Preparing for assessments related to financial regulations and obligations requires a solid understanding of key principles and practical applications. To succeed, it’s essential to master the most common scenarios, rules, and techniques involved in this field. Grasping the core concepts will allow you to tackle various challenges with confidence and clarity.

Understanding the types of problems typically presented is crucial for effective preparation. These problems often test your ability to apply theoretical knowledge to real-world situations. By familiarizing yourself with the typical format and types of inquiries, you can better navigate complex tasks and demonstrate your proficiency.

Approaching these tasks with a strategic mindset is important. Whether you’re reviewing specific guidelines or solving case studies, being able to quickly assess the requirements and focus on the most important aspects will ensure success. With the right preparation, you can approach your next assessment with assurance and clarity.

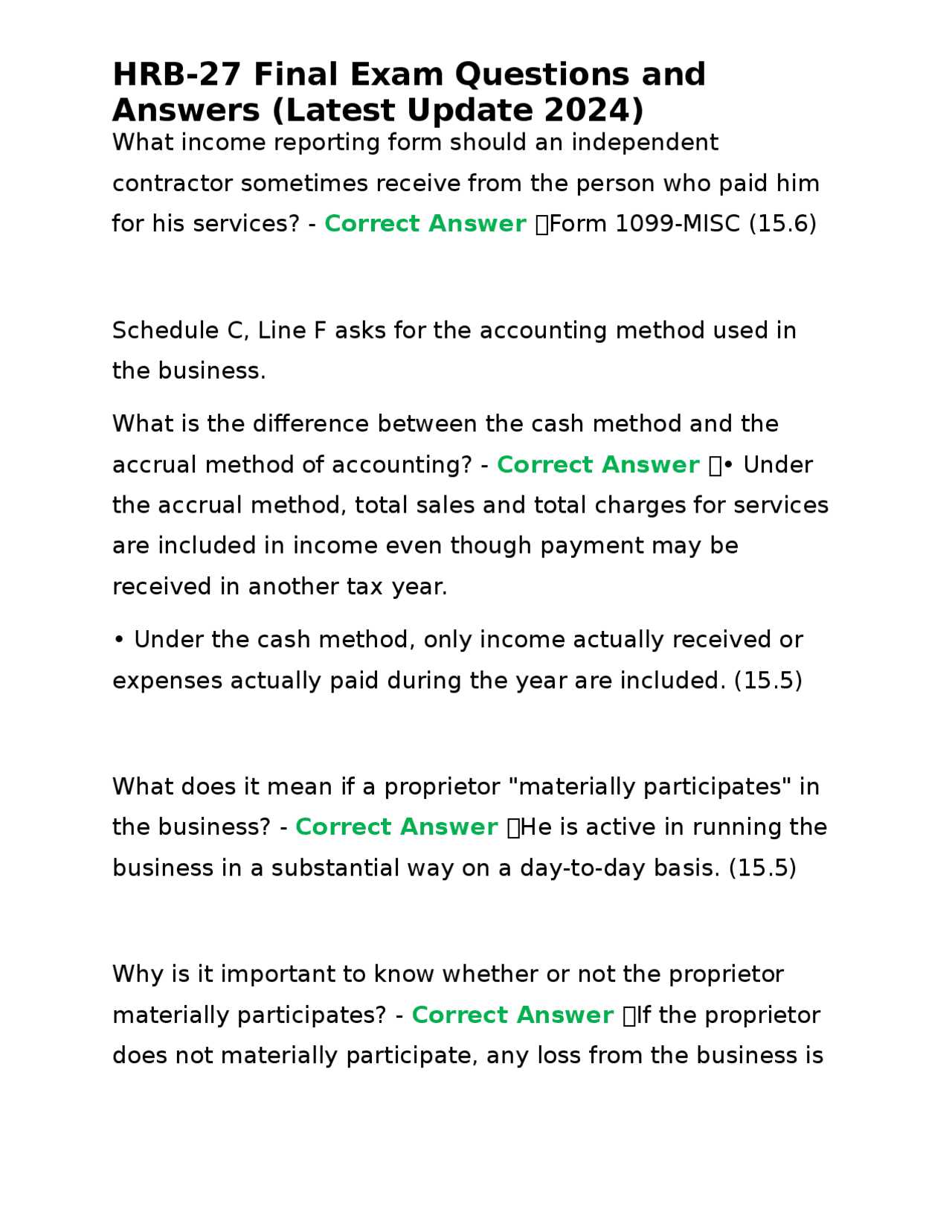

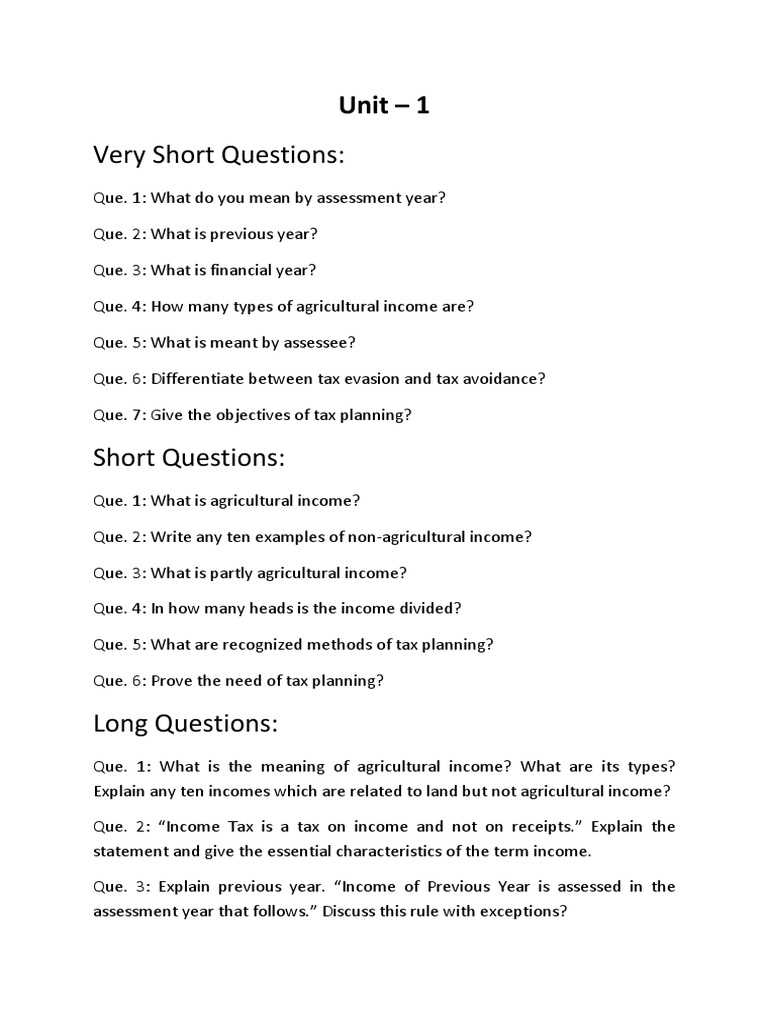

Tax Exam Questions and Answers

Assessments in this field often require an understanding of various principles and their practical applications. Being able to analyze different scenarios, apply the correct rules, and interpret data accurately is essential for success. A strong grasp of fundamental concepts will enable you to approach any problem methodically and efficiently.

Commonly encountered tasks in these evaluations test your ability to solve complex problems, interpret information, and make informed decisions. These challenges may involve everything from calculating liabilities to understanding specific guidelines and their real-world implications. Mastery of these topics is critical to performing well.

Effective preparation is key to success in such evaluations. Familiarizing yourself with the most frequently tested concepts and practicing with examples can significantly enhance your ability to address any issue presented. Developing a structured approach and honing problem-solving skills will ensure that you can tackle tasks with confidence.

Common Tax Concepts You Must Know

When preparing for assessments in the field of financial obligations, it’s essential to have a clear understanding of fundamental principles. These core ideas form the foundation of the subject, helping you interpret real-world scenarios and navigate practical tasks. Familiarity with these concepts will enable you to approach any challenge with clarity and confidence.

Key Principles to Master

- Liabilities: Understanding the different types of financial obligations and how to calculate them is crucial.

- Exemptions: Knowing what items or individuals may be excluded from certain requirements is important for accurate evaluations.

- Credits: Recognizing how to apply reductions or benefits can significantly impact overall calculations.

- Filing Status: The classification of individuals based on their personal situation plays a large role in determining rates and allowances.

Key Methods for Problem Solving

- Calculating Deductions: Identifying allowable expenses that can reduce the overall amount owed.

- Understanding Gross vs. Net: The distinction between total earnings and the amount remaining after deductions must be clear.

- Application of Rates: Knowing how to apply different percentages to various income levels or assets is essential.

Mastering these principles ensures you can tackle any related scenario with precision. By studying these concepts thoroughly, you’ll be well-prepared to address the tasks typically encountered in assessments of this nature.

Understanding Tax Filing Requirements

When preparing for an assessment in this field, it’s crucial to understand the specific criteria and guidelines that govern how individuals and businesses must report their financial activities. Compliance with these rules is essential to ensure proper processing and avoid potential penalties. Understanding the conditions under which filings are required helps clarify the steps involved in the process.

There are different factors that influence when, how, and why a submission may be needed. These include income thresholds, the type of entity involved, and various exclusions or exceptions based on specific circumstances. Being aware of these elements can help streamline the reporting process and ensure everything is in order.

| Filing Condition | Required Action | Exceptions |

|---|---|---|

| Income Level | Submit forms based on income brackets | Varies by filing status |

| Filing Status | Choose appropriate category (single, married, etc.) | Special cases like dependents or self-employed |

| Entity Type | Complete appropriate documentation for individuals or businesses | Nonprofit or exempt organizations may file differently |

By understanding the key factors that influence filing obligations, you can ensure that all necessary actions are taken and that the proper forms are filed in a timely manner.

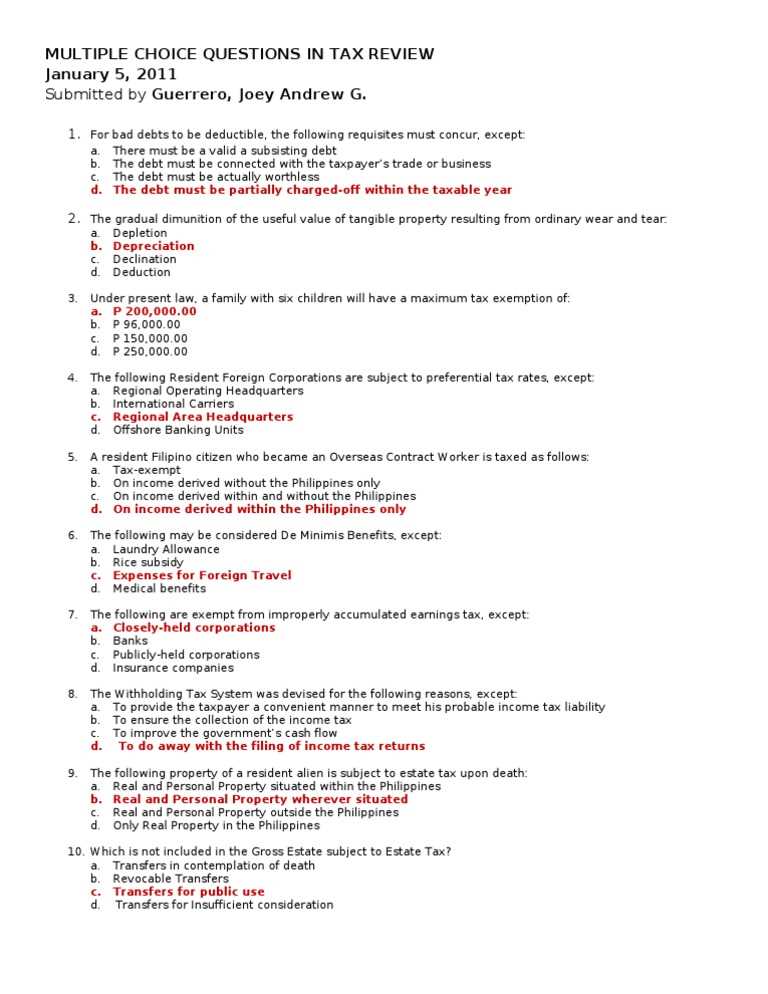

Types of Tax Questions on Exams

In assessments focused on financial regulations, the problems posed often test a wide range of skills. These challenges vary in format, complexity, and scope, requiring you to apply theoretical knowledge to real-world scenarios. Understanding the types of inquiries you may encounter is crucial for efficient preparation and success.

The tasks typically present different ways to evaluate your understanding of rules, calculations, and procedures. Some might ask you to solve numerical problems, while others could focus on interpreting specific guidelines or analyzing case studies. Being prepared for all these types of challenges will help you approach the assessment confidently.

Examples include:

- Calculation Problems: Solving numerical questions that require applying rates and deductions to given figures.

- Conceptual Questions: Assessing your understanding of specific rules, such as eligibility for exemptions or credits.

- Scenario-Based Problems: Presenting hypothetical situations where you must apply knowledge to solve practical challenges.

- Multiple-Choice Questions: Offering several possible answers to test your quick decision-making and knowledge recall.

By familiarizing yourself with the range of problems that may arise, you can tailor your preparation to be more effective and thorough.

How to Approach Tax Calculation Problems

When faced with numerical problems in assessments, it’s important to follow a systematic approach to ensure accurate results. These tasks often require applying specific rules to figures in order to calculate obligations or deductions. Having a structured method helps you tackle even the most complex problems with confidence.

Start by carefully reading the problem to understand the scenario. Identify the key figures provided and determine which formulas or procedures are needed to solve the issue. Break the problem down into smaller, manageable steps, ensuring that you apply the correct principles to each part.

Follow these steps to efficiently solve these problems:

- Identify the Variables: Highlight the key figures or information needed to perform the calculation.

- Choose the Correct Formula: Use the appropriate method or equation based on the specific task.

- Perform the Calculation: Carefully apply the formula to the provided data, ensuring all steps are followed correctly.

- Check for Errors: Review your work to make sure no mistakes were made during the calculation process.

By approaching numerical problems with a clear strategy, you can ensure that you stay organized and minimize the risk of errors, ultimately leading to more accurate solutions.

Tax Deductions and Credits Explained

Understanding the various ways to reduce financial obligations is crucial when preparing for assessments in this field. Certain expenses or situations may allow individuals to lower their overall liability, either by reducing taxable income or directly decreasing the amount owed. It’s essential to know how each method works and how to apply it correctly.

Key Differences Between Deductions and Credits

Both deductions and credits offer ways to reduce financial responsibilities, but they function in different ways:

| Type | How It Works | Impact on Liability |

|---|---|---|

| Deductions | Subtracted from total income to lower taxable amount | Reduces the amount of income that is subject to calculation |

| Credits | Directly subtracted from the final amount owed | Reduces the actual liability amount |

Common Examples of Deductions and Credits

- Standard Deductions: A fixed amount subtracted from gross income, often based on filing status.

- Itemized Deductions: Specific allowable expenses, such as medical costs, mortgage interest, or charitable donations.

- Child Tax Credit: A direct reduction in liability for those with qualifying dependents.

- Education Credits: Benefits for expenses related to schooling, such as tuition or fees.

By understanding the nuances of each method, you can ensure that you’re using them to their full potential, ultimately reducing the financial obligations you’re required to meet.

Common Mistakes to Avoid in Tax Exams

When preparing for assessments in the field of financial regulations, it’s important to avoid certain pitfalls that can hinder your performance. Many individuals fall into the trap of common errors that could easily be prevented with a bit of attention to detail. Recognizing these missteps in advance will help you avoid unnecessary mistakes and increase your chances of success.

One of the most frequent mistakes is rushing through the problems without fully reading or understanding the instructions. Failing to identify key pieces of information or misinterpreting what is being asked can lead to incorrect solutions. Taking your time to analyze the situation carefully ensures that you’re addressing the correct task.

Here are some key mistakes to watch out for:

- Skipping Steps: Overlooking intermediate steps in calculations can lead to errors in the final result.

- Misapplying Rules: Incorrectly applying guidelines or using outdated information can lead to inaccurate conclusions.

- Not Double-Checking Work: Failing to review your answers for calculation errors or overlooked details can cost you valuable points.

- Ignoring Specific Instructions: Not following formatting or procedural requirements, such as rounding or documentation, can lead to penalties.

To avoid these mistakes: Stay organized, read each instruction thoroughly, and approach each problem methodically. Taking a moment to verify your work can make all the difference between a successful outcome and unnecessary errors.

Tax Law Changes and Their Impact

Changes in financial regulations can have a significant effect on both individuals and businesses, influencing their obligations and strategies. These modifications can range from minor adjustments to major overhauls of the rules that govern how income, deductions, and credits are calculated. Understanding how these updates affect different scenarios is crucial for staying compliant and making informed decisions.

How Legal Modifications Affect Individuals

When new rules are implemented, individuals may face alterations in the way they report their earnings or qualify for deductions. For example, changes in the allowable expenses or the income thresholds that trigger specific liabilities can result in higher or lower obligations. Staying updated with these changes ensures that individuals can optimize their filings and avoid potential pitfalls.

Impacts on Businesses and Corporations

Business owners may also experience significant changes due to updated regulations, especially those that affect how profits, investments, and employee-related costs are treated. A shift in corporate rate structures or a change in the way business expenses are deducted could lead to substantial financial adjustments. Companies must stay vigilant in reviewing these new rules to ensure that their operations remain efficient and compliant.

As legal frameworks evolve, it’s important to track these changes carefully. Keeping informed about updates ensures that both individuals and businesses can make adjustments as needed, minimizing risks and maximizing potential benefits.

How to Study Effectively for Tax Exams

Preparing for assessments in the field of financial regulations requires a focused and strategic approach. Success depends not only on understanding the material but also on how you organize your study sessions and manage your time. A well-thought-out plan will ensure that you cover all necessary topics and approach the material with confidence.

Start by breaking down the content into manageable sections. Focus on the core principles first, then dive deeper into the specific rules, calculations, and exceptions. Make sure to prioritize areas that are more complex or that you find challenging. This way, you can devote ample time to mastering the concepts that require more effort.

Some effective study strategies include:

- Use Practice Problems: Actively solve sample cases and calculations to reinforce your understanding and improve your problem-solving speed.

- Review Key Concepts: Revisit important rules and procedures regularly to ensure they are firmly ingrained in your memory.

- Create a Study Schedule: Set aside specific time blocks for each topic, ensuring you stay on track and cover everything before the assessment.

- Join Study Groups: Collaborating with peers can help clarify difficult points and allow you to discuss complex scenarios in a group setting.

By following a structured approach to studying, you can efficiently prepare and increase your chances of performing well, regardless of the complexity of the material. Consistency, focus, and a strategic plan are key elements of successful preparation.

Examples of Real-World Tax Scenarios

In the field of financial regulations, it’s important to understand how theoretical concepts apply in practical, everyday situations. Real-world cases often involve a mix of calculations, rule interpretation, and strategic decision-making, which can vary based on specific circumstances. Examining some common examples can help illustrate how these principles are used in practice.

Here are a few scenarios that demonstrate how different situations are handled:

- Freelancer Filing: A freelancer working from home must account for both business expenses and personal income. Calculating allowable deductions for home office space, travel expenses, and equipment is crucial for minimizing liabilities.

- Rental Property Owner: An individual owning rental properties must navigate rules surrounding income from leases, as well as deductions for repairs, maintenance, and property taxes. Understanding depreciation is key in maximizing benefits.

- Small Business Owner: A small business owner needs to differentiate between personal and business expenses. They must apply the correct allowances for items like office supplies, employee benefits, and business travel to ensure compliance with financial regulations.

- Investment Gains: Individuals with investments need to understand the impact of capital gains and dividend income on their overall financial obligations. Knowing how to calculate taxable gains and claim eligible credits can significantly affect their financial outcome.

By studying these practical cases, individuals can better prepare themselves for navigating complex scenarios, ensuring they are making informed decisions based on the most current regulations and methods.

Time Management Strategies for Tax Exams

Efficiently managing your time during a high-stakes assessment is essential for maximizing performance. Proper time allocation ensures that you can complete all sections without feeling rushed, while also allowing for sufficient review time. A structured approach helps reduce anxiety and improves the quality of your responses.

Prioritize and Allocate Time Wisely

Start by allocating specific time slots for each section of the assessment. Consider the difficulty level of each part and adjust the time accordingly. Easier sections may require less time, allowing for more time on complex topics. This approach helps you stay focused and ensures that you don’t get stuck on any single problem.

Set Realistic Goals and Stick to Them

Setting time-based goals for each section helps to keep you on track. If you’re working through a set of problems, set a target for completing each problem and stick to it. If you’re unsure about a particular question, move on and return to it later. This prevents wasting too much time on one area, allowing you to address the rest of the material effectively.

By following these time management techniques, you can navigate assessments with confidence, ensuring that each section is completed thoughtfully and thoroughly.

How to Interpret Tax Forms Correctly

Understanding financial documents is crucial for anyone looking to navigate complex systems of reporting and compliance. Forms play a vital role in tracking earnings, deductions, and other key financial data, which is essential for accurate filing and minimizing errors. Proper interpretation is key to ensuring that all information is presented correctly and that individuals or businesses remain in compliance with the applicable rules.

Step-by-Step Review of Each Section

When reviewing any form, it’s essential to break it down into its sections. Begin by reading through the instructions carefully to understand what data is required. Each form typically includes fields for personal or business information, financial summaries, and other relevant details. Pay close attention to any numbers or amounts listed in the boxes and ensure they match the records or documentation you have on hand.

Double-Check for Accuracy

Before submitting a completed form, double-check every entry for accuracy. Cross-reference figures with supporting documents such as receipts, bank statements, or previous filings. Mistakes, even small ones, can lead to unnecessary delays or complications. It’s also important to ensure that any additional schedules or attachments are properly filled out and submitted with the form.

By following these steps, you can confidently interpret financial documents, avoid common mistakes, and ensure everything is correctly reported. Whether you’re working with personal or business forms, understanding how to read and fill out each section accurately is a skill that pays off in the long run.

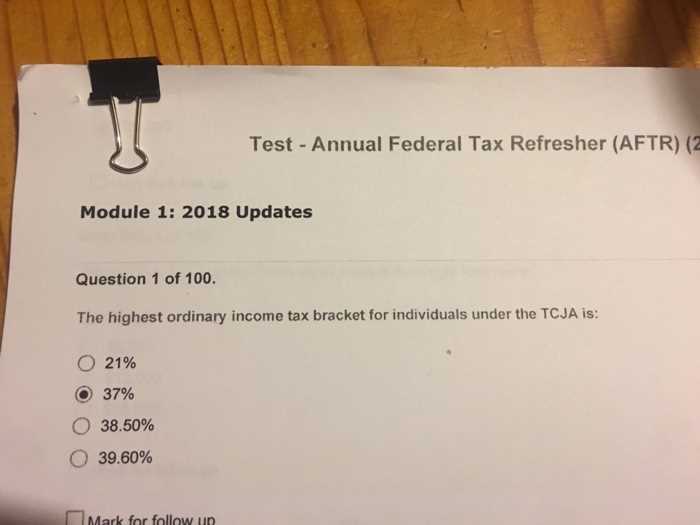

Preparing for Multiple Choice Tax Questions

When facing assessments with multiple-choice items, preparation is key to successfully navigating through the available options. These types of questions often require a combination of knowledge recall, critical thinking, and process of elimination. Understanding the underlying principles and anticipating potential answer formats can give you an edge during the test.

Master Key Concepts and Terminology

It’s important to have a strong grasp of the core principles involved. Focus on understanding the definitions, key terms, and formulas that are commonly tested. Review the foundational concepts thoroughly so that you can identify which answer is most likely correct, even when faced with tricky phrasing or similar options.

Practice with Sample Questions

Simulating test conditions by practicing with sample questions can help familiarize you with the format. This practice allows you to become accustomed to the types of choices you may encounter, and it helps you develop a sense of timing. Through repeated practice, you can identify patterns in the way questions are structured and refine your strategy for answering them efficiently.

By focusing on these areas, you’ll be better prepared to tackle multiple-choice assessments with confidence, ensuring that you can quickly analyze and select the most accurate response.

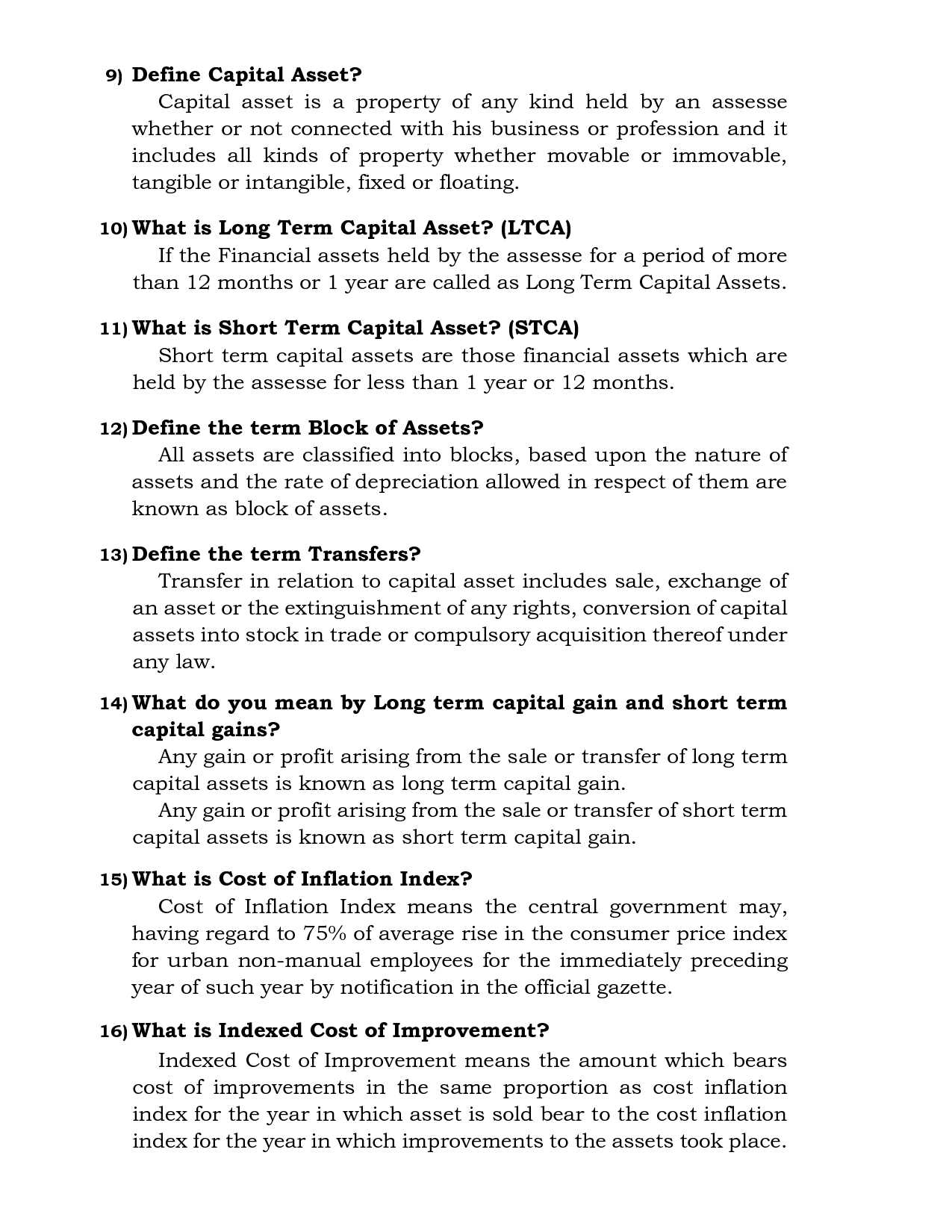

Breaking Down Complex Tax Scenarios

When faced with intricate financial situations, it can be overwhelming to identify the correct approach. These scenarios often involve multiple variables, such as income types, deductions, and specific regulations. Breaking down these situations into manageable steps is crucial for reaching accurate conclusions and making informed decisions.

Steps to Simplify a Complex Case

To effectively analyze a complicated scenario, follow these key steps:

- Identify Key Information: Begin by collecting all relevant data, such as income sources, expenses, or deductions that could impact the final outcome.

- Understand the Rules: Ensure you are familiar with the applicable rules and guidelines that govern each element of the situation.

- Break It Down into Parts: Divide the scenario into smaller, more manageable sections. Address each aspect separately before combining them for a final assessment.

- Consider All Options: Evaluate the potential outcomes for each decision or action within the scenario. Understand the possible consequences and select the most appropriate path.

Practical Examples for Clarity

Let’s consider an example where an individual has multiple income streams, some of which are subject to specific conditions or exemptions. Breaking down this scenario involves identifying each income source and understanding how it impacts the overall calculation. You might also need to analyze whether certain exemptions or deductions apply to particular types of earnings.

By breaking down complex cases into smaller, clear components, you can methodically approach each part and make better-informed decisions, ensuring that all rules are followed and nothing is overlooked.

How to Use Tax Resources During Exams

When preparing for an assessment, having the right materials at your disposal can make a significant difference in your performance. While some assessments may allow for resource use, knowing how to effectively utilize them is crucial. By organizing your materials and understanding when and how to consult them, you can streamline your process and avoid unnecessary distractions.

Maximize Efficiency with Organized Resources

Before starting, ensure that your resources are well-organized. A cluttered set of notes or reference materials can slow you down when you need them most. Create a system where you can quickly locate key information, whether it’s by using tabs, bookmarks, or an index. This will allow you to access critical data at a moment’s notice, saving precious time during the assessment.

Know When to Consult Materials

Effective use of resources isn’t just about having them on hand–it’s about knowing when to refer to them. Focus on answering the questions you are most confident about first, and leave the more complex ones for later. When you do need to consult a resource, focus on understanding the core concepts that directly relate to the problem at hand. Avoid getting bogged down by irrelevant details, as this can waste time and create confusion.

By being prepared and using resources strategically, you can approach the assessment with confidence and increase your chances of success. Remember, it’s not just about having the materials–it’s about knowing how to use them efficiently and effectively.

Frequently Asked Inquiries in Assessments

Understanding the most common topics encountered during evaluations can help you prepare more effectively. By familiarizing yourself with the types of inquiries typically asked, you can approach the assessment with greater confidence. Here, we will highlight several key areas that are often tested, along with tips on how to approach them.

Essential Concepts Often Tested

Some core ideas tend to appear repeatedly in evaluations. Focusing on mastering these will improve your chances of success:

- Basic Concepts of Financial Rules: Grasping fundamental principles like income, deductions, and exemptions is essential.

- Calculation of Liabilities: Be prepared to calculate financial obligations based on varying scenarios and provided data.

- Identification of Allowable Deductions: Understanding which expenditures qualify for reduction is often a key focus.

- Filing Process and Requirements: Knowing how and when to file documents is a common area of questioning.

Scenario-Based Inquiries

Scenario-based inquiries test your ability to apply theoretical knowledge to real-world situations. These types of challenges often require careful analysis and structured reasoning:

- What steps would you take if a person receives a financial windfall? This scenario often involves calculating new liabilities based on unexpected income.

- If a business incurs specific expenditures, how do these affect its overall financial responsibilities? Here, you’ll apply rules regarding deductions and expenses to assess their impact.

- What happens when someone fails to meet filing deadlines? These types of problems typically require you to assess penalties and suggest solutions.

By reviewing these common scenarios and concepts, you will be better equipped to navigate the challenges you face during evaluations. Practicing with these common inquiries can provide valuable insight into the structure and content of assessments.