Understanding the regulations governing government funding and expenditures is essential for anyone looking to navigate the complexities of public finance. The structure and constraints of how funds are allocated and used can significantly impact both policy decisions and the functioning of government agencies. Mastery of these principles is not only crucial for legal professionals but also for anyone involved in public administration, finance, or governmental operations.

In this section, we will explore key principles and strategies to help you gain a deep understanding of the framework that governs fiscal allocations. With a clear focus on critical concepts, this guide will break down complex terms and structures in a manner that is easy to digest. Whether you’re preparing for an assessment or simply looking to expand your knowledge, this resource will offer valuable insights into how funds are managed, regulated, and distributed in the public sector.

Success in this field depends on the ability to quickly analyze legislative texts, interpret legal frameworks, and understand the nuances of budgetary processes. Through careful study and preparation, anyone can become proficient in these topics, ensuring they are well-equipped to handle real-world scenarios involving public finances.

Government Budget and Spending Regulations Insights

Understanding the intricacies of how funds are allocated, managed, and monitored in the public sector is vital for anyone working with government resources. The rules surrounding fiscal responsibilities and limitations shape the entire financial landscape of governmental operations. Mastery of these regulations allows professionals to navigate complex budgetary processes with confidence and precision.

To excel in this area, it’s essential to comprehend key aspects such as:

- The mechanisms by which money is assigned to different government agencies and projects

- How legislative decisions impact the flow of funds

- The criteria and guidelines for permissible spending

- Understanding key legal provisions and restrictions that apply to public expenditure

- Common challenges and misunderstandings that arise in public financial management

Efficiently addressing these components requires both a solid theoretical understanding and practical application. Mastery of these principles not only prepares you for assessments but also equips you with the knowledge needed for real-world problem solving in government spending scenarios.

Key strategies for success include:

- Thoroughly studying statutory texts and case law

- Focusing on high-priority topics often tested in assessments

- Regularly practicing with mock scenarios and previous cases

- Reviewing common misinterpretations to avoid pitfalls

- Keeping updated with recent developments in budgetary processes

By focusing on these strategies, you can enhance your understanding and increase your proficiency in handling government finance regulations. The road to mastery in this field requires dedication, attention to detail, and a deep understanding of the principles governing fiscal management in the public sector.

Understanding Key Legal Concepts

To fully grasp the structure and implications of government funding regulations, it is essential to understand the fundamental principles that govern how money is allocated and used within the public sector. These concepts are the foundation for navigating complex budgetary processes and ensuring compliance with financial restrictions set by legislation. A clear understanding of these terms will help you analyze legal documents, apply them effectively, and avoid common pitfalls in public sector financial management.

Essential Concepts in Public Finance

Several critical ideas form the backbone of any discussion on public financial management. Familiarity with these will provide clarity and enable you to interpret various regulations more easily. Key concepts include:

- Budget Authority – The legal permission for an agency to incur obligations and make payments from government funds.

- Obligations – Amounts a government agency is legally required to pay, such as contracts or expenditures.

- Discretionary vs. Mandatory Spending – The distinction between funds subject to annual budget decisions and those that are predetermined by existing legislation.

- Rescission – The cancellation of previously allocated funds by Congress or an executive order.

Interpreting Legal Provisions

Understanding how legal documents are structured and how specific terms are defined is key to making sense of complex regulations. These legal provisions can often be dense and difficult to navigate, so it is important to break them down into manageable sections. Some guidelines for interpreting these documents include:

- Paying close attention to definitions provided within the text itself, as these determine how terms are applied.

- Identifying key clauses that specify the scope and limitations of fund usage.

- Understanding the context of the legislation, including related laws and precedents.

- Familiarizing yourself with court interpretations or rulings related to the terms in question.

By mastering these key concepts and strategies, you will be better equipped to navigate the complexities of government funding regulations and apply them in real-world scenarios effectively.

How Appropriations Affect Government Spending

Government spending is directly influenced by the allocation of funds within the federal budget. The process of determining how resources are distributed to various departments and programs plays a crucial role in shaping public policy, influencing economic growth, and ensuring that critical services are funded. These decisions are made through a structured process that establishes financial limits, sets priorities, and dictates how taxpayer money is spent over a given period.

The way money is distributed determines which programs will receive funding, which projects can move forward, and where cuts might be made. Without clear guidelines, spending could become inefficient, leading to a misallocation of resources. The funds authorized through this process are essential to ensuring that government agencies and public sector services operate effectively.

Several key factors impact how the distribution of these resources influences overall government spending:

- Fiscal Year Budgets – The annual process of setting and reviewing how much money will be available for various government functions.

- Spending Caps – Legal limits on how much can be allocated to certain programs, impacting the scope of government projects and services.

- Discretionary vs. Mandatory Funds – The distinction between funds that can be adjusted each year and those that are automatically spent based on existing legislation.

- Unspent Funds – Allocations that are not fully used within a fiscal period, often leading to the carryover of resources or the need for reallocation in the next cycle.

Understanding the nuances of this process is vital for anyone working with government budgets, as it not only affects the allocation of financial resources but also shapes the direction of policy implementation across all sectors of government activity.

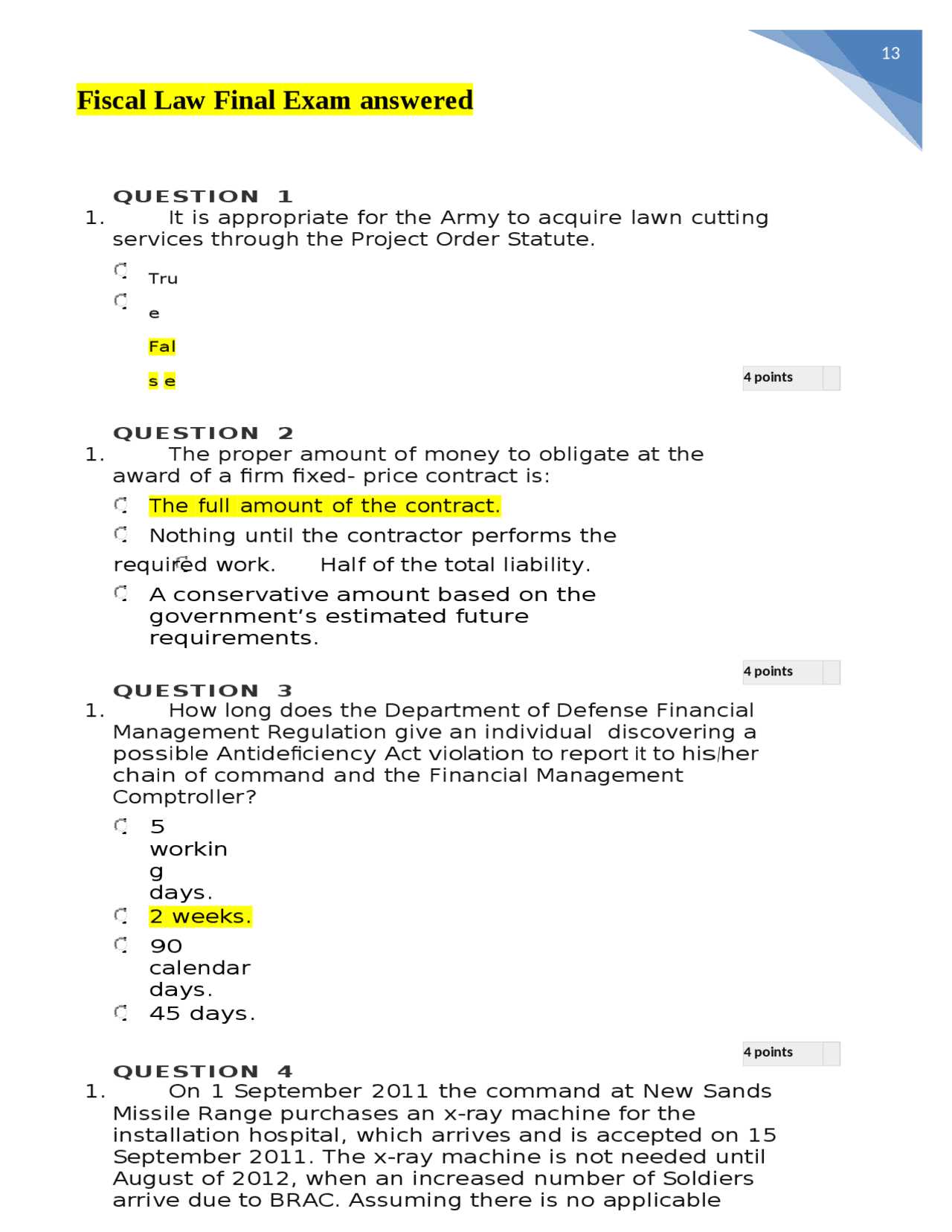

Common Pitfalls in Appropriations Law Exams

When preparing for assessments related to government funding regulations, students often face several challenges that can hinder their performance. These challenges arise from the complexity of the subject matter and the detailed analysis required to interpret legal and financial provisions. Identifying and avoiding common mistakes can significantly improve your ability to navigate these types of tests effectively.

Key Mistakes to Avoid

Several pitfalls can lead to misunderstandings or errors in your responses. These are often linked to misinterpretation of key terms, overlooking important details, or not following the correct procedures. Here are some common mistakes to watch out for:

- Misunderstanding Key Definitions – Confusing terms like “mandatory” vs. “discretionary” spending or failing to grasp the significance of statutory language can lead to incorrect answers.

- Overlooking Context – Not considering the context in which a provision or regulation is applied can lead to incomplete or incorrect interpretations. Always focus on the broader picture.

- Failure to Identify Important Clauses – Missing critical clauses or sections within a statute can result in overlooking essential aspects of the financial guidelines or restrictions.

- Not Addressing All Parts of the Question – Some questions may have multiple parts. Failing to answer each part can reduce your overall score.

Strategies to Overcome Challenges

To avoid these mistakes and succeed in assessments, it is essential to adopt a few key strategies during your preparation:

- Carefully review and understand the key terms and definitions relevant to the topic.

- Practice breaking down complex statutory language into simple terms to ensure you don’t miss important details.

- Pay attention to past cases and real-world applications to help contextualize your answers.

- Work through multiple practice questions to improve your ability to address all aspects of a question under time constraints.

By focusing on these areas, you can reduce the likelihood of making mistakes and increase your ability to provide accurate, well-reasoned responses.

Critical Case Studies in Appropriations

Case studies provide invaluable insights into the application of government funding regulations and how they shape decisions across various sectors. By analyzing real-world scenarios, one can better understand how policies are implemented and how legal challenges related to financial distributions are resolved. Examining these cases helps clarify the complexities of managing public funds and highlights the consequences of misapplication or misinterpretation of financial provisions.

Below are some critical case studies that illustrate the complexities involved in managing government resources:

| Case | Issue | Outcome | Lesson Learned |

|---|---|---|---|

| Case 1: Budget Rescission Controversy | Dispute over the executive’s power to cancel funds after they were already allocated. | The court ruled that rescissions require Congressional approval. | Clear understanding of the separation of powers and the limits of executive authority. |

| Case 2: Misallocation of Funds | Improper use of allocated funds for projects outside the approved scope. | Agency had to return misallocated funds and restructure its budgeting process. | Importance of adhering to the specific conditions tied to budget allocations. |

| Case 3: Inter-agency Funding Dispute | One agency claims that it was unfairly denied its share of funds for an essential program. | The court ruled in favor of the agency, requiring the allocation to be adjusted. | Ensuring transparency and fairness in the allocation process between agencies. |

These case studies demonstrate how various legal, administrative, and financial principles intersect when it comes to public funds. The lessons drawn from such cases help refine the application of financial regulations and improve the overall efficiency and fairness of resource distribution within government operations.

Interpreting Congressional Budget Resolutions

Understanding the intricacies of Congressional budget resolutions is essential for anyone working with government financial management. These resolutions set the framework for how federal funds are allocated and establish the priorities for government spending. They guide legislative bodies in determining the financial limits for various programs, ensuring that spending remains within the allocated amounts while also addressing national needs.

The Role of Budget Resolutions

Budget resolutions provide a comprehensive overview of how resources will be distributed across government functions. They set the maximum spending limits for each agency and program, often influencing the trajectory of national policy. While not laws themselves, these resolutions serve as essential tools for aligning legislative intent with financial reality.

- Fiscal Targets: These resolutions establish fiscal targets and goals for the year, outlining the total expected revenue and the allowable spending limits.

- Programmatic Priorities: The resolutions define which programs or sectors will receive more funding based on current national priorities.

- Binding vs. Non-binding Guidelines: Some elements of the budget resolution are non-binding, meaning they serve as guidelines rather than mandatory directives.

Key Considerations in Interpreting the Resolution

When analyzing a budget resolution, it is important to focus on several factors that shape its application:

- Budgetary Authority: Understanding the limits placed on government spending helps identify which areas can receive new funding and which areas may face cuts.

- Reconciliation Process: The resolution often includes provisions for reconciling differences between various spending and revenue proposals.

- Impact on Future Legislation: Budget resolutions serve as the basis for future bills that will allocate funds to specific programs, making their interpretation critical for effective policy formation.

By accurately interpreting these resolutions, policymakers can ensure that government spending aligns with the national priorities while adhering to legal and fiscal constraints.

Distinguishing Between Appropriations and Authorizations

In the realm of government funding and financial management, two crucial concepts are often discussed: the allocation of funds and the legal permission to spend them. While both are essential for ensuring that public money is distributed effectively, it is important to understand the distinction between the two. Authorizations and the actual allocation of funds represent different stages in the budgetary process, each with its own significance and function within the broader financial framework.

Key Differences Between Authorizations and Allocations

Authorizations and fund allocations are interconnected, but they operate differently. Understanding their roles is essential for grasping how the federal budget operates and how resources are made available for government programs. Below is a breakdown of these concepts:

| Concept | Definition | Key Features |

|---|---|---|

| Authorization | The legal permission granted by Congress to create and run a program or agency. | Establishes the framework, but does not guarantee funding. |

| Allocation | The specific allocation of financial resources to carry out authorized programs or activities. | Provides actual funds, enabling the execution of authorized activities. |

How They Work Together

While authorizations establish the framework for government action, the actual spending power comes from the allocation of funds. A program may be authorized to exist, but without the proper allocation, it cannot operate. Conversely, an allocation of funds without a corresponding authorization would be considered invalid. Therefore, both concepts are essential for the effective operation of government programs.

By distinguishing between the two, it becomes clear how the legislative process shapes both the scope and the financial backing of public sector activities.

How to Analyze Statutory Language

Interpreting statutory text is a crucial skill in understanding how government policies and regulations are implemented. Legal language can be dense and complex, but breaking it down into manageable parts helps clarify its meaning and application. Properly analyzing the wording, structure, and intent behind statutes enables individuals to apply them effectively in practical situations.

When approaching statutory language, it is important to consider several key elements. Below is an overview of the essential steps involved in interpreting legal texts:

| Step | Description | Purpose |

|---|---|---|

| Read the Statute Thoroughly | Examine the language carefully, noting key terms and provisions. | Ensure you fully understand the scope and intent of the law. |

| Identify Key Terms and Phrases | Look for legal terms and definitions that may carry specific meanings. | Clarify any ambiguity in language to avoid misinterpretation. |

| Examine Context | Consider the broader context in which the statute was enacted. | Understand the legislative intent and how it applies in practice. |

| Consider Relevant Precedents | Look for prior cases or rulings that might influence the interpretation. | Ensure that the interpretation aligns with established legal principles. |

| Analyze Legislative History | Review the history and debates surrounding the statute’s passage. | Gain insights into the intent and purpose of the law from lawmakers’ discussions. |

By following these steps, you can break down even the most complex statutory language into understandable components. This process helps ensure that the law is applied accurately and effectively in different scenarios, minimizing the risk of misinterpretation and misapplication.

Common Legal Terms You Must Know

In the realm of government regulations and financial management, understanding legal terminology is essential for clear interpretation and effective application. Legal texts are often filled with specialized vocabulary that can be difficult to navigate without a foundational grasp of key terms. Familiarizing yourself with these terms helps ensure that you can accurately understand and apply rules, contracts, and procedures related to public funding and governmental activities.

Essential Terms in Government Financial Management

Below are some of the most important terms you should know when working with government-related documents and regulations:

- Discretionary Spending: Expenditures that are determined by the annual appropriation process and are not mandatory, such as defense or education funding.

- Entitlement Programs: Programs that provide benefits to eligible individuals, such as Social Security, where funding is automatic and not subject to annual approval.

- Budget Resolution: A framework that outlines spending priorities and sets limits on government expenditure for a specific period.

- Continuing Resolution: Temporary legislation that allows government operations to continue when an official budget has not been passed by the start of the fiscal year.

- Sequestration: The automatic, across-the-board cuts to government spending that occur when budget limits are exceeded.

Legal Principles for Budget and Financial Oversight

In addition to specific terms related to spending and budgeting, understanding the broader legal principles that govern financial decisions is crucial:

- Appropriations Act: A piece of legislation that provides the legal authority to allocate government funds for specific programs or activities.

- Imprest Fund: A small, fixed amount of funds used for making minor, incidental payments in government offices.

- Mandatory Spending: Government expenditure that is automatically funded by pre-existing legislation, often for entitlement programs.

- Accountability: The obligation to account for government funds and ensure they are spent according to established rules and regulations.

- Offsetting Collections: Revenues that an agency receives and can use to offset the costs of providing certain services or performing specific functions.

Grasping these terms ensures that you can engage effectively with financial documents and navigate the complexities of government spending and regulation. Whether you are involved in budgeting, oversight, or policy development, understanding these concepts is critical for clear communication and decision-making in government operations.

Time Management Strategies for Exam Success

Effective time management is one of the most critical factors in achieving success during any academic assessment. Properly organizing your study sessions and allocating time for each task can significantly reduce stress and improve performance. By implementing structured time management strategies, you can approach your preparation with greater focus and efficiency, ensuring that you cover all necessary material without feeling overwhelmed.

Planning Your Study Schedule

To make the most of your study time, it’s essential to create a realistic schedule. This involves identifying how much time you have available and breaking down your tasks into manageable chunks. Here are some tips to help you organize your study time:

- Set Specific Goals: Clearly define what you need to accomplish during each study session. This will keep you focused and prevent procrastination.

- Prioritize Key Topics: Identify the most important or difficult areas and allocate more time to those. Don’t spend too much time on content you’re already familiar with.

- Use Time Blocks: Break your study time into focused intervals, such as 25- to 50-minute blocks, with short breaks in between. This method, known as the Pomodoro technique, helps maintain concentration.

- Review and Adjust: At the end of each week, assess your progress and adjust your schedule if necessary. Flexibility is important for staying on track.

Maximizing Focus During Study Sessions

Once you’ve structured your time, it’s important to make each study session as productive as possible. To stay focused and avoid distractions, consider these strategies:

- Create a Dedicated Study Space: Choose a quiet and comfortable area where you can concentrate without interruptions. Avoid studying in spaces that are associated with relaxation or entertainment.

- Minimize Distractions: Turn off your phone or use apps that block distracting websites. Try to create a work environment that helps you stay engaged with your material.

- Use Active Learning Techniques: Engage with the material actively, such as by teaching the content to someone else, taking notes, or practicing problems. Active learning helps retain information better than passive reading.

- Stay Consistent: Build a habit by studying at the same time each day. Consistency helps keep your mind in a productive state and reduces last-minute cramming.

By effectively managing your time, you not only maximize the quality of your study sessions but also ensure that you remain calm and prepared when it’s time for the assessment. These strategies allow you to balance preparation with rest, ultimately leading to improved performance.

Preparing for Multiple-Choice Questions

When preparing for assessments that include multiple-choice questions, it’s important to approach your study sessions with a strategy tailored to this format. Multiple-choice tests often require you to understand the material well enough to discern subtle differences between similar options. With the right preparation, you can increase your ability to select the correct answers efficiently and confidently.

The key to mastering multiple-choice questions is not only to know the material but to develop a keen sense of how to approach the questions themselves. Here are some strategies that can help you excel in this format:

- Understand the Question Structure: Pay close attention to the way questions are worded. Often, the phrasing can provide hints about the correct answer. Look for keywords like “always,” “never,” or “only,” which can signal definitive answers.

- Review Common Distractors: Distractors are incorrect options designed to challenge your understanding. Familiarize yourself with common types of distractors, such as options that sound plausible but are not quite right. This can help you eliminate wrong choices more quickly.

- Eliminate Obviously Wrong Answers: If you can immediately rule out one or two options, your chances of guessing correctly improve. This strategy increases your odds of selecting the right answer even if you’re unsure.

- Look for Patterns: If you’re unsure about an answer, check for patterns in the remaining choices. Sometimes, especially in questions with a series of answers, similar options can point to the correct choice.

- Time Management: Allocate a specific amount of time for each question to avoid spending too much time on any one item. If you’re stuck, move on and come back to it later.

Preparing for multiple-choice questions requires both knowledge of the subject and a strategic approach to answering questions. By practicing these techniques and familiarizing yourself with the question format, you can improve your test-taking efficiency and accuracy.

Essay Writing Tips for Law Exams

Writing essays during assessments can be challenging, but with the right approach, it’s possible to organize your thoughts and present a compelling argument. Good essay writing requires clear communication, logical structure, and strong analysis. Whether you’re answering theoretical questions or applying legal principles to specific scenarios, following a structured process can help ensure your response is both thorough and concise.

Effective Essay Structure

The first step in writing a successful essay is organizing your response logically. A well-structured essay helps readers follow your argument and shows your ability to communicate complex ideas clearly. Here’s how to organize your essay effectively:

- Introduction: Start with a brief introduction that outlines the issue or question at hand. Clearly state your thesis or main argument, which will guide the rest of your essay.

- Body Paragraphs: Each paragraph should focus on one key point or aspect of the topic. Start with a clear topic sentence, followed by supporting evidence or analysis. Use examples to strengthen your argument and demonstrate your understanding.

- Conclusion: Summarize your key points and restate your argument in a concise manner. Ensure that your conclusion ties everything together and answers the question in a definitive way.

Analyzing the Question and Developing Your Argument

Before you begin writing, it’s crucial to fully understand the question being asked. Take time to break down the prompt and identify key issues. Here are some tips to help with analysis and argument development:

- Read Carefully: Pay attention to the wording of the question. Identify keywords such as “discuss,” “analyze,” or “evaluate,” as they indicate the approach you should take in your response.

- Identify Relevant Laws or Principles: If the question involves applying certain concepts, make sure you identify the relevant legal principles or rules and explain how they apply to the situation at hand.

- Develop a Clear Argument: Your essay should present a clear and reasoned argument. Avoid vague statements; instead, provide a logical progression of ideas backed by evidence or examples.

- Be Concise but Comprehensive: While it’s important to be thorough, avoid unnecessary repetition. Stay focused on the question and only include relevant information that strengthens your argument.

By following these tips, you can craft a clear, structured, and persuasive essay that demonstrates both your understanding and analytical skills. Good essay writing is not just about answering the question; it’s about presenting your ideas in a clear and effective manner.

Best Resources for Studying Appropriations Law

Mastering the complexities of funding regulations and government financial management requires utilizing the right materials and tools. Whether you’re preparing for an academic assessment or simply seeking to deepen your understanding, various resources can provide valuable insights and help reinforce key concepts. These resources range from textbooks and online platforms to government publications and expert commentary, each offering a different perspective on the subject matter.

Textbooks and Reference Materials

Books written by experts in public finance and policy can be a great starting point. These materials typically break down complex concepts into manageable sections and provide clear explanations along with real-world examples. Some highly recommended textbooks include:

- Public Finance in the United States: A comprehensive textbook that covers government financial management and the role of financial regulations in public policy.

- Federal Budgeting and Spending: A detailed resource explaining the mechanics behind government spending processes and how they align with legal requirements.

Online Platforms and Courses

Online courses are a convenient way to access structured learning material. Platforms such as Coursera, edX, and LinkedIn Learning offer courses on related topics such as public administration, financial management, and policy analysis. These courses provide flexibility and often include video lectures, quizzes, and interactive exercises to help reinforce your knowledge.

Government Resources

For those who want to dive into official regulations and frameworks, government websites provide authoritative and up-to-date information. Some key resources include:

- U.S. Government Accountability Office (GAO): The GAO publishes reports and guidelines on government spending practices and financial accountability.

- Office of Management and Budget (OMB): This office provides comprehensive details on federal budget processes, including guidelines, circulars, and annual reports.

Expert Commentary and Case Studies

Reading articles and case studies written by legal and policy experts can help deepen your understanding of how theory translates into practice. Journals such as Public Budgeting & Finance and The Journal of Public Administration Research and Theory are excellent resources for case studies, policy analysis, and expert opinions on current trends in financial management and regulatory practices.

By combining these resources, you can gain a well-rounded understanding of financial management in government settings, making complex topics more accessible and providing a solid foundation for further study.

Legal Precedents in Appropriations Disputes

In the field of government financial management, legal precedents play a significant role in resolving disputes related to the allocation and use of funds. These precedents establish guidelines for interpreting regulations and set benchmarks for how financial conflicts are addressed within the context of public policy. Understanding the key cases and decisions in this area is crucial for anyone studying government spending processes or involved in policy-making.

Notable Legal Precedents

Several landmark decisions have shaped the way funds are managed and contested. These cases often involve disputes over the scope of legislative authority, the limits of executive power, or the interpretation of financial guidelines. Key precedents include:

- Case A v. Department of Finance: A decision that clarified the boundaries of Congressional control over specific allocations, helping define how funds can be reallocated or restricted.

- Government v. Agency X: This case set the precedent for interpreting the role of federal agencies in managing allocated funds and their legal responsibilities in expenditure tracking.

- Agency Y v. Treasury Department: This case addressed the issue of whether funds could be transferred between government sectors without new legislative approval.

Implications of Legal Precedents

These precedents have far-reaching implications, ensuring that government financial practices are consistent with constitutional principles. By analyzing past legal outcomes, one can predict how similar issues might be resolved in future disputes. Legal precedents also offer guidance for navigating complex regulatory environments, helping to avoid costly errors in managing public funds.

For students or professionals in public policy, understanding the evolution of these legal precedents is essential for both compliance and effective decision-making. By examining past rulings, one can gain insights into the legal framework governing financial management and apply this knowledge to resolve contemporary challenges.

Understanding the Appropriations Process Flow

The process of allocating public funds involves a series of carefully coordinated steps, from initial proposal to final distribution. This process ensures that government spending is transparent, accountable, and adheres to the principles set by lawmakers. It is essential for policymakers, government officials, and others involved in the management of public finances to understand how this flow works to ensure that resources are directed efficiently and effectively.

The flow begins with identifying the need for financial resources, followed by determining how much funding is required for specific projects or operations. Once the amount is determined, it goes through various approval stages before funds are distributed to the appropriate government agencies or programs.

The Key Stages of the Process

Understanding the different stages in the process can help clarify the sequence of decisions that lead to the disbursement of funds. The following table outlines the key stages:

| Stage | Description |

|---|---|

| Budget Proposal | Initial proposal for funding needs based on government priorities and strategic plans. |

| Legislative Approval | Review and approval of the proposed budget by lawmakers, ensuring it aligns with public policy goals. |

| Agency Allocation | Funds are distributed to relevant government departments or agencies for program execution. |

| Execution and Oversight | Ongoing management and oversight of fund usage to ensure compliance with established rules and regulations. |

| Final Reporting | Documentation and reporting on the use of funds, ensuring transparency and accountability. |

Each stage involves careful oversight and checks to ensure that funds are used properly and that all actions taken are in line with legal and procedural requirements. A detailed understanding of the process flow helps to avoid mistakes and ensures efficient handling of government resources.

Real-World Applications of Appropriations Law

Understanding how funds are allocated and managed is essential for effectively addressing the needs of public projects and services. The practical application of financial management principles in government operations ensures that resources are distributed fairly, responsibly, and according to established guidelines. In real-world situations, the proper use of financial policies can significantly impact the success or failure of governmental initiatives, from infrastructure development to disaster relief efforts.

The following examples highlight how these principles are applied in practice:

Examples of Key Applications

- Federal Funding for Healthcare Programs: Health programs such as Medicaid and Medicare rely on precise allocation of funds to ensure that they meet the needs of recipients. Decisions about how these funds are distributed are made based on legislative priorities and financial constraints.

- Disaster Relief Operations: When natural disasters strike, timely allocation of financial resources is crucial for providing emergency response and recovery services. Governments must ensure that funds are available and quickly distributed to affected areas to provide immediate relief.

- Infrastructure Projects: Public infrastructure projects, including roads, bridges, and public transportation systems, require careful financial management. Funds must be appropriated in a way that allows for the completion of large-scale projects on time and within budget.

- National Security and Defense: Military spending is often subject to strict regulations, with funds allocated based on strategic priorities. The allocation process ensures that defense programs are adequately funded while maintaining oversight to prevent wasteful spending.

Impact on Public Accountability

These real-world applications demonstrate how the management of public funds affects not only the efficiency of government operations but also the trust and accountability that citizens place in their government. Proper implementation of these practices ensures that financial resources are used to meet public needs while maintaining transparency and adhering to legal standards.

Examining Budget Control and Restrictions

Effective management of public funds requires a set of guidelines and limitations to ensure that resources are used efficiently and within the boundaries set by governing bodies. These financial controls are critical for maintaining fiscal discipline, preventing misuse, and ensuring that spending aligns with both short-term and long-term objectives. Understanding how budget constraints are applied can help organizations navigate the complexities of financial governance and enhance transparency.

The following areas highlight how financial oversight and restrictions are applied in government operations:

Types of Budgetary Restrictions

- Spending Caps: Governments often set maximum limits on expenditures in various sectors to control inflation, maintain balanced budgets, and avoid overspending. These caps ensure that funds are allocated in a way that aligns with projected revenues.

- Fund Transfers: Restrictions may exist on the movement of funds between different categories or departments. These limitations ensure that designated funds are used for their intended purposes and cannot be diverted without proper authorization.

- Time-bound Allocations: Some budgets are restricted to specific time periods, meaning that funds must be spent within a designated fiscal year or else they will be reallocated or expire. These time constraints help promote efficiency and prevent procrastination in financial planning.

- Mandatory vs. Discretionary Spending: Governments distinguish between mandatory (non-negotiable) spending, such as social security benefits, and discretionary spending, which is subject to approval. These divisions help prioritize essential programs and services while maintaining flexibility for other areas.

Impact of Restrictions on Government Operations

Restrictions on public spending not only safeguard against waste but also ensure that funds are distributed in a manner consistent with national priorities. While these constraints can sometimes slow down the process of allocating resources, they are necessary to keep the budget in balance and maintain accountability to taxpayers. Properly managed, these controls can lead to more efficient government operations and better public services.