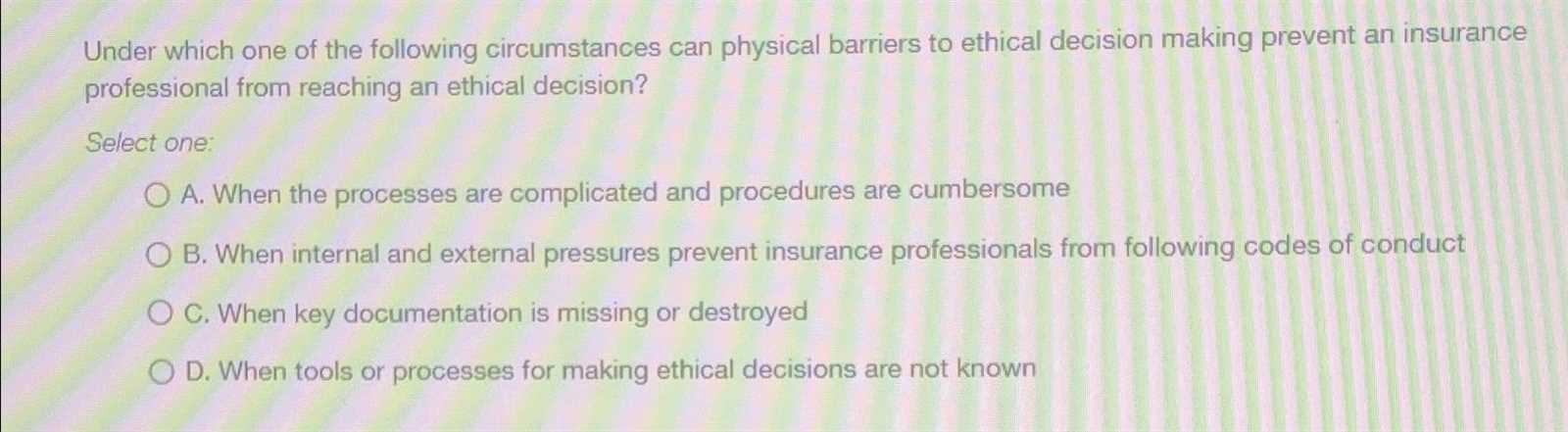

Ethical Decision Making for Insurance Professionals

In any field where individuals are responsible for advising others and making significant financial decisions, the ability to make morally sound choices is crucial. Professionals must weigh the potential impact of their decisions on all parties involved, considering both short-term and long-term consequences. This decision-making process is not only about following rules but also about fostering trust, ensuring fairness, and maintaining the integrity of the industry.

Making the right choices involves carefully evaluating the situation, understanding the relevant laws and regulations, and recognizing any potential conflicts of interest. Ultimately, professionals must choose actions that reflect honesty, respect, and responsibility, even in challenging circumstances. It requires a commitment to upholding core principles and ensuring that decisions align with the values of the profession.

Key Factors in Ethical Decision Making

- Integrity: Professionals should act with honesty and honor, ensuring that their actions align with both legal standards and moral expectations.

- Transparency: All relevant information should be shared with clients to help them make informed decisions, avoiding any hidden motives or misleading facts.

- Accountability: Professionals must take responsibility for their actions and decisions, even when they may not result in a desired outcome.

- Fairness: Every individual should be treated with equal respect and consideration, ensuring no one is unfairly advantaged or disadvantaged.

Making Difficult Choices

- Balancing Interests: Sometimes professionals must balance competing interests, ensuring that no one group is unfairly prioritized over others.

- Seeking Guidance: In complex situations, professionals can seek advice from colleagues or mentors to ensure that their decision-making aligns with ethical standards.

- Reflecting on Impact: Understanding how decisions affect both clients and the broader community helps guide professionals toward more thoughtful and responsible choices.

By consistently applying these principles, professionals can navigate complex situations with confidence, ensuring that their decisions contribute to a positive and trustworthy reputation within their field.

Accountability in Insurance Transactions

Maintaining responsibility and transparency in all dealings is essential for fostering trust and upholding the integrity of any financial practice. Individuals engaged in transactions must ensure that their actions are not only in compliance with the law but also aligned with the principles of fairness and reliability. Accountability ensures that all parties involved are treated with respect and that decisions are made with the utmost integrity.

In financial transactions, especially those involving client funds and personal information, clear documentation, accurate reporting, and honesty are paramount. Professionals must take ownership of their actions, providing clients with the information and support necessary to make informed decisions. Accountability is not just about avoiding mistakes, but also about ensuring that the process is transparent and that any potential issues are addressed promptly and openly.

Key Aspects of Accountability

- Transparency: Clearly communicating the terms, conditions, and expectations in every transaction to avoid misunderstandings and ensure mutual trust.

- Documentation: Keeping detailed records of all transactions to provide a clear audit trail and to resolve any potential disputes quickly and effectively.

- Responsibility: Taking full ownership of decisions and actions, even when things do not go as planned, and taking corrective measures when necessary.

Ensuring Client Trust and Satisfaction

- Clear Communication: Providing clients with all relevant information so they can make well-informed decisions and feel confident in the process.

- Ethical Handling of Issues: Addressing any mistakes or misunderstandings swiftly and fairly, maintaining a focus on the client’s best interests.

- Continuous Improvement: Regularly assessing practices and procedures to ensure that all transactions are handled efficiently, accurately, and with integrity.

By embracing accountability in every transaction, professionals help build lasting relationships based on trust, transparency, and mutual respect. This not only protects the interests of clients but also strengthens the reputation of the entire field.

Transparency in Insurance Communication

Clear and open communication is vital for fostering trust and ensuring a smooth relationship between service providers and their clients. When individuals are provided with all relevant information in a straightforward and understandable manner, they can make well-informed decisions that meet their needs. Transparency in interactions is not just about sharing facts, but about creating an environment where both parties feel confident and respected throughout the process.

In any professional setting, especially when managing important financial matters, providing clear explanations about products, services, terms, and conditions is crucial. When professionals openly communicate all details and potential risks, they empower clients to fully understand what they are agreeing to. Transparent practices help to prevent misunderstandings, build stronger relationships, and ensure that expectations are aligned from the outset.

Principles of Transparent Communication

- Clear Information: Offering detailed and simple explanations about terms, services, and any associated costs, avoiding jargon or complex language that might confuse clients.

- Full Disclosure: Sharing all relevant facts, including potential risks and benefits, so clients can make informed decisions based on a complete understanding.

- Consistency: Ensuring that the information provided remains consistent across all interactions, whether written or verbal, to avoid confusion and maintain clarity.

Building Trust Through Openness

- Honest Assessments: Always providing an honest evaluation of the options available, even if some may not be the most profitable for the service provider.

- Prompt Responses: Addressing any questions or concerns from clients as quickly and thoroughly as possible, demonstrating that their understanding and satisfaction are a priority.

- Accessible Support: Making sure that clients have easy access to the information they need, whether it’s through clear documentation, online resources, or direct communication with the service provider.

By maintaining transparency, professionals not only ensure that their clients are well-informed but also cultivate a trustworthy reputation. This approach helps to build long-lasting relationships, ensuring that clients feel valued and respected every step of the way.

Role of Integrity in Exam Preparation

Maintaining a strong sense of honesty and personal responsibility during the study process is essential for both academic success and personal growth. Integrity in preparation involves not only adhering to established rules and guidelines but also taking the initiative to genuinely engage with the material. This approach ensures that individuals are thoroughly prepared and capable of demonstrating their knowledge accurately, without resorting to shortcuts or dishonesty.

Focusing on authentic study methods and embracing a disciplined approach helps foster a sense of accomplishment. When individuals prioritize integrity, they are not only preparing for an assessment but also reinforcing their commitment to personal values and long-term success. This mindset allows individuals to approach challenges with confidence, knowing that their achievements are earned through hard work and ethical effort.

Benefits of Integrity in Preparation

- Long-term Knowledge Retention: When learners invest time in understanding the material honestly, they are more likely to retain information and apply it effectively in real-world situations.

- Confidence in Abilities: By preparing ethically, individuals develop self-assurance, knowing their success is a result of their own efforts and capabilities.

- Respect for the Process: Integrity ensures that the value of the assessment remains intact, preserving the fairness and credibility of the entire process.

Promoting Fairness and Accountability

- Adherence to Standards: Ethical preparation encourages following the established norms, helping to maintain a level playing field for all participants.

- Honest Reflection: Taking time to assess one’s own understanding and progress ensures that any gaps in knowledge are addressed honestly and appropriately.

- Avoidance of Shortcuts: Choosing to study diligently and ethically eliminates the temptation to resort to dishonest tactics, reinforcing the value of true learning.

By committing to integrity, individuals not only enhance their chances of success but also build a reputation for reliability and trustworthiness. This dedication to honest preparation leads to a deeper sense of personal achievement and ensures that any success is meaningful and deserved.

Ethical Implications of Misrepresentation

Deliberately providing false or misleading information undermines trust and can have far-reaching consequences. When individuals misrepresent facts, they not only deceive others but also compromise the integrity of the entire system. This type of behavior can lead to legal and reputational damage, as well as the erosion of relationships that rely on transparency and honesty. Whether intentional or unintentional, misrepresentation can significantly harm both the individual and the broader community.

The act of misrepresentation does more than distort the truth–it can result in misguided decisions that have real-world implications. When key information is withheld or altered, the affected parties are denied the ability to make informed choices. This can lead to financial losses, unmet expectations, and even long-term damage to one’s credibility. The repercussions are often not immediate, but they can last for years, affecting personal and professional relationships alike.

Consequences of Misleading Behavior

| Impact | Potential Outcome |

|---|---|

| Legal Repercussions | Facing lawsuits, penalties, or loss of license due to fraudulent actions. |

| Reputational Damage | Loss of trust and credibility, which can hinder future opportunities. |

| Financial Harm | Clients or organizations may suffer significant losses as a result of inaccurate or false information. |

| Relationships | Strained or severed relationships with clients, colleagues, or stakeholders. |

Preventing Misrepresentation

- Accurate Communication: Always provide clear and truthful information, ensuring that all facts are represented in their true form.

- Due Diligence: Verify all details before presenting them to others to ensure accuracy and integrity.

- Openness: Encourage transparency in all dealings and be willing to clarify or correct any misunderstandings.

Misrepresentation may seem like a shortcut to achieving a desired outcome, but the long-term effects of dishonesty far outweigh any immediate gains. By prioritizing truthfulness and integrity in all communications, individuals contribute to a more just and reliable system, where decisions are based on accurate and trustworthy information.

Best Practices for Avoiding Fraud

Preventing fraudulent activities requires a proactive approach that incorporates vigilance, transparency, and responsibility. By establishing clear processes, setting firm boundaries, and fostering an environment of accountability, individuals can reduce the risk of deceptive behavior in all transactions. Fraud is not only a legal violation but also a betrayal of trust, which can have lasting consequences for both individuals and organizations.

Effective fraud prevention relies on consistent oversight and a commitment to ethical decision-making. Ensuring that everyone involved in the process is aware of the importance of honesty and fairness is crucial. By fostering a culture where integrity is valued and expected, it becomes easier to identify potential risks before they develop into serious issues.

Key Strategies for Fraud Prevention

- Regular Audits: Conduct frequent checks and evaluations to ensure that all processes are being followed and that no discrepancies go unnoticed.

- Clear Documentation: Keep detailed records of all transactions and agreements, making it easier to spot irregularities and trace any potential fraud.

- Employee Training: Provide ongoing education for staff members on the importance of honesty and the consequences of fraudulent actions.

Identifying Red Flags

- Inconsistent Information: Watch for discrepancies in data or irregularities in documentation that may suggest dishonesty.

- Excessive Secrecy: Be cautious if individuals or teams try to avoid scrutiny or withhold important details from others.

- Unusual Behavior: Keep an eye out for sudden changes in behavior, such as individuals becoming overly defensive or evasive when questioned about their actions.

Fraud prevention is an ongoing effort that requires a collective commitment to fairness, integrity, and responsibility. By implementing these best practices, individuals and organizations can create an environment where deceit is less likely to thrive, leading to stronger, more trustworthy relationships and a more reliable system overall.

Guidelines on Professional Conduct and Behavior

Maintaining a high standard of conduct in the workplace is essential to building trust, fostering healthy relationships, and ensuring the success of any organization. Every individual involved in professional activities is responsible for upholding principles that reflect honesty, respect, and fairness. A commitment to these values not only strengthens personal reputation but also contributes to a more reliable and transparent working environment.

Effective professional behavior is rooted in a consistent approach to integrity, responsibility, and courtesy. Individuals should always prioritize clear communication, demonstrate respect towards others, and make decisions based on facts rather than personal interests. A professional should be someone others can rely on for sound judgment and honesty in every aspect of their work.

Key Aspects of Professional Behavior

- Honesty and Transparency: Be open about intentions, actions, and decisions to promote mutual understanding and avoid any misunderstandings.

- Respect for Others: Treat colleagues, clients, and partners with dignity, valuing their perspectives and contributions without prejudice.

- Accountability: Take responsibility for one’s actions and decisions, and be prepared to address mistakes or oversights in a timely and constructive manner.

Building Trust Through Consistency

- Consistency in Actions: Deliver on promises and commitments consistently, showing others that they can count on you to follow through.

- Adherence to Rules: Follow organizational standards and policies carefully to demonstrate reliability and ethical decision-making in all circumstances.

- Open Feedback: Welcome constructive criticism and feedback from others, as this shows a willingness to improve and grow professionally.

By adhering to these principles of professional behavior, individuals can create a more positive work culture, inspire confidence in their colleagues, and ensure that their actions align with broader organizational goals. It is important to continuously reflect on one’s conduct and strive for personal development to maintain a high level of professionalism in all situations.

Managing Ethical Dilemmas in Insurance

In any industry, individuals are often faced with situations that challenge their core values and require difficult decisions. These moments can test personal integrity and professionalism, demanding a balance between competing interests. In the realm of the financial services industry, such challenges are common, and how one navigates these situations can have a lasting impact on both personal reputation and organizational trust.

When confronted with moral conflicts, individuals must carefully consider the implications of their actions. It is important to take a step back and assess the situation from various angles, recognizing that different choices might benefit or harm different stakeholders. A well-defined framework for decision-making can help clarify the best course of action in moments of uncertainty.

Steps to Navigate Ethical Dilemmas

- Identify the Conflict: The first step is to clearly recognize when a dilemma is present. Identifying the ethical issue at hand helps avoid making decisions based on incomplete or biased information.

- Consider the Impact: Understand the consequences of each possible decision. Weigh the short-term benefits against the long-term effects on all parties involved.

- Consult with Others: When unsure, seeking advice from colleagues, mentors, or even external experts can provide valuable perspectives that might clarify the situation.

- Make a Decision: After weighing all factors, make the most informed and fair choice, ensuring that personal integrity and honesty are upheld.

Fostering an Environment of Accountability

- Open Communication: Encourage transparency within the team. By fostering an environment where individuals feel comfortable discussing challenges, potential ethical issues can be addressed early.

- Implement Clear Policies: Having well-structured protocols in place can guide decision-making and help individuals recognize acceptable actions in difficult situations.

- Encourage Self-Reflection: Professionals should regularly reflect on their own values and decisions to ensure alignment with personal and organizational principles.

Managing moral challenges is not always straightforward, but it is an essential skill in any field. By building a strong foundation based on integrity and accountability, individuals can navigate complex situations with confidence, knowing that their decisions reflect their core values.

Impact of Ethics on Client Relationships

The foundation of any strong professional relationship is built on trust and mutual respect. In fields where individuals provide advice, services, or products to clients, maintaining this trust is crucial. The way professionals handle interactions and make decisions can significantly influence the strength of their relationships with clients. A commitment to principles such as honesty, transparency, and fairness can enhance these bonds, leading to long-term success and satisfaction for all parties involved.

When individuals act with integrity, clients are more likely to feel confident in their decisions and believe they are being treated fairly. This not only fosters loyalty but also encourages clients to return for future services and recommend the professional to others. On the other hand, failing to uphold these values can lead to misunderstandings, dissatisfaction, and potential harm to both the client and the service provider’s reputation.

Building Trust Through Consistency

Consistency is key in any professional relationship. When individuals consistently demonstrate reliable and honest behavior, they build a reputation that clients can count on. This creates a positive feedback loop where clients are more willing to trust the professional’s advice and rely on their expertise.

Key Elements to Strengthen Client Relationships

- Clear Communication: Keeping clients informed at all stages of their dealings ensures that there are no surprises and that they understand the rationale behind decisions.

- Respect for Client’s Best Interests: Always prioritizing the client’s needs above personal gain is essential in maintaining a respectful and ethical relationship.

- Accountability: Taking responsibility for actions, even when things don’t go as planned, helps build trust and shows commitment to the client’s wellbeing.

- Transparency: Being upfront about options, costs, and potential outcomes ensures that clients feel they are making fully informed decisions.

Ultimately, how professionals conduct themselves has a lasting effect on client relationships. By embedding core values into every interaction, individuals can create a positive and trusting environment that benefits both the client and the service provider in the long run.

Training and Development for Ethical Standards

Continuous learning and development play a crucial role in reinforcing fundamental values within any profession. Ensuring that individuals understand and apply core principles consistently requires structured training that addresses both theoretical knowledge and practical application. Well-designed programs help professionals not only grasp the importance of these principles but also learn how to incorporate them effectively into their daily decision-making processes.

Education in this area equips individuals with the tools to navigate complex situations while maintaining integrity and transparency. It also encourages personal reflection and growth, fostering an environment where values are consistently upheld. The goal of such training is to create a culture where adherence to these principles becomes second nature, guiding individuals to act with honesty, responsibility, and fairness.

Components of Effective Training Programs

- Scenario-Based Learning: Presenting real-life situations allows individuals to practice decision-making in a safe environment, helping them develop a deeper understanding of how to apply key values.

- Interactive Workshops: Hands-on training sessions enable professionals to engage in discussions, share experiences, and collectively explore how to handle challenging scenarios.

- Regular Refreshers: Periodic training updates ensure that individuals stay informed about the latest standards and trends, reinforcing important concepts over time.

- Mentorship Programs: Pairing experienced mentors with less experienced individuals provides guidance, feedback, and support, helping to solidify ethical practices in everyday work.

By investing in continuous education and development, organizations can build a workforce that not only meets industry expectations but also sets a higher standard for excellence. Such initiatives foster a culture of respect and trust, benefiting both the individuals involved and the broader community they serve.