When preparing for assessments in the realm of business finance, understanding the core concepts is essential. This section aims to guide you through the crucial topics that are commonly tested, providing insights and strategies for success. Whether you’re revising fundamental principles or diving deeper into complex theories, being well-prepared is the key to excelling.

In this guide, you’ll find essential tips on how to approach various questions effectively, offering a strategic overview of the most important areas to focus on. From analyzing financial documents to mastering the basics of transactions, each element plays a significant role in ensuring you can confidently tackle the challenge ahead.

Preparation and attention to detail are the driving forces behind achieving success. With a solid understanding of the material and the right approach, you can confidently navigate the path toward mastering the content and achieving your academic goals.

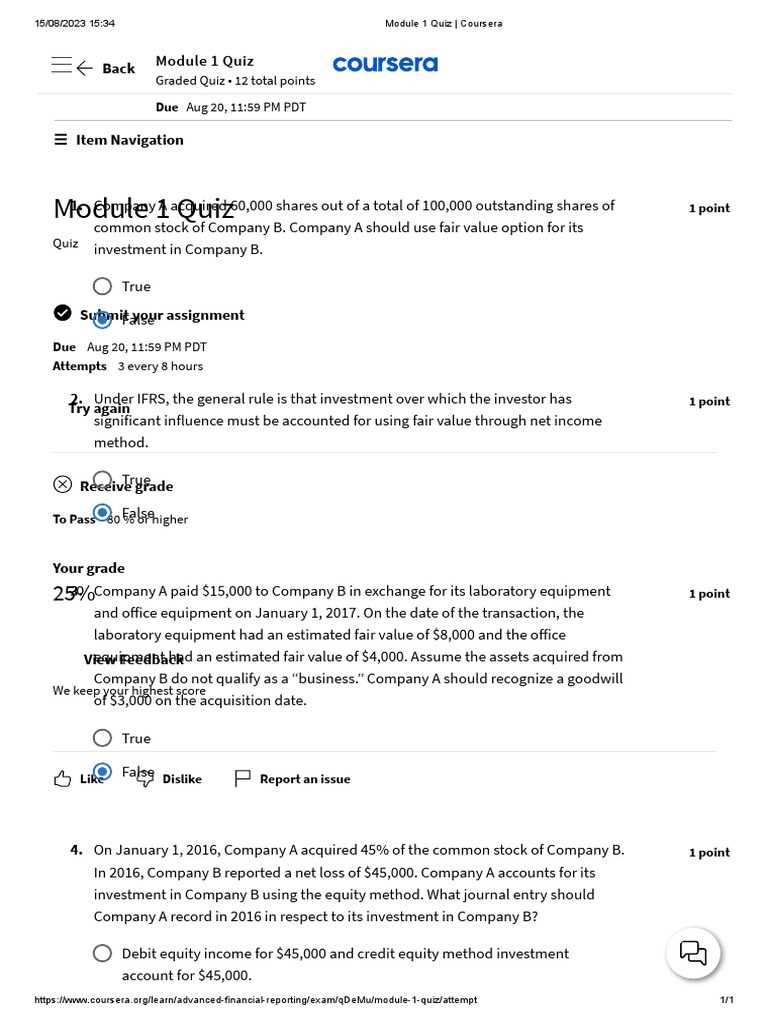

Coursera Financial Accounting Exam Overview

Understanding the structure and expectations of the assessment is vital to performing well. The assessment evaluates your grasp of essential business finance concepts, focusing on your ability to apply theoretical knowledge to real-world situations. This section will help you familiarize yourself with the scope and format of the evaluation, ensuring you’re prepared for what to expect.

The questions primarily test your knowledge of how companies manage and report their financial activities. Expect a mix of conceptual questions and practical scenarios, designed to challenge your understanding of core principles. Success relies on being able to critically analyze various financial data and apply accounting techniques to different contexts.

Preparation involves reviewing key topics such as transaction recording, financial statement analysis, and the relationships between different accounts. Developing a deep understanding of these areas will equip you with the skills to tackle the assessment with confidence and precision.

Key Concepts Tested in the Final

The assessment evaluates a variety of core topics essential to understanding how businesses record, process, and report their financial information. A strong grasp of these key areas is necessary to excel. This section highlights the critical concepts that you should be well-versed in to perform at your best. These concepts serve as the foundation for most of the questions you’ll encounter.

Below is a summary of the major concepts typically covered in the assessment:

| Concept | Description |

|---|---|

| Transaction Recording | Understanding how business transactions are recorded in journals and ledgers, including the use of debits and credits. |

| Financial Statements | Knowledge of the three primary financial documents: balance sheet, income statement, and cash flow statement. |

| Double-Entry System | Mastery of the principles of the double-entry bookkeeping method, where every transaction affects two accounts. |

| Cost Allocation | Understanding how costs are assigned to products or services and their impact on business profitability. |

| Ratio Analysis | Ability to analyze financial performance using key ratios like liquidity, profitability, and solvency ratios. |

| Revenue Recognition | Grasping when and how revenue should be recognized in financial statements, based on accounting standards. |

Familiarity with these concepts will help you effectively tackle the questions and scenarios designed to test your understanding of the material. Be sure to review them thoroughly to ensure you can apply the knowledge in different situations.

Preparation Tips for Financial Accounting Exam

Effective preparation is crucial for performing well in any business finance evaluation. A structured approach can help you master the key concepts and feel confident on the day of the test. This section offers practical tips to ensure you’re ready for any challenge the assessment may present.

Focus on Core Topics

Start by reviewing the primary subjects that will be tested. Prioritize the following areas:

- Transaction recording and journal entries

- Analysis of financial statements

- Application of accounting principles

- Understanding balance sheets and income statements

- Calculation and interpretation of key financial ratios

Practice with Real-World Scenarios

Putting theory into practice is essential for deepening your understanding. Consider the following methods:

- Work through example problems to reinforce your learning.

- Simulate real-life situations where you would need to analyze financial data.

- Review case studies to understand how accounting practices apply in different industries.

By actively engaging with the material and practicing different scenarios, you’ll develop the critical thinking skills necessary to apply the concepts effectively during the evaluation.

Understanding Financial Statements

Grasping how businesses present and interpret their financial data is crucial for assessing their economic health. Financial statements provide insights into a company’s performance and financial position, serving as the foundation for decision-making. This section focuses on helping you understand the core components of these reports and how to analyze them effectively.

The Balance Sheet

The balance sheet is one of the most important documents, as it provides a snapshot of a company’s financial position at a given point in time. It shows the relationship between assets, liabilities, and equity. Understanding how these elements interact allows you to assess a company’s stability and its ability to meet financial obligations.

Income Statement and Cash Flow

The income statement reveals a company’s profitability over a specific period, detailing revenues, expenses, and net income. On the other hand, the cash flow statement provides an overview of cash inflows and outflows, shedding light on the company’s liquidity and how it manages its operational cash flow.

By analyzing these financial documents, you can evaluate how well a company is performing, its financial health, and its potential for growth. Mastery of this concept is essential for interpreting the broader context of any business’s financial operations.

Importance of Accounting Principles

The foundation of any reliable financial system lies in the principles that guide how information is recorded and reported. These principles ensure consistency, transparency, and accuracy in the way businesses communicate their financial health. Understanding and adhering to these rules is essential for maintaining trust and making informed decisions based on financial data.

Accounting principles help establish a common framework that allows individuals and organizations to interpret financial reports in a standardized manner. They serve as the backbone for financial reporting, ensuring that transactions are recorded consistently and fairly, regardless of the entity or industry.

Without these core guidelines, financial information could become inconsistent, leading to misinterpretations and poor decision-making. A strong grasp of these principles helps in accurately analyzing and comparing financial data, both within and across organizations.

Common Mistakes to Avoid

During assessments in business finance, it’s easy to make mistakes that can negatively impact your performance. Being aware of common pitfalls can help you avoid errors that often arise when handling financial data or answering related questions. This section highlights typical mistakes and offers advice on how to steer clear of them.

Below are some of the most frequent errors that students make:

| Mistake | Explanation |

|---|---|

| Misunderstanding Transactions | Not recognizing the correct accounts involved in a transaction or recording the wrong amounts can lead to inaccurate financial reports. |

| Confusing Debits and Credits | Many struggle with the concept of debits and credits, leading to errors in balancing books or journal entries. |

| Overlooking Financial Ratios | Ignoring key ratios, such as liquidity or profitability ratios, can result in an incomplete analysis of a company’s performance. |

| Failing to Understand Timing | Not recognizing when revenue should be recognized or when expenses should be accounted for can distort financial results. |

| Inaccurate Cost Allocation | Incorrectly allocating costs to products or services can lead to misleading profit margins and financial analysis. |

By recognizing and avoiding these mistakes, you can improve your ability to analyze financial data accurately and avoid errors that might otherwise impact your understanding of the subject matter.

How to Approach Multiple-Choice Questions

Multiple-choice questions are designed to test your knowledge and understanding of key concepts. To succeed, it’s important to approach them with a clear strategy. This section outlines effective methods for tackling these types of questions, helping you avoid common mistakes and maximize your performance.

Strategies for Success

Here are some tips to enhance your approach when dealing with multiple-choice questions:

- Read the question carefully: Understand what is being asked before reviewing the options. Sometimes, subtle details in the phrasing can help guide you to the correct answer.

- Eliminate obvious wrong answers: Narrowing down your choices increases your chances of selecting the correct response, even if you’re unsure.

- Look for keywords: Focus on keywords in both the question and the choices that can lead you to the right answer.

- Use your knowledge of principles: Apply the core concepts you’ve studied to quickly identify the most appropriate option.

Managing Time and Confidence

Managing your time effectively during the assessment is also crucial. Here are some tips to help you stay on track:

- Don’t dwell on tough questions: If you’re unsure, move on to the next question and come back later if you have time.

- Trust your instincts: Often, your first choice is the correct one. Don’t second-guess yourself unnecessarily.

- Stay calm and focused: Stay composed and methodical in your approach, even if the questions seem difficult at first.

By following these strategies, you can approach multiple-choice questions with greater confidence and accuracy, improving your chances of success in the assessment.

Study Resources for Financial Accounting

To successfully navigate through the study material, having the right resources is essential. Whether you prefer books, online courses, or interactive tools, a combination of study aids can help reinforce your understanding and prepare you effectively. In this section, we’ll explore various resources that can support your learning journey and help you master key concepts.

Books and Textbooks

Books provide a solid foundation for understanding the principles and theories behind financial management. Some widely recommended textbooks include:

- “Principles of Finance” – Offers in-depth explanations of key financial concepts and practical examples.

- “Essentials of Business Finance” – A great resource for beginners looking for clear and concise explanations.

- “Financial Reporting and Analysis” – Helps in understanding how to analyze financial statements and interpret key metrics.

Online Courses and Tutorials

Online platforms provide interactive courses and video tutorials, which can be an excellent way to learn at your own pace. Some top-rated platforms include:

- LinkedIn Learning: Offers short courses on various topics related to finance and business management.

- Khan Academy: Provides free video tutorials explaining the fundamentals of business finance and financial markets.

- Udemy: Features a wide range of finance-related courses designed for both beginners and advanced learners.

Practice Resources

Practicing problems and case studies can significantly enhance your ability to apply theoretical concepts to real-life scenarios. Consider these resources:

- AccountingCoach: A comprehensive online resource with quizzes and exercises for mastering key concepts.

- Quizlet: Offers flashcards and practice exams on various topics, including financial analysis and reporting.

- Wiley’s Accounting Exam Prep: A resource specifically designed for practicing questions commonly found in business finance assessments.

By using a variety of resources, including books, online courses, and interactive tools, you can ensure a well-rounded preparation that caters to different learning styles and helps reinforce your understanding of important concepts.

Time Management During the Exam

Effective time management is crucial when taking any test. With limited time and a set number of questions, it’s important to approach the assessment with a clear plan. Managing your time wisely will ensure you can complete all sections, review your answers, and avoid unnecessary stress.

Key Strategies for Time Management

Here are some practical tips to help you make the most of the time during your assessment:

- Understand the format: Before starting, familiarize yourself with the number of questions and the type of content. This will help you allocate time more effectively.

- Set a time limit for each section: Divide the total time by the number of sections or questions, and try to stick to this limit as you work through the test.

- Start with easier questions: Quickly go through the test and answer questions you are confident about first. This will help build momentum and save time for tougher questions.

Managing Challenging Questions

Some questions might be more challenging than others, and spending too much time on them can leave you rushing through the easier ones. Here are some tips:

- Don’t get stuck: If you find a question particularly difficult, move on to the next one and come back to it later. It’s better to skip and return than to waste time on one question.

- Use process of elimination: If unsure about an answer, eliminate the obviously incorrect choices and make an educated guess. Often, the remaining options are easier to evaluate.

- Mark for review: Use any available features to mark questions you want to revisit. This will help you stay focused on completing the test without missing key details.

By organizing your time wisely and staying focused, you’ll be able to tackle the test confidently and maximize your chances of success. Time management is as important as knowledge, so make it a priority during your preparation and on test day.

Practical Examples to Improve Knowledge

Understanding theoretical concepts is important, but applying them to real-life situations is key to mastering any subject. Practical examples help bridge the gap between theory and practice, allowing learners to solidify their knowledge and develop problem-solving skills. In this section, we will explore several examples that will help reinforce essential principles and improve comprehension.

Example 1: Budgeting for a Business

One practical example to understand core concepts is budgeting for a small business. Imagine you are tasked with creating a financial plan for a company with a set income. You will need to allocate resources for operating expenses, wages, and other costs, ensuring that the business stays profitable. This example involves calculating net income, determining fixed and variable costs, and applying knowledge of cash flow management.

Example 2: Analyzing a Company’s Profitability

Another valuable exercise is analyzing the profitability of a company by examining its income statement. For instance, given a hypothetical company’s revenue and expenses, you can calculate gross profit, operating profit, and net income. This allows you to practice evaluating financial performance and understanding the impact of different types of costs on a company’s bottom line.

Example 3: Creating a Personal Financial Statement

A third example is creating a personal financial statement, which involves tracking income, savings, and expenditures. This can help you understand how individual financial decisions affect overall financial health. By categorizing assets, liabilities, and calculating net worth, you will improve your ability to assess financial stability and plan for the future.

These practical examples allow you to apply theoretical knowledge to realistic situations, giving you a deeper understanding of the material. Engaging with real-world scenarios enhances your ability to retain key concepts and prepares you to solve problems effectively.

Understanding Debits and Credits

Debits and credits are foundational concepts that underpin the entire system of recording business transactions. While they may seem complex at first, understanding how these entries affect accounts is essential for accurate record-keeping and financial analysis. Each transaction in a financial system impacts at least two accounts–one account is debited, and another is credited, following the principles of double-entry bookkeeping.

In essence, every transaction involves a balancing act where debits and credits ensure that the accounting equation (Assets = Liabilities + Equity) remains in equilibrium. For example, when a company receives cash from a sale, it debits the cash account (an asset) and credits the sales revenue account (income), reflecting the increase in both the asset and the company’s earnings.

Debits

Debits are used to record increases in assets and expenses, as well as decreases in liabilities, equity, and income. When an account is debited, it typically represents something being added, whether it is cash or an asset purchased for the business. For example, if a company buys equipment, the equipment account is debited to show the increase in assets.

Credits

Credits, on the other hand, are used to record increases in liabilities, equity, and income, as well as decreases in assets and expenses. When a company takes out a loan, the liability account for the loan is credited to reflect the increase in the business’s obligations. Similarly, when a company makes a sale, the revenue account is credited, reflecting the increase in income.

To ensure the accuracy of financial reports, it is crucial to remember that for every debit entry, there must be an equal and corresponding credit entry. This balance helps maintain consistency in financial records, providing clarity and accuracy for decision-making processes. By practicing the application of debits and credits in various scenarios, you can strengthen your understanding of how they influence overall financial statements.

Mastering Income Statements and Balance Sheets

Understanding how to read and interpret key financial documents is essential for any business or individual interested in monitoring and improving financial health. Among the most important of these documents are the income statement and balance sheet. These statements provide a snapshot of a company’s performance and financial position, offering valuable insights into its profitability, asset management, and overall financial stability.

The income statement reveals how well a company generates profit from its revenue, by subtracting expenses from sales. It shows whether the company is making money or incurring losses over a specified period. The balance sheet, on the other hand, provides a snapshot of the company’s assets, liabilities, and equity at a given point in time, helping stakeholders assess the company’s financial structure and solvency.

Understanding the Income Statement

The income statement is often referred to as the “profit and loss statement” and provides an overview of a company’s revenues, costs, and expenses during a specific period. The primary goal of this statement is to show the company’s profitability over time. Key components of the income statement include:

- Revenue: The total amount of money received from the sale of goods or services.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of the goods sold.

- Gross Profit: Revenue minus the cost of goods sold.

- Operating Expenses: Costs associated with running the business, such as salaries, rent, and utilities.

- Net Income: The final profit or loss after subtracting all expenses from total revenue.

Breaking Down the Balance Sheet

The balance sheet is a snapshot of the company’s financial position at a specific point in time. It is based on the accounting equation: Assets = Liabilities + Equity. The balance sheet is divided into two main sections:

- Assets: Resources owned by the company, such as cash, property, and equipment.

- Liabilities: The company’s debts or obligations, including loans and accounts payable.

- Equity: The owners’ interest in the company, calculated as the difference between assets and liabilities.

By mastering the income statement and balance sheet, you gain the ability to analyze the financial health of a business, track performance over time, and make informed decisions. These statements, when understood properly, serve as powerful tools for anyone involved in business management, investing, or financial planning.

Analyzing Cash Flow Statements

A cash flow statement is an essential financial document that reveals how a company generates and spends cash over a specific period. Unlike the income statement, which focuses on profitability, the cash flow statement provides a clearer picture of a company’s liquidity by tracking the actual movement of cash in and out of the business. It helps investors, managers, and stakeholders assess the company’s ability to pay its bills, invest in growth, and manage debt.

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities. Each of these sections provides insights into different aspects of a company’s financial operations. Understanding how to interpret these sections is crucial for analyzing a company’s overall financial health and its capacity to meet its short- and long-term obligations.

Operating Activities

This section reflects the cash generated or used by the company’s core business operations. It includes cash inflows from sales and cash outflows from expenses such as salaries, rent, and utilities. The net cash flow from operating activities indicates whether a company is generating sufficient cash to maintain day-to-day operations and fund its ongoing activities without relying on external financing.

- Cash Inflows: Payments received from customers or clients.

- Cash Outflows: Payments made for operational costs, including wages, raw materials, and utilities.

- Net Cash Flow from Operations: The difference between inflows and outflows, indicating the efficiency of business operations.

Investing Activities

This section covers cash transactions related to the company’s investments in long-term assets, such as property, equipment, and securities. It also includes cash received from the sale of assets or investments. Analyzing this section helps determine whether a company is investing enough to fuel future growth or whether it is divesting assets to cover operational expenses.

- Cash Outflows: Payments made for purchasing long-term assets or investments.

- Cash Inflows: Proceeds from selling assets or investments.

- Net Cash Flow from Investing Activities: The balance of cash spent or received from these investment-related transactions.

Financing Activities

The financing activities section tracks cash movements related to external funding, such as issuing or repaying debt, issuing shares, or paying dividends. This section reflects how the company raises capital and manages its capital structure. Analyzing this section helps understand the company’s reliance on debt or equity financing and its approach to managing financial leverage.

Tips for Reviewing Your Exam Answers

Reviewing your responses before submitting an assessment is a crucial step that can help identify errors, improve clarity, and ensure accuracy. Taking the time to double-check your work can significantly enhance the quality of your responses and boost your confidence in the final result. A systematic approach to reviewing your responses can also help you catch mistakes that might otherwise go unnoticed during the first round of answering.

When revisiting your work, it’s important to focus on both the content and the structure of your answers. Ensure that you’ve addressed the questions fully and provided the necessary explanations or calculations. It’s equally essential to look for any inconsistencies or errors in your logic or calculations that could affect the overall quality of your submission.

Focus on Clarity and Precision

One of the most common issues in assessments is a lack of clarity in responses. Ensure that your answers are concise yet complete, offering the necessary details without unnecessary elaboration. Clearly structured answers with appropriate explanations are easier to understand and more likely to earn full marks.

- Be Clear: Avoid ambiguity by being as precise as possible with your statements.

- Use Simple Language: Complex wording can confuse your reader, so keep your language straightforward.

- Double-Check Terminology: Ensure you’ve used terms correctly, particularly technical or subject-specific vocabulary.

Verify Calculations and Data

For any assessment involving numerical or data-based questions, it’s critical to verify your calculations. A simple mathematical error or a misplaced decimal point can lead to incorrect answers. Take the time to recheck your math and confirm that the data used is accurate and relevant to the question.

- Recalculate: Double-check any arithmetic or algebra to make sure your results are correct.

- Check Units: Make sure all units are consistent and appropriate for the question.

- Cross-Verify Data: Ensure that any data or facts used in your response align with the given information.

By following these simple but effective tips, you can enhance the quality of your responses and increase your chances of achieving a higher score. Reviewing your work carefully shows attention to detail and a commitment to producing accurate, well-structured responses.

Utilizing Online Community for Support

Engaging with an online community can provide invaluable assistance when you’re preparing for a challenging assessment or seeking clarification on complex topics. Many learning platforms offer discussion forums, peer support, and collaborative spaces where students can share insights, ask questions, and discuss difficult concepts. Leveraging this network can enhance your understanding and boost your confidence as you work through your course material.

In an online learning environment, interacting with fellow learners is often one of the most effective ways to clarify doubts and deepen your knowledge. By discussing key topics and sharing strategies, you can gain new perspectives and solutions that might not be immediately apparent from the course materials alone.

Benefits of Joining Online Forums

Participating in a learning community has several advantages. It not only allows you to ask questions but also provides an opportunity to teach others. By explaining concepts to peers, you reinforce your own understanding. Additionally, getting feedback from others can help identify gaps in your knowledge and give you ideas on how to approach difficult questions.

- Peer Support: Exchange ideas and solutions with classmates who may have encountered similar challenges.

- Expert Advice: Many platforms feature mentors or instructors who actively participate in discussions, offering expert guidance.

- Collaborative Learning: Working together allows for a broader range of perspectives and approaches to problems.

How to Make the Most of Online Communities

To maximize the benefits of online forums and discussions, it’s important to engage actively and regularly. Here are some tips for getting the most out of these resources:

- Ask Clear Questions: When seeking help, provide as much context as possible to make it easier for others to understand your query.

- Contribute to Discussions: Sharing your insights and solutions not only helps others but also reinforces your own knowledge.

- Search Before Asking: Many common questions may have already been answered in the community, so use the search function to find existing solutions.

| Tip | Action |

|---|---|

| Active Participation | Contribute to discussions to deepen your own understanding and help others. |

| Clear Communication | Ensure your questions are detailed and concise to get the most relevant answers. |

| Use Resources | Explore other learners’ posts and shared resources for new ideas and solutions. |

By utilizing these online communities effectively, you can build a support system that enhances your learning experience, helps you solve problems faster, and fosters a sense of belonging within the course. The collaborative environment can make the learning process both more efficient and enjoyable.

Assessment Scoring and Evaluation

Understanding how your performance is measured and evaluated is crucial when preparing for any assessment. It helps you gauge the areas in which you excel and those that require more attention. Typically, assessments are scored based on correct responses, with each correct answer contributing a certain number of points to your overall score. This process allows for an objective evaluation of your understanding of the material covered.

In most cases, the evaluation is not just about the number of correct answers but also the application of knowledge, the ability to analyze scenarios, and the clarity of your reasoning. Whether it’s a multiple-choice question or a problem-solving task, demonstrating a clear understanding of the core principles is key to achieving a high score.

Understanding Scoring Criteria

To succeed, it is important to be aware of the criteria that determine your overall score. Here are some common factors that influence evaluation:

- Accuracy: The most significant factor is the correctness of your answers. Each correct response will typically contribute to your final score.

- Completion: Ensuring that all sections are completed is vital. Partial responses may not contribute as effectively to your score.

- Clarity and Precision: How clearly you explain your reasoning and how precisely you apply your knowledge can affect evaluation, especially for open-ended questions.

Reviewing Your Performance

Once the assessment is graded, you will usually have access to feedback that highlights both your strengths and areas for improvement. Take time to review this feedback and understand where you can make improvements for future assessments.

- Identify Patterns: Look for patterns in the questions you struggled with. This can indicate areas where your understanding might need strengthening.

- Apply Feedback: Use the feedback provided to refine your study techniques and avoid repeating the same mistakes in the future.

- Track Progress: Keeping track of your scores over time helps you monitor your improvement and adjust your study habits accordingly.

By recognizing the key factors that influence scoring and evaluation, you can better prepare for assessments, strategically focusing on areas that matter most. This understanding not only helps you achieve better results but also enhances your overall learning experience.

What to Do After Completing the Assessment

After finishing an assessment, it’s important to take a moment to reflect on the process and plan your next steps. Completing the task is an accomplishment, but your journey doesn’t end there. How you approach the post-assessment phase can help you understand your strengths and pinpoint areas for improvement, ultimately enhancing your learning experience and helping you grow.

Once the assessment is submitted, avoid the urge to rush into another task immediately. Instead, take the time to review the experience. Whether you performed as expected or encountered difficulties, this reflection phase is essential for your continued progress.

Review Your Performance

After the assessment is graded, it’s important to thoroughly review your results. This can provide valuable insights into how well you understood the material and how accurately you applied your knowledge. Pay attention to the feedback, as it can highlight areas where you excelled and where further practice is needed.

- Examine Mistakes: If there were any mistakes, take time to understand why they happened. Did you misunderstand the question or misapply a concept? Recognizing these patterns helps you avoid repeating them in future tasks.

- Celebrate Successes: Acknowledge the parts you did well on. This not only boosts your confidence but also reinforces your understanding of the topics you’ve mastered.

- Seek Additional Resources: If certain concepts were particularly challenging, consider revisiting study materials or seeking additional resources that can clarify these areas.

Set New Goals for Improvement

After evaluating your performance, set specific goals for what you want to achieve moving forward. This could involve reviewing certain topics in more depth, practicing specific skills, or improving your time management. Having clear goals will keep you focused and motivated as you continue your learning journey.

- Focus on Weak Areas: Identify the topics where you struggled and devote extra time to those in your future studies.

- Practice Regularly: Regular practice helps reinforce concepts and improve long-term retention. Consider taking practice quizzes or completing additional exercises.

- Stay Consistent: Consistency in your study habits will lead to steady improvement. Make sure to dedicate time regularly to reviewing the material, even after an assessment is complete.

By taking the time to reflect on your performance and set actionable goals, you ensure that the process doesn’t end with the submission of your work. This ongoing cycle of reflection and goal setting is key to mastering any subject and achieving continued success.

Strategies for Improving Accounting Skills

Enhancing expertise in managing financial records requires a well-rounded approach. It involves not only understanding theoretical concepts but also applying them to practical situations. Developing strong analytical and problem-solving abilities is essential for interpreting and organizing complex data. Whether you’re a beginner or looking to sharpen your skills, following a structured path can significantly improve your proficiency.

1. Strengthen the Fundamentals

Start by mastering the core concepts that form the foundation of the discipline. Without a solid understanding of the basics, progressing to advanced topics can be challenging. Focus on grasping the essential principles, key terms, and foundational techniques.

- Learn Essential Terminology: Familiarize yourself with common terms such as assets, liabilities, equity, and revenue. Understanding these concepts is critical to grasping how various financial components interact.

- Understand Core Processes: Get comfortable with the basics of budgeting, forecasting, and record-keeping. These are vital for managing and interpreting financial data accurately.

- Focus on Key Calculations: Practice fundamental mathematical processes like profit margins, return on investment, and cost of goods sold. These calculations form the basis for evaluating financial health.

2. Consistent Practice and Application

The best way to reinforce your understanding is by applying your knowledge through practice. This can involve solving problems, analyzing real-world case studies, or using simulations to test your skills.

- Work Through Practical Exercises: Solve problems and work through example scenarios. Practice will improve your ability to quickly and accurately apply concepts.

- Analyze Real-World Data: Try working with financial statements from actual companies. This exercise will help you understand how theoretical concepts are applied in real business settings.

- Use Online Tools: Utilize digital tools or software that simulate financial management. These resources offer practical experience in handling data and making decisions.

3. Seek Continuous Feedback

Receiving feedback from mentors, peers, or professionals in the field can help identify areas for improvement. Understanding mistakes and learning from them is crucial for growth.

- Ask for Feedback on Work: Regularly seek input on your assignments or calculations. Constructive criticism can guide your improvement and highlight weak areas.

- Engage with a Community: Participate in study groups or online communities. Discussing concepts with others can provide fresh perspectives and deepen your understanding.

- Work with a Mentor: A mentor can provide guidance on complex topics and help you stay on track. Their experience can offer valuable insights that improve your learning process.

4. Continuously Challenge Yourself

Once you’ve mastered the basics, it’s important to keep pushing your boundaries. Take on more complex projects, explore advanced topics, and seek opportunities to apply your knowledge in diverse contexts.

- Set Learning Milestones: Break down complex subjects into manageable goals. Focus on mastering each milestone before moving on to the next to avoid feeling overwhelmed.

- Explore Advanced Topics: Once comfortable with the basics, dive into specialized areas such as investment analysis, tax planning, or strategic financial decis