Mastering key concepts in business-related subjects is essential for achieving success in any rigorous academic challenge. This section offers insight into the various areas that are commonly tested, focusing on understanding the core principles and methods that are fundamental to the subject.

Whether you’re reviewing fundamental formulas, tackling complex calculations, or analyzing various financial records, a clear approach is necessary. Effective preparation can make a significant difference in both understanding the material and performing well under pressure.

Structured practice and reviewing sample tasks will help reinforce your knowledge and boost your confidence. By focusing on the most important elements and applying your skills, you can confidently approach the challenges of this field.

Financial Accounting 2 Exam Preparation

Preparing for an advanced assessment in business-related subjects requires a focused approach. Success in this type of test depends on a clear understanding of key principles and the ability to apply them in various scenarios. The process involves reviewing core topics, practicing problem-solving techniques, and strengthening analytical skills to confidently tackle complex tasks.

Master Core Principles

To perform well in the assessment, it is essential to grasp the fundamental concepts. These include understanding the structure of business records, the relationship between different financial elements, and the rules that govern transactions. Reinforcing these core principles ensures that you can quickly identify patterns and apply the right techniques when solving problems.

Practice Problem-Solving Techniques

Effective preparation also involves working through practice tasks. By regularly solving problems similar to those that may appear on the test, you will develop the ability to approach unfamiliar scenarios with confidence. This process helps you familiarize yourself with the types of challenges you may face and strengthens your overall problem-solving skills.

Key Concepts for Financial Accounting 2

Understanding the key concepts is crucial for success in any advanced study of business management and record-keeping. These concepts form the foundation for analyzing financial information, making informed decisions, and solving complex problems. Mastering these core areas will not only improve comprehension but also enhance practical skills in applying knowledge effectively.

The following table highlights some of the essential concepts to focus on during preparation:

| Concept | Description |

|---|---|

| Transaction Analysis | Understanding how transactions affect the overall financial structure and how to record them accurately. |

| Balance Sheet Structure | Recognizing the components of a balance sheet, including assets, liabilities, and equity, and how they interrelate. |

| Income Statement Interpretation | Learning how to interpret income statements and evaluate a company’s profitability. |

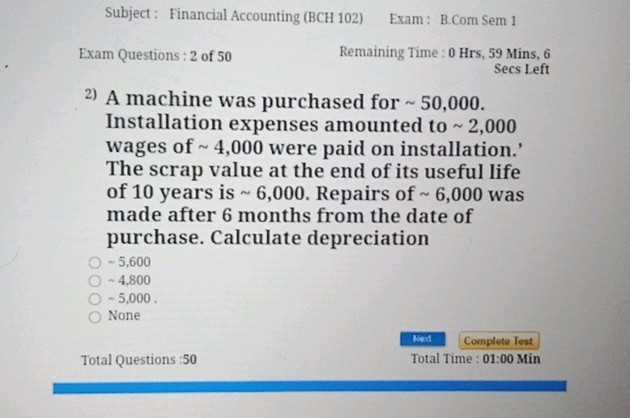

| Depreciation Methods | Familiarizing with different methods of depreciation and their impact on financial reports. |

| Cash Flow Analysis | Understanding the importance of cash flow and how to manage it within a business framework. |

Understanding the Accounting Equation

The accounting equation is the foundation of every financial record and analysis. It represents the relationship between a company’s resources, obligations, and ownership. Understanding this balance is crucial as it ensures that all financial data is correctly recorded, providing an accurate picture of a business’s financial health.

The Basic Equation

The basic formula for the equation is straightforward: Assets = Liabilities + Equity. This equation ensures that a company’s resources (assets) are always financed either by borrowing (liabilities) or through the owners’ investment (equity). It maintains consistency across financial statements, ensuring that everything balances out correctly.

Application in Financial Records

Each transaction a company makes affects this equation in some way, whether it’s purchasing assets, taking on new debt, or increasing equity. By tracking these changes, businesses can maintain accurate records, helping to identify trends and make informed decisions. This balance is central to producing reliable financial statements, including balance sheets and income statements.

Commonly Tested Accounting Topics

Certain areas of study are frequently highlighted in assessments, as they cover essential concepts critical for understanding financial operations. Focusing on these topics ensures a solid foundation and prepares you for the challenges of applying theoretical knowledge to practical situations. Mastering these areas increases confidence and improves overall performance in business-related evaluations.

Key topics often include the structure and analysis of financial statements, transaction recording, cost behavior, and methods for evaluating performance. These areas are crucial for anyone looking to excel in the field and handle the complexities of financial management effectively.

How to Analyze Financial Statements

Analyzing business records is a critical skill that enables you to assess a company’s performance and make informed decisions. By carefully reviewing key documents, you can understand the financial health of an organization, identify trends, and recognize potential areas of improvement. The analysis involves interpreting the data to gain insights into profitability, liquidity, and overall stability.

Key Metrics to Evaluate

When reviewing reports, focus on key metrics that reflect the company’s financial status. These metrics include profitability ratios, liquidity ratios, and solvency measures, each providing valuable information for decision-making. Understanding how to calculate and interpret these values is essential for making accurate assessments.

Using Ratios for Analysis

Financial ratios are commonly used tools for assessing business performance. They offer a way to compare different aspects of a company’s operations, such as how efficiently it generates profit or how well it manages its debt. The following table outlines some of the most important ratios to consider when analyzing reports:

| Ratio | Purpose |

|---|---|

| Current Ratio | Measures the company’s ability to cover short-term liabilities with its assets. |

| Profit Margin | Indicates how much profit the company makes for each dollar of revenue. |

| Return on Assets | Shows how effectively the company uses its assets to generate profit. |

| Debt-to-Equity Ratio | Compares the company’s debt to its equity to assess financial leverage. |

Important Formulas for the Exam

Mastering key formulas is crucial for solving problems accurately and efficiently in any business-related assessment. These formulas allow you to perform calculations that are central to understanding a company’s financial position, profitability, and overall performance. Familiarity with these formulas will help you approach complex tasks with confidence.

Here are some of the most important formulas you should focus on during your preparation:

- Current Ratio: Current Assets ÷ Current Liabilities – Measures liquidity and the ability to cover short-term obligations.

- Quick Ratio: (Current Assets – Inventory) ÷ Current Liabilities – A more stringent measure of liquidity, excluding inventory.

- Net Profit Margin: Net Income ÷ Revenue – Shows the percentage of profit from total revenue.

- Return on Assets (ROA): Net Income ÷ Total Assets – Assesses how efficiently assets are used to generate profit.

- Return on Equity (ROE): Net Income ÷ Shareholder’s Equity – Measures profitability in relation to shareholders’ investment.

- Debt-to-Equity Ratio: Total Liabilities ÷ Shareholder’s Equity – Compares debt with equity to evaluate financial leverage.

Understanding and applying these formulas will greatly enhance your ability to solve typical problems efficiently and accurately. Make sure to practice these regularly to ensure you can use them under exam conditions.

Time Management Tips for Exam Day

Effective time management is crucial for success on test day. Being able to allocate enough time to each task, while ensuring you don’t rush through difficult questions, is key to performing well. By following a structured approach, you can maximize your efficiency and minimize stress, ensuring that you can complete all sections of the assessment with confidence.

Prioritize and Plan

Before starting, take a moment to review the structure of the test. Prioritize the questions based on difficulty, allocating more time for complex problems. This strategy ensures that you don’t get stuck on any one question and can still answer easier ones within the time limit. Starting with easier tasks can help build momentum and boost confidence early on.

Use Your Time Wisely

During the assessment, be mindful of the clock. Track your progress and avoid spending too much time on a single problem. If you find yourself struggling with a question, move on and come back to it later if time allows. Keeping a steady pace will help ensure that you complete the entire test while maintaining accuracy.

Study Strategies for Financial Accounting

Effective study techniques are essential for mastering the complex concepts involved in managing business records. The right approach can enhance your understanding, improve retention, and boost your confidence for tackling challenging problems. By using structured study methods and staying organized, you can better prepare for assessments and grasp key ideas more effectively.

Active Learning Techniques

One of the most effective strategies is to engage in active learning. Instead of simply reading through notes, try to apply concepts to real-world scenarios. This helps solidify your understanding and ensures that you can recall information under pressure.

- Practice Problems: Solve as many practice problems as possible. Repetition reinforces learning and helps identify areas of weakness.

- Group Study: Collaborating with peers can help clarify concepts and expose you to different problem-solving approaches.

- Teach Someone Else: Explaining concepts to others can deepen your own understanding and reveal gaps in your knowledge.

Efficient Study Schedule

Creating a study schedule is crucial for managing your time and staying on track. Break down the material into manageable sections and allocate specific times for each topic. Regular, consistent study sessions are more effective than cramming at the last minute.

- Set Goals: Define what you want to achieve in each study session, such as mastering a particular concept or completing a set of practice problems.

- Review Regularly: Make time to review previous topics periodically to reinforce your memory.

- Take Breaks: Avoid burnout by taking short breaks during long study sessions to maintain focus and energy.

Best Resources for Exam Success

To achieve success in any challenging assessment, it is essential to use high-quality study materials. The right resources can provide deeper insights, reinforce learning, and help you master the concepts required for excellent performance. By leveraging a variety of tools, you can enhance your preparation and approach each section with confidence.

Books and Textbooks

Comprehensive textbooks are often the best starting point for understanding core concepts. They offer detailed explanations and step-by-step guides that lay the foundation for solving complex problems.

- Study Guides: Well-structured guides that break down topics into digestible parts, often with practice exercises and key formulas.

- Review Books: These are excellent for last-minute revision, providing summaries of major concepts and frequently tested material.

- Reference Books: These books dive deeper into advanced topics, ideal for expanding your knowledge beyond the basics.

Online Platforms and Tools

In the digital age, there are numerous online platforms that offer interactive learning tools and practice materials. These resources provide flexibility, allowing you to study at your own pace and track your progress.

- Online Courses: Platforms like Coursera and Udemy offer structured courses with video lessons and quizzes to reinforce learning.

- Practice Websites: Websites with mock assessments and problem-solving exercises can help you get familiar with the format and types of questions you will encounter.

- Discussion Forums: Joining online study communities such as Reddit or specialized forums lets you exchange tips and ask questions about difficult concepts.

Handling Complex Journal Entries

Managing intricate journal entries can be one of the more challenging tasks in recording business transactions. These entries often involve multiple accounts and require careful attention to detail to ensure accuracy. Mastering the process of handling these entries will improve your ability to track and report on financial activity, as well as minimize errors.

The key to managing complex entries is understanding the relationships between different accounts and how each transaction impacts them. Breaking down the process step-by-step can help you stay organized and avoid confusion when dealing with multiple components.

One effective approach is to start by identifying the accounts involved. This includes both the debit and credit sides of the transaction, making sure the totals balance out correctly. As you gain more experience, you’ll be able to recognize common patterns and apply them more efficiently.

Additionally, paying close attention to the timing and sequence of entries is essential. Some entries may span multiple periods or involve adjustments that need to be recorded at specific intervals. Developing a systematic approach for these entries ensures nothing is overlooked.

What to Expect on the Exam

As you prepare for the assessment, it’s important to know what to expect. The structure and content will challenge your understanding of key concepts, as well as your ability to apply them in practical scenarios. Familiarizing yourself with the types of tasks and problems you’ll face can help reduce anxiety and enhance your performance on test day.

In general, you will encounter a mix of problem-solving exercises and conceptual questions. These tasks will assess not only your ability to recall information but also your skill in analyzing complex situations and applying relevant knowledge to solve them effectively.

Commonly Tested Areas

- Understanding of Basic Concepts: Expect to be tested on foundational principles and how they interrelate.

- Problem Solving: There will likely be questions that require you to apply formulas and concepts to real-world scenarios.

- Calculations and Adjustments: You may need to complete complex calculations, adjusting balances or preparing hypothetical reports.

Test-Taking Tips

- Time Management: Plan your time wisely. Allocate enough time to read and answer each question carefully.

- Focus on Key Areas: Spend extra time on areas that you find most challenging, but don’t neglect easier sections.

- Stay Calm: If you encounter a difficult question, move on and return to it later. Staying calm helps maintain focus.

Revising Key Theories

Reviewing core theories is essential for mastering the foundational principles of any subject. In this case, understanding the theoretical framework will enable you to apply the knowledge effectively during assessments. Revision should focus on key ideas and their practical applications, ensuring that concepts are not only memorized but also understood deeply.

Start by identifying the most important theories and principles that are commonly assessed. Focus on understanding the logic behind these concepts, as well as how they interconnect. Practicing the application of these ideas will make the revision process more effective and help you retain the information long term.

Key Areas to Revise

- Theoretical Foundations: Review the basic principles that serve as the building blocks of more complex topics.

- Conceptual Frameworks: Understand the underlying frameworks that guide decision-making and problem-solving in real-world scenarios.

- Regulatory Guidelines: Study the rules and regulations that govern the field, ensuring you can apply them correctly.

Effective Revision Strategies

- Summarize Key Concepts: Create concise notes or mind maps to capture the essence of each theory.

- Practice with Examples: Work through multiple scenarios to understand how theoretical concepts are applied in practice.

- Review Regularly: Set aside time each week to go over concepts, revisiting the most challenging areas frequently.

Practical Tips for Answering Questions

Effectively responding to tasks during an assessment requires a strategic approach. It’s not just about recalling information but also applying it in a structured and clear manner. Developing the ability to organize your thoughts and answer with precision can significantly improve your performance.

When you approach a question, take the time to carefully read and understand it. Break it down into smaller parts, focusing on the key components. Make sure you understand what the question is asking before you start formulating your response. A clear, methodical approach will help you avoid common mistakes and ensure that you address each part of the question correctly.

Effective Answering Strategies

- Plan Your Response: Before writing, outline the key points you want to cover. This helps in organizing your answer logically.

- Stay Concise: Focus on the main points. Avoid unnecessary details that do not directly answer the question.

- Use Examples: Where possible, support your response with relevant examples to illustrate your understanding.

Time Management Tips

- Allocate Time: Assign a specific amount of time to each task, ensuring you don’t spend too much time on one part.

- Answer What You Know First: Start with the easier tasks to build confidence and then move to the more challenging ones.

- Review Your Responses: If time allows, go back and double-check your answers to ensure accuracy.

Common Mistakes to Avoid During the Exam

During any assessment, it’s easy to make errors that can cost valuable marks. These mistakes often arise from rushing, misinterpreting instructions, or neglecting key details. Being aware of these common pitfalls allows you to stay focused and enhance your chances of success.

One of the most frequent mistakes is not fully understanding what the task requires. This can lead to incomplete or off-target responses. Another common issue is not managing time effectively, which results in leaving parts of the task unanswered or poorly completed. Additionally, failing to review your work can lead to overlooked errors, which are often easy to fix with a second glance.

Key Errors to Avoid

- Misinterpreting the Prompt: Always ensure you understand the question completely before responding. Look for keywords that indicate what is being asked.

- Overlooking Details: Pay attention to small instructions that might change the direction of your answer, such as specific formats or required steps.

- Rushing Through Responses: Take your time to structure clear, detailed answers instead of hurriedly writing down the first ideas that come to mind.

How to Avoid These Mistakes

- Read Carefully: Always read each task thoroughly before starting to write, ensuring you know exactly what is being asked.

- Manage Your Time: Allocate a specific amount of time to each task and stick to it, ensuring you don’t spend too much time on any one part.

- Review Your Work: If time permits, always review your responses to catch any possible errors or incomplete thoughts.

Sample Questions and Answer Strategies

To succeed in any type of evaluation, it is essential to understand how to approach different types of tasks. By practicing with example prompts, you can improve your ability to respond effectively and structure your thoughts logically. In this section, we will explore various types of tasks you might encounter, along with strategies for crafting clear, precise responses.

When tackling a prompt, it is crucial to break down the request into manageable parts. Identify key elements such as what is being asked, the type of response expected, and any specific instructions. Once you’ve assessed the task, plan your response, focusing on clarity and relevance. It is also helpful to outline your thoughts before diving into writing, ensuring you stay on track and cover all necessary points.

Effective Response Strategies

- Understand the Core Requirement: Always determine the central focus of the task before answering. Whether it’s calculating a value or explaining a concept, ensure you know what is being asked.

- Structure Your Response: Organize your thoughts logically. Start with a brief introduction or explanation, followed by the main points, and conclude with a summary or final thought.

- Be Concise but Complete: While being thorough, avoid over-explaining or adding irrelevant information. Focus on the key aspects that directly address the task.

Sample Task Breakdown

- Sample Prompt 1: Calculate the total value of assets given a set of data. Begin by identifying the necessary formula, substitute the values correctly, and perform the calculation step by step.

- Sample Prompt 2: Explain the impact of a particular decision on an organization’s operations. Structure your response by providing context, describing the effects, and concluding with possible outcomes.

- Sample Prompt 3: Analyze a provided financial report. Start by reviewing key figures, identify trends, and then explain their significance in a clear, structured manner.

How to Improve Your Exam Scores

Achieving higher scores in assessments requires a combination of effective strategies, diligent preparation, and time management. By focusing on key study techniques and avoiding common pitfalls, you can significantly enhance your performance. This section provides actionable advice on how to optimize your study routine and approach the assessment with confidence.

The first step in improving your results is to understand the material thoroughly. Review all relevant topics, practice applying concepts, and focus on areas where you may have difficulty. Additionally, regular practice is essential. Solving mock tasks or revisiting previous tests can help reinforce your knowledge and develop a deeper understanding of the subject matter.

Active Study Techniques

- Break Down the Material: Instead of cramming large chunks of information, divide the content into smaller sections. Study each part systematically, ensuring you master one topic before moving to the next.

- Use Active Recall: Instead of passively reading, actively test yourself on the material. This helps reinforce memory retention and boosts long-term understanding.

- Teach What You Learn: Explaining complex concepts to others or even to yourself is an excellent way to solidify your understanding. Teaching forces you to process the information more deeply.

Time Management Strategies

- Create a Study Schedule: Allocate dedicated time slots for each subject or topic. Ensure there is a balance between study time and breaks to avoid burnout.

- Prioritize Weak Areas: Identify your weak points early on and devote extra time to those areas. This will help you turn your challenges into strengths.

- Simulate Real Conditions: Practice under timed conditions to simulate the pressure of the actual assessment. This can help you manage time more effectively during the real test.