Achieving proficiency in financial planning and oversight is essential for success in various assessments related to this field. Understanding the key principles and methodologies will help in making informed decisions and responding to complex questions with confidence. This section is designed to guide you through the critical components of managing funds and analyzing financial outcomes, offering insights that will be valuable for anyone preparing for related evaluations.

Whether you’re dealing with intricate fiscal processes or interpreting various financial documents, knowing how to approach and break down questions is crucial. By developing a clear understanding of the fundamental concepts and honing your problem-solving skills, you will be better equipped to handle the challenges that come your way. The following sections offer strategies, common pitfalls to avoid, and tips for improving your knowledge and performance in financial assessments.

Budget Execution Final Exam Answers

Successfully navigating complex financial assessments requires not only theoretical knowledge but also the ability to apply that knowledge in real-world situations. Understanding the key principles and methodologies involved in managing and analyzing fiscal data is crucial. This section provides guidance on how to approach the critical components of managing funds and interpreting financial statements during evaluations.

Essential Concepts for Success

Mastering the core principles is the first step in ensuring a solid understanding of fiscal management. Here are some fundamental concepts to focus on:

- Financial planning: The process of allocating resources efficiently to achieve organizational goals.

- Variance analysis: Understanding the difference between projected and actual figures to assess performance.

- Resource management: Efficient use of available resources to maximize outcomes.

- Cost control: Identifying areas where expenses can be minimized without compromising quality.

Practical Tips for Assessment Preparation

When preparing for financial evaluations, it’s important to focus on both theoretical knowledge and practical skills. The following strategies can help improve your performance:

- Review financial reports: Familiarize yourself with key documents like balance sheets and income statements.

- Understand key metrics: Focus on ratios, margins, and other performance indicators that are often assessed.

- Practice problem-solving: Work through case studies and sample questions to sharpen your analytical skills.

- Manage time effectively: During the assessment, allocate time wisely to address each question thoroughly.

By focusing on these strategies, you’ll be better prepared to tackle any financial scenario and demonstrate a comprehensive understanding of the subject matter. The ability to adapt and apply concepts in various situations is crucial for success in this area.

Understanding Financial Management Principles

Grasping the foundational concepts of financial oversight is essential for making informed decisions and ensuring the efficient use of resources. These principles provide the framework for allocating funds, tracking expenses, and making adjustments as necessary to meet organizational goals. A strong understanding of these core concepts is key to performing well in any financial assessment.

Key Elements of Financial Oversight

Successful management requires a deep understanding of several critical components. The following elements are essential for effective financial oversight:

- Resource Allocation: Distributing available funds strategically to meet short- and long-term objectives.

- Monitoring and Control: Continuously tracking expenditures and performance to ensure that financial plans stay on track.

- Performance Evaluation: Regularly reviewing financial outcomes and comparing them against established goals to identify discrepancies.

- Adjustments and Reallocations: Making necessary changes to financial plans based on performance data and changing circumstances.

Key Tools and Techniques

To effectively implement these principles, several tools and techniques are frequently employed to track, analyze, and adjust financial activities:

- Variance Analysis: Comparing expected vs. actual financial performance to identify areas that require attention.

- Financial Forecasting: Predicting future financial conditions based on historical data and current trends to guide decision-making.

- Cost-Benefit Analysis: Evaluating the financial feasibility of projects by comparing expected costs with anticipated benefits.

- Cash Flow Management: Ensuring liquidity by balancing incoming and outgoing funds effectively.

By mastering these principles and tools, you can develop a comprehensive understanding of how to manage finances effectively, optimize resources, and contribute to the overall success of any financial operation.

Key Terms in Financial Management

Understanding the fundamental terminology in financial planning and oversight is crucial for anyone looking to gain a deeper understanding of how financial systems operate. Familiarity with these terms helps in interpreting reports, making informed decisions, and navigating the complexities of managing organizational resources. This section will introduce some of the most important terms you will encounter in financial contexts.

Essential Financial Terminology

Here are some key concepts that are vital to understanding financial activities and assessments:

- Revenue: The income generated from normal business operations, typically through the sale of goods or services.

- Expenditure: The amount spent by an organization on goods, services, and operational costs.

- Cash Flow: The movement of money into and out of an organization, reflecting its liquidity and financial health.

- Capital: The funds available for investment in assets or the ongoing operations of a business.

Financial Management and Analysis Concepts

In addition to basic terms, it’s important to grasp some analytical concepts that help assess financial performance:

- Profit Margin: The difference between revenue and costs, expressed as a percentage of revenue.

- Cost Control: The practice of managing and reducing expenses to improve profitability.

- Return on Investment (ROI): A performance measure used to evaluate the efficiency of an investment or compare the efficiency of several investments.

- Liquidity: The ability of an organization to meet its short-term financial obligations using its available resources.

By becoming familiar with these essential terms, you can build a strong foundation for understanding financial reports and making strategic decisions. Mastery of these concepts is key to excelling in any area of financial management.

Common Financial Management Challenges

In any financial oversight process, organizations often encounter various obstacles that can hinder progress and affect performance. These challenges arise from a variety of factors, including inaccurate forecasting, changes in market conditions, and misallocation of resources. Understanding these issues is key to finding effective solutions and ensuring smoother operations. This section outlines some of the most common difficulties faced in financial management and offers insights on how to address them.

Frequent Obstacles in Financial Oversight

Many financial management processes face recurring problems that can disrupt plans and strategies. Some of the most common issues include:

- Inaccurate Forecasting: Predicting financial outcomes too optimistically or pessimistically can lead to misallocation of funds and inadequate planning.

- Cash Flow Shortages: A lack of liquidity can prevent an organization from covering its immediate expenses, causing delays or operational disruptions.

- Cost Overruns: Unforeseen expenses or inefficient resource use can result in exceeding financial limits, compromising the overall strategy.

- Unclear Financial Goals: When objectives are not well-defined, it becomes difficult to measure success and allocate resources effectively.

Mitigating Financial Risks

To reduce the impact of these challenges, there are several strategies that organizations can adopt:

- Regular Monitoring: Constantly reviewing financial reports and performance metrics allows for quick identification of discrepancies and necessary adjustments.

- Scenario Planning: Preparing for different financial outcomes through predictive models can help mitigate risks when unexpected changes occur.

- Improved Communication: Ensuring that all stakeholders are aligned on financial goals and strategies can prevent misunderstandings and mismanagement of resources.

- Effective Risk Management: Identifying potential financial risks early and taking steps to mitigate them is essential for long-term stability.

By recognizing and addressing these common challenges, organizations can better navigate the complexities of financial management and ensure their resources are used effectively to achieve their objectives.

How to Approach Assessment Questions

Successfully tackling questions during any assessment requires a strategic approach that goes beyond simply knowing the material. It involves analyzing the question carefully, organizing your thoughts, and presenting your answers in a clear and structured way. Understanding how to approach each type of query can make a significant difference in your overall performance and help you manage your time effectively during the test.

Steps to Effectively Handle Questions

Here are some practical steps to take when approaching different types of questions:

| Step | Description |

|---|---|

| 1. Read Carefully | Ensure you fully understand what is being asked before beginning your response. Pay attention to keywords and instructions. |

| 2. Organize Your Thoughts | Outline your main points or arguments to maintain a logical flow in your response. This helps keep your answer on track. |

| 3. Address All Parts of the Question | Many questions contain multiple components. Be sure to answer each part thoroughly to avoid missing important details. |

| 4. Use Relevant Examples | Support your responses with specific examples or real-world applications to demonstrate your understanding of the subject. |

| 5. Review Your Response | After completing your answer, take time to review it for clarity, accuracy, and completeness. Ensure you haven’t overlooked any important points. |

By following these steps, you will be able to approach questions methodically, ensuring that your responses are not only well-structured but also demonstrate a deep understanding of the subject matter. With practice, you can develop the confidence and skills needed to excel in any assessment scenario.

Strategies for Studying Financial Management

Effective preparation for understanding financial oversight and resource allocation requires a structured approach. Developing a comprehensive study plan is essential for mastering the key principles and techniques involved in managing funds. By focusing on both theoretical concepts and practical applications, you can build a solid foundation for success. This section outlines a range of strategies that can help improve your understanding and retention of critical material.

Key Approaches for Efficient Learning

When preparing for any financial-related assessment, consider implementing the following strategies to ensure thorough understanding:

- Break Down Complex Concepts: Divide challenging topics into smaller, more manageable sections. This makes them easier to understand and remember.

- Utilize Real-World Examples: Apply theoretical knowledge to practical situations to see how concepts work in real scenarios.

- Create a Study Schedule: Set aside dedicated time for each topic, allowing you to focus without distractions and avoid last-minute cramming.

- Review Past Cases and Scenarios: Familiarize yourself with historical financial cases or sample questions to identify patterns and prepare for possible test scenarios.

- Collaborate with Peers: Discussing concepts with others can offer new perspectives and enhance your understanding of difficult material.

By using these strategies, you can maximize your study efficiency and ensure that you’re well-prepared to handle any financial management challenges. With consistent effort and a clear focus, you’ll be able to approach the material with confidence and achieve better outcomes.

Types of Financial Management Questions

In any financial assessment or review, questions are designed to test a variety of skills and knowledge related to managing and allocating resources effectively. These questions often come in different formats, each requiring a distinct approach for a successful response. Understanding the various types of questions you may encounter is essential for preparing adequately and providing thorough answers. This section will explore the common question types and strategies for tackling them.

Common Formats of Financial Management Questions

There are several types of questions commonly seen in assessments related to financial oversight. Each format tests different aspects of your understanding:

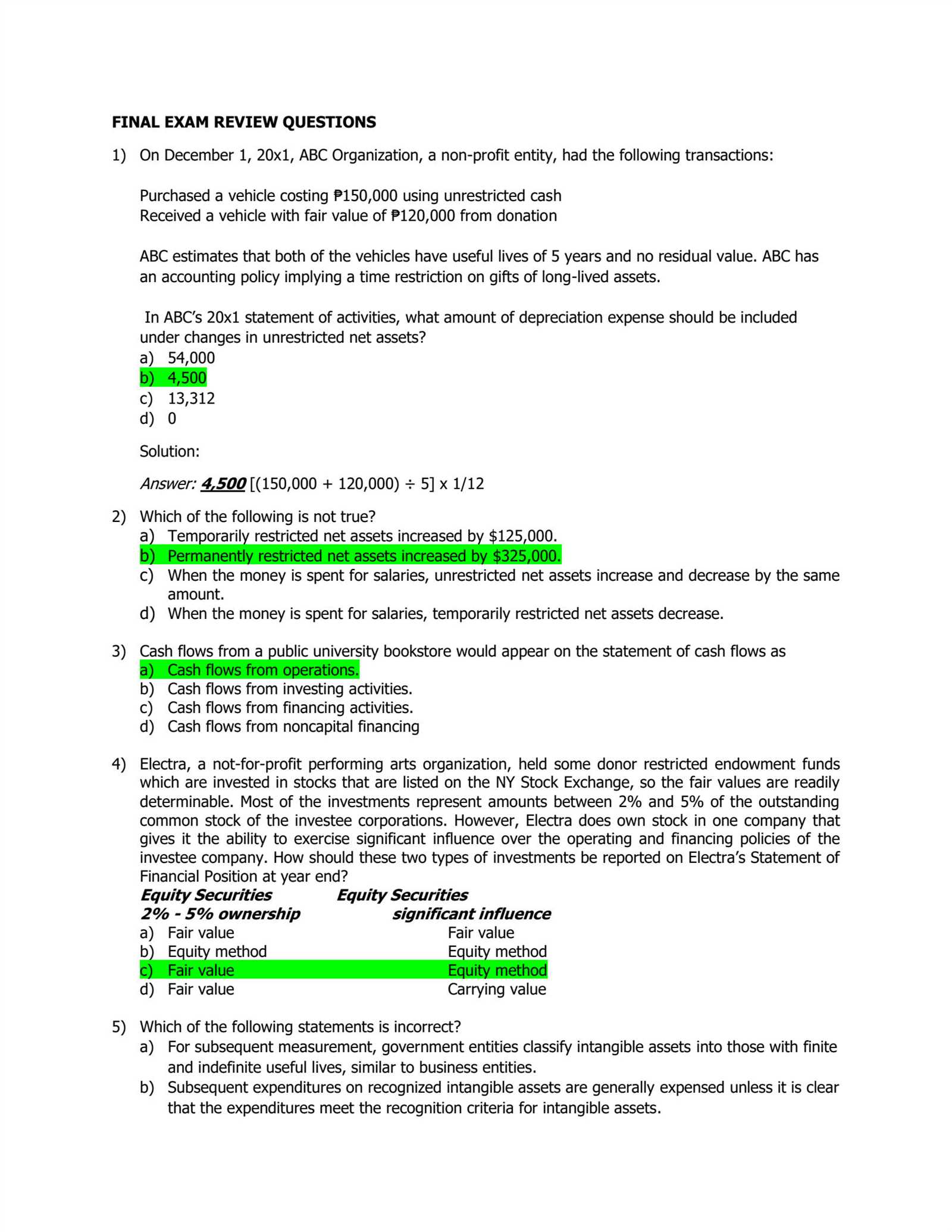

- Multiple Choice: These questions present several possible answers, and you must select the most accurate one. They often test your ability to recognize the correct concepts and definitions quickly.

- Short Answer: These questions require brief responses that directly address a specific topic or concept. Focus on clarity and conciseness while ensuring that your answer is complete.

- Case Studies: In these questions, you are given a scenario or problem related to financial management and asked to analyze it. You’ll need to apply your knowledge to propose solutions or explain the reasoning behind certain financial decisions.

- Calculation Problems: These questions involve numerical problems where you must perform calculations based on provided data. Ensure you understand the formulas and steps needed to arrive at the correct solution.

- Essay-Type Questions: These require you to provide detailed, well-organized responses. You will need to demonstrate your ability to explain complex concepts clearly and support your arguments with examples or theoretical applications.

Strategies for Answering Different Question Types

To excel in answering financial management questions, it is essential to use appropriate strategies for each type:

- For Multiple Choice: Eliminate obviously incorrect options first, and then carefully consider the remaining choices before selecting your answer.

- For Short Answer: Be concise but thorough. Focus on key points and ensure your answer addresses the specific question asked.

- For Case Studies: Break down the scenario into smaller parts. Analyze the given information, identify the key issues, and propose a well-reasoned solution.

- For Calculation Problems: Double-check your math and ensure that all necessary steps are followed correctly. Always review your final answer to avoid simple mistakes.

- For Essay-Type Questions: Organize your response clearly with an introduction, body, and conclusion. Provide evidence or examples to back up your arguments and ensure your explanation is thorough.

By recognizing the different types of questions and preparing for each format, you can approach your financial assessments with confidence and increase your chances of success. Practicing these techniques will help you develop the skills needed to answer accurately and efficiently.

Real-World Examples in Financial Management

Understanding theoretical concepts is important, but seeing how those principles are applied in real-world scenarios brings them to life. Practical examples from various sectors help to illustrate how resources are allocated, monitored, and adjusted based on changing circumstances. By examining these cases, you can gain valuable insights into the challenges and strategies used in managing financial operations effectively. This section will explore a few real-world examples where these principles have been successfully implemented.

Government Funding Allocation

One of the most prominent examples of effective financial management can be found in government operations. Public institutions are often required to allocate large sums of money for various public services. The key challenge is ensuring that funds are distributed appropriately across departments, with accountability at every stage. For instance, when responding to a national health crisis, governments need to make rapid decisions about how to allocate emergency funds. These decisions must balance urgency, long-term priorities, and available resources. Proper tracking and adjustment are necessary to ensure that the funds are spent efficiently and for their intended purposes.

Corporate Resource Management

In the private sector, companies face similar challenges when managing their financial resources. For example, a multinational corporation may need to allocate funds for new product development, marketing campaigns, and operational expansion. A major challenge arises when unexpected changes in the market require quick reallocation of resources. During a period of economic downturn, a company may need to cut back on discretionary spending, such as marketing or non-essential operations, while protecting critical functions like research and development. Companies that manage these transitions effectively can minimize financial disruption and ensure long-term stability.

Non-Profit Sector Funding

Non-profit organizations are often subject to strict oversight due to their reliance on donations, grants, and government funding. These funds must be carefully monitored to ensure they are used in alignment with the organization’s mission and donor intent. For example, during a natural disaster, a non-profit focused on humanitarian aid must quickly assess how to distribute incoming donations for maximum impact. This may involve direct aid to affected communities or supporting relief operations in multiple regions. The ability to adapt and make timely, informed decisions is critical for maintaining the trust of donors and ensuring that funds reach those in need.

By examining these real-world examples, we can see how financial management principles play a critical role across different sectors. Whether in government, corporate, or non-profit settings, the ability to allocate, track, and adjust resources effectively is essential for long-term success and accountability.

Common Mistakes in Financial Assessments

During any assessment of financial management, there are several common pitfalls that students and professionals alike often fall into. These mistakes can stem from misunderstandings of key concepts, poor time management, or a lack of attention to detail. Recognizing these errors beforehand can help you avoid them and approach the task with greater confidence and accuracy. In this section, we’ll explore some of the most frequent mistakes made in financial evaluations and provide strategies to overcome them.

Lack of Clarity in Definitions

One of the most common errors is a failure to properly define key terms and concepts. Financial management involves numerous technical terms and understanding their precise meaning is essential for providing accurate responses. Misinterpreting definitions or using vague language can lead to incorrect conclusions or incomplete answers. To avoid this, ensure you clearly understand the meaning of each term before you begin writing and use precise language when explaining concepts.

Overlooking Assumptions

In financial assessments, assumptions play a vital role in shaping analysis and decision-making. Often, students may overlook or make invalid assumptions, which can lead to incorrect answers. It’s important to identify any assumptions made during problem-solving, especially when calculating projected figures or explaining hypothetical scenarios. Always state your assumptions clearly and ensure they are reasonable based on the information provided.

Ignoring the Big Picture

Focusing too much on individual details without considering the broader financial picture is another common mistake. While it’s important to be accurate in calculations and descriptions, overlooking the context or the overall goal of the analysis can lead to answers that are technically correct but miss the mark. Always connect your answers to the larger objectives of the task, whether it’s maintaining sustainability, ensuring effective resource allocation, or meeting strategic financial goals.

Time Mismanagement

In many assessments, time is limited, and managing it effectively is crucial. Some candidates spend too much time on one question or part of the question, leaving little time for others. This can lead to incomplete answers or rushed calculations. It’s important to allocate time wisely for each section and stick to a planned approach, making sure that you can address all questions comprehensively within the given time frame.

Neglecting to Review Work

Finally, failing to review your work before submission can lead to missed errors or overlooked details. Small mistakes, such as calculation errors or missing steps, can significantly affect the accuracy of your answers. Always reserve time at the end of the assessment to go over your responses, check for consistency, and correct any mistakes you may have made during the process.

By being aware of these common mistakes and taking steps to avoid them, you can enhance the quality of your responses and perform more effectively in financial assessments. Careful preparation, attention to detail, and effective time management will allow you to approach the task with greater confidence and accuracy.

Reviewing Financial Reports for Accuracy

Accurate financial reports are essential for informed decision-making and maintaining the credibility of any organization. Ensuring that these reports are free from errors requires a careful and systematic review process. This section will discuss key steps in verifying the accuracy of financial statements, including identifying common errors, cross-checking data, and utilizing tools for thorough analysis. By following these practices, you can improve the reliability of the reports and ensure they reflect true financial performance.

Identifying Common Errors in Reports

When reviewing financial documents, it’s important to be aware of typical mistakes that can occur during data entry or calculation. These might include simple mathematical errors, misclassification of accounts, or incorrect data entries. For example, expenses might be recorded under the wrong category, or revenue figures might be inflated. Always check for discrepancies, ensuring that figures align with the original source documents and are consistent throughout the report.

Cross-Referencing Data with Source Documents

One of the most effective ways to ensure the accuracy of financial reports is by cross-referencing the data with the original source documents. This includes invoices, receipts, bank statements, and other primary records. By comparing figures from the reports with those in source documents, you can confirm that all transactions are accurately captured and categorized. This step is crucial for detecting any missing or erroneous entries that could affect the overall financial picture.

Utilizing Financial Tools for Analysis

There are numerous tools and software available today that can assist in analyzing financial data for accuracy. These tools can automate calculations, generate reports, and highlight potential errors, allowing for a more efficient review process. Spreadsheets, accounting software, and specialized financial analysis tools can help you quickly identify discrepancies, inconsistencies, or patterns that require further investigation. By leveraging these tools, you can ensure that the reports are both accurate and reliable.

Verifying Consistency Across Reports

It’s important to verify that financial data is consistent across all related reports. For example, figures from the balance sheet should match the income statement, and cash flow reports should align with both. If there are discrepancies between these documents, it may indicate errors or issues with the data input. Consistency checks help to ensure that the financial reports provide a coherent and accurate representation of the organization’s financial health.

Seeking Expert Input for Complex Issues

In cases where the financial data is complex or unclear, seeking the expertise of a senior accountant or financial analyst can be invaluable. These professionals can provide additional insight into the accuracy of the reports and help resolve any issues that may arise. Their experience and knowledge of accounting principles and financial regulations can ensure that the reports are not only accurate but also compliant with industry standards and legal requirements.

By following these steps and maintaining a rigorous review process, you can ensure that financial reports are free from errors and reflect the true state of an organization’s finances. Accuracy in financial reporting is essential for decision-making, forecasting, and maintaining transparency, making it a critical part of any business or governmental operation.

Analyzing Financial Discrepancies in Assessments

When reviewing any financial analysis or evaluation, one of the most crucial tasks is identifying and understanding variances between expected and actual outcomes. Discrepancies can provide valuable insights into the effectiveness of financial planning, revealing areas where resources were either over-allocated or under-utilized. In this section, we will explore how to approach variance analysis effectively, offering strategies for recognizing and interpreting these differences in a clear and systematic way.

Understanding the Concept of Variance

Variance analysis involves comparing the planned figures with actual results to identify discrepancies. These differences can either be favorable or unfavorable, depending on whether actual performance exceeds or falls short of expectations. By analyzing these variances, you can gain a deeper understanding of financial performance and determine areas that need adjustment or further investigation. The goal is to assess whether the differences are due to controllable factors or external influences.

Identifying Sources of Variance

Variances can arise from several factors, including changes in market conditions, unexpected costs, or inaccurate forecasting. Common sources of variance include:

- Market Fluctuations: Unexpected changes in the economy or supply chain may lead to higher or lower costs than anticipated.

- Operational Issues: Inefficiencies or delays in operations can cause unplanned expenditures or reduce revenue generation.

- Forecasting Errors: Inaccurate predictions based on flawed assumptions or outdated data may lead to significant differences between forecasted and actual figures.

Evaluating Variance Impact

Once variances are identified, it’s important to assess their impact on the overall financial performance. Some discrepancies may have a minor effect, while others could signal significant issues that need to be addressed immediately. Analyzing the root cause of each variance will help determine whether corrective actions are necessary. For example, a large variance in operational costs might indicate inefficiencies in the production process, while a variance in revenue may suggest a decline in customer demand or pricing errors.

Corrective Actions and Adjustments

After identifying and evaluating variances, corrective actions may be required to realign performance with expectations. This could involve revising financial projections, adjusting operational strategies, or reallocating resources to better meet goals. Ensuring that proper adjustments are made promptly can help improve future performance and minimize the risk of similar variances in the future. Regular variance analysis allows for continuous monitoring and improvements in financial management.

By understanding the factors that cause variances and developing strategies to manage them, you can improve the accuracy of financial planning and ensure that resources are being utilized effectively. Properly analyzing and addressing discrepancies helps to enhance the financial integrity of any organization and contributes to more informed decision-making.

Understanding Financial Adjustments and Revisions

In any financial planning process, it is common to encounter situations where initial allocations and projections must be modified due to unforeseen circumstances or changes in priorities. Adjustments and revisions are essential tools for maintaining financial accuracy and ensuring that resources are aligned with actual needs. This section will explore the key concepts behind these changes, their importance, and how to implement them effectively in any financial scenario.

The Need for Adjustments and Revisions

Financial plans often face fluctuations due to various internal and external factors, such as market shifts, unforeseen costs, or changes in organizational goals. In such cases, adjustments and revisions become necessary to reflect current realities. These changes ensure that the financial framework remains relevant and functional throughout a given period. Without proper adjustments, organizations risk overcommitting resources or failing to capitalize on emerging opportunities.

Types of Financial Adjustments

There are several ways to make financial modifications, depending on the nature and scale of the changes. Some common types include:

- Reallocating Resources: Shifting funds or assets from one area to another to address immediate needs or emerging priorities.

- Increasing Allocations: Adding funds to specific areas when new opportunities or demands arise, such as unexpected operational costs.

- Reducing Allocations: Cutting down on planned expenditures when certain goals are no longer required or when efficiency improvements allow for cost savings.

- Revising Projections: Updating financial forecasts based on new data, revised assumptions, or changing market conditions.

How to Implement Adjustments Effectively

When making revisions or adjustments, it is critical to follow a structured approach to ensure they are done in a way that aligns with both short-term needs and long-term objectives. Here are some steps to consider:

- Identify the Need for Change: Regularly review financial performance and identify any areas where adjustments are necessary due to variances or changing circumstances.

- Assess the Impact: Evaluate how the changes will affect the overall financial situation, including the potential benefits and risks.

- Ensure Stakeholder Buy-in: Engage relevant parties, such as department heads or decision-makers, to ensure they understand and support the revisions.

- Communicate the Changes: Clearly communicate the adjustments to all involved parties to ensure alignment and smooth implementation.

Effective management of financial adjustments and revisions is critical to ensuring the ongoing success of any financial plan. By staying flexible and responsive to changes, organizations can better manage their resources and improve overall financial health.

Time Management During the Assessment

Effective time management during an assessment is crucial for maximizing performance. The ability to allocate time wisely across different sections can significantly impact the outcome. In this section, we will explore strategies and techniques that can help you manage your time efficiently, ensuring that you have sufficient time for all parts of the task while minimizing stress and errors.

Key Strategies for Time Management

When you’re facing a timed assessment, it’s important to approach it with a clear plan. Here are some strategies to help you manage your time effectively:

- Prioritize Tasks: Start by quickly reviewing the questions or tasks and identify which ones will take the most time or require deeper thought. Tackle the more straightforward or easier items first to ensure you make steady progress.

- Set Time Limits: Allocate a specific amount of time for each section or question. Stick to these limits to avoid spending too much time on one part and neglecting others.

- Stay Flexible: While it’s important to follow your plan, be prepared to adapt if a question turns out to be more challenging than expected. If you’re stuck on something, move on and come back later if time permits.

- Use a Timer: Keep track of time by setting a timer or watch, so you’re constantly aware of how much time remains. This will help you pace yourself throughout the assessment.

Sample Time Allocation Table

Here is an example of how to allocate time across different sections of an assessment, assuming you have a total of 90 minutes:

| Section | Time Allocation | Notes |

|---|---|---|

| Introduction or Overview | 5 minutes | Read through the instructions and plan your approach. |

| Multiple-Choice Questions | 20 minutes | Quickly answer these, and revisit if time allows. |

| Short-Answer or Essay Questions | 50 minutes | Allocate more time here, but avoid getting bogged down by a single question. |

| Review and Editing | 15 minutes | Double-check answers for errors and completeness. |

Following a structured approach to time management will help you stay calm, focused, and ensure that you complete all tasks within the allotted time. By practicing these techniques, you can improve your ability to handle time pressures and increase your chances of success.

How to Improve Financial Planning Skills

Enhancing your ability to manage finances effectively requires continuous learning and practice. Developing a solid understanding of how to allocate resources, track expenses, and make adjustments based on changing circumstances is essential. In this section, we will explore practical strategies to help you sharpen your skills in managing financial plans, improving both accuracy and efficiency in your approach.

Key Areas to Focus On

To improve your financial management skills, focus on these essential areas:

- Understanding Financial Statements: A solid grasp of financial statements is crucial. Familiarize yourself with balance sheets, income statements, and cash flow reports. Understanding these documents helps in making informed decisions about where to allocate funds and where to cut back.

- Tracking Expenses: Regularly monitor all sources of expenditure, big or small. Create a system for tracking daily, weekly, or monthly expenses to identify patterns and areas where spending can be reduced.

- Setting Clear Financial Goals: Define short-term and long-term financial objectives. Setting clear, measurable goals allows for better decision-making and ensures resources are allocated efficiently towards achieving those goals.

- Building a Contingency Plan: Unexpected costs can arise, so it’s important to have a contingency plan in place. Setting aside a portion of your funds for emergencies will ensure you are prepared for unforeseen expenses.

Practical Tips for Improvement

Here are some practical tips to enhance your financial planning skills:

- Practice with Real-Life Scenarios: The more you practice applying financial principles to real-life situations, the better you’ll understand how to manage resources effectively. Use personal or professional examples to simulate financial decision-making processes.

- Use Financial Tools: Take advantage of digital tools and software that can help track and analyze finances. These tools can automate calculations, set reminders, and help visualize data, making it easier to manage funds effectively.

- Learn from Mistakes: Financial planning often involves trial and error. Learn from past mistakes and adjust your strategies to avoid repeating the same errors in the future.

- Seek Expert Advice: Don’t hesitate to consult with financial experts when needed. They can provide insights into areas you may not be familiar with, helping you refine your approach to managing finances.

By focusing on these areas and following these strategies, you can significantly improve your ability to manage finances more effectively, whether for personal or professional purposes. Mastering these skills will give you the confidence to make sound financial decisions and better allocate resources for the future.

Tips for Success in Financial Planning Tests

Successfully tackling financial assessments requires a combination of preparation, strategy, and effective time management. Whether you’re facing multiple-choice questions or problem-solving scenarios, having the right approach can help you perform at your best. In this section, we’ll discuss key strategies to enhance your performance during financial planning evaluations, ensuring you not only understand the material but also excel under test conditions.

Preparation Strategies

Proper preparation is key to success in any evaluation. Here are a few steps to help you get ready:

- Review Core Concepts: Revisit the foundational principles of financial management. Familiarize yourself with key concepts, terminology, and formulas that you will be tested on. Understanding these will allow you to approach questions confidently.

- Practice with Sample Questions: Utilize practice tests and sample problems to simulate the actual assessment environment. This will help you get accustomed to the question formats and improve your problem-solving speed.

- Clarify Doubts Early: If you’re unsure about any topic, seek clarification well in advance of the test. Waiting until the last minute can lead to unnecessary stress and confusion.

Effective Test-Taking Tips

Once you’re in the testing environment, these tips will help you maximize your chances of success:

- Read Questions Carefully: Take your time to read each question thoroughly before jumping into the solution. This ensures you understand what is being asked and can avoid common mistakes.

- Manage Your Time: Keep an eye on the clock and allocate your time wisely. Don’t spend too long on any one question–move on if you’re stuck and return to difficult questions later.

- Show Your Work: For problem-solving questions, write down each step of your calculations. Even if you make a mistake, partial credit can be awarded for showing your process.

- Double-Check Your Answers: If time permits, review your answers before submitting the test. Ensure all calculations are correct and that you’ve answered every question.

Common Pitfalls to Avoid

While preparing and taking the test, be mindful of these common mistakes:

- Skipping Over Complex Questions: Don’t skip questions because they seem challenging. Attempt them to the best of your ability and return later if needed.

- Overlooking Small Details: Pay attention to small details, like units of measurement or minor instructions. Missing these can lead to errors that could affect your overall score.

- Neglecting to Review: Failing to review your work before submission can result in overlooked mistakes. Always allocate some time to check your answers.

| Tip | Description |

|---|---|

| Start Early | Begin your preparation well ahead of the test day to avoid last-minute cramming. |

| Stay Organized | Organize your study materials and schedule regular review sessions to stay on track. |

| Practice Regularly | Regular practice with sample questions will enhance your confidence and speed. |

| Stay Calm | Remain calm during the test to think clearly and avoid making hasty decisions. |

By implementing these tips and staying focused during your preparation and the test itself, you’ll be in a great position to achieve success in your financial planning assessments.

Resources for Learning Financial Planning and Management

Learning the principles of financial management and resource allocation requires access to reliable sources and tools. Whether you’re looking to deepen your understanding of concepts or prepare for assessments, there are various materials available to enhance your skills. Below are several valuable resources to support your learning journey in this field.

Books and Texts

Books are a great foundation for understanding the theoretical aspects of financial planning. Consider the following:

- Financial Management Textbooks: Comprehensive texts that cover everything from basic concepts to complex financial strategies.

- Case Studies: These books provide real-life scenarios and how financial principles are applied in different organizations.

- Guides to Financial Analysis: These guides focus on teaching how to assess financial data, balance sheets, and financial reports for making informed decisions.

Online Courses and Tutorials

Online platforms offer convenient, interactive learning options. Some popular websites include:

- Coursera: Offers a range of courses on finance, management, and financial strategy from top universities.

- edX: Provides free courses and certifications on various aspects of financial planning and management.

- LinkedIn Learning: A platform that offers professional development courses, including ones focused on financial skills and resource management.

Practice Tools and Simulations

To develop practical skills, consider using the following tools:

- Spreadsheets: Learning how to use Excel or Google Sheets to track financial data and perform analysis is essential for practical application.

- Simulation Software: Some websites offer simulations that mimic real-world financial scenarios, helping you apply concepts in a controlled environment.

- Online Calculators: Use financial calculators to practice calculations related to forecasting, investment planning, and financial projections.

Industry Reports and Articles

Staying up-to-date with industry news and expert insights can expand your knowledge:

- Financial Journals: Scholarly journals often publish the latest research and trends in financial management and resource allocation.

- News Websites: Websites like Bloomberg and Reuters provide timely updates on market conditions, economic trends, and financial policies.

- Blogs by Financial Experts: Follow financial advisors and industry professionals who share their insights through blogs, articles, and opinion pieces.

Workshops and Seminars

Engaging in workshops and seminars can enhance both your theoretical and practical understanding:

- Local Workshops: Many organizations host seminars that focus on improving financial decision-making skills.

- Webinars: Virtual webinars hosted by financial experts can provide in-depth knowledge on specific financial topics.

By utilizing a combination of books, online resources, practical tools, and industry insights, you can build a strong foundation in financial planning and management, preparing yourself for both academic and real-world applications.

How to Stay Calm During the Test

Managing stress and maintaining focus during a high-pressure situation can significantly impact your performance. Developing strategies to stay composed and approach challenges with a clear mind is essential for success. Here are some techniques to help you remain calm and confident during a crucial assessment.

Preparation and Mindset

Proper preparation is key to building confidence before the test. Consider the following approaches:

- Thorough Review: Ensure you have studied the relevant materials and are familiar with the key concepts. Confidence comes from knowing you’re well-prepared.

- Positive Visualization: Imagine yourself successfully completing the test. This mental exercise can help reduce anxiety and increase your sense of control.

- Mindset Shift: Instead of focusing on the pressure, focus on the opportunity to demonstrate your knowledge. Remind yourself that you’ve put in the effort to succeed.

During the Test: Techniques to Stay Focused

When you’re in the middle of the assessment, it’s important to stay calm and focused. The following methods can help:

- Deep Breathing: Take a few slow, deep breaths to calm your nervous system. Deep breathing can help reduce anxiety and improve concentration.

- Read Questions Carefully: Don’t rush through the questions. Read each one thoroughly to avoid making careless mistakes due to nervousness.

- Time Management: Allocate time to each section of the test to avoid feeling overwhelmed. If you get stuck, move on and come back to challenging questions later.

- Stay Positive: If you encounter a difficult question, remind yourself that it’s just one part of the overall test. Maintain a positive attitude and focus on your strengths.

By incorporating these strategies, you can stay calm, focused, and in control, maximizing your performance during stressful situations.