Mastering the fundamentals and understanding key topics is crucial for anyone preparing for the certification assessment in the field of risk coverage. This section will guide you through essential concepts and help clarify the most common areas that are tested.

To succeed in the evaluation process, it is important to be familiar with both the theoretical principles and practical scenarios. By reviewing targeted material, you will be better prepared to tackle various sections efficiently. Focus on areas such as legal frameworks, coverage limits, and risk mitigation strategies.

Throughout this guide, we will present sample content to simulate the type of material you may encounter. Reviewing these examples will improve your confidence and test-taking skills, ensuring a higher chance of success when facing the actual challenge.

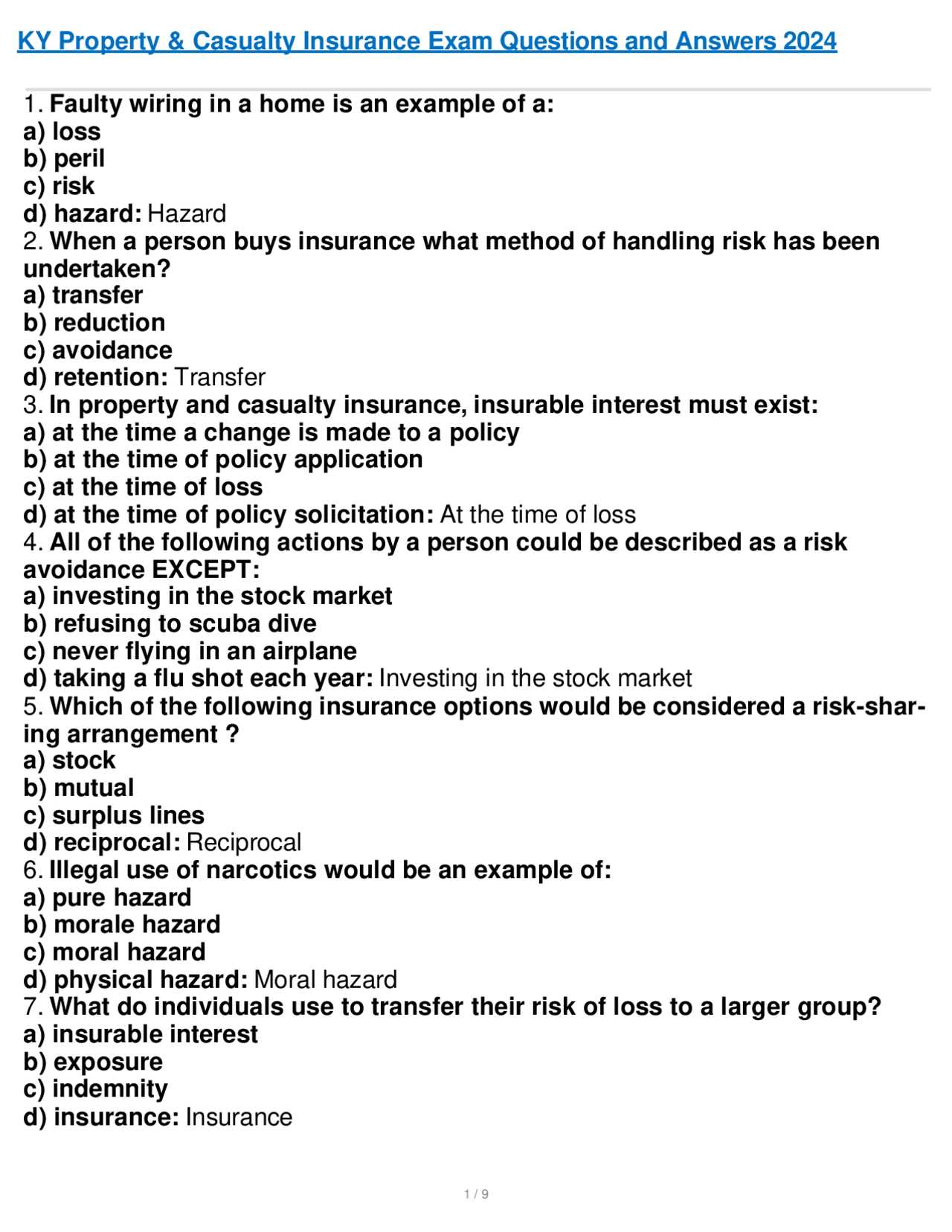

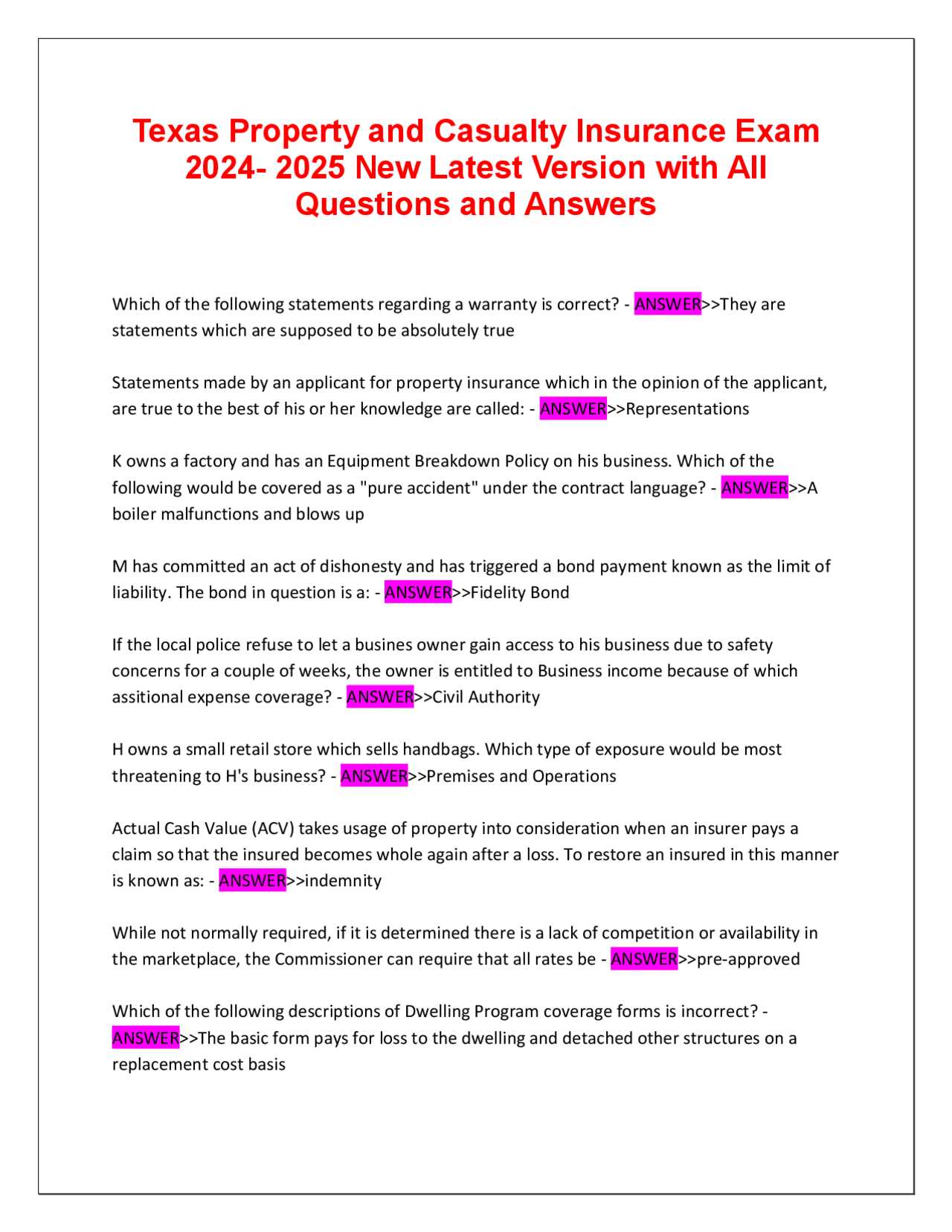

Property Insurance Exam Questions and Answers

Preparing for the assessment in this field involves understanding various concepts, applying theoretical knowledge, and solving practical scenarios. The materials provided below offer insight into the types of tasks you will face, helping you become familiar with both the subject matter and the format of the assessment.

Throughout this section, you will find sample content designed to test your grasp of critical topics. These exercises will challenge your ability to apply learned principles in realistic situations, ensuring you are well-prepared for the challenges that lie ahead.

By practicing with these examples, you can refine your skills and improve your problem-solving strategies. With focused preparation, the process becomes clearer, and the path to success becomes more attainable.

Understanding Key Property Insurance Concepts

Grasping the essential ideas of coverage and risk management is fundamental for anyone aiming to succeed in this field. By mastering core topics such as protection limits, exclusions, and specific clauses, you gain the tools necessary to tackle complex scenarios efficiently.

The foundation of this knowledge lies in understanding the types of plans available and their respective functions. Each plan offers distinct levels of protection, and being able to differentiate between them will aid in identifying the most suitable coverage options for various situations.

Moreover, knowledge of common terms used in this context, such as deductibles, premiums, and claim processes, is essential. Familiarity with these terms ensures you can interpret agreements accurately and apply the correct procedures in real-life situations.

Common Topics in Property Insurance Exams

When preparing for assessments in this field, it’s essential to understand the most frequently tested subjects. These areas often include the fundamentals of coverage types, claims processes, and regulatory requirements. By familiarizing yourself with these core topics, you ensure a comprehensive grasp of the material, making it easier to navigate through more complex challenges.

Key Areas of Focus

Some of the most important subjects that commonly appear include the following:

| Topic | Description |

|---|---|

| Coverage Types | Understanding the various protection plans available, including basic and specialized options for different needs. |

| Claims Procedures | Familiarizing yourself with how claims are filed, processed, and resolved. |

| Legal Requirements | Awareness of regulations and laws that govern the contracts and obligations in this sector. |

| Risk Management | Strategies for identifying, assessing, and mitigating risks that can affect individuals or businesses. |

Commonly Tested Scenarios

Real-world applications and situational analysis often form a large part of the test material. Examples of these include determining appropriate coverage based on varying risk factors or calculating potential premiums based on different criteria. These scenarios are designed to test both your theoretical understanding and practical problem-solving skills.

Types of Property Insurance Policies

In this field, there are several plans designed to offer protection against various risks and damages. Each option is tailored to meet specific needs, providing different levels of coverage. Understanding these types will help individuals and businesses select the right choice based on their requirements and potential threats.

Common Coverage Plans

Here are some of the most widely used protection options:

- Basic Coverage: Provides fundamental protection for damages resulting from common risks such as fire or theft.

- Comprehensive Protection: Offers a broader scope of coverage, addressing a wider range of risks, including accidental damages and natural disasters.

- Specialized Plans: Tailored to meet the specific needs of businesses or properties that face unique risks, such as flooding or earthquakes.

- Liability Protection: Protects against legal claims for injury or damage caused by the policyholder’s actions or negligence.

Additional Options

Besides the main types, there are additional features that can be added to a coverage plan:

- Additional Living Expenses: Covers the cost of living elsewhere while repairs are made to a damaged home.

- Endorsements: Custom add-ons that modify or expand existing coverage to suit specific needs.

- Flood Coverage: A separate policy or add-on to protect against water damage not covered by standard plans.

How to Study for Property Insurance Exams

Preparing for the certification in this field requires a strategic approach that combines understanding the core material, practicing problem-solving, and applying real-world scenarios. Effective study methods will help you build the knowledge needed to pass the evaluation with confidence.

Study Strategies

Here are some key techniques to enhance your preparation:

- Review Core Concepts: Start by mastering the basic terms, definitions, and principles that are essential for understanding the subject.

- Practice with Sample Scenarios: Solve mock problems to simulate the types of situations you will face. This helps you become familiar with the format and boosts your confidence.

- Create a Study Schedule: Develop a clear timetable that breaks down study sessions into manageable parts, ensuring that all topics are covered over time.

- Use Study Guides: Invest in comprehensive guides that focus on important areas and include helpful tips to clarify difficult concepts.

Test-Taking Techniques

Once you’ve prepared the material, consider these strategies to optimize your performance:

- Read Carefully: During the test, carefully read each scenario or problem to ensure you understand what is being asked.

- Manage Your Time: Allocate time for each section, ensuring you complete all parts without rushing.

- Eliminate Incorrect Choices: For multiple-choice sections, narrow down your options by eliminating clearly incorrect answers, increasing your chances of selecting the right one.

- Stay Calm: Maintain a calm and focused mindset throughout the evaluation process, which will help you think clearly and make better decisions.

Tips for Answering Multiple Choice Questions

Multiple-choice sections are a common format in assessments, requiring a strategic approach to selecting the correct response. While the choices may appear similar, a clear understanding of the material, along with a careful analysis of each option, is essential for success.

Here are some helpful strategies to increase your chances of selecting the right answer:

- Read Each Option Carefully: Take the time to examine all available choices before making a decision. Often, answers will contain subtle differences, so reading them thoroughly is crucial.

- Eliminate Incorrect Options: If you’re unsure of the answer, start by eliminating clearly wrong choices. This narrows down your options and increases your likelihood of choosing correctly.

- Look for Key Words: Pay attention to words like “always,” “never,” “usually,” and “rarely.” These terms can give you clues about the accuracy of the options, as certain answers may be too absolute to be correct.

- Stay Calm and Focused: Keep a clear mind while answering. Rushing through questions may lead to careless mistakes. If you’re stuck, move on and return later with a fresh perspective.

- Trust Your Instincts: If you find that your first choice was based on a strong understanding of the material, stick with it. Second-guessing often leads to confusion and changes to correct answers.

By applying these tips, you’ll approach the multiple-choice portion with confidence, ensuring better outcomes during your test.

Legal Aspects of Property Insurance

The legal framework surrounding coverage contracts is essential to understand, as it governs the rights and responsibilities of all parties involved. Knowing the laws, terms, and regulations that dictate how policies are structured, enforced, and disputed ensures both the provider and the policyholder are protected.

Legal principles also address issues such as claim disputes, the role of negligence, and the enforcement of exclusions. It is crucial to be familiar with these rules to ensure that agreements are fair and that all parties fulfill their obligations under the terms of the coverage.

In addition to statutory regulations, understanding case law and precedents can also provide valuable insights into how legal challenges are handled in the context of coverage agreements. Knowing when to involve legal professionals or when an issue can be resolved outside the courtroom is a key part of effective risk management.

Risk Management in Property Insurance

Effective management of potential threats and uncertainties is crucial for safeguarding assets. Identifying, assessing, and mitigating risks allows individuals and businesses to minimize financial loss while ensuring their operations remain secure. A well-structured strategy helps prevent unexpected setbacks and ensures that resources are allocated efficiently to address possible challenges.

Risk Identification and Assessment

The first step in any management plan is identifying the types of risks that could affect a property or organization. These could range from natural disasters, such as floods or fires, to man-made threats like theft or vandalism. Once these risks are recognized, they need to be evaluated based on their likelihood and potential impact.

Mitigation and Prevention Strategies

After assessing risks, it is important to develop strategies to minimize or avoid them altogether. This can involve implementing safety measures, such as fire prevention systems or security protocols, and adopting policies that promote proactive management. Additionally, diversifying assets or investments can also serve as a way to spread risk and reduce potential losses.

Calculating Coverage Limits and Premiums

Understanding how to determine the appropriate coverage and calculate related costs is essential for choosing the right plan. The process involves evaluating the value of the assets to be protected, assessing potential risks, and calculating the costs that will ensure adequate compensation in the event of a loss. Balancing coverage limits with premium rates helps individuals and businesses make informed decisions about their protection needs.

Determining Coverage Limits

To accurately set the right coverage limits, the following factors should be considered:

- Asset Value: The overall worth of the items or structures being protected is a key determinant in establishing appropriate coverage limits.

- Risk Assessment: Identifying the potential risks that may affect the assets will help determine how much protection is needed to mitigate those threats.

- Replacement Cost: In cases where assets might be damaged or destroyed, it’s important to ensure that coverage reflects the cost of replacement, not just the current market value.

Calculating Premium Rates

Premiums are determined based on a variety of factors, which may include:

- Coverage Type: Different types of protection, such as basic or comprehensive coverage, will result in varying premium rates.

- Deductible Amount: A higher deductible typically leads to lower premiums, while a lower deductible results in higher premiums.

- Risk Profile: The level of risk associated with the insured property plays a role in determining the premium. For example, properties in areas prone to natural disasters may attract higher premiums.

Understanding Claims and Underwriting Processes

The procedures involved in making a claim and evaluating risk are crucial for ensuring that individuals and businesses receive fair compensation while maintaining the integrity of their protection plans. These processes help determine the extent of coverage provided and ensure that claims are handled efficiently. Understanding how risks are assessed and claims are processed can lead to a smoother experience and better decision-making.

Claims Process Overview

The claims process involves several steps to ensure that a valid request is addressed promptly and fairly. It starts with the policyholder reporting the incident, followed by an assessment of the loss, and culminates in compensation if the claim is approved. Key stages include:

| Step | Description |

|---|---|

| 1. Incident Report | The policyholder notifies the provider about the loss or damage. |

| 2. Evaluation | An adjuster assesses the damage and determines the amount of loss. |

| 3. Approval or Denial | The provider decides whether the claim is valid based on the policy terms. |

| 4. Compensation | If approved, the policyholder receives compensation for the covered loss. |

Underwriting Process Overview

Underwriting is the process of evaluating risk before coverage is issued. The underwriter reviews the application and assesses the potential for loss, considering factors such as property condition, location, and risk history. The result of this evaluation determines the terms of the contract, including premium amounts and coverage limits. Key stages include:

| Step | Description |

|---|---|

| 1. Risk Evaluation | The underwriter analyzes the likelihood of potential risks affecting the property. |

| 2. Information Collection | Gathering details about the insured property, including its value and condition. |

| 3. Decision Making | The underwriter decides on the terms, coverage, and premium based on risk analysis. |

| 4. Issuance of Coverage | If the terms are agreed upon, coverage is issued and activated. |

Property Insurance Terms You Should Know

When navigating the world of coverage, it’s essential to understand the key terminology used in the field. Familiarizing yourself with these concepts helps clarify the terms of protection and ensures that decisions are made with a clear understanding of what’s being offered. Below are some important terms that everyone should know before entering into a contract.

- Deductible: The amount a policyholder must pay out of pocket before coverage takes effect for a claim.

- Premium: The regular payment made to maintain a policy, typically paid annually or monthly.

- Liability Coverage: Protection that covers legal expenses and damages if the policyholder is found responsible for an accident or injury to others.

- Exclusion: Specific conditions or risks that are not covered by the policy, often related to certain types of damage or loss.

- Claim: A formal request made by the policyholder for compensation after a loss or damage occurs.

Understanding these terms is just the beginning. There are many other critical elements that contribute to the overall framework of a plan. Being informed will allow you to make better choices and ensure you are adequately covered when the need arises.

Important Insurance Regulations to Remember

Understanding the rules and regulations that govern coverage is crucial for both policyholders and providers. These laws are designed to ensure fair practices, protect consumers, and maintain the stability of the market. Being aware of these guidelines can help you avoid common pitfalls and make informed decisions when it comes to securing protection.

| Regulation | Description |

|---|---|

| State-Specific Laws | Each state has its own set of laws that dictate how coverage is structured and what protections are mandatory for policyholders. |

| Minimum Coverage Requirements | Most regions require a minimum amount of coverage to ensure basic protection for individuals and businesses. |

| Claims Handling Procedures | There are specific guidelines regarding how claims should be processed, including timelines for reporting and settlement. |

| Fair Practices Act | Regulations to prevent deceptive marketing and ensure that consumers are treated fairly throughout the process of obtaining protection. |

| Rate Approval | Insurance providers must submit their pricing structures for approval to ensure that rates are fair and not discriminatory. |

Adhering to these regulations helps maintain transparency and ensures that consumers are adequately protected under the law. Being knowledgeable about these standards can help mitigate risks and avoid legal complications.

Sample Questions and Model Answers

To prepare effectively for assessments, it’s essential to familiarize yourself with common types of inquiries that may arise. Reviewing sample scenarios along with ideal responses provides valuable insight into how to approach different topics. This practice helps reinforce key concepts and ensures a deeper understanding of the material. Below are some examples to guide your preparation.

- Scenario 1: A homeowner’s property is damaged due to a natural disaster. What steps should they take to file for compensation?

- Model Answer: First, assess the damage and document it thoroughly with photos. Then, contact the provider to initiate the claim process. Ensure that all necessary paperwork is submitted within the specified time frame, and provide any required evidence to support the claim.

- Scenario 2: An individual needs to calculate the appropriate coverage amount for a building. What factors should they consider?

- Model Answer: The coverage amount should account for the replacement cost of the property, including building materials and labor. Other factors, such as location, potential risks (fire, flooding), and the property’s overall value, must also be evaluated when determining the correct amount of protection.

- Scenario 3: What happens when a claim is denied due to a policy exclusion?

- Model Answer: If a claim is denied, the individual should carefully review the policy to understand the reason for the denial. They may appeal the decision or seek legal advice if they believe the denial was unjust. Understanding the exclusions upfront helps prevent future disputes.

Practicing with such scenarios can enhance your understanding of practical applications and boost your confidence in responding to real-world situations effectively.

Exam Strategies for Time Management

Efficiently managing your time during an assessment is crucial for maximizing performance and ensuring that you can address all topics thoroughly. With careful planning and strategic allocation of time, you can approach each section confidently and avoid unnecessary stress. Below are some effective techniques to help you manage your time wisely during any assessment.

1. Prioritize Tasks

Start by reviewing the entire set of instructions or prompts to identify sections that may require more time or focus. Allocate time according to the complexity of the tasks. Begin with easier questions or those you’re more confident in to gain momentum before tackling more challenging ones. Prioritizing helps you avoid wasting time on sections that may not yield as many points.

2. Set Time Limits for Each Section

Divide the total time available for the test into manageable blocks, assigning specific durations to each section. For example, if there are multiple parts, aim to complete each within a set time, leaving a buffer period for review at the end. Keeping track of time during the test ensures that no section is rushed or overlooked.

By practicing these strategies before the actual assessment, you can develop the confidence and discipline needed to work efficiently under pressure. Effective time management helps ensure that all questions are answered thoroughly and that you have enough time to revisit difficult areas.

Preparing for Exam Day

Preparation on the day before a major assessment is just as important as the weeks of studying leading up to it. To perform your best, it’s essential to establish a calm mindset and ensure that all logistical details are handled in advance. The final 24 hours are your chance to solidify your readiness and minimize last-minute stress.

Start by reviewing any notes or materials that you’ve set aside for the final review. This is not the time for cramming new information but rather for reinforcing what you already know. Focus on key concepts or tricky areas where you need a refresher. This targeted review can boost your confidence and help you feel prepared.

Ensure you have everything needed for the day: identification, any required documents, and writing tools. Prepare your clothing for comfort and practicality, keeping in mind that you’ll want to stay relaxed and focused during the test. If the location is unfamiliar, plan your route and allow plenty of time for travel to avoid unnecessary pressure.

On the day of the test, make sure to eat a nutritious meal, hydrate well, and get enough sleep the night before. A healthy body supports a sharp mind, so taking care of your physical well-being will allow you to perform at your best. Finally, when you sit down to begin, take a deep breath and approach each section with focus and clarity. You’ve prepared well–now trust in your knowledge and skills.

Key Mistakes to Avoid in Property Insurance Exams

When preparing for a major assessment, there are several common missteps that can hinder performance. Avoiding these pitfalls will help you maximize your score and ensure a smoother experience on test day. Understanding the most frequent errors can give you a significant advantage.

One major mistake is neglecting to read instructions carefully. Many candidates rush into answering without fully understanding what is being asked. Always take the time to read through the guidelines and questions carefully to ensure you respond correctly. Skipping this step can lead to missed points due to misunderstandings.

Another common error is mismanaging time. Some test-takers spend too much time on difficult sections, leaving little time for the remaining questions. It’s important to pace yourself. Set time limits for each section, and if you get stuck, move on and return to the harder questions later. This strategy ensures you address every part of the assessment.

Overthinking or second-guessing your answers is another mistake that can affect your performance. Once you’ve selected an answer, trust your initial judgment unless you are absolutely sure of an error. Constantly changing answers can lead to confusion and unnecessary stress.

Finally, failing to review your responses at the end of the assessment can cost valuable points. If time allows, double-check your work to catch any overlooked mistakes or inconsistencies. A quick review can often reveal small errors that would otherwise go unnoticed.

After the Exam: What’s Next?

Once the assessment is complete, many people wonder what steps to take next. The period following a significant test can be both a time of relief and uncertainty. While waiting for results, it’s important to stay focused and take proactive steps to ensure continued progress.

First, it’s essential to review your performance. Reflect on areas where you felt confident and those that presented challenges. Understanding your strengths and weaknesses will help you in future studies or professional development, regardless of the test outcome.

Additionally, this is the perfect time to organize any follow-up actions or next steps. If you’ve passed the assessment, ensure that you complete any necessary documentation or submit any required forms. This may include certifications, licenses, or registration with relevant bodies.

If the results are not as expected, don’t be discouraged. Many professionals and individuals face setbacks, and it’s important to view this as an opportunity for growth. Analyze areas where you can improve, and consider retaking the assessment after further preparation. Staying positive and focused will help you succeed the next time around.

In either case, your post-assessment actions will set the tone for your next steps in both personal and professional development. Take the time to assess the bigger picture and continue working towards your goals.