Successfully passing a financial certification requires a deep understanding of core concepts and practical knowledge. This guide is designed to help you navigate through key material, offering insights into how to tackle various challenges that may arise during the assessment process.

By focusing on essential topics, you can build a strong foundation and develop the skills necessary to excel. Whether it’s mastering essential calculations or understanding the nuances of financial documentation, this resource provides the tools to help you succeed.

Effective preparation is key to boosting your confidence and performance. Practicing with relevant exercises and scenarios will enhance your ability to apply theory in real-world situations. The more familiar you become with potential challenges, the better equipped you will be on test day.

Understanding the format and types of tasks that will be presented ensures you are not caught off guard. Use this guide as a reference to review common subject areas and refine your approach to problem-solving.

Key Preparation for Financial Certification Assessments

Mastering the concepts tested during a financial certification assessment requires careful preparation and an understanding of the topics likely to appear. Familiarizing yourself with potential challenges, solving practical exercises, and reviewing key calculations can significantly improve your performance. This section covers the critical areas to focus on, offering a deeper dive into the essential tasks and topics.

Core Areas to Focus On

Preparing for an evaluation requires attention to a variety of fundamental subjects. The following areas are crucial to building a well-rounded understanding:

- Basic accounting principles

- Financial statement preparation

- Taxation and compliance knowledge

- Data analysis and interpretation

- Cost management techniques

Practice with Real-World Scenarios

Understanding theoretical concepts is essential, but applying them to real-life situations is what truly solidifies knowledge. Working through scenarios and sample problems will prepare you for the types of tasks you may face. Consider practicing with:

- Mock financial reports

- Case studies involving financial planning

- Simulated budget creation exercises

- Tax filing procedures

By focusing on these practical tasks, you can hone your skills and gain the confidence necessary to perform under pressure.

Key Topics to Study for Assessment

To succeed in a financial evaluation, focusing on fundamental principles and key areas of practice is essential. These core topics form the foundation of your knowledge, enabling you to approach the tasks with clarity and confidence. A strong understanding of these areas is critical for both theoretical and practical application during the assessment process.

The table below highlights the main subjects that require in-depth study:

| Topic | Description |

|---|---|

| Financial Reporting | Understand how to prepare balance sheets, income statements, and cash flow reports. |

| Cost Accounting | Learn about budgeting, cost control methods, and expense analysis. |

| Taxation | Familiarize yourself with tax regulations, deductions, and filing processes. |

| Data Interpretation | Develop skills in analyzing financial data, recognizing trends, and drawing conclusions. |

| Internal Controls | Study procedures for ensuring accuracy and compliance within financial systems. |

By dedicating time to mastering these topics, you will build a well-rounded expertise necessary for successfully completing the assessment.

Common Mistakes in Financial Assessments

During financial evaluations, many individuals make errors that could easily be avoided with proper preparation and attention to detail. Understanding these common pitfalls allows candidates to approach the process with a more strategic mindset, minimizing the chances of mistakes that could impact their performance.

Some of the most frequent errors include misinterpreting instructions, neglecting to review calculations, or overlooking key details in the provided material. These issues can lead to incorrect responses or missed opportunities to demonstrate knowledge. Below are a few common missteps:

- Rushing Through Calculations: Not taking the time to double-check basic arithmetic or more complex computations can result in simple mistakes.

- Ignoring Key Information: Failing to read all instructions or overlook important facts in a given scenario can lead to incomplete or incorrect solutions.

- Poor Time Management: Focusing too much on one section and neglecting others can lead to unfinished tasks and lost points.

- Incorrectly Applying Theories: Misapplying accounting principles or formulas can confuse answers, especially when it comes to complex tasks like financial statement preparation.

- Overlooking Small Details: Often, smaller details like formatting, required supporting documents, or specific terminology can cause problems if ignored.

By being aware of these common mistakes, you can avoid them and improve your chances of success during the evaluation.

Understanding Basic Accounting Principles

A strong grasp of fundamental financial concepts is essential for solving complex problems and making informed decisions. These core principles form the foundation of all financial practices and play a key role in shaping accurate reports, analysis, and decision-making in the field of finance.

The table below outlines the key principles every aspiring professional should understand:

| Principle | Description |

|---|---|

| Accrual Basis | Revenue and expenses are recorded when they are earned or incurred, not when cash is exchanged. |

| Consistency | Once an accounting method is chosen, it should be applied consistently throughout all periods to ensure comparability. |

| Reliability | Only objective and verifiable data should be recorded in financial statements. |

| Matching | Expenses should be matched with the revenues they help generate in the same period. |

| Conservatism | When in doubt, record expenses and liabilities as soon as possible, but revenue only when it is certain. |

Understanding these principles will help establish a solid foundation for more complex financial tasks, ensuring accuracy and reliability in all aspects of the profession.

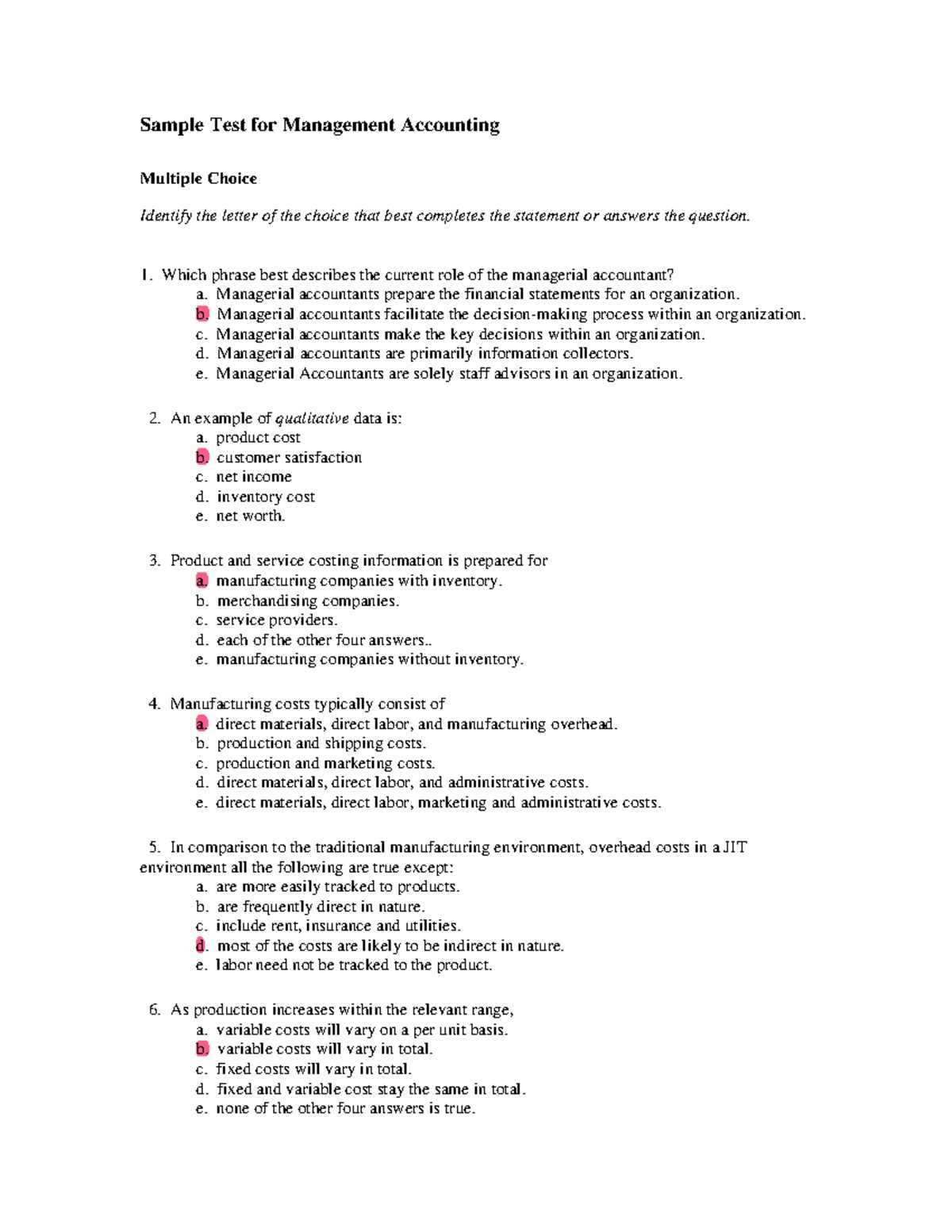

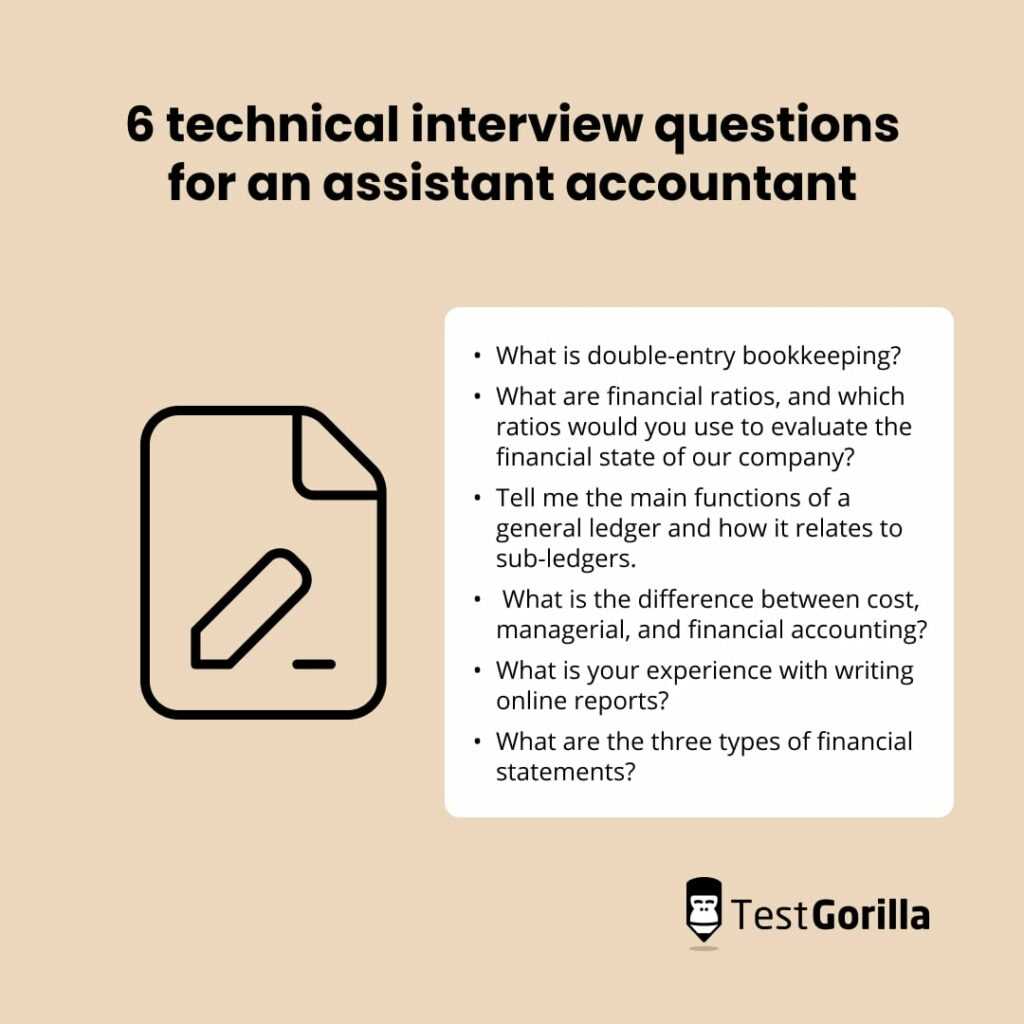

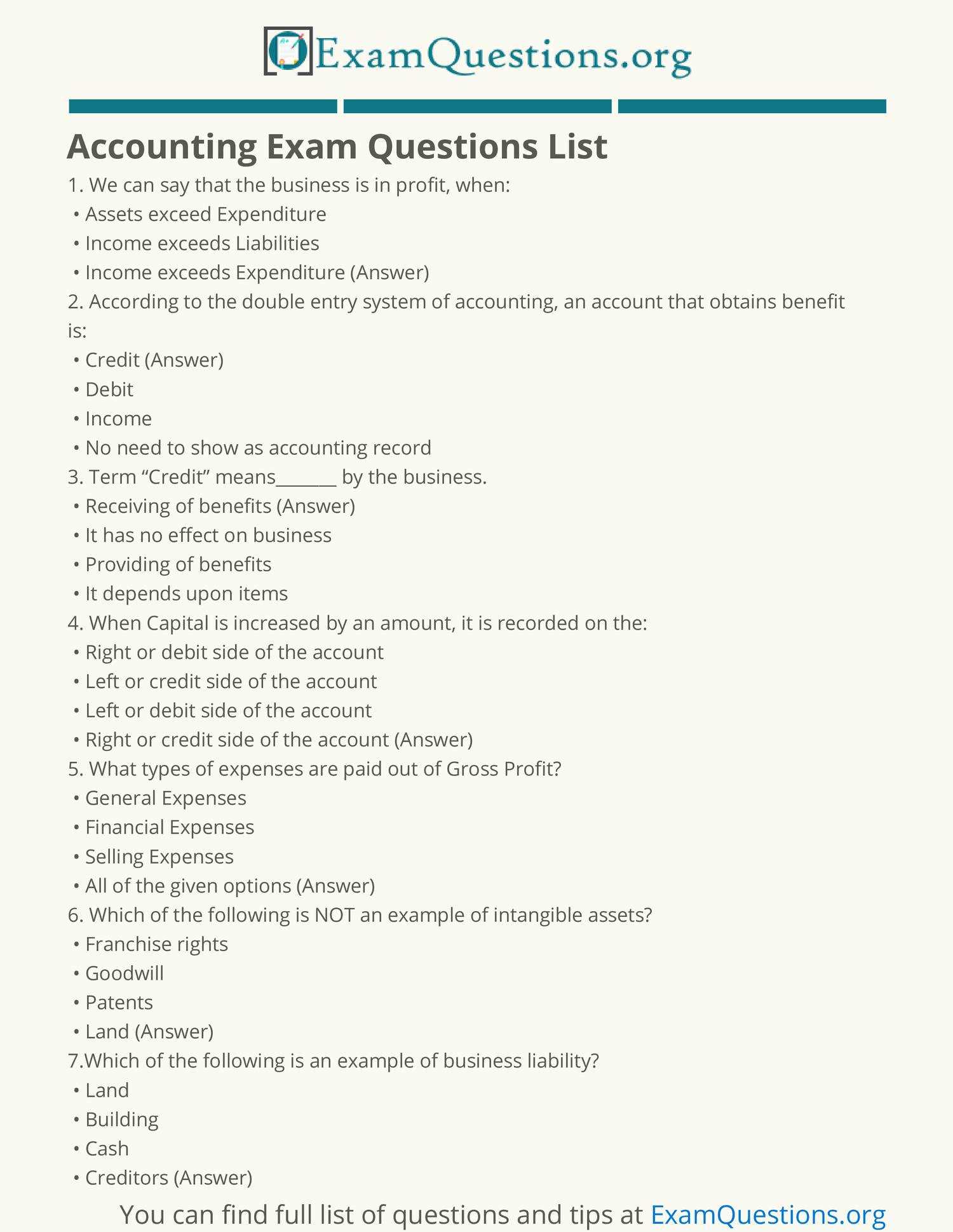

How to Approach Multiple-Choice Questions

Multiple-choice tasks can often be daunting, but with the right strategy, they can become more manageable. Success in these types of assessments lies in the ability to analyze the options critically and eliminate incorrect answers. This section will provide helpful tips on how to approach these types of questions with confidence and efficiency.

Key Strategies for Success

To improve your performance on multiple-choice tasks, follow these strategies:

- Read Carefully: Ensure you understand the prompt before considering the options. Pay close attention to specific wording or instructions that may affect the answer.

- Eliminate Obvious Errors: Often, there will be one or two options that are clearly incorrect. Eliminate those first to narrow down your choices.

- Consider All Options: Avoid jumping to conclusions too quickly. Even if an option seems correct, review all the choices to ensure it’s the best answer.

- Look for Keywords: Pay attention to keywords like “always,” “never,” or “usually” in the choices, as these can indicate whether the statement is true or false.

- Manage Your Time: Don’t spend too much time on a single question. If you’re unsure, make your best guess, mark the question, and move on.

Using Logical Deduction

Sometimes, the process of elimination is not enough. Use logical reasoning to identify the most likely answer:

- Look for patterns in the phrasing of the options.

- Consider the context of the material you have studied.

- Make educated guesses based on what you know about the topic.

By following these strategies and applying logical thinking, you can increase your chances of selecting the correct option and performing well in your assessments.

Tips for Time Management During the Test

Effective time management is crucial when facing a financial assessment. Without a clear strategy, it’s easy to become overwhelmed by the number of tasks or spend too much time on challenging sections. This section will explore key strategies for maximizing your efficiency, ensuring that you complete all tasks within the allotted time frame.

Prioritize and Plan

Before diving into the questions, quickly scan through the entire test to get an overview of what needs to be completed. By identifying sections that you find easier or more difficult, you can allocate your time more effectively.

- Start with Easier Tasks: Begin with the sections you are most confident in. This builds momentum and gives you a sense of accomplishment.

- Allocate Time for Each Section: Set a specific time limit for each task or section and stick to it. Use a watch or timer to keep track.

- Don’t Get Stuck: If you encounter a difficult task, move on and return to it later if time allows.

Track Your Progress

Keeping an eye on the clock during the test is essential. You don’t want to find yourself running out of time at the end with unanswered sections.

- Set Milestones: Plan to reach specific points in the test within a certain time frame. This will help you gauge if you’re on track.

- Monitor Your Time: Periodically check the time and adjust your pace if you find yourself spending too long on certain sections.

By organizing your approach and using time wisely, you will feel more in control and reduce the stress that can come with tight deadlines.

Essential Formulas for Financial Assessments

Mastering key mathematical formulas is essential for successfully completing financial evaluations. These formulas provide the structure needed to accurately calculate and analyze financial data. Knowing when and how to apply these formulas ensures efficiency and precision in solving complex problems.

Here are some of the fundamental equations that every aspiring professional should be familiar with:

| Formula | Application |

|---|---|

| Basic Accounting Equation | Assets = Liabilities + Owner’s Equity Used to ensure that the balance sheet remains balanced, this equation forms the foundation of all financial reporting. |

| Net Income | Net Income = Revenue – Expenses This formula helps determine the profit or loss over a specific period, critical for performance evaluation. |

| Gross Profit Margin | Gross Profit Margin = (Revenue – Cost of Goods Sold) / Revenue Used to evaluate the profitability of a company’s core operations. |

| Return on Assets (ROA) | ROA = Net Income / Average Total Assets Helps assess how efficiently assets are being used to generate profit. |

| Current Ratio | Current Ratio = Current Assets / Current Liabilities Measures the company’s ability to cover short-term obligations with short-term assets. |

Familiarity with these formulas will not only help you complete calculations accurately but also deepen your understanding of the financial processes at play during assessments.

Practical Examples of Accounting Problems

Applying theoretical knowledge to real-world scenarios is essential for developing a deeper understanding of financial practices. Solving practical accounting problems helps reinforce core concepts and sharpen problem-solving skills. In this section, we will explore common scenarios and step-by-step approaches to solve them effectively.

Example 1: Calculating Net Profit

Consider a company with the following financial data:

- Revenue: $150,000

- Cost of Goods Sold: $60,000

- Operating Expenses: $40,000

- Interest Expenses: $5,000

To calculate the net profit, follow these steps:

- Start with the revenue: $150,000.

- Subtract the cost of goods sold: $150,000 – $60,000 = $90,000 (Gross Profit).

- Subtract operating expenses: $90,000 – $40,000 = $50,000 (Operating Profit).

- Subtract interest expenses: $50,000 – $5,000 = $45,000 (Net Profit).

Net profit for the company is $45,000.

Example 2: Calculating the Current Ratio

Here is an example to assess a company’s liquidity using the current ratio. The following data is given:

- Current Assets: $120,000

- Current Liabilities: $80,000

To calculate the current ratio:

- Use the formula: Current Ratio = Current Assets / Current Liabilities.

- Substitute the values: $120,000 / $80,000 = 1.5.

The company’s current ratio is 1.5, which indicates it has sufficient assets to cover its short-term obligations.

By practicing with such examples, individuals can improve their ability to handle financial data accurately and confidently in real-life situations.

How to Analyze Financial Statements Effectively

Understanding and analyzing financial reports is essential for evaluating the health of a business. By examining key data points, you can gain insights into profitability, liquidity, and overall performance. This section covers the fundamental steps for analyzing financial records, focusing on the most important aspects to consider when interpreting these documents.

When reviewing financial statements, there are several key components to focus on:

| Key Component | What to Analyze | Why It Matters |

|---|---|---|

| Income Statement | Revenue, Expenses, Net Income | Provides insight into profitability and cost management, showing if the company is generating enough revenue to cover its expenses. |

| Balance Sheet | Assets, Liabilities, Equity | Shows the company’s financial position, including what it owns, owes, and the owner’s stake. Key for evaluating financial stability. |

| Cash Flow Statement | Operating, Investing, Financing Cash Flow | Reveals the cash generated and spent during a period, helping assess liquidity and how well the company manages its cash. |

After reviewing these statements, calculate important financial ratios to gauge the company’s performance. Ratios such as the current ratio, return on equity, and gross profit margin can provide more clarity on financial health.

Finally, it’s important to compare the company’s performance over time or with industry standards to assess trends and benchmarks. This will help you identify areas of improvement and potential risks.

Preparing for Auditing and Tax Questions

Successfully addressing inquiries related to auditing and tax requires a deep understanding of key principles, regulations, and practices. It is essential to grasp the fundamental concepts, techniques, and frameworks that govern financial examinations and tax computations. In this section, we will discuss effective strategies for preparing for topics commonly encountered in these areas.

Mastering Auditing Principles

Auditing is a critical process that ensures financial statements are accurate and comply with regulations. To prepare for questions in this area, focus on the following key aspects:

- Types of Audits: Understand the differences between internal, external, and government audits.

- Audit Process: Familiarize yourself with the stages of an audit, from planning to reporting.

- Audit Evidence: Know the types of evidence auditors collect, such as financial records and corroborating documents.

Additionally, practice reviewing sample audit reports to improve your ability to identify discrepancies and assess compliance with established standards.

Understanding Taxation Principles

Tax-related inquiries often require a solid understanding of local tax laws, calculation methods, and reporting requirements. The following topics are essential when preparing for tax-related discussions:

- Tax Calculation: Review methods for calculating individual and corporate tax liabilities based on income and applicable rates.

- Tax Deductions and Credits: Study common deductions, such as business expenses, and credits, like those for education or energy efficiency.

- Tax Filing Requirements: Familiarize yourself with deadlines, necessary documentation, and penalties for late filing.

By focusing on these core concepts and consistently practicing with real-world scenarios, you will improve your readiness for both auditing and tax-related tasks.

Common Accounting Ratios to Know

Financial ratios are essential tools for evaluating the performance and stability of a business. They help provide valuable insights into areas such as profitability, liquidity, and operational efficiency. By analyzing these ratios, one can assess the overall financial health of a company and identify potential risks or opportunities for improvement. In this section, we’ll explore some of the most commonly used ratios in financial analysis.

Here are some key ratios to be familiar with:

- Current Ratio: Measures a company’s ability to meet its short-term liabilities with its short-term assets. The formula is Current Assets / Current Liabilities.

- Quick Ratio: Also known as the acid-test ratio, it is a more stringent measure of liquidity, excluding inventory from current assets. The formula is (Current Assets – Inventory) / Current Liabilities.

- Return on Equity (ROE): Indicates the profitability of a business in relation to its shareholders’ equity. The formula is Net Income / Shareholders’ Equity.

- Gross Profit Margin: Shows the percentage of revenue that exceeds the cost of goods sold, indicating production efficiency. The formula is (Revenue – Cost of Goods Sold) / Revenue.

- Debt to Equity Ratio: Assesses a company’s financial leverage by comparing its total liabilities to its shareholders’ equity. The formula is Total Debt / Shareholders’ Equity.

- Inventory Turnover: Measures how many times a company’s inventory is sold and replaced over a period. The formula is Cost of Goods Sold / Average Inventory.

By understanding and calculating these ratios, you can better evaluate a company’s financial position and make more informed decisions when analyzing financial reports.

Reviewing Accounting Ethics and Standards

Ethics and standards play a critical role in ensuring the integrity and transparency of financial reporting. Understanding the ethical guidelines and professional standards that govern financial practices is essential for maintaining trust and accountability. This section explores the key principles and frameworks that professionals must adhere to when preparing financial statements and performing related duties.

One of the fundamental aspects of financial practice is adhering to ethical conduct, which includes honesty, objectivity, and confidentiality. These principles guide individuals in making decisions that prioritize fairness and transparency, avoiding conflicts of interest or misleading financial reporting.

In addition to ethical conduct, professionals must be familiar with the key standards that govern financial reporting. These standards provide clear guidelines on how financial statements should be prepared, ensuring consistency and comparability across different organizations. Two major frameworks include:

- International Financial Reporting Standards (IFRS): Widely adopted by many countries, these standards ensure that financial statements are consistent, transparent, and comparable internationally.

- Generally Accepted Accounting Principles (GAAP): These are the rules used primarily in the United States to standardize financial reporting, ensuring that all financial statements follow consistent principles.

Understanding these ethical guidelines and professional standards is crucial for any professional involved in financial reporting. By adhering to these principles, individuals contribute to maintaining the accuracy, integrity, and credibility of financial information, which in turn helps to build public trust in financial markets.

Exam Strategies for Challenging Topics

When preparing for assessments, certain topics may appear particularly difficult due to their complexity or the level of detail required. Developing effective strategies to tackle these challenging areas can make a significant difference in understanding the material and performing well. In this section, we’ll explore some strategies to help manage difficult subjects and improve overall performance.

The key to success lies in breaking down complex concepts into manageable parts. Focusing on one aspect at a time and mastering it before moving on to the next can lead to a clearer understanding and reduce the feeling of being overwhelmed. Additionally, using a variety of study resources, including textbooks, practice problems, and online tutorials, can provide different perspectives on the material.

Another effective strategy is to practice applying the concepts in real-world scenarios. This allows you to better understand their practical application and reinforce your knowledge. Working with peers or instructors can also be valuable, as discussing difficult topics with others often leads to new insights and a deeper comprehension.

Here are some specific strategies to employ when dealing with challenging topics:

| Strategy | Application |

|---|---|

| Active Recall | Test your understanding by trying to recall information from memory, rather than just passively reviewing notes. |

| Spaced Repetition | Review material at increasing intervals to reinforce learning and improve long-term retention. |

| Concept Mapping | Create visual diagrams linking related concepts to see the connections and structure of the material. |

| Focused Practice | Concentrate on solving practice problems that directly relate to the challenging areas, reinforcing your knowledge through repetition. |

By employing these strategies, you can approach difficult topics with greater confidence and a more organized approach, increasing your chances of mastering them effectively. With consistent effort and a strategic study plan, tackling even the toughest subjects becomes more achievable.

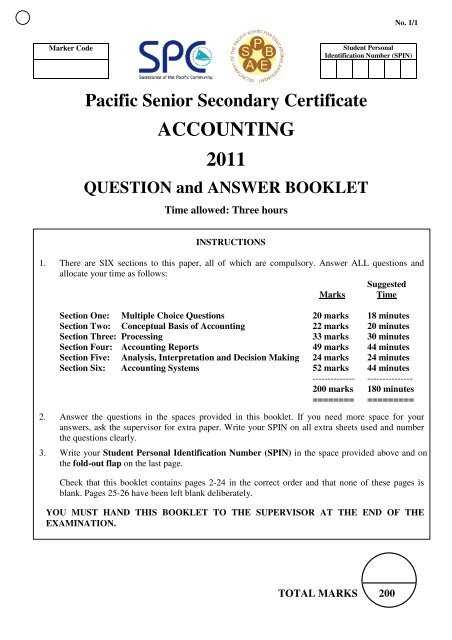

Mock Exams and Practice Tests

Simulated assessments play a crucial role in preparing for any type of evaluation. These practice sessions not only familiarize you with the structure and format of the real test, but also help to build confidence, manage time efficiently, and identify areas that require more focus. This section explores the benefits of mock sessions and practice exercises in enhancing your readiness for the upcoming challenge.

One of the main advantages of simulated assessments is that they allow you to practice under test conditions, which can help reduce anxiety and improve performance on the day of the actual evaluation. By completing mock tests, you become more accustomed to the types of problems you might face and the time constraints involved. It is essential to treat these practice sessions as if they were real, following all the same rules and timing to gain the maximum benefit.

Another benefit is the ability to pinpoint weaknesses and gaps in your knowledge. After completing a mock assessment, reviewing the results can provide valuable insights into which topics need further revision. This feedback is crucial for targeting specific areas and ensuring thorough preparation.

Benefits of Practice Tests

- Time Management: Practicing within a set time limit helps you develop strategies to manage time effectively during the actual evaluation.

- Reduced Anxiety: Regular practice helps you become more comfortable with the testing environment, leading to reduced stress and anxiety.

- Improved Focus: Mock sessions train you to maintain focus and complete tasks efficiently, simulating the real test experience.

Tips for Effective Mock Test Preparation

- Review After Completion: Always take the time to go over your answers, even if you felt confident. Understanding why a choice was correct or incorrect is key to learning.

- Start with Timed Sessions: Begin by completing practice tests under timed conditions to simulate the pressure of the real situation.

- Mix Topics: Use a variety of practice materials that cover all areas of the subject, rather than focusing too much on one specific topic.

By incorporating mock assessments and practice exercises into your preparation plan, you can increase your chances of success and approach the test with a higher level of confidence and readiness.

How to Handle Stress During the Exam

Feeling anxious or stressed during a high-pressure assessment is a common experience. However, managing stress effectively can make a significant difference in your performance. This section explores various strategies to stay calm, focused, and in control during critical moments. The key is to recognize stress early and use techniques to manage it, ensuring you remain clear-headed throughout the process.

One of the most effective ways to manage stress is through proper preparation. The more familiar you are with the material and the format, the more confident you’ll feel. However, stress can still arise, especially as the clock ticks down. In such situations, it’s important to remember that staying calm is just as important as knowing the content. By employing simple breathing techniques, taking short mental breaks, or focusing on one question at a time, you can reduce anxiety and maintain clarity.

Effective Stress-Relief Techniques

- Deep Breathing: Slow, deep breaths can help calm the nervous system and regain focus, especially when you start to feel overwhelmed.

- Positive Visualization: Visualizing success or imagining yourself answering questions with ease can boost your confidence and reduce stress.

- Time Management: Break the task into smaller, manageable steps and allocate specific time slots for each section. This prevents the feeling of being overwhelmed by the entire assessment.

Maintaining Focus Under Pressure

- Stay Present: Focus on the current task rather than worrying about the questions you may not know. Keeping a clear mind on what you’re doing helps you work more efficiently.

- Take Short Breaks: If you’re stuck on a question, it’s okay to skip it temporarily and come back to it later with a fresh perspective.

- Stay Hydrated: Drink water throughout the assessment to stay physically energized and mentally sharp.

By using these strategies, you can better manage stress, enhance your concentration, and perform at your best under pressure.

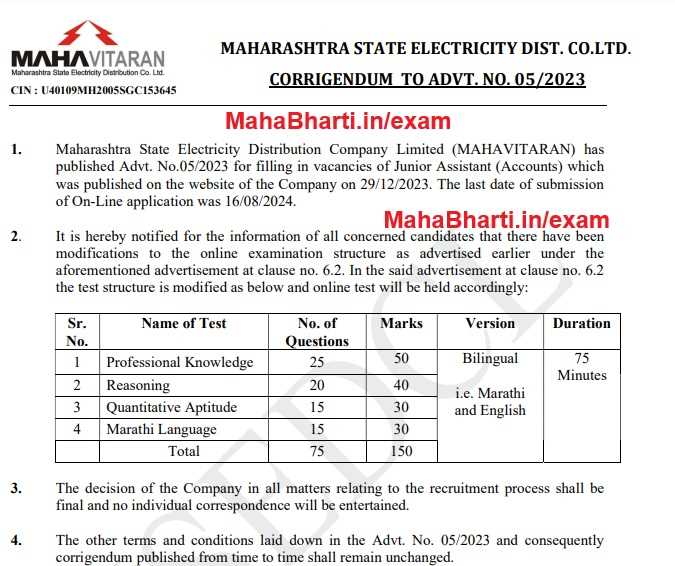

What to Expect on the Junior Accountant Exam

The process of assessment for entry-level roles in financial management typically includes a series of tasks designed to evaluate both theoretical knowledge and practical abilities. These assessments often cover a range of topics relevant to basic financial operations and reporting, aimed at testing your proficiency in core principles and techniques. Understanding the structure and types of challenges you may face can significantly enhance your preparation and boost your confidence going into the test.

In general, you can expect to encounter a combination of multiple-choice questions, practical problem-solving tasks, and situational analysis questions. These may test your ability to apply fundamental concepts in accounting, bookkeeping, and financial reporting. The purpose is to assess how well you understand the material, and how efficiently you can apply it to solve real-world problems in a professional setting.

Key Areas You Will Be Tested On

- Financial Statements: Understanding the preparation and analysis of balance sheets, income statements, and cash flow statements.

- General Ledger: Knowledge of journal entries, ledgers, and trial balances is crucial for tracking transactions accurately.

- Taxation Principles: Basic taxation laws and calculation of tax liabilities may be a part of the test, assessing your understanding of legal requirements in financial reporting.

- Cost Accounting: Knowing how to allocate costs and calculate unit costs for different types of business activities is essential for any financial role.

- Auditing Basics: You may also encounter questions related to internal controls, audit procedures, and common audit terminology.

Types of Tasks to Expect

- Calculation Problems: Expect numerical questions that require you to compute totals, percentages, and other financial measures.

- Scenario-Based Questions: You may be given a business scenario and asked to identify errors, propose solutions, or interpret financial data.

- Multiple-Choice Questions: These will test your ability to recall key facts and concepts quickly, requiring both precision and efficiency.

- Short-Answer Questions: Some questions may ask you to explain specific principles or processes in detail, testing your depth of understanding.

Being familiar with these areas and types of questions will help you approach the assessment with greater ease and clarity. Focus your preparation on understanding key concepts, practicing problem-solving techniques, and managing your time efficiently during the test.

Final Review and Exam Day Tips

As the day of assessment approaches, it’s important to conduct a thorough final review to ensure that you are well-prepared and confident. The last phase of preparation is about reinforcing your knowledge and addressing any weak points. This section will help you focus on key strategies and tips that will support you in the final hours leading up to the test and on the day itself.

It’s essential to balance your time during this phase. You don’t want to cram in too much information last minute but instead focus on key areas and reinforce your understanding. Reviewing your study materials, practice tests, and notes can be highly effective for building confidence. Also, remember to stay calm and collected–stress management is just as crucial as knowledge during this stage.

Final Review Strategy

- Prioritize Key Topics: Focus on areas that are most likely to be tested. This includes financial statements, basic accounting principles, and common ratios.

- Review Practice Tests: Go through any mock assessments you have completed, identifying any mistakes you made, and understanding why the correct answers are right.

- Clarify Doubts: If there are concepts or methods you’re still unsure about, take some time to go over them with a tutor, a study group, or by looking up additional resources.

- Mind the Timing: Practice solving questions within a set timeframe to ensure you can manage your time effectively on the day.

Tips for the Day of the Test

- Arrive Early: Give yourself plenty of time to get settled in, relax, and calm your nerves before the test begins.

- Read Instructions Carefully: Make sure you understand the instructions for each section of the test. Misunderstanding the requirements can lead to avoidable mistakes.

- Manage Your Time: Keep track of time during the assessment, allocating enough time to each section. Don’t get stuck on difficult questions–move on and come back to them later if necessary.

- Stay Calm: If you feel overwhelmed, take a deep breath. Staying calm will help you think clearly and make better decisions throughout the test.

- Don’t Rush: While time is important, rushing through questions may lead to careless mistakes. Ensure that you take the time to check your work.

By following these final review strategies and test-day tips, you will be better equipped to face the challenges of the assessment confidently. Keep a positive mindset, manage your time wisely, and stay focused on the task at hand. Good luck!